Table of contents

Running a business means making a lot of decisions. In the early days of running mine, it felt like I was making all of them at once. Starting a beverage brand with zero background in the industry meant I was navigating one learning curve after another — product development, distribution, finance. The list goes on. So when it came to choosing a business bank, I went with what felt familiar and easy: the digital bank I already used personally.

Looking back, it was a solid starting point, but I didn’t dig that deep. I didn’t know that better options existed. I could’ve chosen one that gave me a clearer view of cash flow or another that may have reduced the number of tools I was juggling. And I wasn’t alone. Talking with other business owners I realized that they too were sticking with the banks they used personally instead of finding a bank that’s built for their unique business needs. For many, that meant traditional brick-and-mortar banks. But as digital banking became more mainstream, more people were giving it a second look, drawn by lower fees, real-time insights, and tools designed for how modern businesses actually run.

So how do you figure out which banking setup is right for your business? In this article, we’ll break down what digital banking is, how it compares to traditional banking, and how to choose the option that best fits your needs.

What is digital banking, and how does it work?

Digital banking lets you manage your business finances entirely online. No branch visits or paperwork required. From sending payments to checking your balance or moving money, everything can happen from your phone or computer.

Here’s what that looks like day to day.

- Online only: With no physical branches, you can manage your finances anytime, anywhere — right from your phone, tablet, or computer.

- Flexible access: Digital banks give you 24/7 control over your money. That means instant and unlimited access to your funds, real-time balance updates, bill pay whenever you need it, and extended customer support hours through chat and in-app help.

- Cost-effective: By operating without the expenses of physical branches, digital banks often reduce fees and pass those savings directly to you, offering greater value for your money.

- Innovation-driven: Powered by the latest financial technology, digital banks often offer real-time business insights, intuitive tools, and integrations that help you stay ahead, with many also supporting alternative currencies like Bitcoin and other emerging payment methods.

At their best, digital banks are designed for how businesses operate today: fast, flexible, and fully connected. But whether digital, traditional, or something in between is right for you really depends on how your business runs day to day.

So let’s get more specific. Here are a few real-world business scenarios to help you see how different banking setups stack up, and which one might be the best fit for your needs.

Digital vs. traditional banking: Which works better for you?

Every business runs differently, and your banking needs should reflect that. Let’s look at how each option fits some real-world business scenarios so you can find the setup that works best for you.

Scenario 1: You run a coffee shop with a growing online store — and you’re always on the go.

- Best Fit: Digital Banking

- Why: Selling both in-person and online means your money moves in multiple directions, and you need a single system that keeps up. Digital banking gives you real-time visibility into sales and spending across channels, with mobile-first tools that let you move money, pay vendors, or check balances anytime.

Scenario 2: You run a small bed & breakfast and prefer to manage your finances in person.

- Best Fit: Traditional Banking

- Why: You value the ability to walk into a branch, speak to someone directly, and handle tasks like depositing checks or requesting certified payments face-to-face. For businesses that prefer one-on-one service and a more traditional approach to money management, a local bank can offer familiarity and structure.

Scenario 3: You’re juggling payments, banking, and cash flow — and want everything in one place.

- Best Fit: Integrated Digital Banking (like Square Banking)

- Why: Whether you’re a busy quick-service restaurant or a solo service pro, switching between disconnected tools slows you down. Integrated banking brings everything together — the speed of digital banking plus the context and tools you already use to run your business, all in one place.

Of course, not every business fits neatly into one scenario. And that’s okay. The right banking setup depends on where you are today: just getting started, growing quickly, or trying to streamline your tools. If you’re still figuring out what’s best for your business, this quick guide can help to point you in the right direction.

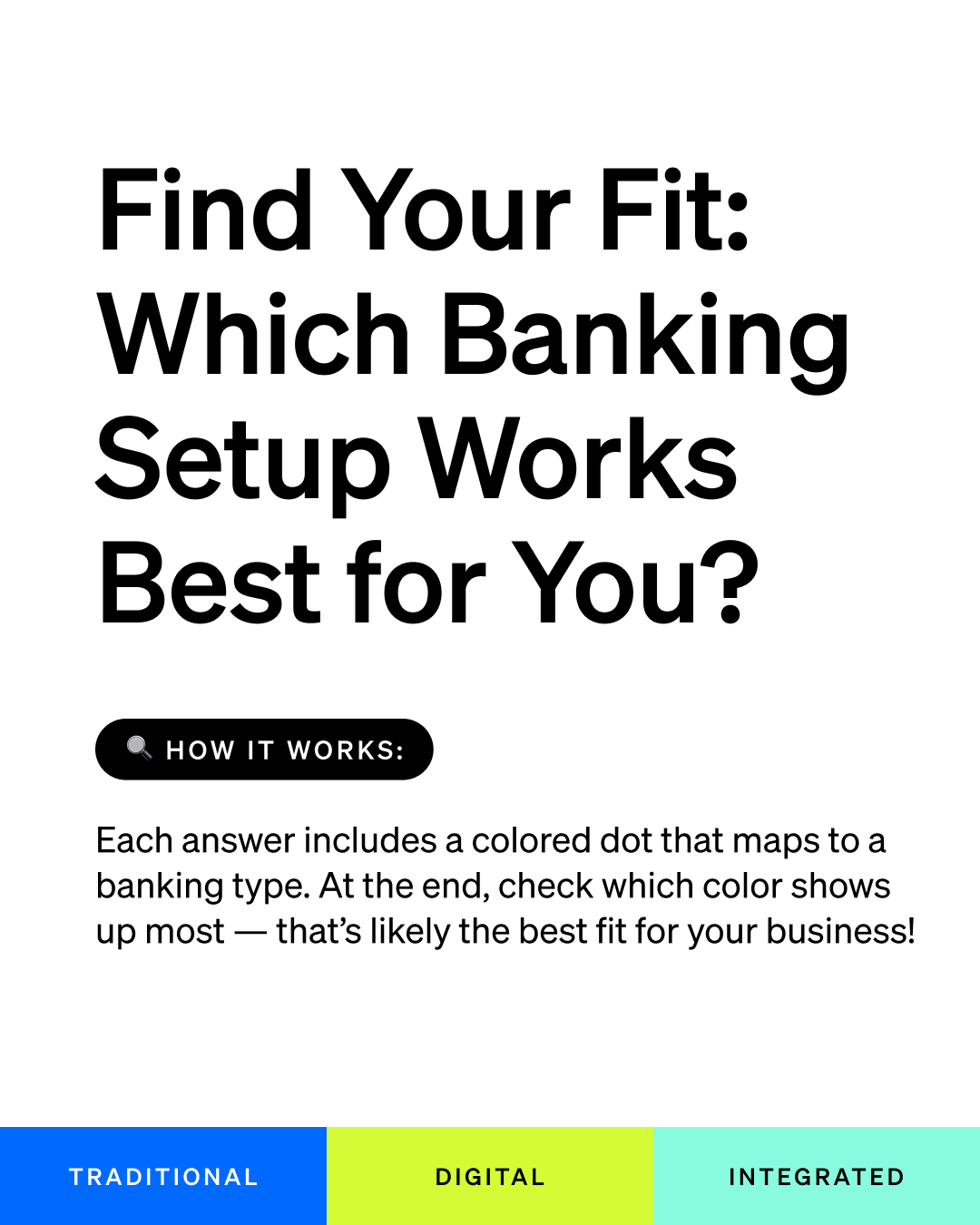

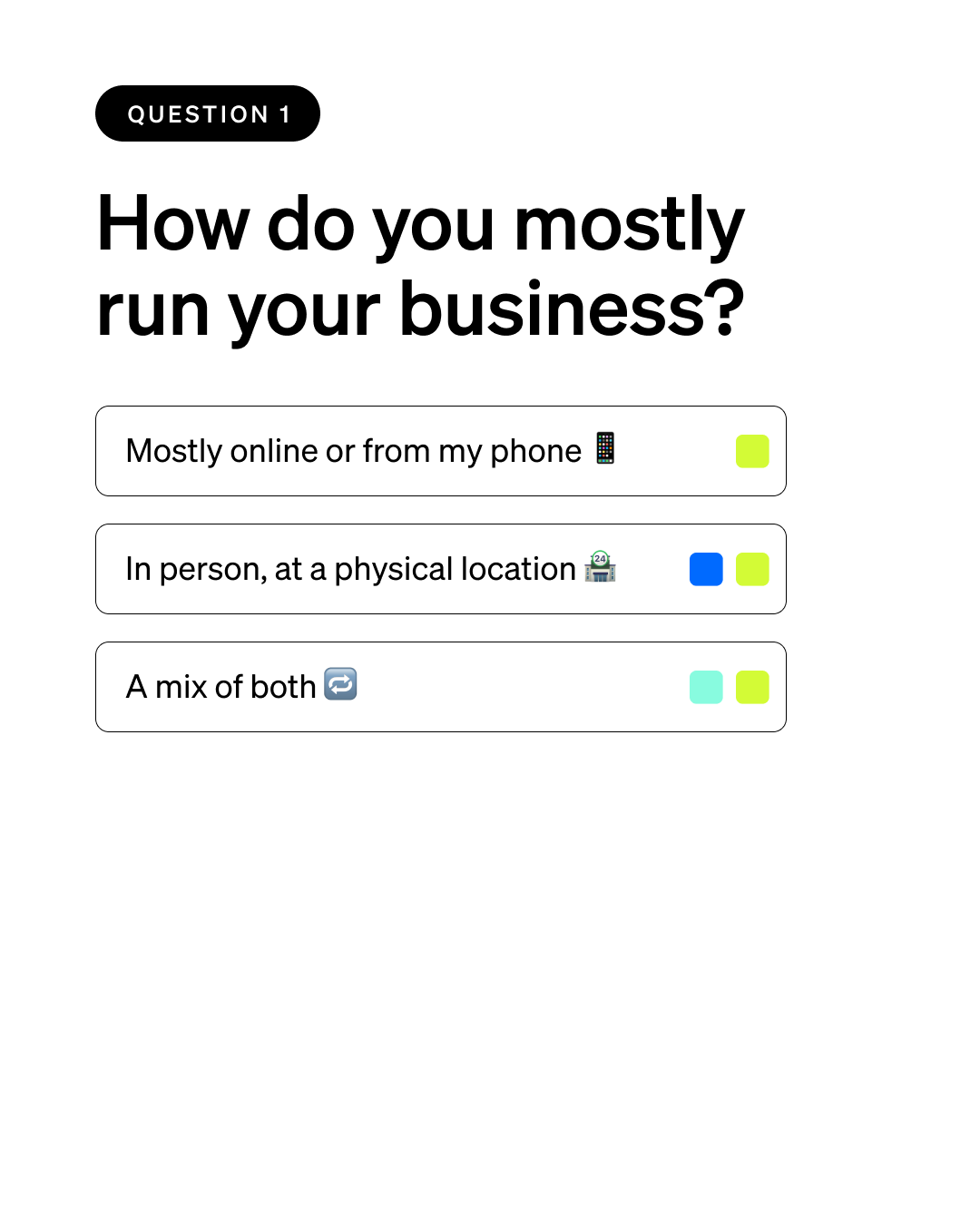

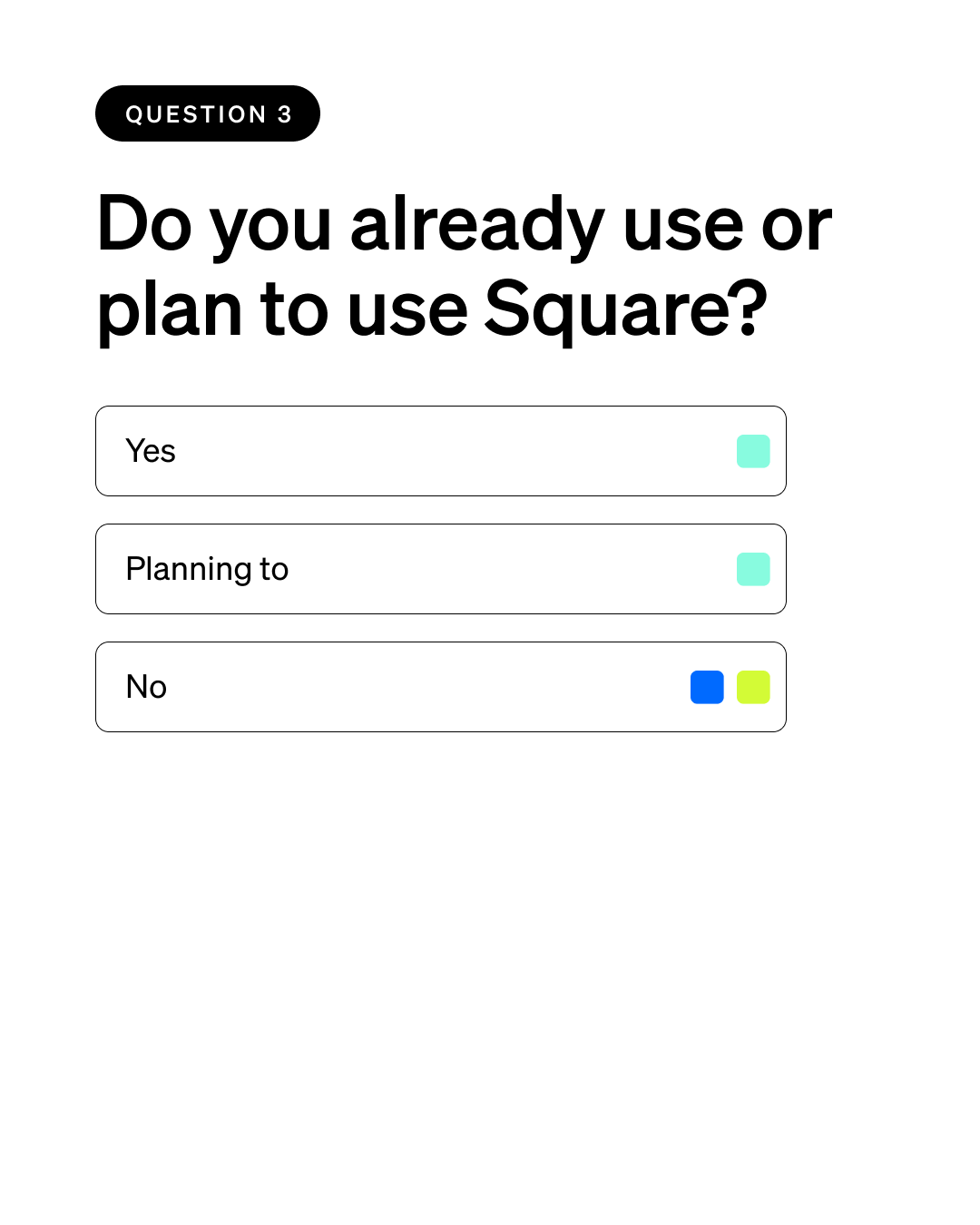

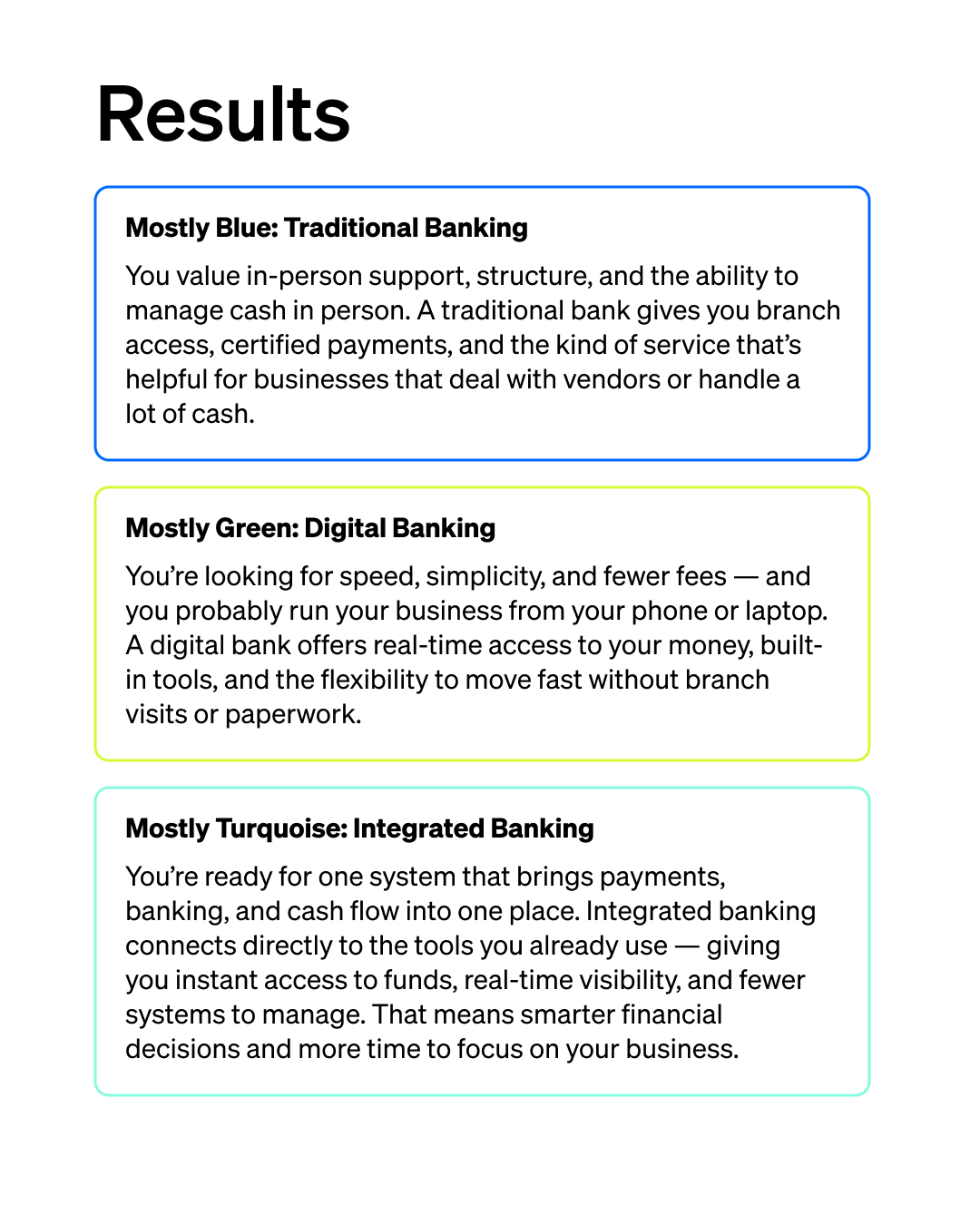

Find your fit: Which banking setup works best for you?

Each answer includes a colored dot that maps to a banking type. At the end, check which color shows up most — that’s likely the best fit for your business!

How it works:

No matter which result you landed on, one thing’s clear: how you run your business should shape how you manage your money. For sellers juggling sales, bills, and cash flow, integrated banking keeps it all in one place, so you can stay organized without bouncing between tools.

When it was just me and my cofounder running our beverage brand, we were constantly hopping between systems tabs — checking payouts, tracking bills, and stitching it all together across multiple spreadsheets. It was messy and time-consuming. That’s why integrated banking can be a game-changer. Let’s take a look at how it works, and why it might be the most efficient setup for running your business today.

Integrated banking: Banking where you do business

If you’ve ever struggled to get a clear view of your finances, integrated tools like Square Banking can help. By connecting directly to your payments, you get real-time visibility into your cash flow — no spreadsheets, no guesswork. It’s built for business owners who want the speed and automation of a digital bank, with the added benefit of being deeply connected to how you actually earn and spend.

Already using Square? Banking lives right alongside your sales, payments, and expenses — no extra apps, no extra logins. Here’s how that looks in practice:

1. Instant access to your money — right where you work

There’s no need to transfer funds from your POS to a separate bank account. Your sales are deposited instantly into Square Checking, giving you immediate access1 to your money the moment a sale happens. You can spend those funds right away using your Square Debit Card2 or move them into Savings automatically.

You also receive ACH transfers up to two days earlier than with traditional banks, giving you more control, more flexibility, and fewer delays.

2. Seamless integration

Sales, spending, savings, and even loans — all in one system, with one login. No switching tabs, or juggling platforms. Whether revenue comes from Square or third-party apps like DoorDash or Uber Eats3, your money flows into the same place, making it easy to track income, manage cash flow, and take action in real time, all from your Square Dashboard app.

And it doesn’t stop there. Square Checking is connected to the rest of your business tools, so your money moves seamlessly wherever it needs to go:

- Loans: Approved for a Square Loan4? Funds land instantly in your Checking account — ready to spend.

- Payroll: Run payroll directly from Checking, as little as one business day before payday.

- Transfers: Move money instantly between Checking and Savings — no fees, no delays, no limits.

- Invoices: Get paid via ACH with $0 processing fees when funds go to Square Checking.

- Cash: Add cash for free5 at 70,000+ locations like Walgreens®, 7-Eleven, and Kroger® — more locations than Chase ATMs and branches combined”.

As one Square seller shared:

It helps us so much that all our banking tools are connected. With Square, our savings, checking, even our loans are all in one place—so we can see what’s happening in real time, every day.”

Juan Saravia → Owner of La Pupusa Urban Eatery

3. Free — absolutely no hidden fees

As an integrated digital bank, Square helps you keep more of what you earn. Unlike traditional banks that charge monthly fees, require minimum balances, or hit you with overdraft penalties, Square Checking and Savings accounts come with no hidden fees or minimums — meaning no surprises.

Square Checking users save an average of $156 per year in banking monthly fees compared to many traditional banks.7

4. Real time cash flow visibility

See what’s coming in and going out, all in one place. With sales and spending side by side, you get a simplified view of your cash flow, updated in real time. View all your banking activity directly in your app or Square Dashboard so you can make confident decisions without the guesswork.

5. Automated budgeting and tax preparation

I loved how my digital bank let me set up savings pots — it made planning for big expenses way easier. Square Savings takes that further, with automation built for business. Automatically set aside a percentage of each sale into folders for taxes, payroll, or restocks. It’s hands-off budgeting that keeps you organized without the effort.

With benefits like speed, automation, and built-in tools, it’s no surprise digital banking has become essential for small businesses. Integrated banking goes further by connecting directly to the tools you already use. With Square Banking, everything works together — and it shows. Customer satisfaction on average is 86% — 20% higher than the leading traditional banks in the U.S.8

Choose the banking setup that works for you

Choosing a business bank isn’t just about where your money goes. It’s about how easily you can move, manage, and make the most of it. Traditional banks offer structure. Digital banks offer speed and innovation. But if you’re already using Square, or considering doing so in the future, there’s a smarter option: banking that’s built into how you do business.

The best banking solution is the one that fits how you do business. Whether that means going traditional, digital, or integrated, the goal is the same: stay in control of your money and build a system that supports the way you work.

Discover more about how Square Banking helps you manage money in real time, all in the same place you run your business.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC.

Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

1 Instant availability of Square Payments. Funds generated through Square payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

2 Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. If you have a Square Debit Card, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met.

3 With early deposit access, Block, Inc. may make incoming electronic direct deposits made through ACH available for up to two days before the scheduled payment date. Not all direct deposits are eligible. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. Early deposit access is automatic and there is no fee.

4 Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc. All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

5 Cash deposited into your Square Checking account is generally available in your account balance immediately after a deposit is processed. Fund availability times may vary due to technical issues.

6 Source: Square Data 2025, Chase Branch data from chase.com as of 2025

7 Source: Square Banking Fee Study 2025

8 Source: Square Survey 2024, JD Power Retail Banking Study 2025

© 2025 Square, Inc. and/or Square Financial Services, Inc. All rights reserved.

![]()