Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Turn what’s possible into what’s next

The latest launches at Square can help you run every aspect of your business, from starting and selling to financing and growing.

Power your day with a pocketable POS

Square Handheld

Process payments, take tableside orders, and manage inventory — all from the palm of your hand. Only 0.7 pounds and super feature packed, this new, durable device helps you engage more customers, increase profits, and do more on the move. It’s the ultimate in portability.

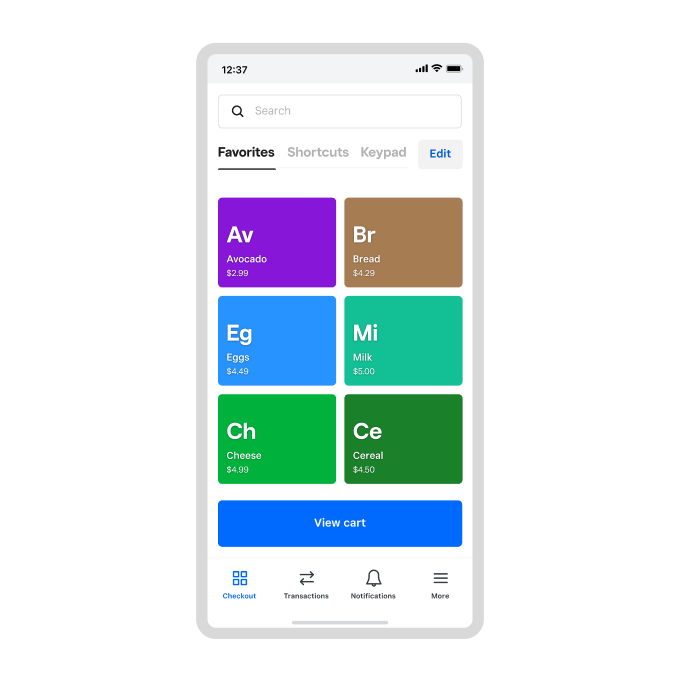

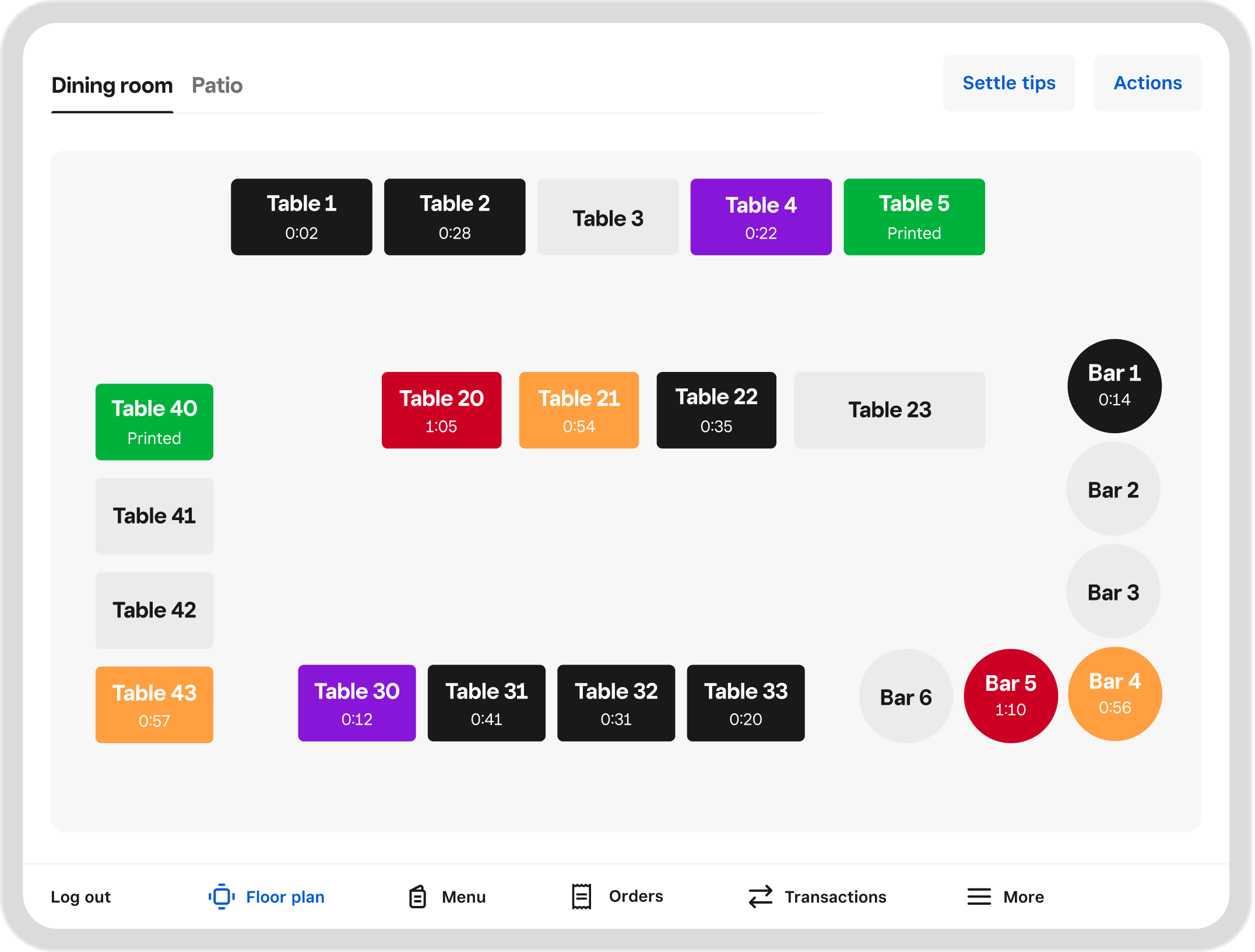

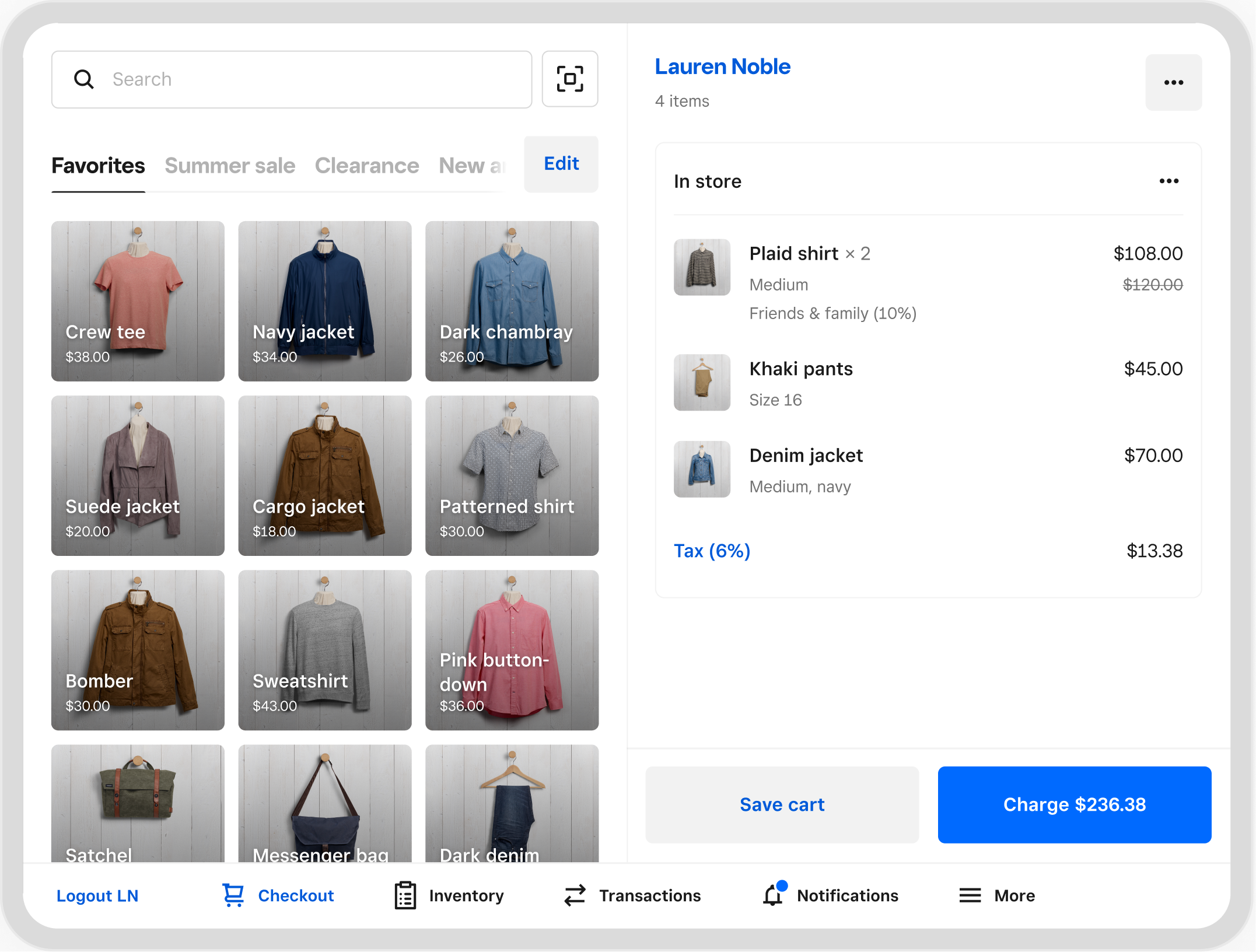

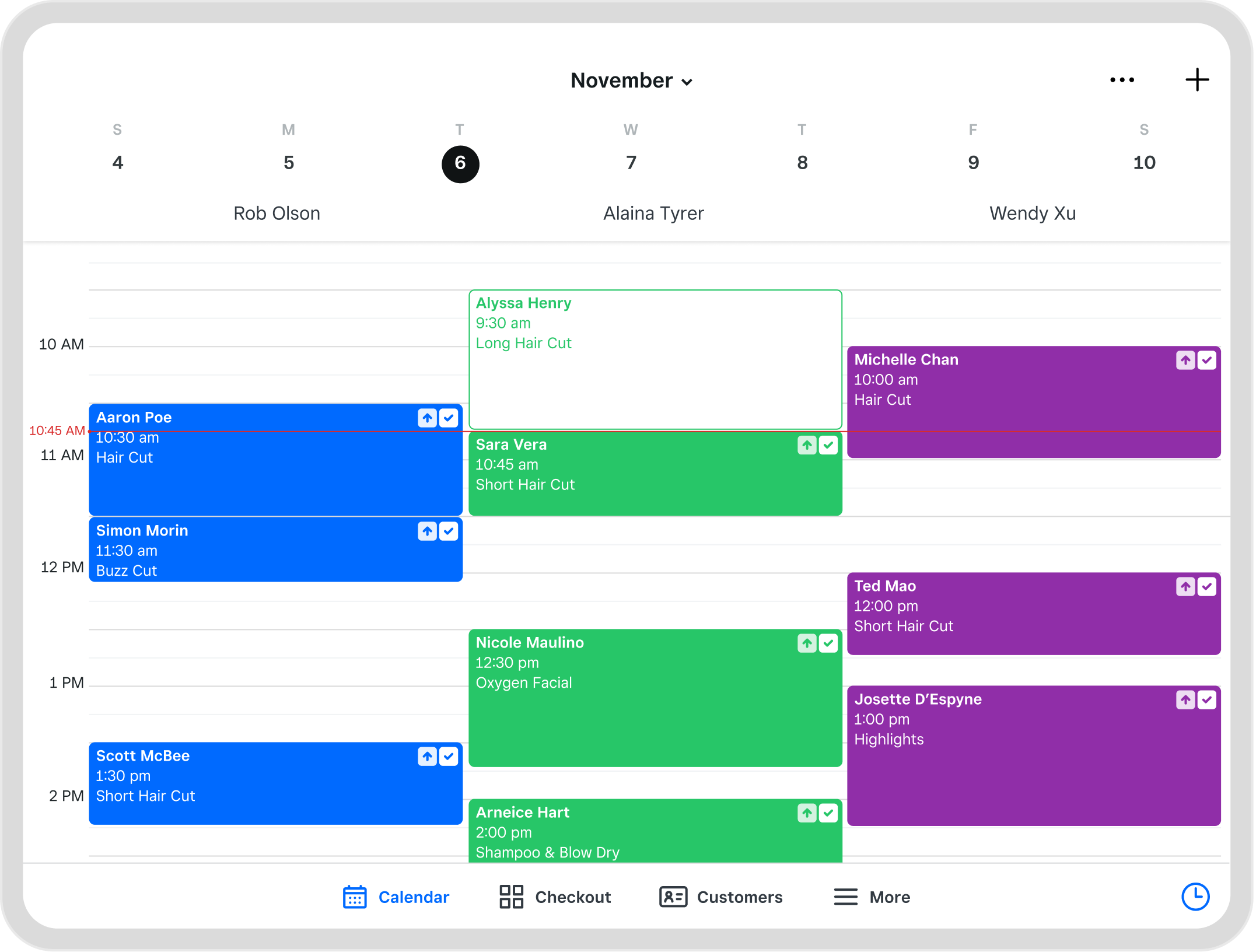

Sell however you like from an updated POS app

Square Point of Sale

Get up and running quickly with this powerful, intuitive POS, personalized for your business needs. Equipped with specific settings, features, and functionality purpose-built for different business types, you can access tools to handle everything from taking a payment to managing complex ops.

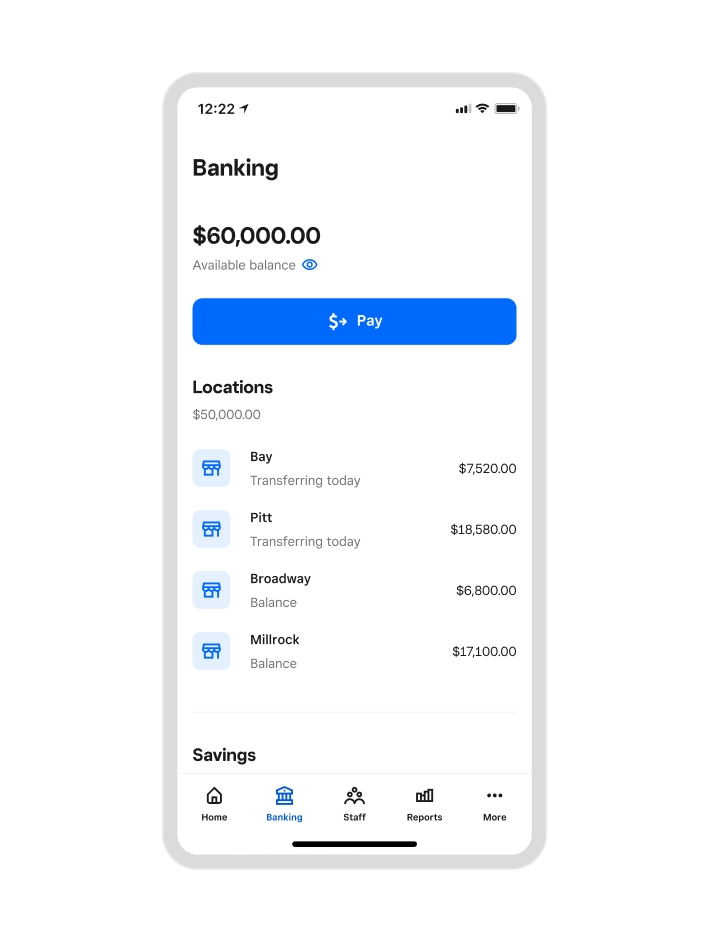

Control your cash flow with Square Banking1

Square Checking

Tap into your funds instantly.2 With a free Square Checking Account and debit card3 you can access, spend, and manage your money as soon as you make a sale. No fees, no minimums.

Now with Square Invoices, you’ll pay $0 in processing fees when you receive an ACH bank payment directly into your Square Checking account.

Square Savings

Save automatically with every sale and budget effortlessly, all while earning 1.00% APY.4 With smart folder recommendations, it's even easier to set aside funds for key expenses like taxes and supplies, based on insights from businesses like yours. 100% free, no fees or minimums.

Square Loans

Fast funding made simple, repaid automatically with a percentage of your daily sales. With a Square Loan, you can smooth your cash flow and grow your business, with no hidden fees or long forms to fill out. Get your loan funds deposited instantly into your Square Checking account, or get your money as soon as the next business day to keep things moving.

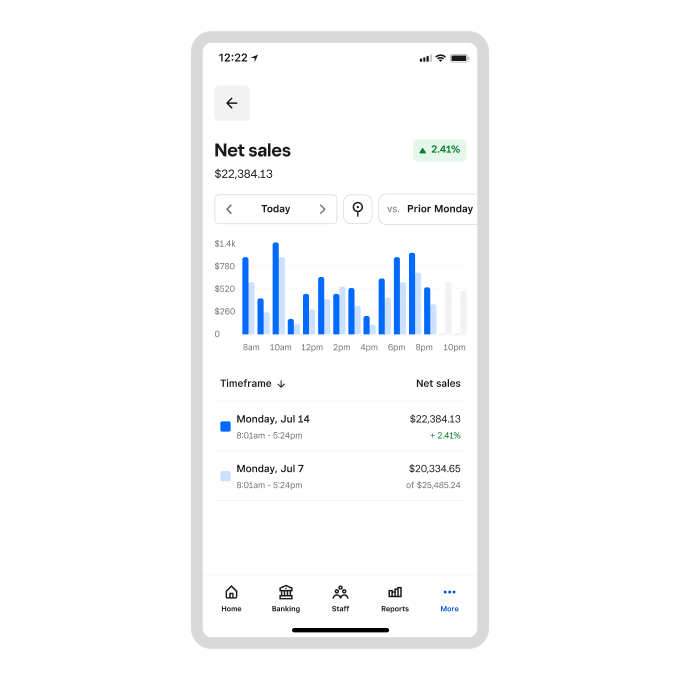

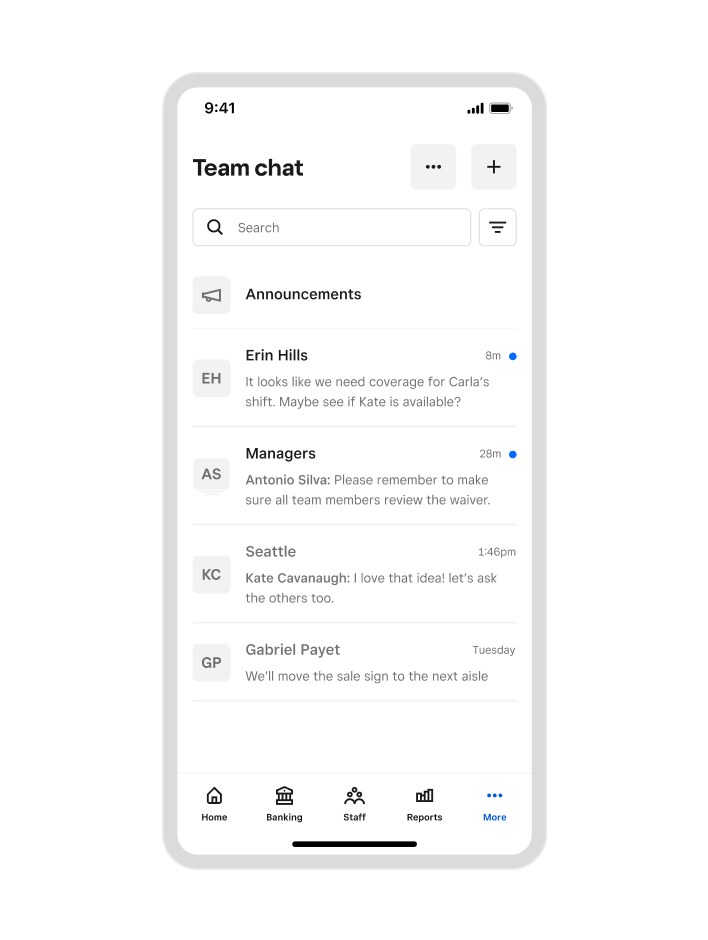

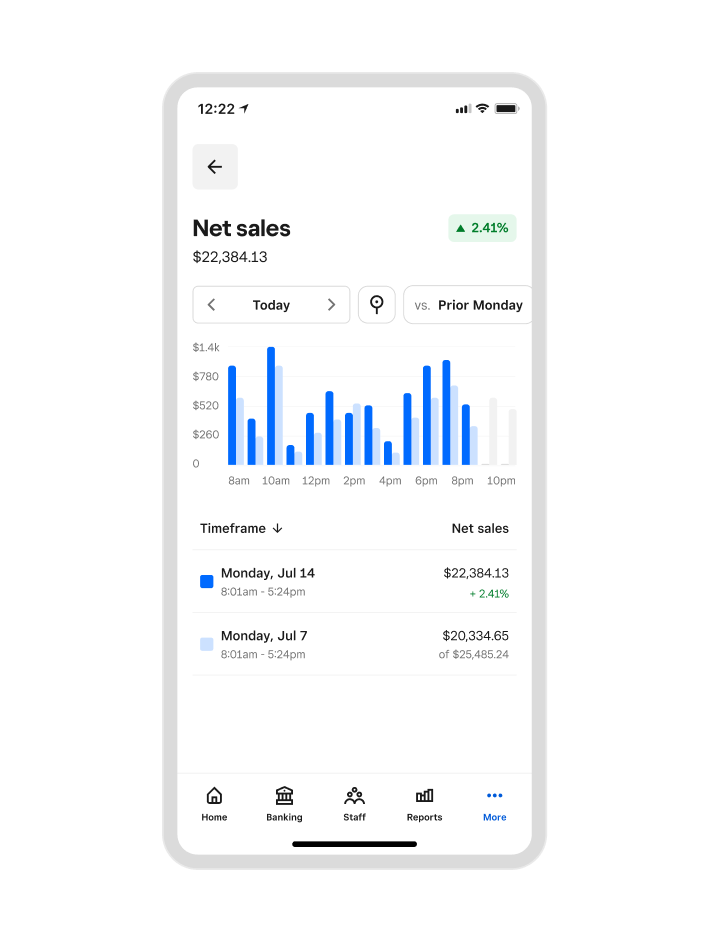

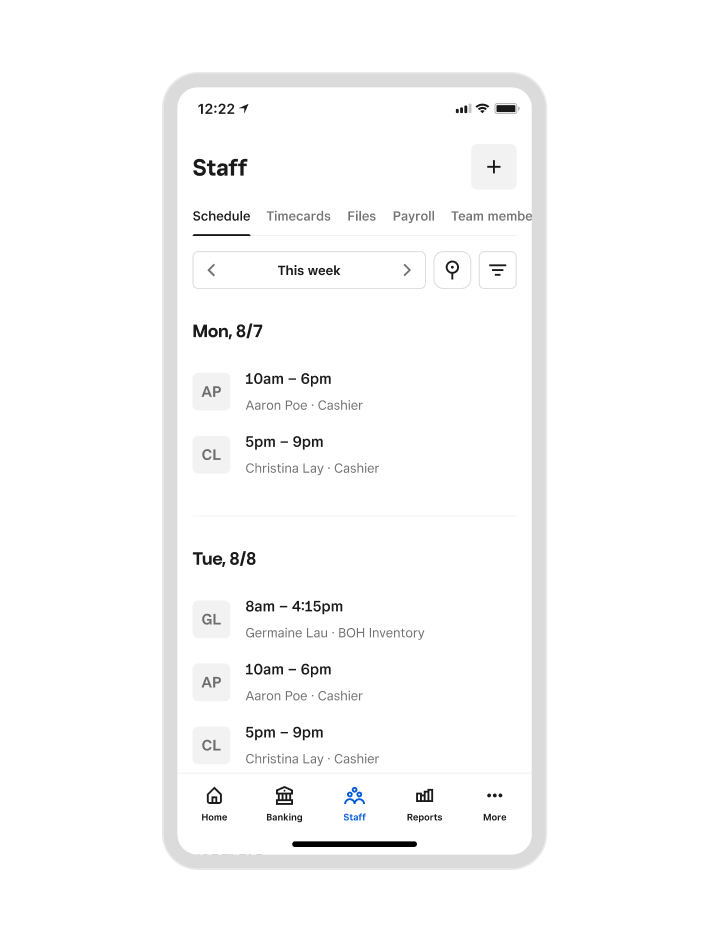

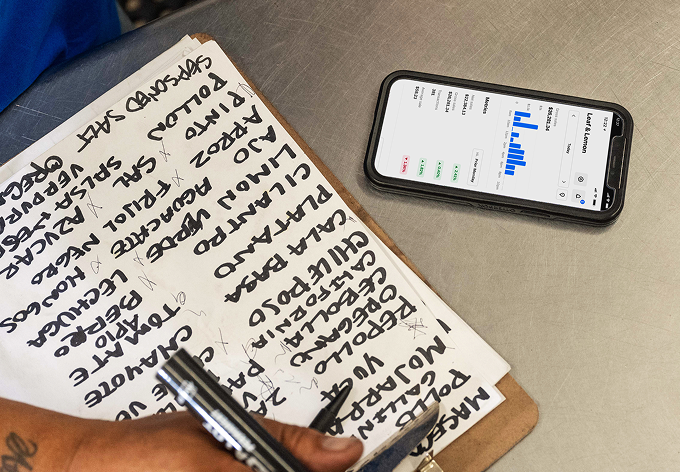

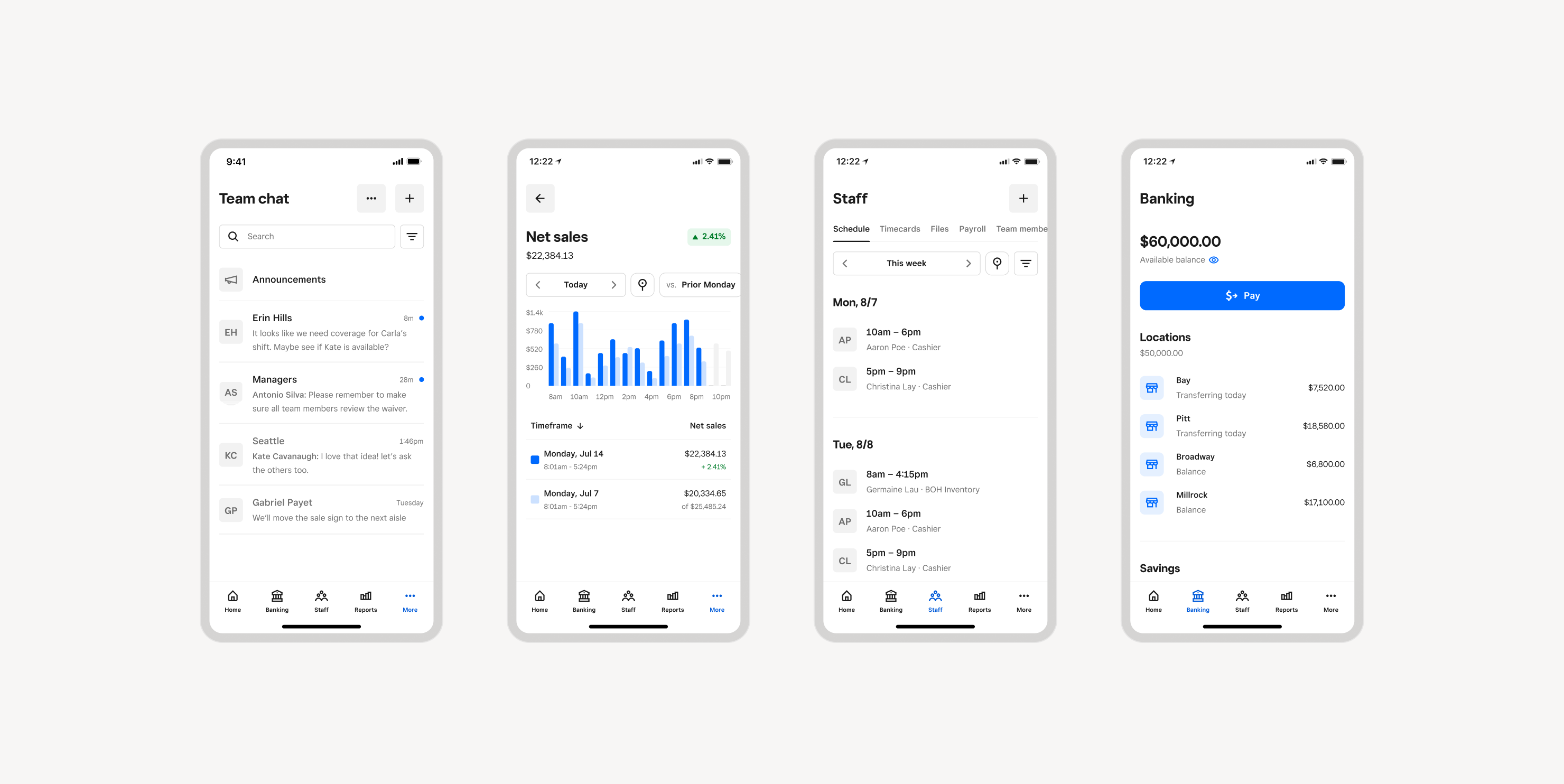

Manage all your tasks wherever you are

Square Dashboard

With the new and improved Square Dashboard app, you can get a unified look at your business and manage essential tasks in real time. Track business performance, manage your finances, and keep up with your team — anytime, anywhere.

Square Dashboard

With the new and improved Square Dashboard app, you can get a unified look at your business and manage essential tasks in real time. Track business performance, manage your finances, and keep up with your team — anytime, anywhere.

Explore more new and improved features for your business

Square AI

Open Beta

Get instant insights with just a question. Want to know your best sellers, slowest hours, top customers, or labor trends? Just ask. Square AI helps you uncover answers, spot trends, and make smarter decisions—fast.

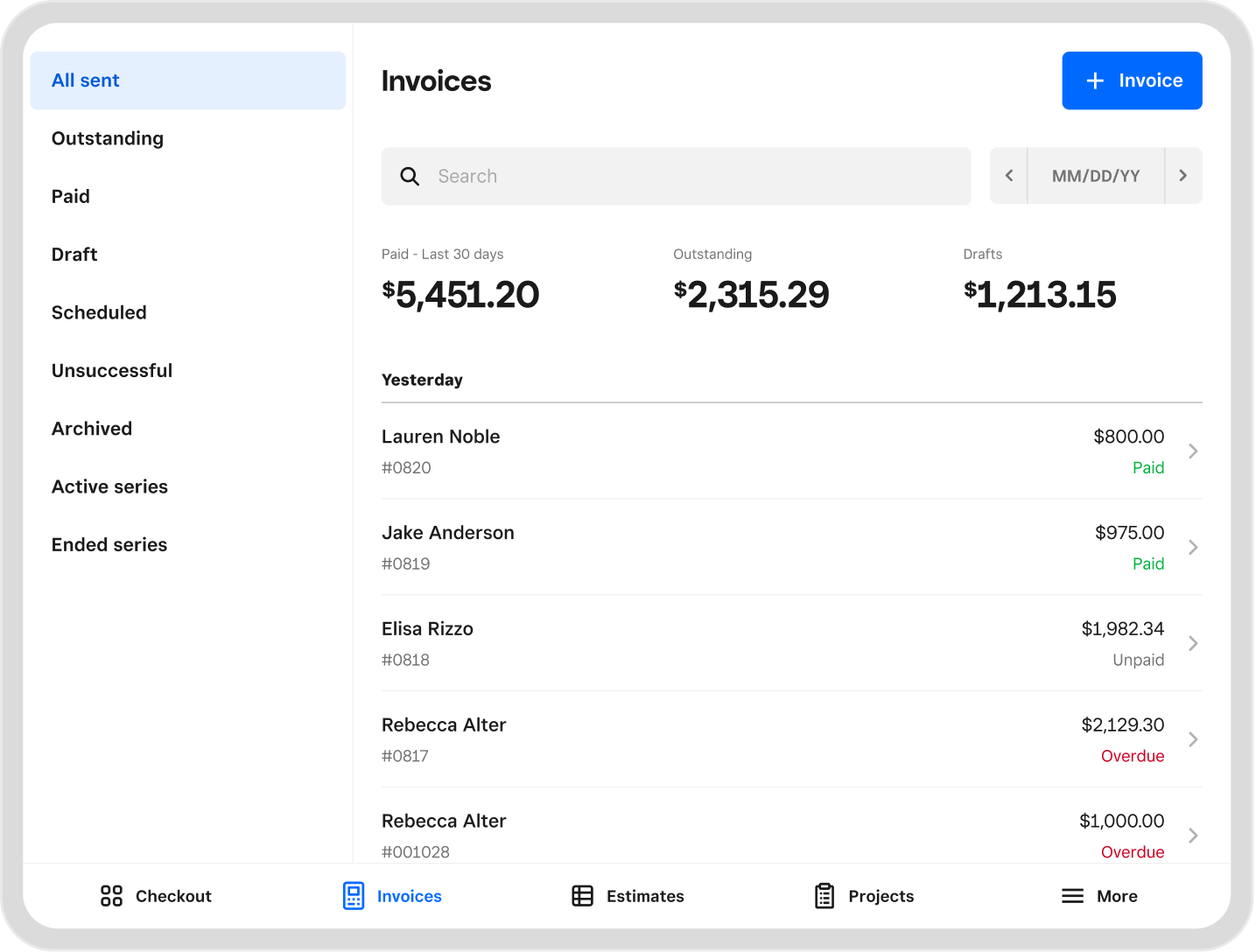

Save on fees and speed up payments with Square Invoices and Square Checking

Pay $0 in processing fees when you receive an ACH bank payment directly into your Square Checking account. Reduce the steps to depositing your checks by reconciling check payments directly against a Square Invoice.

Send invoices up to $1 million

Stay organized: Consolidate your payments for large projects into a single invoice, and accept installment payments up to your default limit. Let your buyers customize the amount they want to pay on an invoice.

New hire onboarding and staff improvements

Streamline new hire onboarding and collect team member documents centrally within Square with improvements to the Square Team app.

“Text us” button

Build trust with your customers and close sales faster by giving them an effortless way to contact you during their buying or booking process.

Custom tenders

Coming soon

Capture and track all payments you receive, even those that aren’t processed through Square.

Simplified item creation flow

Coming soon

Now it’s easier than ever to create items with a flow that lets you enter essential information quickly and go in depth only where needed.

Improved bulk tooling for online selling

Get set up online faster with tools that let you edit multiple item attributes at the same time. Upload many photos at once that map to the right product automatically.

New item library filters

Navigate your item library more efficiently with new filtering options. Filter by item type, stock quantity, or sale status, and combine filters to update your catalog quickly.

Remote device management

Stay in charge of your day: Check network strength and connection; monitor your Square tools live; turn on proactive notifications; and switch quickly to offline payments.5

Reliability improvements to reduce business disruptions

We’re always working hard to bring you a faster, more reliable platform. We’ve made improvements to reduce outages, to reduce Square Reader disconnects by 70%, and to speed up our POS cart-to-checkout by 55% with enhanced notifications, and an easy switch to offline payments when needed.

Robust, professional-grade network connectivity

Reduce the potential for disruptions with premium networking equipment. We partnered with best-in-class manufacturer Ubiquiti to give you quick access to a stronger and more reliable network. Access it on Square Shop.

Check out features by business type:

Simplified item creation flow: Get notified when it's live.

Custom tenders: Get notified when it's live.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc.

1Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking Account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

2Instant availability of Square Payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

3Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

4Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount, and other eligibility factors. A minimum payment of 1/18 of the initial loan balance is required every 60 days, and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

5Offline payments are processed automatically when you reconnect your device to the internet and will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined, or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. Offline payments are not supported on older versions of Square Reader for contactless and chip (1st generation, v1 and v2).