Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Debit Card Your cash flow at your fingertips

Instant access to sales revenue¹

100% free, no fees

Sign up in less than two minutes

Built-in security features

Simplify your business spending

Tap into sales instantly

With Square Checking and Debit Card, your money is ready to spend as soon as you make a sale — in person or digitally with Apple Pay® or Google Pay™.

Share spending power

Get one card for you and up to four more for your team, empowering others to make business purchases from your Square Checking balance. Lock or cancel a card at any time.

Absolutely no fees. Ever.

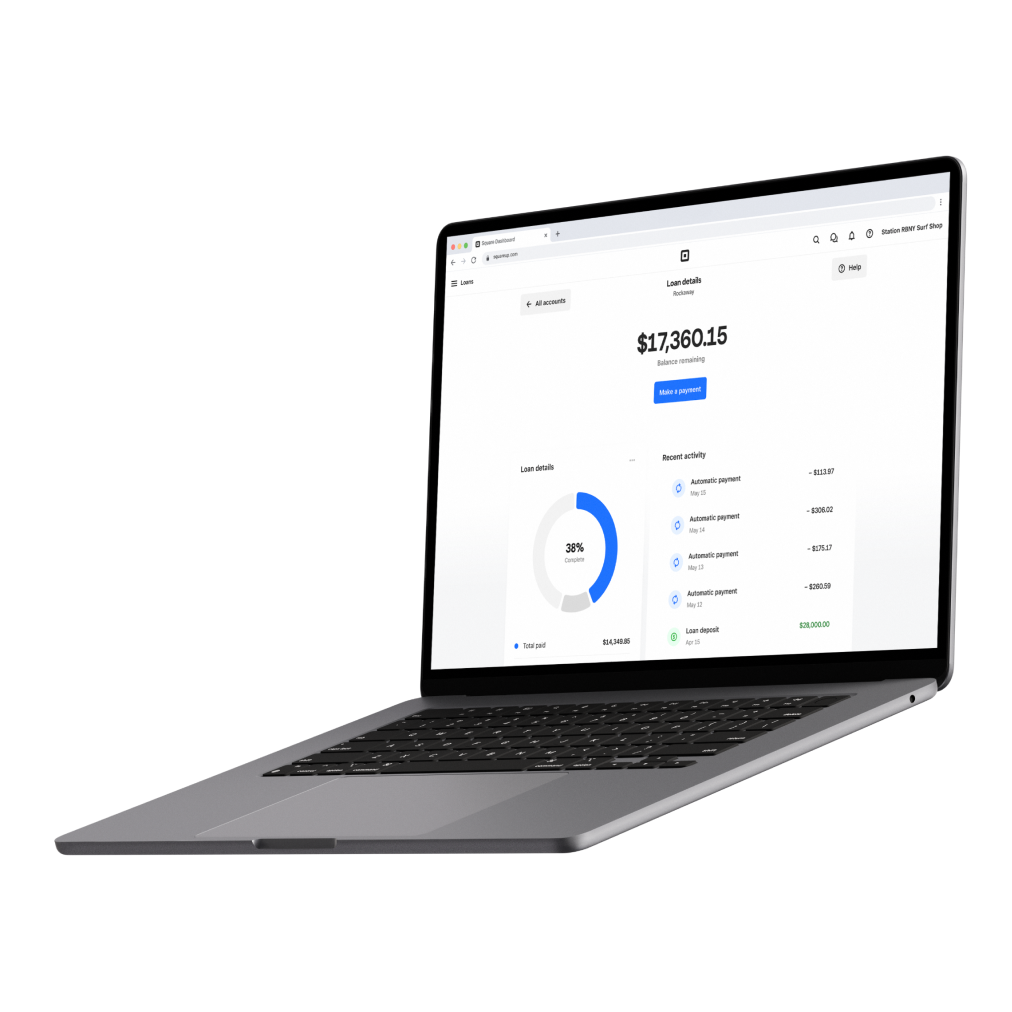

Square Checking

Other banks

Monthly service or maintenance fees

Square Checking

$0

Other banks

$10–$16 per month

Minimum balance requirement

Square Checking

$0

Other banks

$500–$5,000 minimum

Overdraft fees

Square Checking

N/A

Other banks

$35 per item

Required opening deposit

Square Checking

$0

Other banks

$1–$1,500

Foreign transaction fees

Square Checking

0%

Other banks

1–3%

ATM fees

Square Checking

$0

Other banks

$3–$5, plus ATM operator fees

“I’m not ashamed to say I’m not good on the computer or with numbers. It’s not about that. It’s about people. How other people support each other. And a company like Square — that cares about a small place like me — that’s really important to me.”

Barb Batiste

B Sweet

Los Angeles, CA

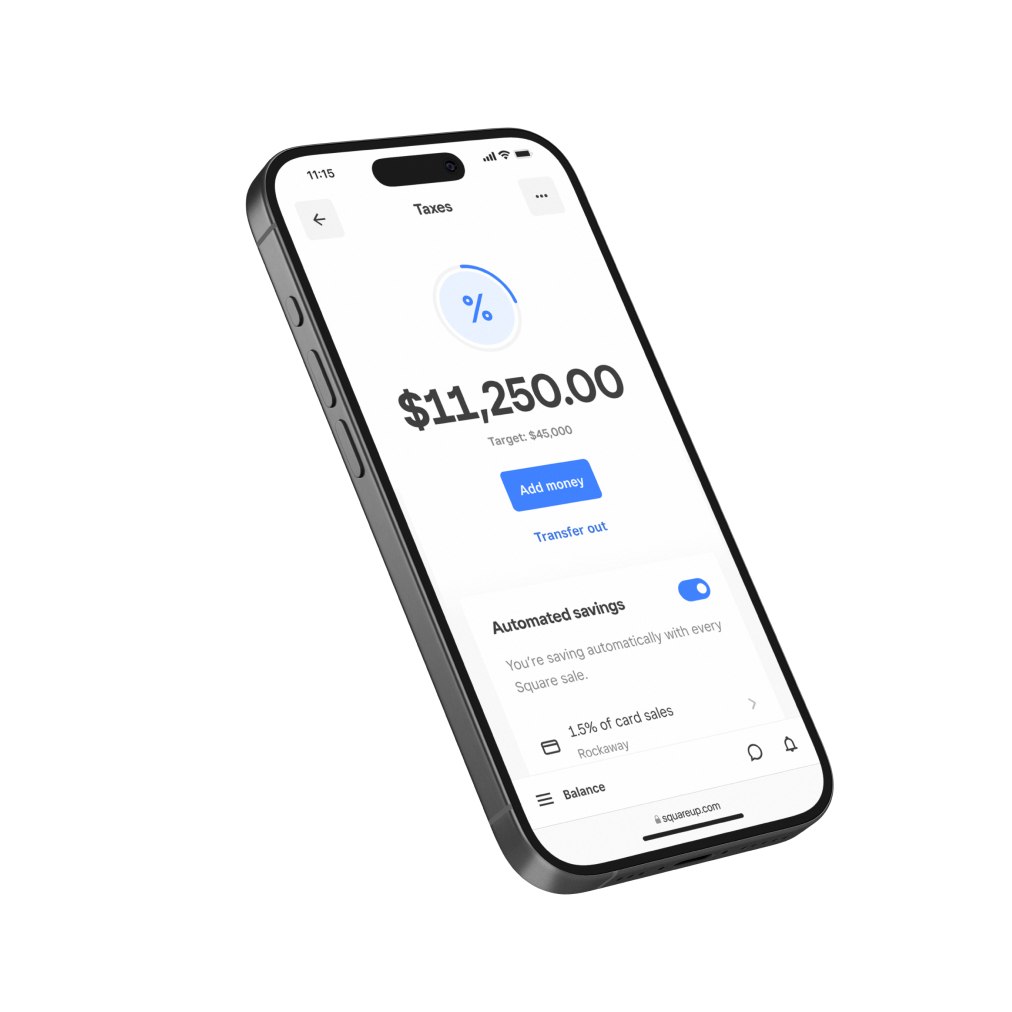

Get your money moving at your speed

Talking money

FAQ

How do I sign up for a Square Debit Card?

Square Debit Card comes with a Square Checking account. To open a Square Checking account:

Go to the Balance applet in your Square Point of Sale app or

Dashboard and select Square Checking.

Select Open account.

Verify your information.

Personalize your business debit card.

Confirm the shipping address for your business debit card.

How long does it take for my card to arrive?

Your card will arrive within 7–10 days after you order it.

You can also use your card digitally as soon as you open your checking account, so you don’t have to wait for the physical card to arrive in the mail. Add your card to Apple Pay® or Google Pay®, or display your card information in your Square Point of Sale app, to see your card details and spend right away.

How do I activate my physical card?

Once your physical card arrives in the mail:

Visit the Balance section of your Square Point of Sale app or Dashboard.

Select Square Checking.

Select Activate physical card.

Check the email associated with your Square account for a one-time passcode.

Enter the passcode.

Enter the expiration date and the CVV on the back of your card.

Your physical card is now ready to use for purchases with a tap, dip, or swipe!

How do I add my Square Debit Card to my mobile wallet?

We recommend that you add your debit card to Apple Pay® or Google Pay™ as soon as you open your checking account, so you can start to use your money while you wait for your physical card to arrive.

Are the funds on my Square Debit Card safe?

Help safeguard your funds with high-risk spend alerts, SMS alerts, 2-step verification, and card lock.

What are the Square Debit Card ATM limits?

Square Debit Card can be used at any ATM that accepts Mastercard® debit cards. Third-party ATM operator fees may apply. The maximum amount which can be withdrawn at an ATM is $500–$3,000 per transaction; $1000–$3,000 per day; $1,000–$7,000 per week; and $2,000–$10,000 per month.

How do I order additional cards for my business?

You can order up to five Square Debit Cards for your Square Checking account at no additional cost. Additional debit cards can be for the account owner or for four other individuals.

Keep your business moving with the Square Credit Card

Learn about new features and hear stories from other Square cardholders.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met.

Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

1Instant availability of Square payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

ACH transfer fund availability: Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.