Station RBNY isn’t your average surf and skate shop — it’s a Rockaway institution built on love for the waves and the community. The community surf shop provides everything you need for a fun day at the beach, from sales to rentals to lessons. Founder Nigel Louis brings his Barbadian surf roots to Rockaway Beach, infusing his experience into every aspect of the business.

With a combined 25+ years of surf and skate experience, Louis and his team at Station RBNY aren’t just selling gear; they’re building connections. They listen to the community, adapting to its needs and keeping the good vibes alive.

Humble beginnings

Louis started the community surf shop with little capital. With no prior business experience, he learned on the job. “So I didn’t come from money. And I didn’t start [Station RBNY] with tons of dough. I think I had maybe fifteen to twenty thousand saved at the time. But the transition was tough because what I realize now — and I say it to everyone — is people don’t understand the commitment it takes to be a business owner,” said Louis.

While he had his moments of doubt, glowing reviews from satisfied customers have been a huge source of motivation and have reaffirmed the reasons he started the business in the first place. Those moments give him a sense of purpose and help him remember that there is more to get done. “To me, I look at it like it’s the universe saying, like, you know, ‘Now is not the time to give up yet — you have more to accomplish,’” said Louis. Despite his these challenges, he was determined to continue running Station RBNY.

Searching for a solution to simplify the financial side of things

For Louis, the most challenging part of owning a business was managing cash flow. “I didn’t really have a proper system and cash flow was just through the bank, but a lot of that stuff was more a little bit more reactionary. I think if I did it [again], I would do it a little bit differently because the cash flow thing is kind of one of the biggest downfalls of business,” said Louis.

Square has been absolutely amazing. It’s just what I needed. I think having everything in one place is really good. [I like] how easy and almost, like, dumb-dumb it is. And Square having analytics at the touch of a dime being able to really get into the minutia of your business. ”

Nigel Louis → owner of Station RBNY

Finding a solution that addressed these pain points and made it easier for him to manage his business was a priority for Louis. Square delivered.

Leveraging financing that meets specific business needs

Before taking on Square Loans, Louis tried other loan options that weren’t right for his business, that incurred excessive interest, and that, ultimately, affected his credit score. “I did one or two predatory loans and realized just how sketchy that is and having to pay back way more than you need. But when you’re trying to keep your dream alive, you do what you have to do,” said Louis.

The loan repayment structure from Square was helpful. It made it easier to make payments on time in a frictionless way, as Square Loans offers automatic daily loan repayment. “I was … in a super [tight] capital situation, and then being able to be offered the loan and done in a way that it’s, like, taken out per transaction or per, like, end-of-day batches was such a big help. If I didn’t have [the loan from Square] to count on, I’m pretty positive that I wouldn’t be here,” said Louis.

Staying in control with the all-in-one Square ecosystem

The comprehensive Square platform has helped Louis manage his business finances and simplify his processes. “Having everything in one place has been a godsend for a number of reasons. For me, I’m a little bit of a one-man show, and it just makes my life easier,” adds Louis.

Prior to Square he used a traditional bank account, which he managed with his then business partners. While the account allowed him to send money quickly and instantaneously, Louis recalls that “it was a bit cumbersome, especially with everyone moving to digital.”

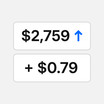

Switching to Square Banking allowed Louis to do more than just transfers. He can track his loan payments and regular business transactions from one central dashboard. This allows him to make informed cash flow decisions — for example, ramping up sales in time to meet an upcoming loan payment. “Being able to see everything in one window is kind of cool. I can see my loan with the payments that are being made right there. And then I can plan things out, for example, by saying, ‘All right, cool. This weekend we need to hustle because we may want to pay things back quickly,’” said Louis.

Staff well-being is a priority for Louis, who believes in taking proactive steps to boost staff morale. Square Payroll offers him several ways to stay on top of his payroll tasks and staff performance. He is able to offer incentives, special one-off payment, and advance pay to his employees. He says that having the ability to do these things as a small business helps him retain staff.

Louis is also excited about the new Square Checking feature that allows him to issue printable checks. Louis says that the feature is super helpful for managing contractors. Paying stuff on time — like scheduling a payment — that’s been super helpful. Paying vendors on specific days a certain amount? I could just set it and forget it. It really helps,” said Louis.

The ability to automate the simple stuff with Square makes all the difference. “I think that just being smarter about how I run my business and having those banking tools available has been super helpful.

“I have to do this reset for my business. And in resetting, I’m trying to align myself with all the things that were helpful for me when I grew the business — and, honestly, Square has been a partner from day one,” said Louis, who describes this clean start as the next big step for the business.

All loans are issued by Square Financial Services, Inc., a Utah-Chartered Industrial Bank. Actual fee depends upon payment card processing history, loan amount, and other eligibility factors. A minimum payment of 1/18 of the initial loan balance is required every 60 days, and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. Square Debit Card may be used wherever Mastercard is accepted. Accounts are FDIC-insured up to $250,000.

![]()