Table of contents

When I first started at Block (Square and Cash App’s parent company) in 2017, integrating bitcoin into our ecosystem was a novelty. Over time, Block became a leader in supporting bitcoin and, quite frankly, the move even raised eyebrows inside our own organization.

To be fair, we may have been ahead of our time. Bitcoin, and really digital currency as a whole, was still fairly counter-culture. You could argue it still is.

But just like with AI, the world’s economy is catching up to a new, more democratized way of doing business. We like to think that Cash App and Block have played a big role in bitcoin’s mainstream acceptance.

Truth be told, we may be ahead of the marketplace once again. But being early has always been part of our DNA. It’s one way we live out our mission of economic empowerment.

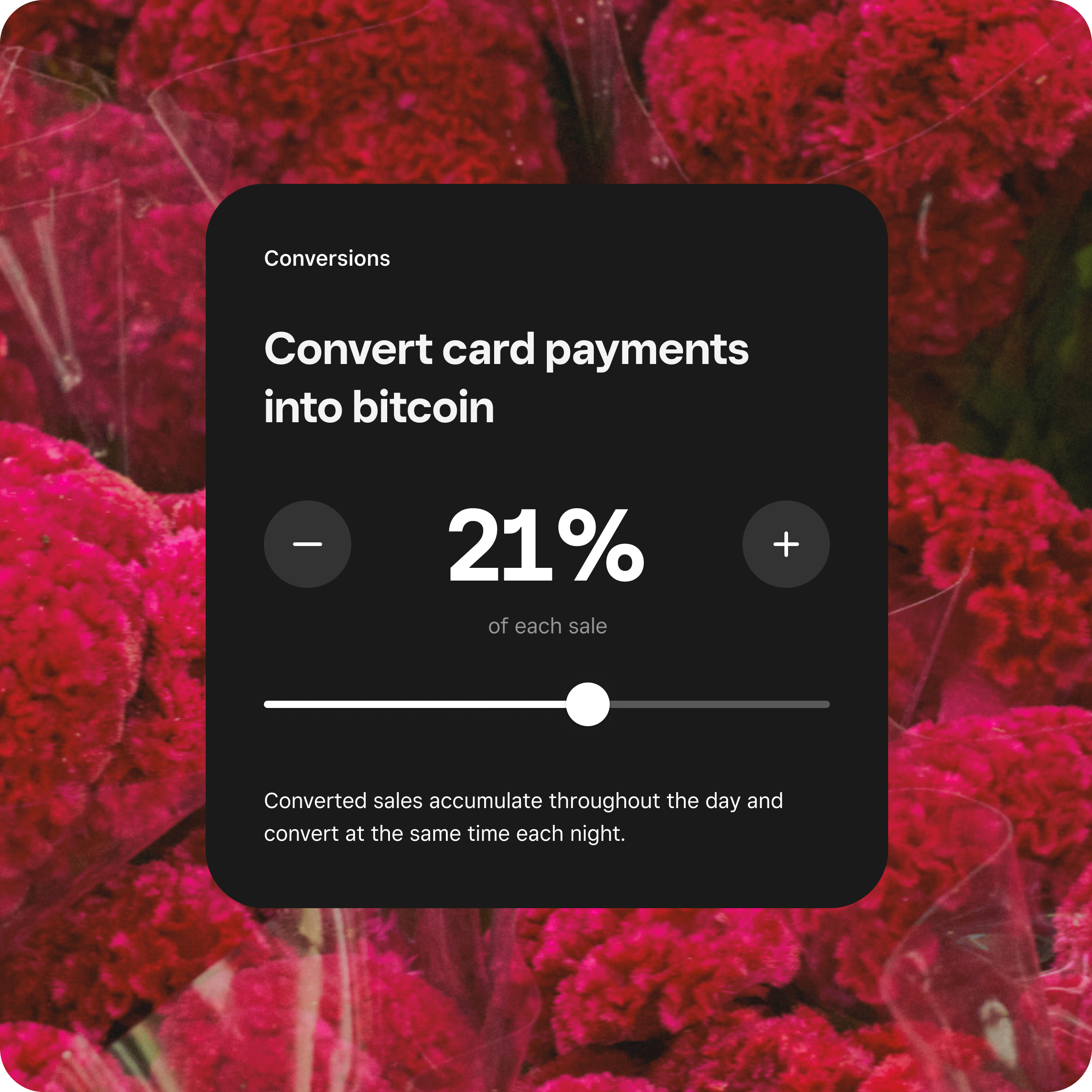

That’s what makes me so excited that Square is (at long last!) rolling out Bitcoin Payments1 in November 2025. Eligible Square businesses will be able to accept bitcoin payments directly through their point-of-sale (POS) system. We’re also launching Bitcoin Conversions natively within Square October 2025. Bitcoin Conversions will allow eligible Square businesses to automatically convert a percentage of card sales into bitcoin – an easy way to diversify your finances over time. It’s a simple, smart growth strategy that works alongside Checking2 and Savings3 to support your financial goals.

We’re doing this because bitcoin gives entrepreneurs a new lever: a way to spend and invest outside of traditional rails – with faster settlement, lower fees, and long-term potential. Until now, these tools have been out of reach for most small businesses. Square is changing that.

Meeting customers where they are, and businesses where they want to be

Merchants should never miss a sale, and adopting bitcoin gets them one step closer to that goal.

Bitcoin speeds up the transaction process and cuts out those nagging credit card fees. When a coffee shop or retail store can accept Bitcoin Payments through Square, they enjoy instant access to funds and get to keep more of their revenue by avoiding credit card fees and chargebacks.”

Miles Suter → Bitcoin Product Lead at Block, Inc.

We did an initial test with 1,500 businesses, and I have to tell you, they were all in. What we learned is that business owners prefer full autonomy and appreciate the ability to make their own decisions when it comes to what they do with their funds after they accept them.

Interestingly, the really large merchants, those with many locations, really took to the bitcoin integration during our test. It just felt natural to them to make it as easy as possible for customers to complete a transaction.

Our idea was to help Square businesses meet customers where many of them already are and allow them to pay with bitcoin. We use our devices for almost everything these days, so it makes sense that digital currency is where commerce is headed.

I actually think mom-and-pop entrepreneurs can benefit even more from taking bitcoin than the larger corporations. And depending on their cash flow needs, business owners can convert a percentage of their revenue to invest in bitcoin, where they may not have had the financial privilege to do that previously.

Meeting the need for flexibility and growth

We’ve seen this change in bitcoin adoption coming. We believe that bitcoin is every day money, and that it can be a source of economic empowerment for individuals and for businesses alike. We’ve been moving in three phases:

- Making bitcoin more accessible, which we began with Cash App (Block runs one of the world’s top Lightning nodes — routing bitcoin to millions globally.).

- We are making bitcoin custody more secure through Bitkey and providing tools to give miners to strengthen the decentralization of the entire system, while empowering individuals to become financially self-sovereign through our new mining sustainability initiative, Proto.

- Making bitcoin everyday money. As more merchants accept bitcoin and consumers pay with it on Square, we believe it will be considered interchangeable with credit cards or dollars.

Ease for customers, control for business owners

Above all else, we want business owners to have choice in the type of payment options they offer customers. If they want to accept bitcoin, let’s make it easy for them to do so. You can start small and learn more about bitcoin as you go.

We wanted to be ahead of the curve with bitcoin tools natively integrated within the Square ecosystem so that merchants are better prepared for the future. As always, Square is keeping control in business owners’ hands.

Square conversions features — letting merchants choose how much revenue to allocate to bitcoin — are completely customizable.

For consumers, paying with bitcoin is as simple as scanning a QR code at checkout. Square handles all of the complexity behind the scenes, including real-time exchange rate calculations and confirmation notifications for merchants.

We believe It’s only a matter of time before bitcoin is an everyday payment method. Our integration is specifically designed for the next 100 million users and mainstream adoption, not just for bitcoin-native users.

Nothing gets me more excited than the good old-fashioned American entrepreneur, improving their life and community through their economic achievement and grit. We believe that bitcoin is a great choice, preserving your wealth in the long run and opening you up to a larger audience. That’s what I want to bring to entrepreneurs all over the U.S.

See for yourself why we believe your business will thrive with bitcoin.

1.) Square Bitcoin is not offered to NY Sellers or non-US Sellers. Availability subject to change and regulatory approval. Bitcoin’s value is volatile and can change quickly. Bitcoin transactions are irreversible and may experience occasional delays or payment failures. Bitcoin services are provided by Block, Inc., licensed where required. Block, Inc. operates in NY as Block of Delaware and is licensed to engage in virtual currency business activity by the NYDFS.

2.) Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

3.) Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. Funds generated through Square payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Checking Accounts are FDIC-insured up to $250,000.

© 2025 Square, Inc. and/or Square Financial Services, Inc. All rights reserved.

![]()