Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

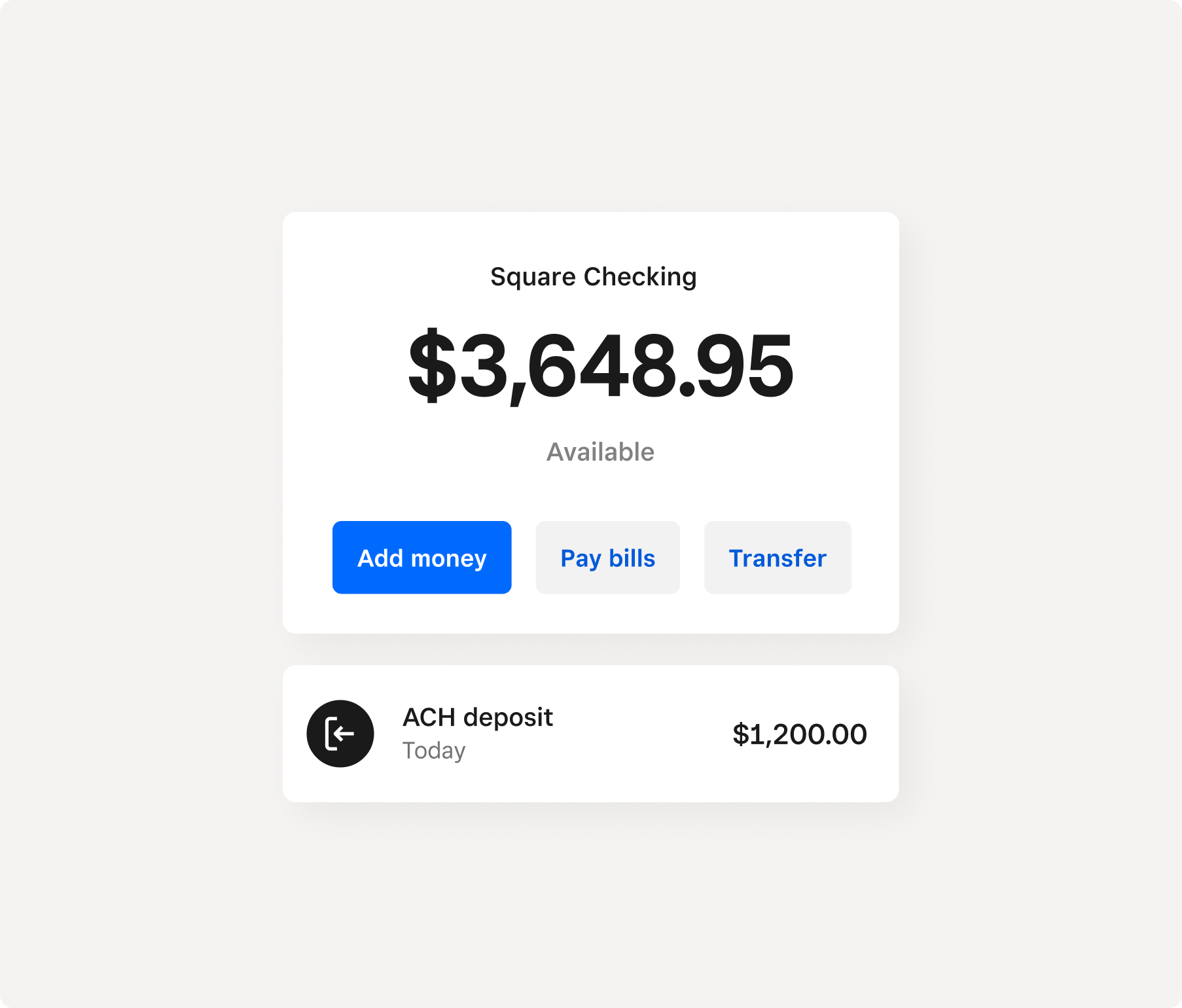

Square Checking Tap into your money instantly

Instant access to sales revenue, 24/7¹

No account fees, no minimums

Built-in security features

Sign up in less than two minutes

Spend on your own terms

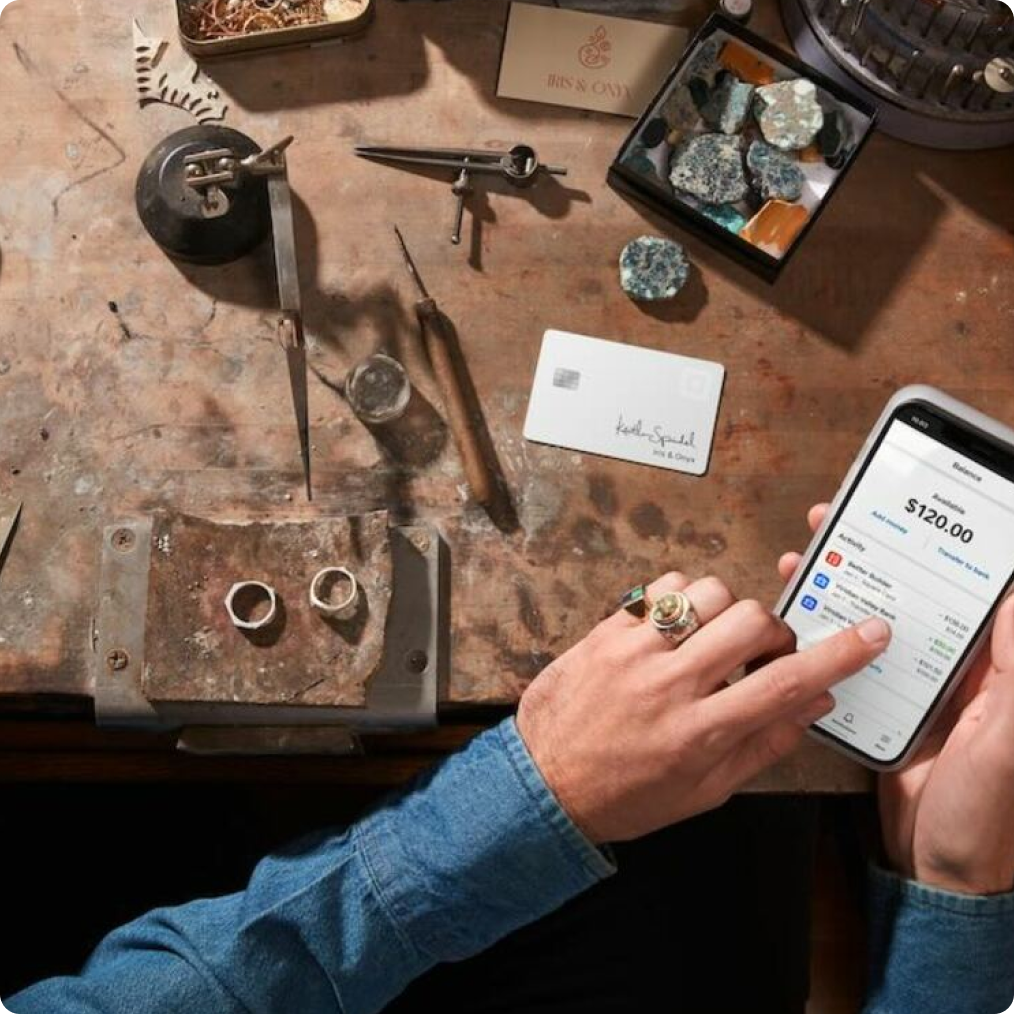

Pay with a debit card²

Make a sale, spend instantly. Plus, get up to five debit cards to share with your team so they can make business purchases in person or digitally with Apple Pay® or Google Pay.™

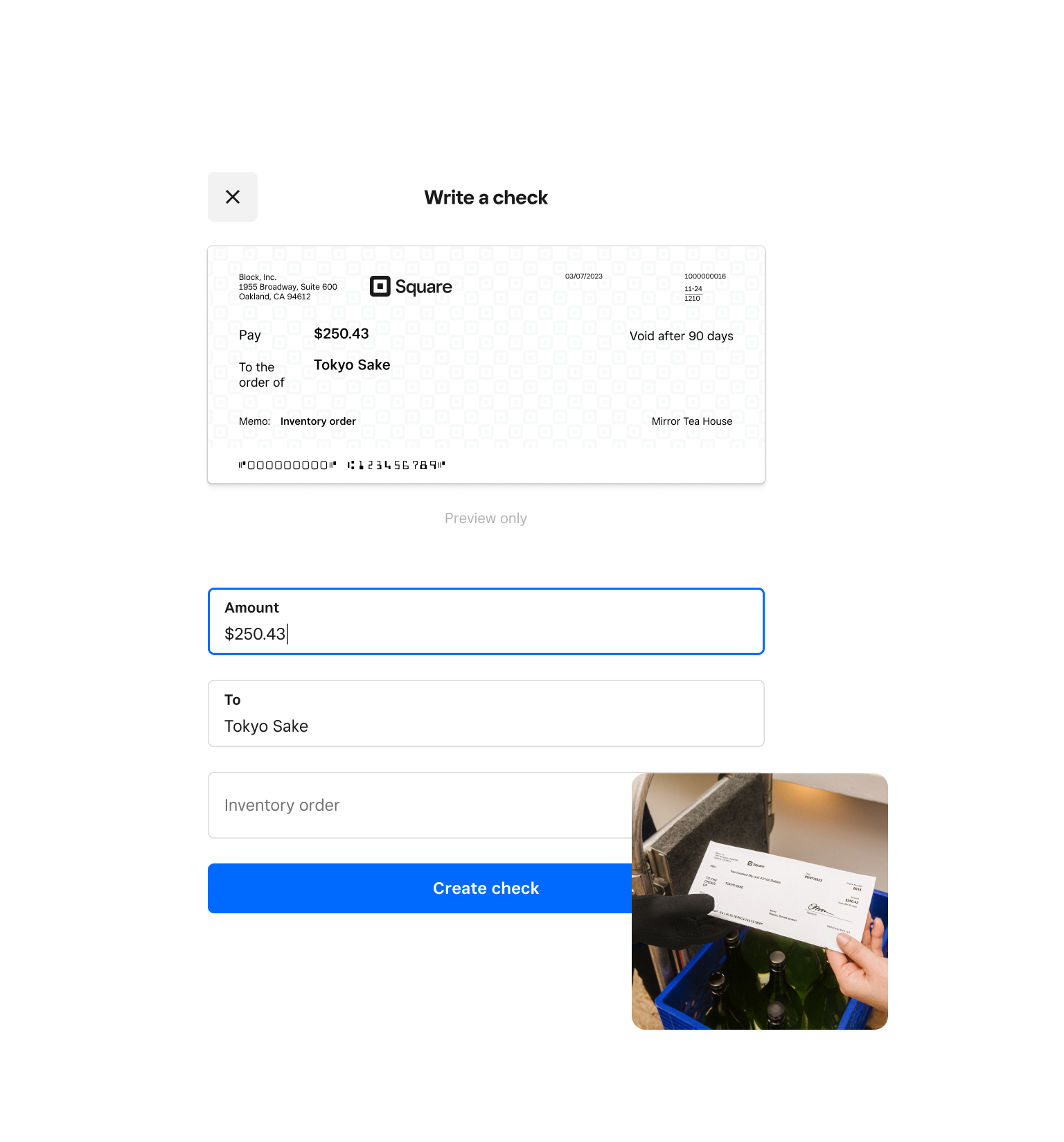

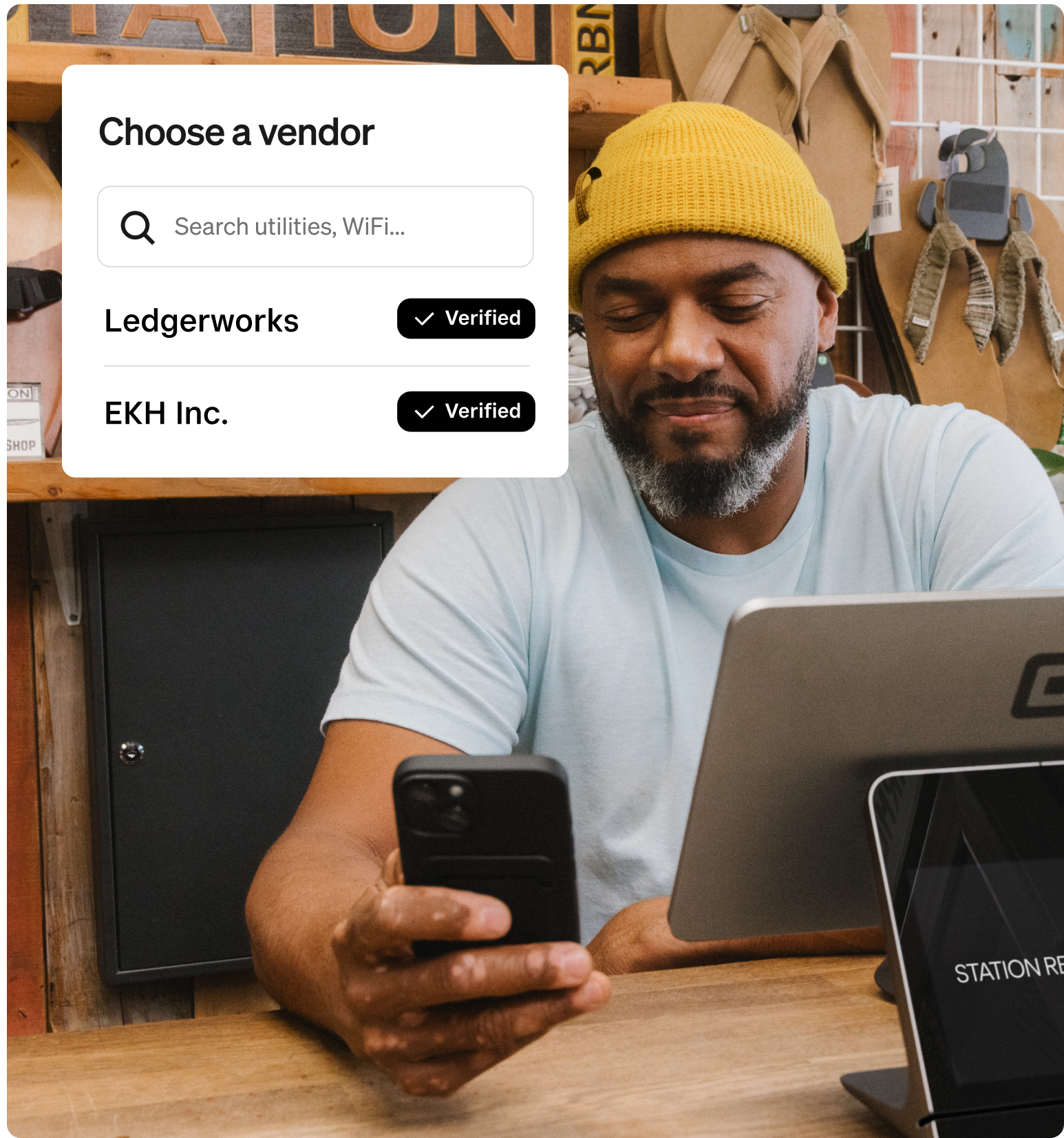

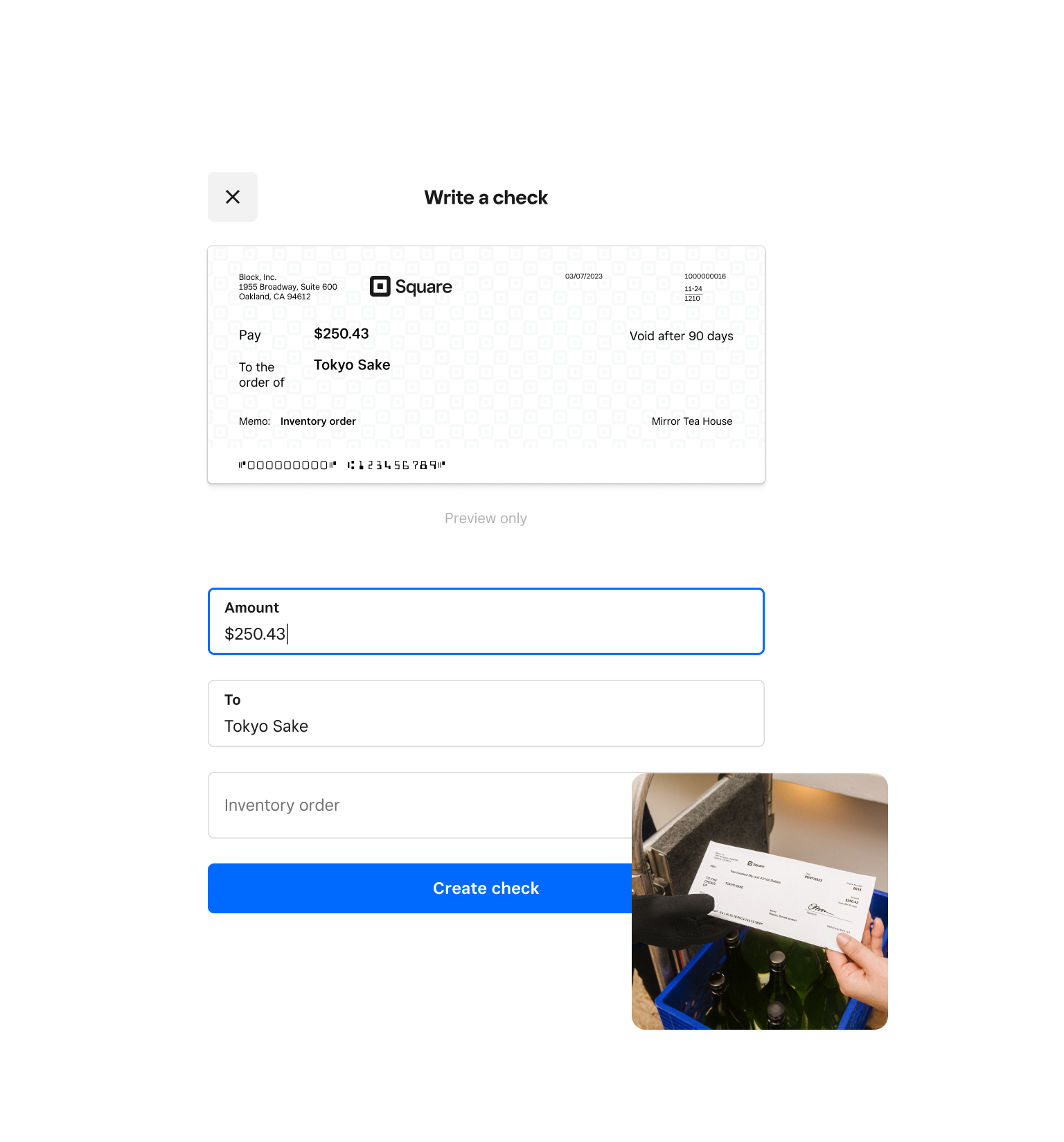

Make bill payments

Your money is available right away, so you can send payments to your vendors via debit card, ACH, Bill Pay, or printable check.

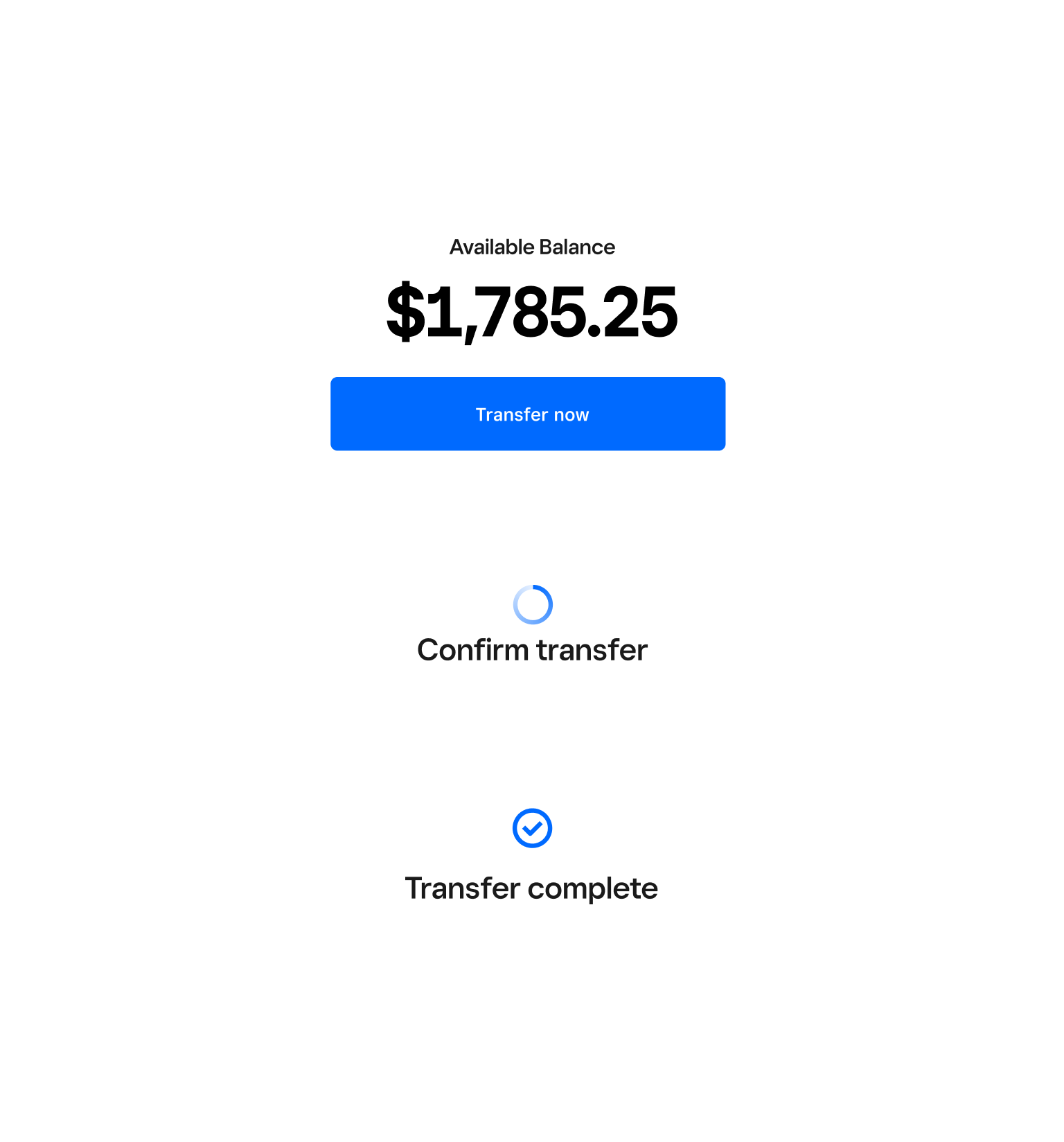

Transfer money fast

Transfer funds to an external bank account instantly, by the next business day, or on a recurring schedule — whatever works best for your business.³

Put all your revenue under one roof

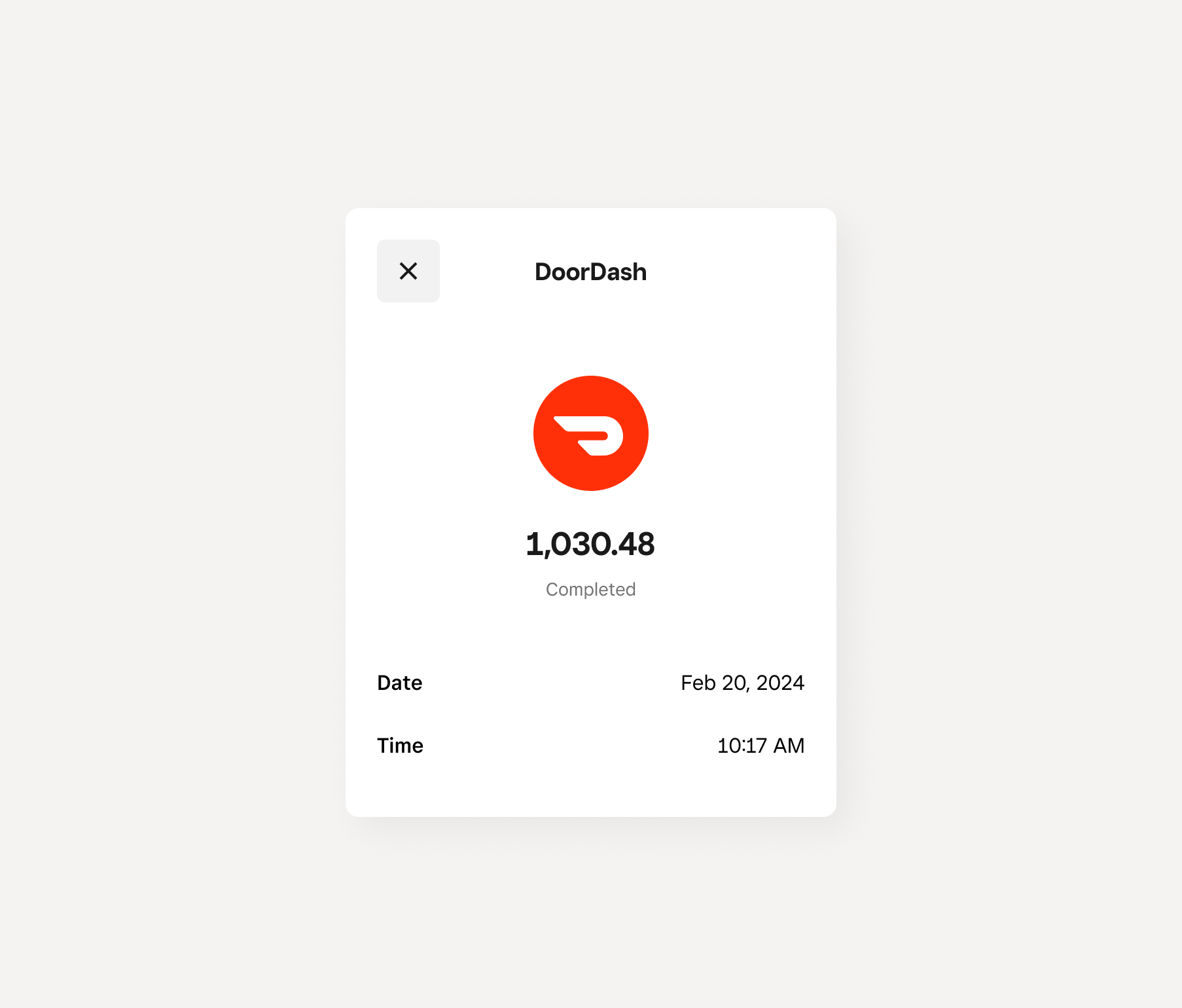

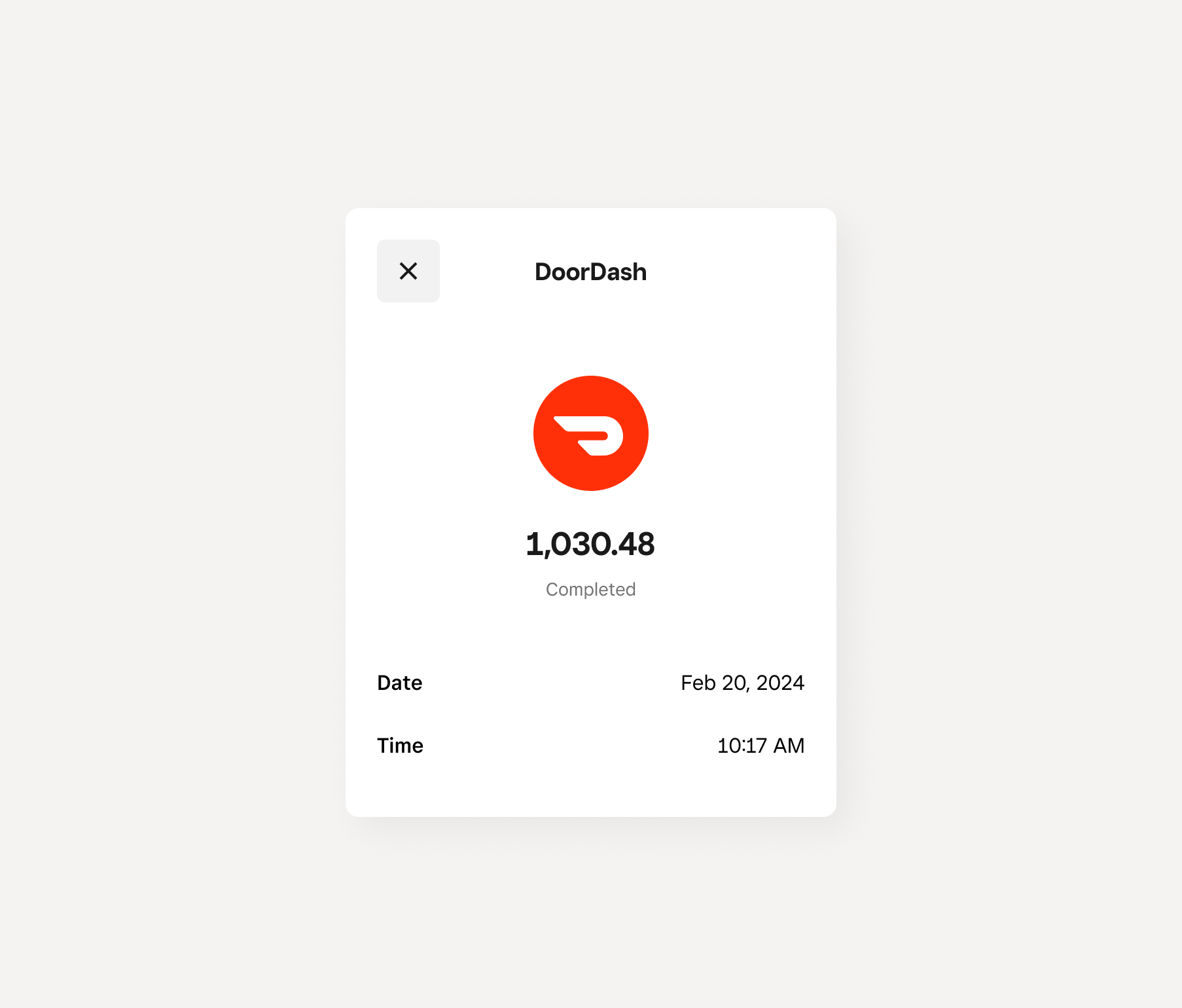

Access third-party revenue quickly

Access third-party revenue quickly

Earn money outside of Square? Get funds up to two days faster when you set up one-time or recurring ACH deposits.⁴

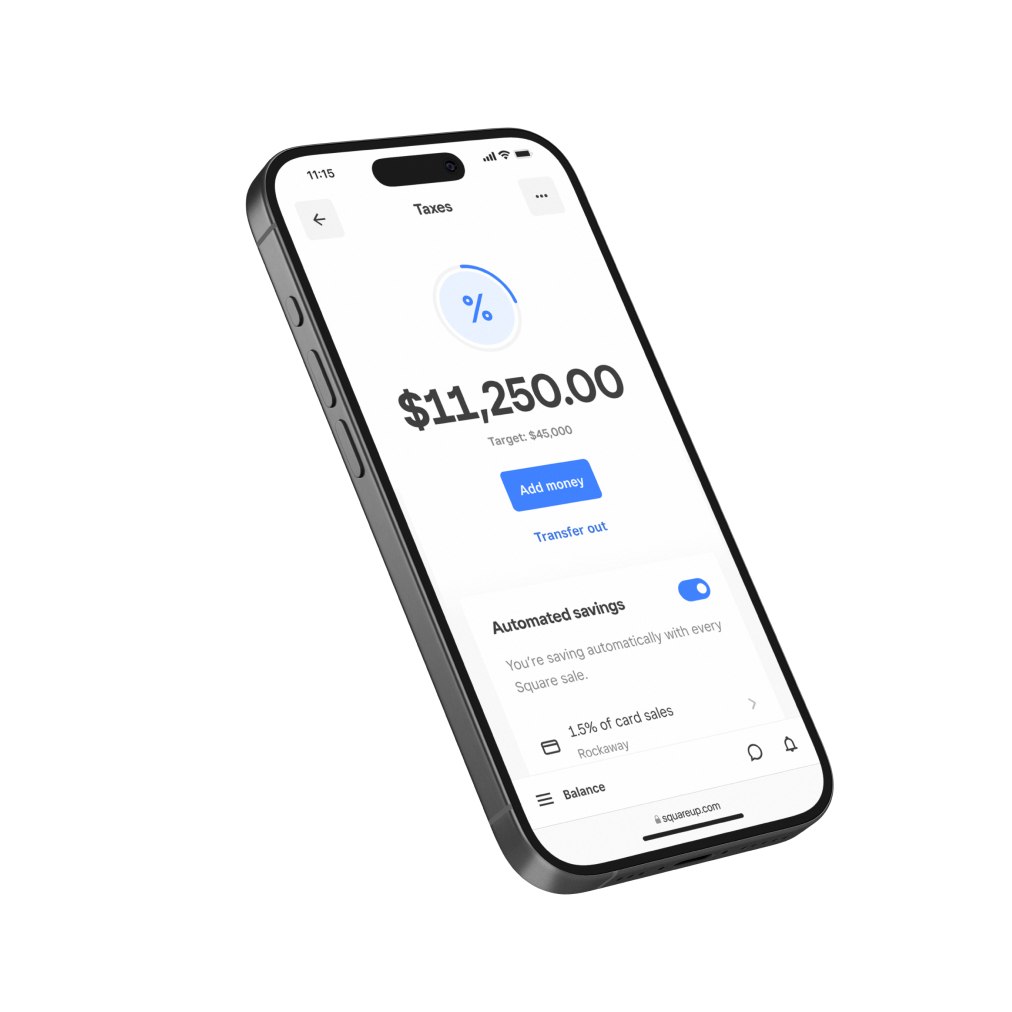

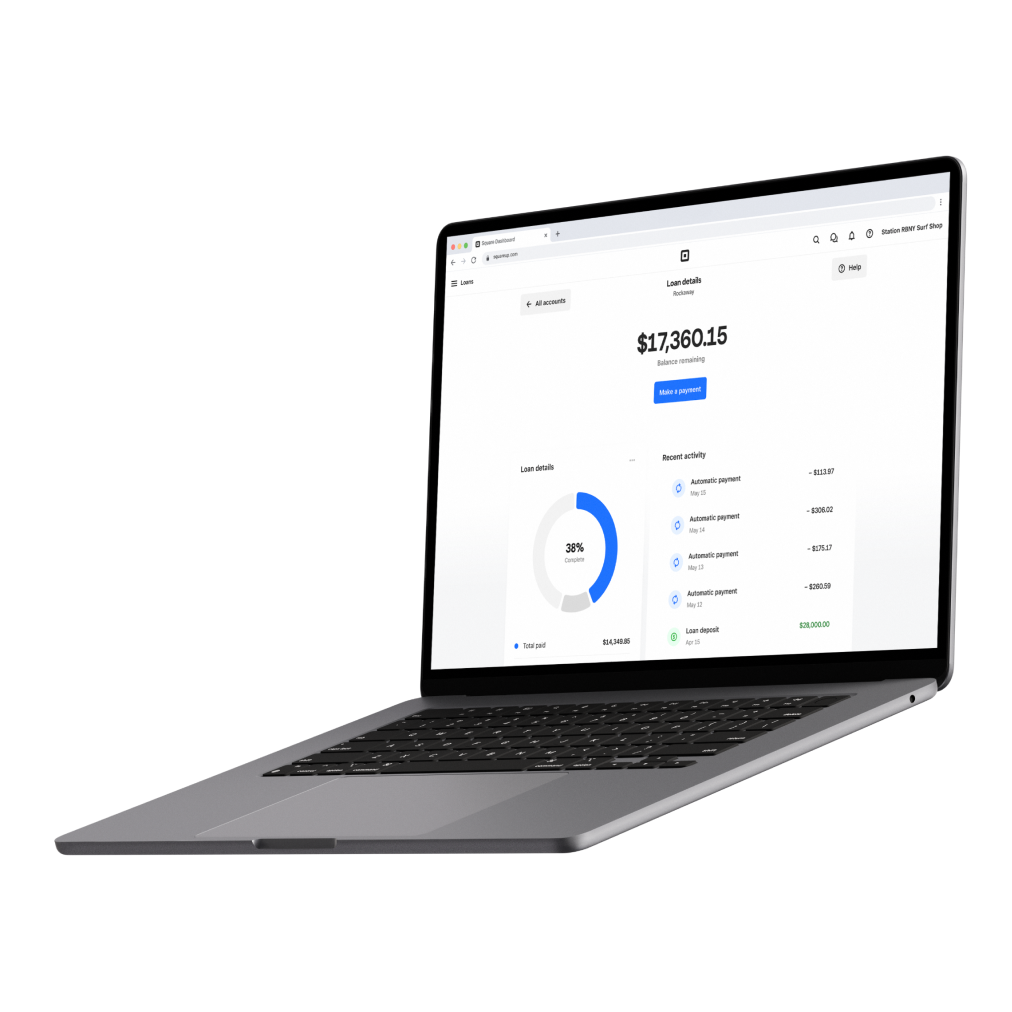

Get your loan funds instantly

Get your loan funds instantly

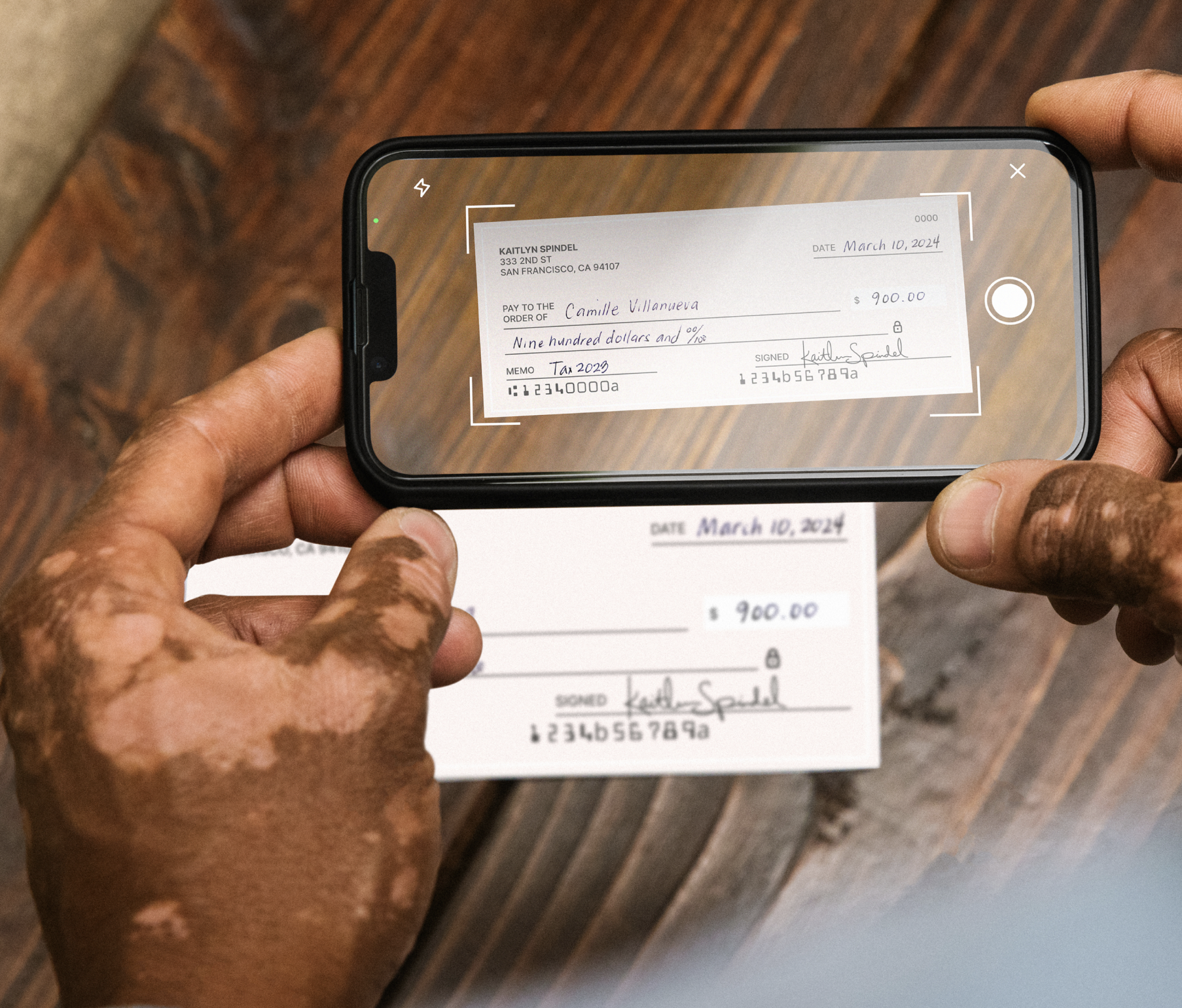

Deposit checks on your phone

Deposit checks on your phone

Top up your balance

Top up your balance

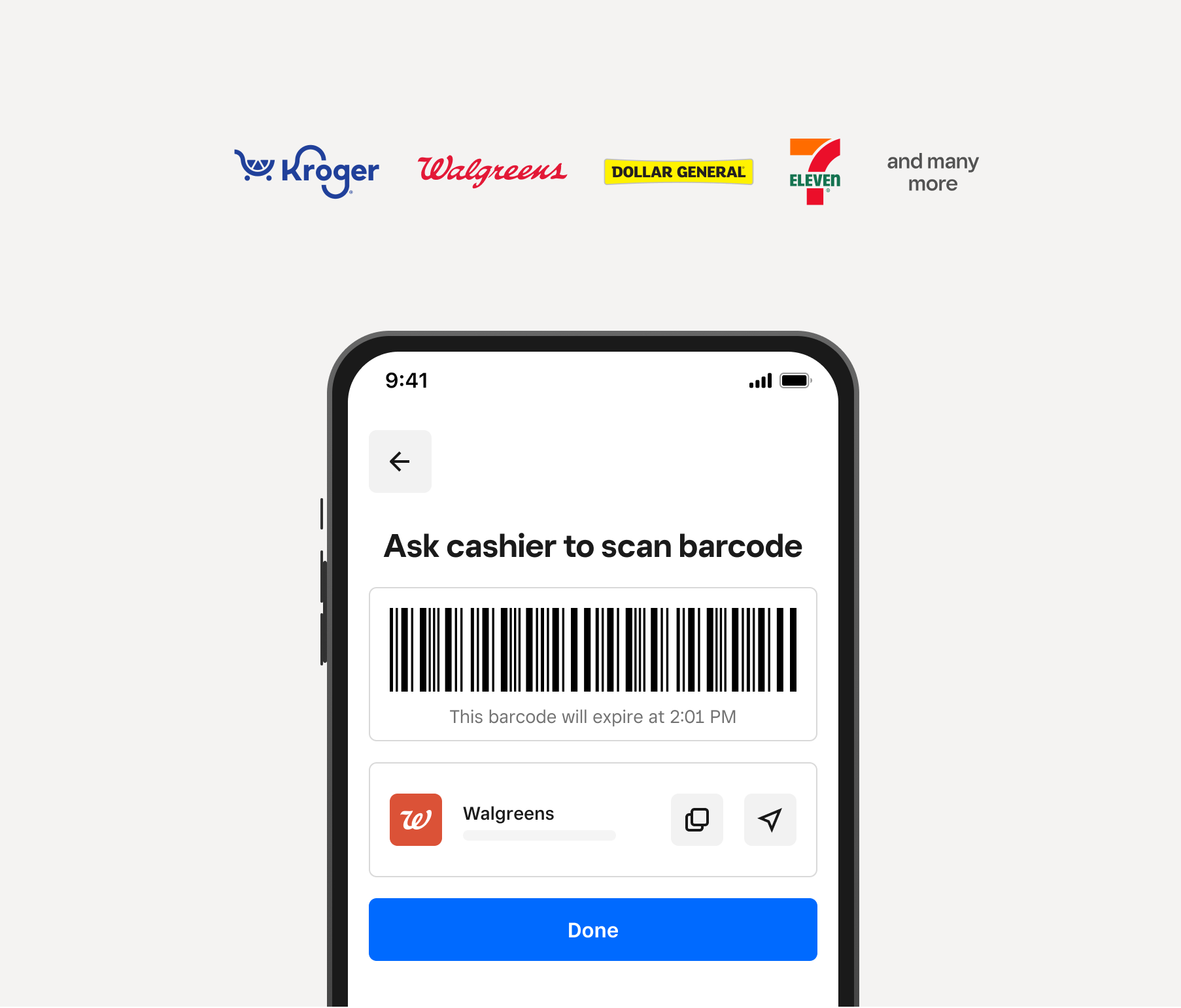

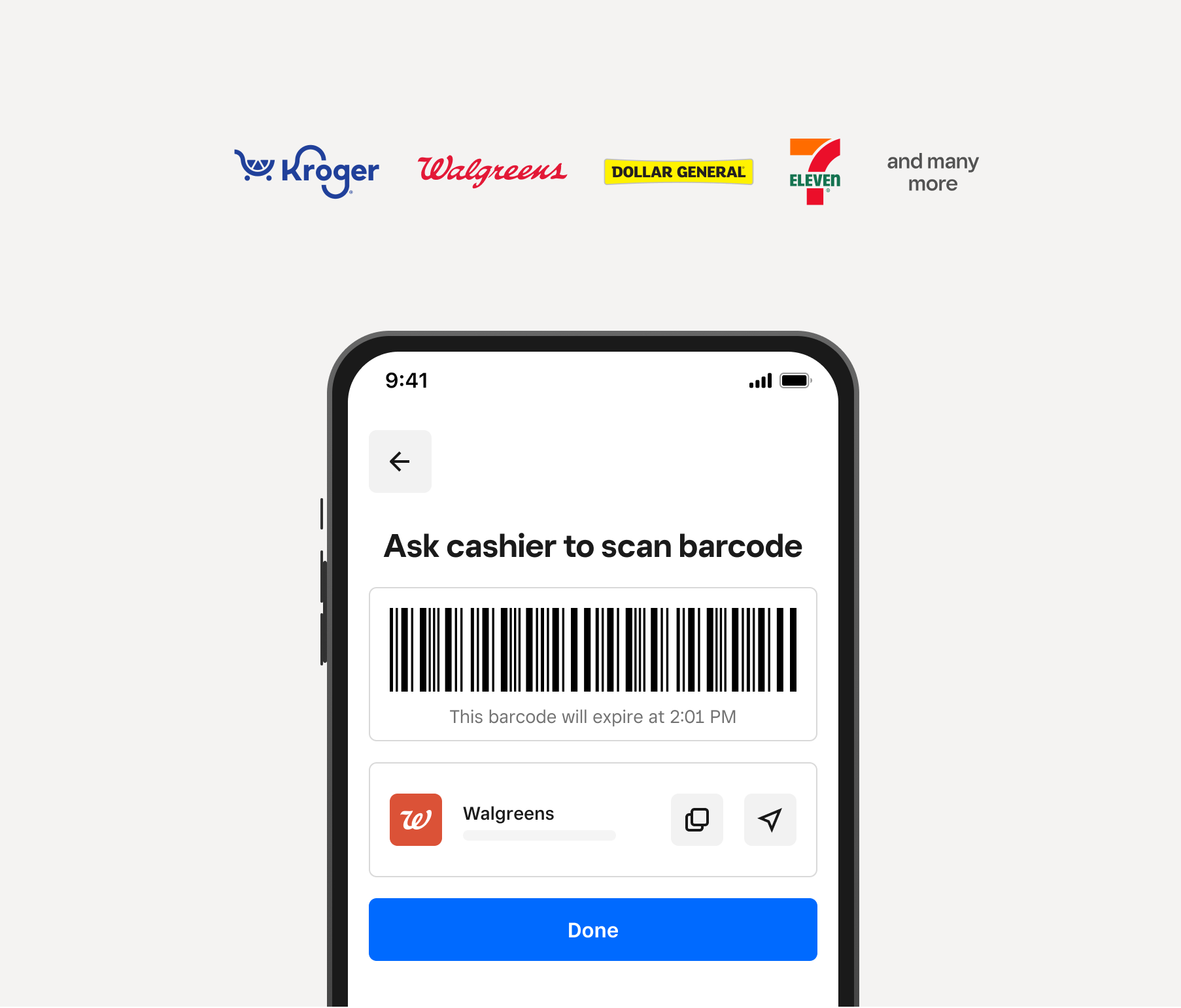

Deposit cash at nearby stores

Deposit cash at nearby stores

Easily add cash to your account for free at stores, like Kroger®, Walgreens, Dollar General, and 7-Eleven. Deposits are available in minutes.⁵

Absolutely no fees. Ever.

Square Checking

Other banks

Monthly service or maintenance fees

Square Checking

$0

Other banks

$10–$16 per month

Minimum balance requirement

Square Checking

$0

Other banks

$500–$5,000 minimum

Overdraft fees

Square Checking

N/A

Other banks

$35 per item

Required opening deposit

Square Checking

$0

Other banks

$1–$1,500

Foreign transaction fees

Square Checking

0%

Other banks

1–3%

ATM fees

Square Checking

$0

Other banks

$3–$5, plus ATM operator fees

ACH bank transfer (via Square Invoices)

Square Checking

$0

Other banks

1%–3% processing fees

How LA’s La Pupusa Urban Eatery Manages Cash Flow With Square

“We use our Square Checking to take care of our payroll, our taxes, and different expenses that come up here and there. It’s a great tool to help us streamline all our financials.” — Juan Saravia

Get your money moving at your speed

Talking money

FAQ

How do I sign up for a Square Checking account?

Signing up for Square Checking and Square Debit Card is easy and takes less than two minutes.

Sign up to sell with Square

Go to Banking in your Square Point of Sale app or Dashboard and select Square Checking

Select Open account

Verify your information

Personalize your business debit card

Confirm the shipping address for your business debit card

Does Square Checking have any fees?

No, we do not charge any recurring fees for Square Checking — no minimum balance fees, no services fees, no monthly maintenance fees, no overdraft fees. Square does not charge ATM fees, but third-party ATM operator fees may apply.

Does Square Checking have any minimum balance requirements?

No, we do not have any account minimum balance requirements. There are no account opening minimum balances and no ongoing monthly balance requirements.

How long does it take for my account to be opened?

As soon as you finish opening your account, you can start using it right away on your Square Point of Sale app or Dashboard.

How do I add my Square Debit Card to my mobile wallet?

We recommend that you add your Square Debit Card to Apple Pay® or Google Pay™ as soon as you open your Square Checking Account, so you can start using your money while you wait for your physical card to arrive. Add your debit card to Apple Pay or Google Pay.

Can I set up automatic or recurring transfers from Square Checking?

Yes. With recurring transfers, you can automatically send money from your Square Checking account to an external bank on a daily, weekly, or monthly schedule. No fees, no manual steps — just set it once and stay focused on your business.

Is my money safe with Square Checking?

Help safeguard your funds with high-risk spend alerts, SMS alerts, two-step verification, and card lock. Manage your Square Debit Card.

Is Square a bank?

Square, which is a Block, Inc. company, is a financial services platform and not a bank. Square Checking is provided by Sutton Bank, Member FDIC.

Ready to bank with Square?

Get financial tips and hear how other businesses manage their cash flow with Square.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc.

Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking Account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

Instant access

1Instant availability of Square Payments. Funds generated through Square payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

Square Debit Card

²Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted.

Instant transfers

3Instant and same-day transfers require a linked bank account or debit card and cost a fee per transfer. Funds are subject to your bank’s availability schedule. Minimum amount is $25 USD and maximum is $10,000 USD in a single transfer. New Square sellers may be limited to $2,000 per day. Fund availability times may vary due to technical issues.

Early deposit access

4With early deposit access, Block, Inc. may make incoming electronic direct deposits made through ACH available for up to two days before the scheduled payment date. Not all direct deposits are eligible. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. Early deposit access is automatic and there is no fee.

Cash deposit

5Cash deposited into your Square Checking account is generally available in your account balance immediately after a deposit is processed. Fund availability times may vary due to technical issues.

VanillaDirect Pay is provided by InComm Financial Services California, Inc. and by InComm Financial Services, Inc. (NMLS# 912772), which is licensed as a Money Transmitter by the New York State Department of Financial Services. Terms and conditions apply.