Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Discover what’s new. Shape what’s next.

RELEASES

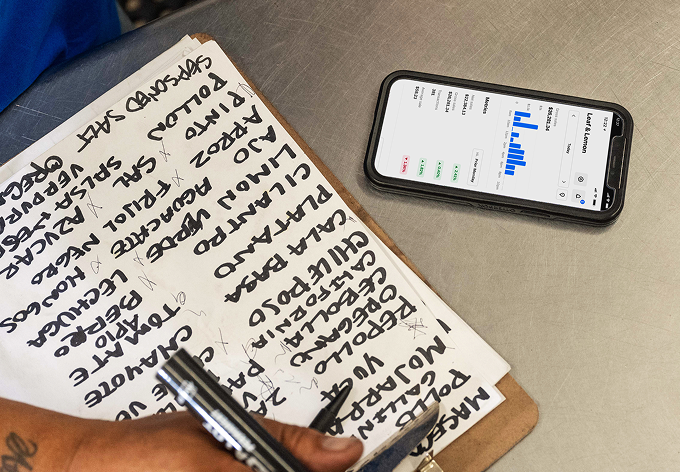

Explore the latest launches in Square hardware, tools, banking,¹ and more.

Check out features by business type:

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc.

Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking Account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

1Instant availability of Square Payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

2Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

3Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount, and other eligibility factors. A minimum payment of 1/18 of the initial loan balance is required every 60 days, and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

4As compared to online ordering platforms Toast, Clover, and SpotOn, based on publicly advertised pricing as of May 13, 2025.

5Delivery commission saving is an estimate based on an assumed 30% commission charged by third-party delivery partners on premium plans.

6Instant Payouts services require a Square Checking account. Funds provided through Instant Payouts services are generally available in the Square Checking account balance immediately after an order is processed. Fund availability times may vary due to technical issues. If an order is not paid out instantly, it will be available according to your regular deposit schedule. Payout limits, including limits on payout amounts, may apply.

Other trademarks and brands are the property of their respective owners.

7Offline payments are processed automatically when you reconnect your device to the internet and will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined, or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. Offline payments are not supported on older versions of Square Reader for contactless and chip (1st generation, v1 and v2).