Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Banking Bank where you do business

Block, Inc. is a financial services platform and is not an FDIC insured depository institution. Banking services are provided by Square’s banking affiliate, Square Financial Services, Inc. or Sutton Bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured depository institution. See full disclosure.

Take total control of your cash flow

When you take payments and bank through Square, the sky’s the limit. See all you can do to set your business up for financial success at every turn.

Manage all your money in one place

Instantly access and spend your sales revenue

Automate everyday financial chores

Your money, on your time

Access money instantly

Access money instantly

Tap into your sales revenue 24/7. With Square Checking and Debit Card,¹ your money is ready to spend as soon as you make a sale.

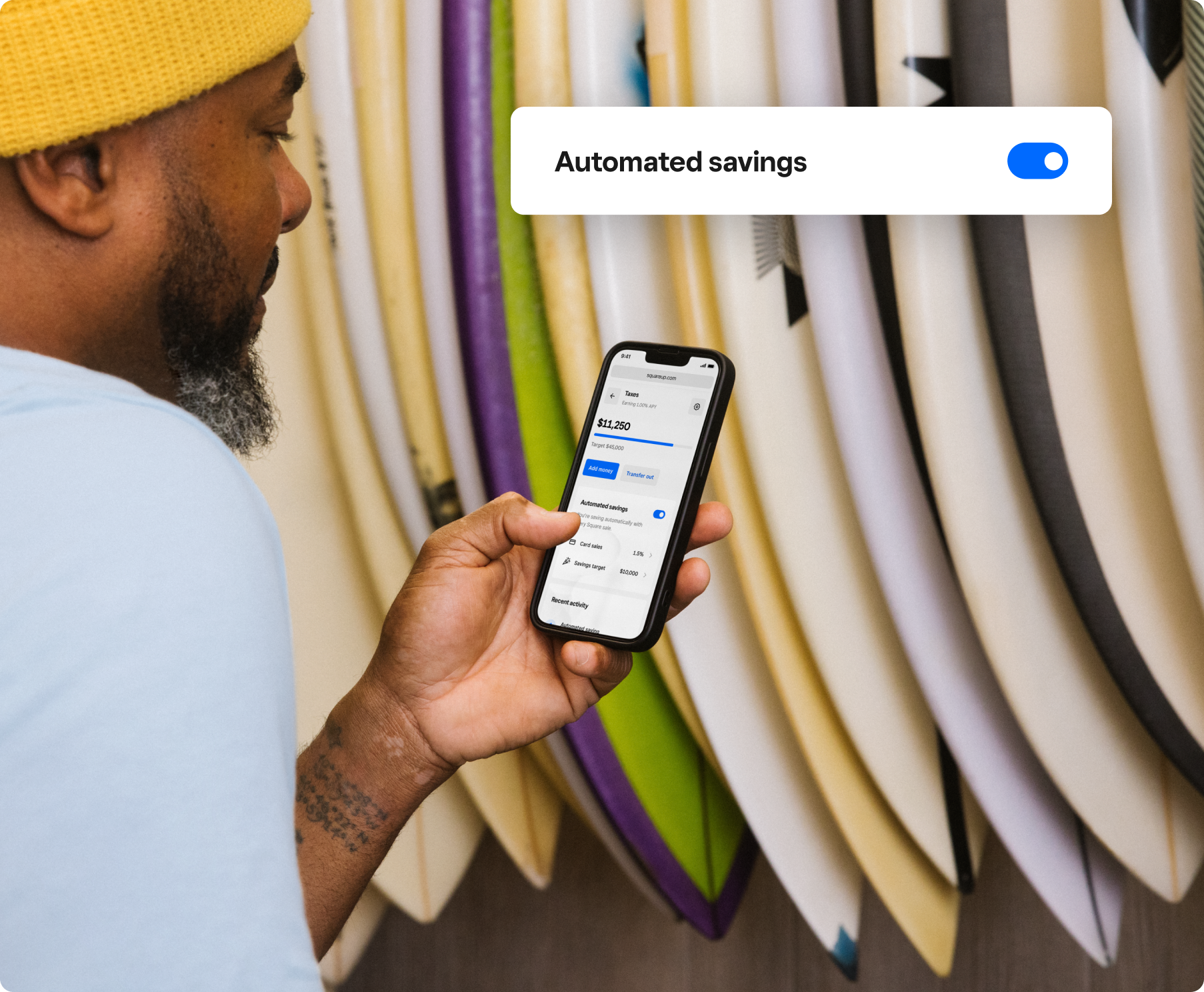

Budget automatically

Budget automatically

Plan ahead for future expenses. Automatically set aside part of your sales for taxes, expenses, and more.²

Secure a loan

Secure a loan

Weather the ups and downs of your business. Secure a custom loan offer, and put repayment on autopilot.³ No ongoing interest, no long forms, and no waiting — get funds instantly through Square Checking.

Get a credit card

Get a credit card

Make purchases right when you need to with the Square Credit Card. Earn 1% back on Square processing fees when you make purchases for your business.⁴

Pay bills easily

Pay bills easily

Get ahead of your bills. Use your sales to automatically pay your vendors on time, every time.

Convert sales revenue to bitcoin

Convert sales revenue to bitcoin

Automatically convert up to 50% of your daily sales revenue into bitcoin as a simple way to build a diverse investment strategy.5 Choose how much to convert and when to sell.

“One of the reasons why we love Square so much is because they offer so many financing options. It’s very crucial for our small business to succeed.”

Caroline Rodrigues

Merci Milo

Los Angeles, CA

“Square honestly helps you progress and become a better business and better manage everything around you.”

Juan Saravia

La Pupusa Urban Eatery

Los Angeles, CA

“I use Square for banking, and it has really revolutionized my business organization. I’m able to see everything including my transactions and how much I’m spending per project.”

Emily Yates

Flower Friends SF

Oakland, CA

Banking access for every business

1M+

business owners trust Square Banking for their financial needs.

Internal Square data, April 2025

88%

of businesses with Square Loans report growth.

Square survey data, 2025

57%

of self-reported Square Loans recipients are women-owned businesses, far above the almost 20% share for small business lenders overall.

Internal survey data, 2025

$156

average savings in monthly banking fees by sellers using Square Checking compared to traditional banks.

Banking fee study, 2025

Talking money

Learn more about your privacy and security

The privacy and security of both you and your customers are top priority for Square. Visit The Bottom Line or the Support Center to search for more articles and education about security and privacy at Square.

FAQ

Does Square Checking have any fees?

No, we do not charge any recurring fees for Square Checking — no minimum balance fees, no services fees, no monthly maintenance fees, no overdraft fees. Square does not charge ATM fees, but third-party ATM operator fees may apply.

Does Square Savings have any fees?

No. There are no monthly maintenance fees, sign-up fees, or fees associated with minimum balances. There are also no overdraft fees or withdrawal limit fees that are associated with traditional business savings accounts.

How do I sign up for a Square Checking account?

Signing up for Square Checking and Square Debit Card is easy and takes less than two minutes. First, you need to sign up to sell with Square. Then, opening your checking account is only a few more steps.

How does automated savings work?

With automated savings, you can choose a percentage of your Square sales revenue that will automatically move into a dedicated savings folder account throughout the day. Many business owners choose to automatically set aside funds for sales or income tax, emergency use, or business investment purposes in order to separate those funds from their primary business banking account.

How do I become eligible for Square Loans?

Square Loans are currently offered by invitation. We automatically review your activity to evaluate loan eligibility. If we spot that you’re eligible to apply for Square Loans, we’ll proactively reach out to you (via email and in your Square Dashboard) with a customized loan offer.

You can also use the eligibility page located in your Square Dashboard to gain more insight into the status of your Square Loans eligibility.

What are the potential tax implications of converting sales to bitcoin?

Bitcoin is taxed like any other financial investment, so it’s important to understand the tax implications before you buy or sell it. When you acquire bitcoin on Square, we’ll provide you with a Form 1099-DA for filing your taxes. It’s your responsibility to determine any tax impact of your bitcoin transactions. Square is unable to provide tax advice.

How exactly does the bitcoin conversion feature work?

Choose a percentage of your daily net card sales to automatically convert into bitcoin. We’ll withhold that amount from your sales and automatically convert it into bitcoin every day at the then-current market price. A flat 1% fee will apply to the purchase amount. Selling and sending bitcoin may result in additional fees. See Square Bitcoin Terms for more information.

Ready to bank with Square?

Get financial tips and hear how other businesses manage their cash flow with Square.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc.

Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking Account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met.

Square Checking and Debit Card

1Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

Instant availability of Square Payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

Square Savings

2Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

The rate of our savings account is more than 2x the national average of 0.41% APY, based on the national average of savings accounts rates published in the FDIC Weekly National Rates and Rate Caps accurate as of 1/21/2025.

Square Loans

3All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Square Credit Card

4American Express is a registered trademark of American Express. Other trademarks and brands are the property of their respective owners.

Square Capital, LLC is a wholly owned subsidiary of Block, Inc., d/b/a Square Capital of California, LLC in FL, GA, MT, and NY. Block, Inc. and Square Capital, LLC are not banks. Square Credit Cards are issued by Celtic Bank, Member FDIC, pursuant to a license from American Express, and may be used wherever American Express is accepted. If approved, APR may vary based on creditworthiness and other factors. Subject to credit approval.

Bitcoin

5Square Bitcoin features are offered by Block, Inc. and are subject to change and may not be available in all locations. Bitcoin services are not licensable activity in all U.S. states and territories. Bitcoin is not legal tender, is not backed by the government, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation protections.

Bitcoin’s value can change rapidly, which means the amount of bitcoin needed for a purchase, or the amount made from a product sale on Square, may vary from moment to moment. Bitcoin transactions may experience technical issues and are generally irreversible - all payment details should be carefully verified before confirming any transaction.

Block, Inc. makes no representation on the accuracy, suitability, or validity of any information provided. Block, Inc. operates in New York as Block of Delaware and is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. At present, Square Bitcoin is not anticipated to be available to sellers that are located in New York State or outside the U.S. and may be subject to regulatory approval, where applicable.