Table of contents

It’s the end of an era. After more than 200 years in circulation, the last penny has been minted by the U.S. Treasury. The historic shift was proposed to reflect an increasingly cashless society and ease the tax burden on taxpayers, who are said to save an estimated $56 million a year without penny production.

With the minting of the last penny, many businesses are looking ahead to what this means for cash transactions, especially as coin shortages persist throughout the country.

What do business owners need to know about penny elimination?

The U.S. Treasury has officially ended penny production for general circulation, however, pennies still remain a legal form of payment. As circulation dwindles, businesses will need to plan for situations where exact change cannot be provided. One common approach used in countries that have eliminated one cent coins is cash rounding.

What is cash rounding and how does it work?

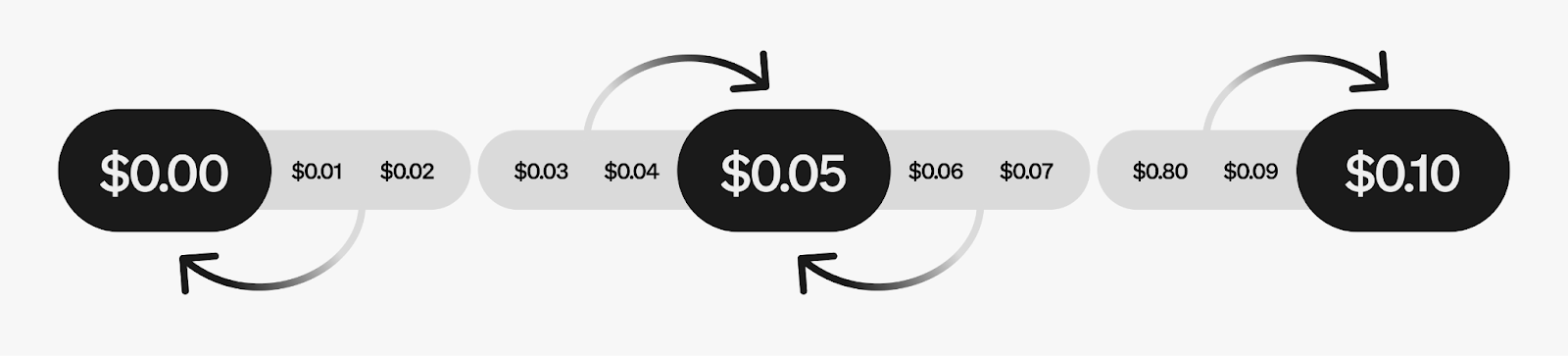

Cash rounding, also known as penny rounding, adjusts cash transaction totals to the nearest five cents. For businesses that operate internationally, this may be a familiar practice. This is the standardized rounding approach used in Canada and Australia, following the elimination of their lowest-denomination coins in 2013 and 1992, respectively.

This framework takes the guesswork out of handling cash transactions whose totals don’t end in a multiple of 5 cents. Cash rounding occurs at the end of all cash transactions, after taxes have been applied. Cash rounding does not affect debit/credit or other cashless forms of payment like Tap to Pay on iPhone or Tap to Pay on Android.

In practice, the transaction would either be rounded up or down, depending on the price. For example, an item totaling $1.01 or $1.02 after tax would be rounded down to $1. An item totaling $1.03 or $1.04 after tax would be rounded to $1.05.

Here’s a full breakdown of how cash rounding looks in practice:

|

Total Amount |

Rounding Applied |

Cash Amount |

|

$1.01 |

-$0.01 |

$1.00 |

|

$1.02 |

-$0.02 |

$1.00 |

|

$1.03 |

+$0.02 |

$1.05 |

|

$1.04 |

+$0.01 |

$1.05 |

|

$1.05 |

$0.00 |

$1.05 |

|

$1.06 |

-$0.01 |

$1.05 |

|

$1.07 |

-$0.02 |

$1.05 |

|

$1.08 |

+$0.02 |

$1.10 |

|

$1.09 |

+$0.01 |

$1.10 |

|

$1.10 |

$0.00 |

$1.10 |

Options for cash rounding solutions

Manual rounding

When it comes to putting cash rounding into practice in your business, one solution is to do this manually. For each transaction you process, you can do the math to round the transaction total to the nearest nickel, and recalculate accordingly to give the customer the correct change. However, this method can introduce errors to the checkout process.

It’s easy for a cashier to make a mistake, round the wrong way and give the incorrect change. Additionally, without properly documenting this rounding, your point of sale reporting would no longer be accurate for your daily register tallies as well as your total annual cash levels. While small, these discrepancies can add up over time.

Automatic rounding

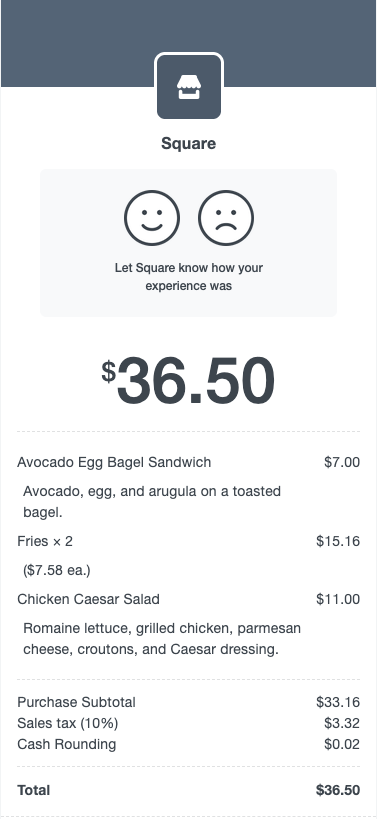

Alternatively, automatic cash rounding solutions exist that solve these issues easily and consistently. Point of sale systems like Square have introduced a pilot of the cash rounding feature to make this transition as simple as possible. When using Square POS with cash rounding enabled, any transaction rung up as cash would be automatically rounded to the nearest five cents.

For example, a $5.94 sale would have an additional $0.01 line added named “Cash Rounding,” bringing the new total to $5.95 and automatically showing the correct amount of change to give the customer. For a $5.91 transaction, there would be a “Cash Rounding” line for -$0.01, removing 1 cent from the total. This line shows up on your register and receipts, informing your customer and keeping your business compliant. The rounding is also reflected in your reporting and cash management sessions, so you will always see the true amount of money you have in your cash drawer.

What to know about cash rounding

Pennies still count: Although pennies will no longer be produced, any existing pennies in circulation can still be used by customers to make payments. If a customer’s transaction is rounded to $10.95, for example, a customer can still put pennies toward the final total.

The impact on split payments: When customers go to split a payment between cash and card, the cash portion will be rounded to the nearest nickel and the card portion will be adjusted accordingly.

Pricing tactics: The beloved and common “99-cent pricing tactic” may lose some of its charm. For example, pricing a sandwich for $6.99 as opposed to $7 has been a long-standing tactic to make prices appear cheaper to customers. However, as cash rounding becomes more common, some businesses may opt to adjust the tactic to 95 cents.

With the official end of the penny, cash rounding could become commonplace at the counter. If you decide to implement a cash rounding method, be sure to check with your legal advisor to make sure your setup complies with applicable laws and regulations.

![]()