Table of contents

Before joining Square in 2022 as a Product Marketing Manager, I ran a low-alcohol beverage company called Two Days. Like most entrepreneurs, I got into the business because I had a passion for the product, not for the administrative, operational, and financial tasks that are necessary to run a successful brand. While running Two Days, I experienced many highs (like building a product from scratch and seeing it come to life on shelves at stores like Whole Foods Market) and lows (like watching thousands of our products topple and explode during transit to one of our biggest events).

I also learned a lot about managing a company’s finances. We sold across multiple channels — retail, eCommerce, and events — which meant juggling different payment timelines and adapting to ever-changing cash flow demands. Too often, a delayed deposit would throw off a vendor payment, make it harder to restock supplies, or turn payroll into a last-minute scramble.

While every business is unique, the need for timely access to cash is something many entrepreneurs understand all too well. Having a reliable financial system that helps you move quickly, spend confidently, and stay in control is essential to keeping your business running smoothly.

Square Checking1 provides instant access to your sales, and from there, gives you a full set of tools to make spending simpler and smarter: a business debit card, built-in spend tracking, Bill Pay, ATM access, Checks and more — all integrated with your Square Point of Sale.

Here’s how Square Checking supports real business needs and helps keep daily operations running smoothly.

What makes Square Checking different

Three hundred and seventy thousand businesses trust Square Checking as their business account because it eliminates the need to manage a dozen disconnected tools. You get one account that’s built for how your business actually runs when you use Square Checking. Here’s what sets it apart:

Instant access to your sales — even from partners like DoorDash and Uber Eats

When you need to pay a vendor, you employees, and the bills, you need access to your funds fast. With Square Checking, your money hits your account the moment a sale comes through — including earnings from third-party delivery platforms like DoorDash and Uber Eats2. You also get ACH transfers up to two days earlier than with traditional banks, giving you more freedom to purchase inventory, restock supplies, and keep things running without delay.

On average, Square Checking users save 44 hours per month by not waiting for deposits to settle.

*Source: Square Internal Data, 2024

Absolutely no fees

Having an account with no monthly fees or minimums was a total game changer for me, both when I was bootstrapping the business and later as it grew. It let me focus on building the brand without the worry of extra costs holding me back.

Square Checking users save an average of $156 per year in banking monthly fees compared to many traditional banks.

*Source: Square Banking Fee Study 2025

Spend with your free business debit card — plus additional cards for your team

Buy what you need, when you need it. You can use your Square Debit Card3 anywhere Mastercard® is accepted, and issue up to four additional cards to your team so they can purchase what they need, when they need it.

Flexible ways to pay

Not every expense fits on a card. Square Checking lets you pay by ACH transfer, Bill Pay, or even printable check, so you’re covered no matter what.

Integrated with your Square POS

View your sales and your spending all in one place — meaning no manual transfers or extra tools to manage. For me, that meant more time back to focus on doing what I loved most: creating new flavors and connecting with customers.

So, what does all of this look like in practice? Let’s take a look at how businesses are putting Square Checking to work every day.

How businesses put Square Checking to work

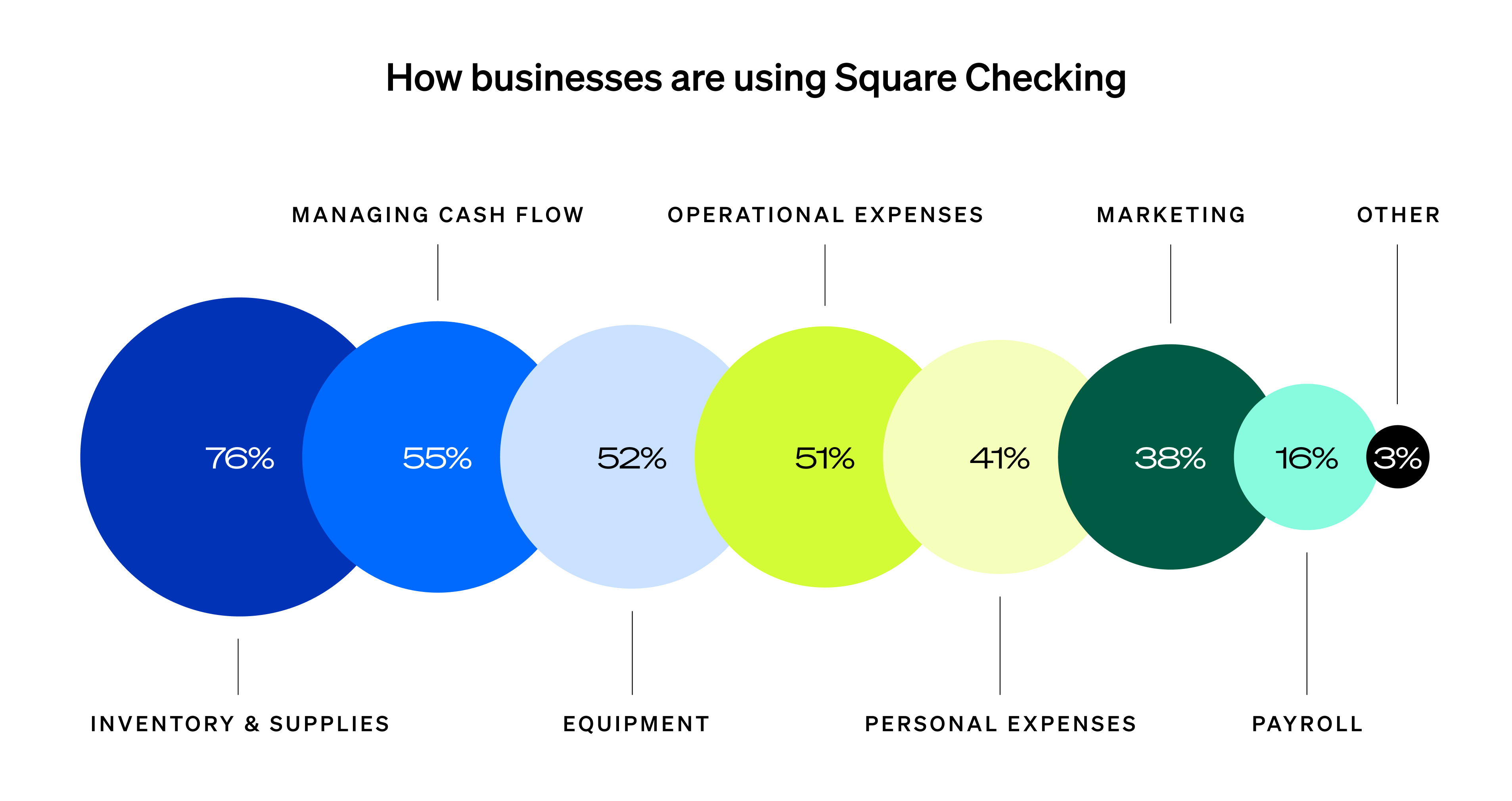

From daily purchases to covering payroll, business owners use Square Checking to manage their money in real time. Here are the top ways sellers spend:

We use our Square checking account to take care of our payroll, taxes and different expenses that come up here and there. It’s a great tool to help us streamline all our finances.”

Juan Saravia → Owner of La Pupusa Urban Eatery

Everyday Spending with Square Debit Card

One of the most common ways businesses spend is with the Square Debit Card — a simple, familiar tool I relied on for countless last-minute needs. Whether grabbing extra ingredients during a busy event or filling up gas for retail store visits, I could buy what I needed instantly because the funds were available to spend as soon as a sale was processed. Plus, you can get a virtual card for online purchases or add it to Apple Pay® or Google Pay™ for fast, contactless checkout, no physical card needed.

Over 72% of Checking users spend with their Square Debit Card on any given day, making it a go-to tool for everyday business spending.

*Source: Square Internal Data, 2025

Paying vendors and bills

Businesses are also using Square Checking to manage more than just everyday card purchases. From rent and recurring software subscriptions to vendor invoices, you can handle it all in one place without needing a separate tool. Here’s what that looks like:

- ACH transfers let you send money directly to external accounts or pay vendors — completely free.

- Bill Pay helps you manage one-time or recurring payments, for things like subscription software or inventory resupplies.

- You can even send a printable check if that’s what your vendor prefers.

Withdrawing or depositing cash

For the moments when cash is part of doing business, whether you’re depositing cash tips or making in person purchases, Square Checking has you covered. You can withdraw funds using your Square Debit Card at any ATM nationwide (3rd party ATM fees may apply). Need to add cash to your account? Deposit money for free at over 70,000 stores like Kroger®, Walgreens, Dollar General, and 7-Eleven day or night and have it available to spend in minutes.

So whether you’re swiping your card, paying a vendor, or withdrawing cash, Square Checking gives you the flexibility to do it all. Just as importantly, it also helps you make sense of your expenses so you can turn everyday transactions into real insights.

Turning spending into insights

Knowing where your money goes isn’t optional, it’s essential. I quickly realized how much easier managing my business finances became when my expenses were clearly organized by category. That’s why with Square Checking, every transaction is automatically tagged and categorized. From meals to supplies to travel, you get a clear view of your spending without lifting a finger.

*Based on Square’s 2025 Future of Commerce report, surveying 6,000 owners and managers of businesses in three industries: beauty, retail, and restaurant.

This kind of built-in spend categorization helps you:

- Get a clear picture of where your money is going

- Spot patterns and identify potential opportunities to cut back

- Budget with greater confidence for what’s ahead

Once you have a clear picture of your spending, you can start putting your money to work and setting aside what you need, before you need it.

Budget proactively, spend confidently

Managing your money isn’t just about spending, it’s also about setting funds aside so you’re prepared for what’s ahead. With Square Savings4, you can automatically move funds into folders tied to specific goals and instantly transfer them to your Square Checking account when it’s time to pay your bills, with zero fees.

Normally, quarterly taxes are such a stressful time. This last quarter, it was such a breeze. I just transferred the money from Square Savings into my checking account and paid my sales tax. It was the easiest thing ever.”

Doran Tomoko → Owner of Haute Beauty

Whether you’re setting aside money for taxes, rent, payroll, or a rainy day, automated savings make it easy to plan ahead with confidence, knowing what you’ll need later is already taken care of.

Tax, Rainy Day and Rent were the top three savings folder names created by Square businesses in 2025.

Your business, your way

Your business isn’t one-size-fits-all, and your banking tools shouldn’t be either. Square Checking gives you instant access to your money, with zero fees. It brings flexibility, transparency, and integration into one place, so you can move money, manage spend, and plan ahead with less stress.

Learn more about Square Checking or dive into your Square Dashboard and sign up to start tracking and optimizing your spend today.

1. Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

¹ Instant availability of Square payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

ACH transfer fund availability: Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

² Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

³ Instant transfer requires a linked bank account or supported debit card and costs a fee per transfer. Funds are subject to your bank’s availability schedule. Minimum amount is $25 and maximum is $10,000 in a single transfer. New Square sellers may be limited to $2,000 per day. Fund availability times may vary due to technical issues.

⁴ With early deposit access, Block, Inc. may make incoming electronic direct deposits made through ACH available for up to two days before the scheduled payment date. Not all direct deposits are eligible. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. Early deposit access is automatic and there is no fee.

5 Cash deposited into your Square Checking account is generally available in your checking account balance immediately after a deposit is processed. Fund availability times may vary due to technical issues.

VanillaDirect Pay is provided by InComm Financial Services California, Inc. and by InComm Financial Services, Inc. (NMLS# 912772), which is licensed as a Money Transmitter by the New York State Department of Financial Services. Terms and conditions apply.

2. Instant Payouts services require a Square Checking account. Funds provided through Instant Payouts services are generally available in the Square Checking account balance immediately after an order is processed. Fund availability times may vary due to technical issues. If an order is not paid out instantly, it will be available according to your regular deposit schedule. Payout limits, including limits on payout amounts, may apply.

3. Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

¹ Instant availability of Square payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

ACH transfer fund availability: Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

4. 1 Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

2 The rate of our savings account is more than 2x the national average of 0.41% APY, based on the national average of savings accounts rates published in the FDIC Weekly National Rates and Rate Caps accurate as of 1/21/2025

3 Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Checking Accounts are FDIC-insured up to $250,000.

© 2025 Square, Inc. and/or Square Financial Services, Inc. All rights reserved.

![]()