Table of contents

Cash flow is a top concern for businesses of all sizes, but many business owners don’t understand the nuances of how to manage their cash flow. You can position yourself to master cash flow management by following the best practices other successful business owners adhere to.

We surveyed 240 business owners to learn more about how thriving business leaders manage their cash flow and rounded up the seven best strategies to make the most of every dollar your business earns.

1. Separate business and personal finances immediately

One of the first steps successful business owners take is establishing dedicated business bank accounts. As soon as you’ve registered your business and received an Employee Identification Number (EIN), you can open business bank accounts to better track your business finances. According to our Square Business Banking and Cash Flow Report, 55% of business owners open an account within two months of starting their new venture.

Small business financial accounts often include a checking account, a savings account, and one or more business credit cards. Eighty-six percent of respondents to the Square survey have both business checking and savings accounts. Whether you’re preparing to launch or already have a running business, keeping your business and personal finances separate is essential for good financial hygiene.

Next steps: Open dedicated business bank accounts before launching to simplify tax prep, loan applications, and financial tracking.

2. Organize your bank accounts

Just like with your personal finances, it’s a good idea to put away business savings for emergencies, to help with seasonality, and for future investments to grow your business. While large enterprises may have dozens of accounts, small to medium-sized businesses can also have multiple accounts for different needs. Among small businesses, 74% use two to three accounts, while 25% use four or more.

Depending on your needs, you may want to divide your funds for different purposes, such as payroll and taxes. Selecting a banking partner that provides tools like folders for organization within a single account will enable you to stay organized without going overboard and opening more bank accounts than necessary. With Square Savings folders, you can automatically allocate a portion of your income for different needs and goals (taxes, new locations, etc.). Fifty-seven percent of small business owners track separate savings goals using multiple accounts. With Square Savings, you can do that with a single savings account.

Next steps: Create sub-accounts or savings folders for taxes, payroll, and emergency funds to improve financial clarity.

3. Prioritize savings — even in tight months

Financially resilient businesses prioritize savings regardless of revenue fluctuations. Even the best-performing businesses see ups and downs on occasion. That’s why 97% of surveyed businesses have savings goals, which is a wise decision. These businesses allocate an average of 10% of their annual revenue to savings.

The top savings goals include:

- Inventory/supplies (86%)

- Emergency expenses (79%)

- Filling cash flow gaps (63%)

- Paying taxes (39%)

Every business is unique, so you may want to save for another set of goals. The Profit First strategy, based on the popular book, suggests setting up accounts for income, profit, owner’s compensation, taxes, operating expenses, long-term savings, inventory, and equipment. Review your business’s financial needs to pick the right accounts.

Next steps: Automate transfers into dedicated savings accounts to ensure steady contributions throughout the year. Square Balance Folders make this easy, and you can automate your savings.

4. Leverage data to make smarter decisions

Running a business without regularly checking in on your financial data is like driving blind. Businesses that regularly review financial metrics are more financially resilient and tend to make better decisions to improve their cash flow. A monthly financial review can be very helpful, and closely looking at financial and marketing data points can help you supercharge your sales and profits. For example, conversion rate, churn rate, email open rate, and financial ratios. Track what’s most relevant to your unique business.

Sixty percent of businesses use banking services to monitor cash flow, and 54% use payroll and tax software to stay compliant and track expenses. Spend less time trying to understand your finances by using a banking partner that provides a consolidated view of your cash flow with unified activity and sales reporting. When you bank with Square, you can take payments, manage your funds, and budget your money all in one place.

Next steps: Conduct quarterly financial reviews to identify cash flow bottlenecks and adjust strategies accordingly.

5. Invest in an integrated technology solution to automate manual tasks

Automation helps businesses stay ahead of cash flow challenges. That goes for everything from reordering inventory to automated savings. Fifty-seven percent of businesses automate savings and 71% use invoicing software to track and manage client payments. Depending on your business, you may find many tools to help automate. Everything you automate gives you more time to focus on growing your profits.

Using integrated tools for payments, invoicing, and reporting helps save time flipping between systems and improves efficiency. When you use a single provider for a suite of business services, much of that automation is built in from the start. With Square, you can power your entire business.

Next steps: Set up invoicing software, automated payments, payroll management, and cash flow tracking tools early to streamline operations.

6. Expect — and plan for — seasonal revenue fluctuations

Many retail businesses know the holiday season will be the busiest time of year, and they’ll see a slump in the summer. Accountants know they’ll be busiest from the start of the year through tax season but don’t have as much to do in the fall. You can also plan for seasonal revenue fluctuations and ensure that a dip in cash flow doesn’t harm your overall business.

According to Square data:

- Revenue peaks in November, December, and January for most businesses

- 29% of retail businesses see peak revenue in November

- Savings balances are typically lowest from March to July

Next steps: Use past sales trends to predict slow periods and build a financial cushion ahead of time. Using Square Analytics you can get access to real-time data to understand what’s selling, when funds are transferred, and to see you bottom line at glance.

7. Secure financing strategically (and persist if denied)

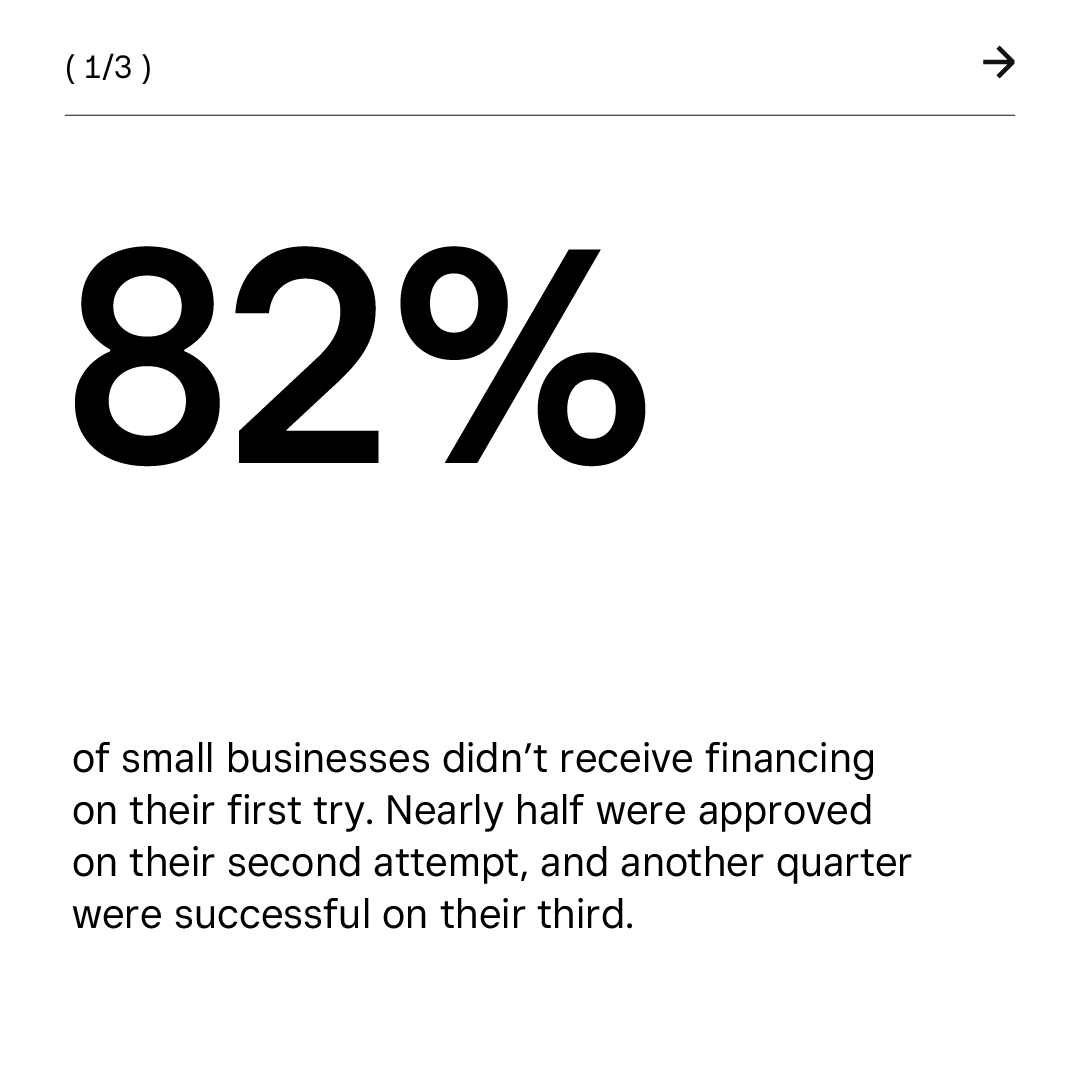

The most successful businesses in the world often carry millions or even billions of dollars in debt. While high-interest loans can be damaging, strategic small business financing can help reach business goals, such as a larger inventory or capital investment. When you shop around, you can find the best deals available. If you’re turned down the first time, it’s worth looking for new funding sources that better align with your borrower profile.

Our recent survey shows that 82% of small businesses didn’t receive financing on their first try, and 47% were approved on their second application. Ninety-seven percent of businesses use business credit cards for financing. When used responsibly, credit and financing can fit into your cash flow management strategy.

Next steps: Improve approval odds by tracking financial metrics, maintaining good credit, and applying strategically. You can apply with Square Loans in minutes. There’s no interest, just a flat fee, and repayments are automatically made from sales.

Follow the lead of top-performing businesses

Avoid thinking of financial management as a burden — it’s an empowering part of entrepreneurship. Eighty-five percent of business owners say they enjoy managing their business finances. When you confidently approach your business finances with a can-do attitude, you’re putting yourself in a position to master your cash flow and run a profitable business for years to come.

Download our full Banking and Cash Flow Report to view more cash flow insights and learn how you can level up your business finances.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Square, Inc.

All loans and Savings accounts are issued by Square Financial Services, Inc., a Utah-Chartered Industrial Bank. Member FDIC. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. Accounts are FDIC-insured up to $250,000. Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

![]()