Table of contents

Bitcoin adoption has moved well beyond tech circles. A Security.org survey found that about 28% of American adults — roughly 65.7 million people — now own some form of digital currency, up from 15% in 2021. And bitcoin remains the most popular, owned by more than 70% of those surveyed.

As more people grow comfortable with bitcoin, customers are looking for new ways to pay. Now it’s easier than ever for Square businesses to meet that demand. With Square’s new Bitcoin Payments and Bitcoin Conversions1 features, you can accept bitcoin directly from customers or choose to hold some of your sales in bitcoin, all from your Square Dashboard. There’s no need to manage wallets or private keys, and you’ll get the same simplicity and transparency you expect from every other Square product.

“We’re doing this because bitcoin gives entrepreneurs a new lever,” explained Miles Suter, Bitcoin Product Lead at Block (Square’s parent company). “It’s a way to spend and invest outside of traditional rails – with faster settlement, lower fees, and long-term potential. Until now, these tools have been out of reach for most small businesses. Square is changing that.”

Whether you’re simply curious about how it works or ready to expand your payment options, this guide walks you through the essentials: what bitcoin is, how Square keeps things simple and secure, and how you can start using it in your business.

Bitcoin basics: What you should know

Before you start accepting bitcoin, it helps to understand what it actually is and why people use it.

Bitcoin is a digital currency that allows people to send and receive payments directly, without going through traditional banks or intermediaries. Transactions are recorded on a public ledger called the Bitcoin blockchain, which helps ensure transparency and security.

For many customers, paying with bitcoin is about speed and convenience. Transactions can happen almost instantly when processed through the Lightning Network, a payment layer built on the Bitcoin blockchain that makes bitcoin transactions faster and cheaper, which is how Bitcoin Payments through Square works. Others appreciate the privacy and control that come with using bitcoin and may also see it as a way to support businesses that embrace new technology.

Accepting bitcoin at your business gives your customers another way to pay — and a growing number of consumers are ready to use it. According to the Wharton Consumer Cryptocurrency Confidence Report, the percentage of people who believe merchants accept bitcoin rose from 16% in early 2023 to 25% by the end of 2024.

With interest growing, offering bitcoin as a payment option can help your business stand out while giving your customers the flexibility they expect.

Accepting Bitcoin Payments through Square

Bitcoin Payments allows your customers to pay with bitcoin through your Square POS, Online Store, or Invoices — just like any other payment method. Starting November 10, 2025, you’ll be able to accept bitcoin and automatically receive your funds in bitcoin (BTC) or U.S. dollars (USD). Square is also waiving processing fees until 2027, so you can accept bitcoin at 0% fees, with no chargebacks, and instant access to your funds.

Greg Hoffmeister, owner of Doctor’s Island Brewing Co. in Massachusetts, understands the value of bitcoin and has integrated it into his business. “There’s so much value in bitcoin. I truly believe it. I’m seeing it in my own business, and that’s why I’ll accept Bitcoin Payments for beer,” he said.

Hoffmeister even created a rewards program that pays customers in bitcoin. Once customers earn enough rewards, they can either pay for their beer in bitcoin or hold it and watch its value grow over time.

How Bitcoin Payments works

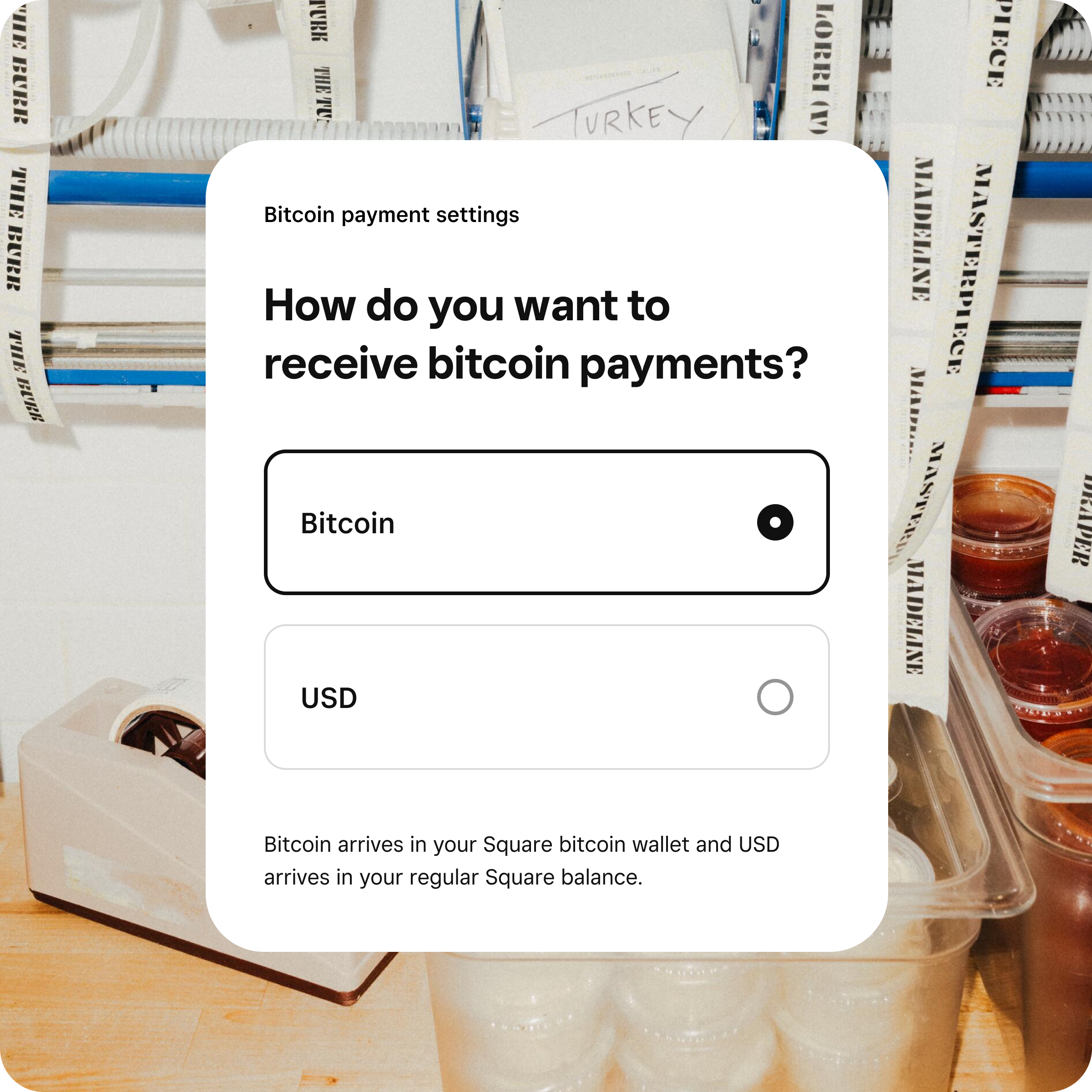

When a customer chooses bitcoin at checkout, Square instantly processes the transaction and gives you the choice to settle in either BTC or USD. The payment appears in your Square Dashboard like any other sale.

When customers select bitcoin as their payment method, they can pay using any Lightning-enabled bitcoin wallet, such as Cash App. Payments settle in seconds, and funds appear almost instantly in your Square Dashboard.

Square manages all the technical details behind each transaction, so there’s no need to handle wallets, private keys, or external exchanges. The process is designed to be as simple and secure as accepting a card payment.

How to accept bitcoin payments with Square

- Verify your identity and complete two-step verification.

- Enable Bitcoin Payments in your Square Dashboard or Square Point of Sale app.

- When a customer wants to pay with bitcoin, select Bitcoin as the payment method at checkout.

- A Lightning Invoice QR code will appear on your screen.

- The customer scans the QR code with their Cash App (or another Lightning-enabled) wallet.

- The payment settles in seconds, and funds appear almost instantly in your Square Dashboard — either in bitcoin or automatically converted to USD, depending on your settings.

Bitcoin payments are currently supported for transactions up to $600. For larger purchases, your customers will need to use another payment method.

How your customers can pay with Cash App

For your customers, the process is just as smooth. Here are the steps they need to take:

- Download Cash App and verify their identity.

- Buy bitcoin in Cash App or deposit it from another wallet.

- Tap the ‘$’ Payments tab on the home screen.

- Tap the QR scanner in the top-left corner.

- Hold the camera over the QR code to scan it.

- Confirm and pay. The transaction completes in seconds.

Bitcoin Payments are currently available to U.S. businesses (with the exception of businesses located in New York) with eligible Square accounts. Exclusions may apply, and availability may expand to other markets over time.

Managing bitcoin earnings with Bitcoin Conversions

Bitcoin Conversions makes it easy to hold bitcoin as part of your business funds directly from your Square Dashboard. You can instantly convert a portion of your Square balance into bitcoin or set an automatic rule to convert up to 50% of your daily sales into bitcoin as a simple way to diversify your earnings.

Joe Carlo, co-founder of Pink Owl Coffee in Northern California converts a percentage of the business’s sales into bitcoin. “We’ve never missed a day of converting a portion of our sales, and we’ve already acquired significant savings just by converting 10% of our daily sales,” Carlo said.

It’s all about flexibility. You decide how much to convert and when to sell, and you can change your settings anytime. Conversion rates and fees always appear upfront before you confirm a transaction, so there are no hidden costs.

More businesses are starting to view bitcoin as part of a broader financial strategy. “I want to take my excess profits and savings and store it in a form that I know will hold its value and probably increase in its purchasing power over time,” Hoffmeister explained.

According to River Financial’s Bitcoin Adoption Report 2025, companies now hold about 3.3% of all bitcoin in circulation, a 30% year-over-year increase. With Bitcoin Conversions, you can take a similar approach without ever leaving your Square ecosystem.

How to use Bitcoin Conversions

To automatically convert a portion of Square card sales into bitcoin, you’ll choose a percentage of your sales within Square Dashboard. Your selected percentage of sales will be converted to bitcoin once daily between 5pm and 9am EST. To get started:

- Sign in to Square Dashboard and go to Banking.

- From the Bitcoin section, click Get started.

- Enable two-step verification (2FA) if not already active on your account.

- Choose what percentage of your daily sales you’d like to convert to bitcoin, from 1-50% in 1% increments > Next.

- Review and confirm your Bitcoin conversion settings and click Complete Setup.

If you see a conversion rate that’s less than the withholding rate you’ve chosen, or if you already have existing allocations such as Automated Savings or Square Loans, the total amount withheld can never exceed 100% and will be adjusted accordingly when bitcoin withholding is applied.

Bitcoin Payments vs. Conversions: What’s the difference?

Both Bitcoin Payments and Bitcoin Conversions give you new ways to use bitcoin through Square. The key difference lies in how you use them: one helps you accept bitcoin from customers, while the other helps you hold bitcoin as part of your business funds.

|

Feature |

What it does |

When to use it |

|

Bitcoin Payments |

Accept bitcoin from customers as payment for goods or services. |

When you want to offer bitcoin as another checkout option. |

|

Bitcoin Conversions |

Convert part of your Square sales into bitcoin from your Dashboard. |

When you want to hold or invest in bitcoin directly. |

Together, these features make it simple to both participate in the bitcoin economy and manage your earnings in one connected Square experience.

Using bitcoin in your Square ecosystem

Square has always made it easy to manage your business finances in one place, with full transparency and control in a platform that’s simple to use. Bitcoin Payments and Bitcoin Conversions extend that same experience to bitcoin, giving you more flexibility without adding complexity.

From your Square Dashboard, you can manage Bitcoin Payments right alongside Square Checking, Savings, and Loans. Funds from Bitcoin Payments settle instantly, similar to how card transactions flow into Square Checking.

As with Square Banking, there are no hidden fees, no minimums, and no surprises. Funds are available immediately, avoiding the one-to-two-day delays common with traditional banks.

Because everything is integrated, you can adopt bitcoin while keeping the same workflows you already use to run your business.

Square’s approach to financial empowerment

Square’s mission has always been to give business owners more control over how they manage, access, and grow their money. Bitcoin Payments and Bitcoin Conversions are the next step in that journey. They offer the same speed, transparency, and trust you already expect from Square — now with more ways to hold and use value.

“We want business owners to have choice in the type of payment options they offer customers,” Suter explained. “If they want to accept bitcoin, let’s make it easy for them to do so. You can start small and learn more about bitcoin as you go.”

Whether you want to accept bitcoin from your customers, diversify your balance, or simply explore what’s possible, Square makes it easy to do it all in one place.

Ready to get started?

Visit your Square Dashboard > Banking > Bitcoin to turn on Bitcoin Payments or set up Bitcoin Conversions today.

Frequently Asked Questions

Is bitcoin secure?

Yes. Square manages the entire payment process, so you don’t need to handle wallets, private keys, or exchanges. Transactions are protected by the same security standards that power all Square payments.

Why should I accept Bitcoin Payments through Square?

Accepting bitcoin gives your customers another way to pay — one that’s fast, secure, and future-focused. You’ll also benefit from 0% processing fees until 2027, no chargebacks, and instant access to your funds. Plus, you can choose whether to receive your payments in bitcoin or U.S. dollars, depending on what works best for your business.

Can I turn off Bitcoin Payments?

Absolutely. You can disable or re-enable Bitcoin Payments anytime from your Square Dashboard.

What are the potential tax implications of converting sales to bitcoin?

Bitcoin is treated like other financial investments for tax purposes. When you buy or sell bitcoin through Square, we’ll issue a Form 1099-DA to help you file accurately. You’re responsible for determining how your bitcoin transactions affect your taxes, so it’s a good idea to speak with a tax professional for guidance. Square can’t provide tax advice, but you’ll have complete records of every transaction to make reporting easier.

Are there risks with owning bitcoin?

Like any investment, bitcoin’s price can rise or fall. While it can offer growth potential, it also carries risk. Square gives you secure tools to buy, hold, and sell bitcoin, but you should only convert funds you’re comfortable holding.

How quickly do Bitcoin Payments settle?

Bitcoin Payments typically settle almost instantly, thanks to the Lightning Network, which enables fast, low-cost transactions built on top of the Bitcoin blockchain.

Can buyers still earn loyalty points when paying in bitcoin?

Yes. Buyers will continue to earn loyalty points for Bitcoin Payments, just as they would with other payment methods.

How do bitcoin transactions appear in my reports?

All bitcoin sales and conversions appear in your Square Dashboard alongside your other transactions. You can filter or export them at any time for record keeping or tax purposes.

![]()