Table of contents

This article is for educational purposes and does not constitute legal or tax advice. For specific advice applicable to your business, please contact a professional.

Hiring your first employees can be a very exciting — and overwhelming — time as a small business owner. As your business grows, you want to ensure you are able to manage your team and expenses successfully. The cost of labor can be one of the most significant, if not the most significant, expenses you will be responsible for as a business owner.

To ensure your small business’ success, let’s dive into the concept of labor cost, how to measure that cost, and how it can help you have greater control over your business.

What is labor cost?

It’s essential to understand what your labor costs are and how to manage them when getting to this point in the growth of your company. It isn’t just about the hourly wages that you are paying your staff. Labor costs can include:

- The employees’ gross wages

- Social Security

- Taxes

- Any benefits you offer your workers

However, there are often costs you may happen to overlook that should be factored into your actual labor expense. It’s important to pay attention to the true cost of labor for your business so that it doesn’t negatively affect your revenue.

Comparing fixed labor cost and variable labor cost

When understanding how to calculate labor cost, it’s important to understand which costs are fixed and which costs will vary depending on factors like production or economic conditions. Fixed labor costs are any costs that aren’t expected to change over a period of time. The annual salary of an employee would be considered a fixed cost.

Variable labor costs change with the production of the business. For example, hourly employee pay rates are variable if you are in the retail or the service industries, which sees seasonal traffic changes where you’ll need to increase the number of workers available to meet demand. While some hourly employees can be a part of your fixed labor cost (such as those that are on a set schedule of, say, 30 hours per week), remember that variable labor costs are associated with labor that fluctuates with the needs of the business. Another variable labor cost would be associated with contracted work, such as repair or cleaning services.

What are costs of direct labor and costs of indirect labor?

There are two different categories of labor costs. As a business, you’ll need to consider direct labor costs and indirect labor costs. Direct labor refers to any employees that work directly with your customers or clients. The cost of direct labor would then be referring to wages, benefits, and any compensation you offer your direct labor.

Indirect labor refers to any employees that support the company from behind the scenes. For example, indirect labor would be accounting, human resources, or operations. For both of these categories, you’ll also need to factor in costs such as paid time off, sick days, and workers’ compensation.

It’s important to understand your business’s direct and indirect costs in order to make informed pricing decisions and future plans. Tracking these costs separately will give you a full overview of your operational expenses and those associated directly with your goods or services. Once you understand the direct costs, you can plan for more competitive pricing. Once you understand the indirect costs, you can have a more educated and well-executed plan for future growth and further improvements of the business.

How to calculate labor cost

There are a few ways you’ll want to calculate your total labor costs while taking into account all expenses related to your employees. There are specific labor cost formulas for both direct and indirect labor costs. Let’s first look at how to calculate direct labor costs.

How to calculate direct labor cost

The first step in calculating the cost of direct labor is to understand how much you’ll be paying your team, whether salary or hourly. If hourly, you’ll need to determine how many hours will be worked per week and how many overtime hours will be needed, if any.

Next, you’ll want to determine the additional labor costs associated with benefits, insurance, and taxes per employee. Add these costs to the pay wages you calculated in the first step. This will give you the total costs you’ll be responsible for in that calculated period of time.

If you want to determine the labor cost per hour, you can divide that total labor cost number by the total number of hours your employees will work. The direct labor cost formula would be as follows:

Direct labor cost per hour = (gross pay + additional benefits) / worked hours per period

How to calculate indirect labor cost

Understanding the actual cost of indirect labor can be a bit more challenging because there are not always predictable expenses. Remember, these costs are not directly tied to the production of your products or services.

To determine indirect labor cost, you’ll want to first identify the number of hours any indirect labor employees have worked. For a more accurate calculation, subtract any time off allotted for each indirect employee. Once you have the total hours, multiply those hours worked by each employees’ hourly wage to find out the total indirect labor cost. Finally, add any benefits, insurance or taxes associated with the employee, as necessary. The indirect labor cost formula would be as follows:

Indirect labor cost per employee/contractor = (total actual worked hours x employee pay wage) + additional benefits cost

What a labor cost formula can look like

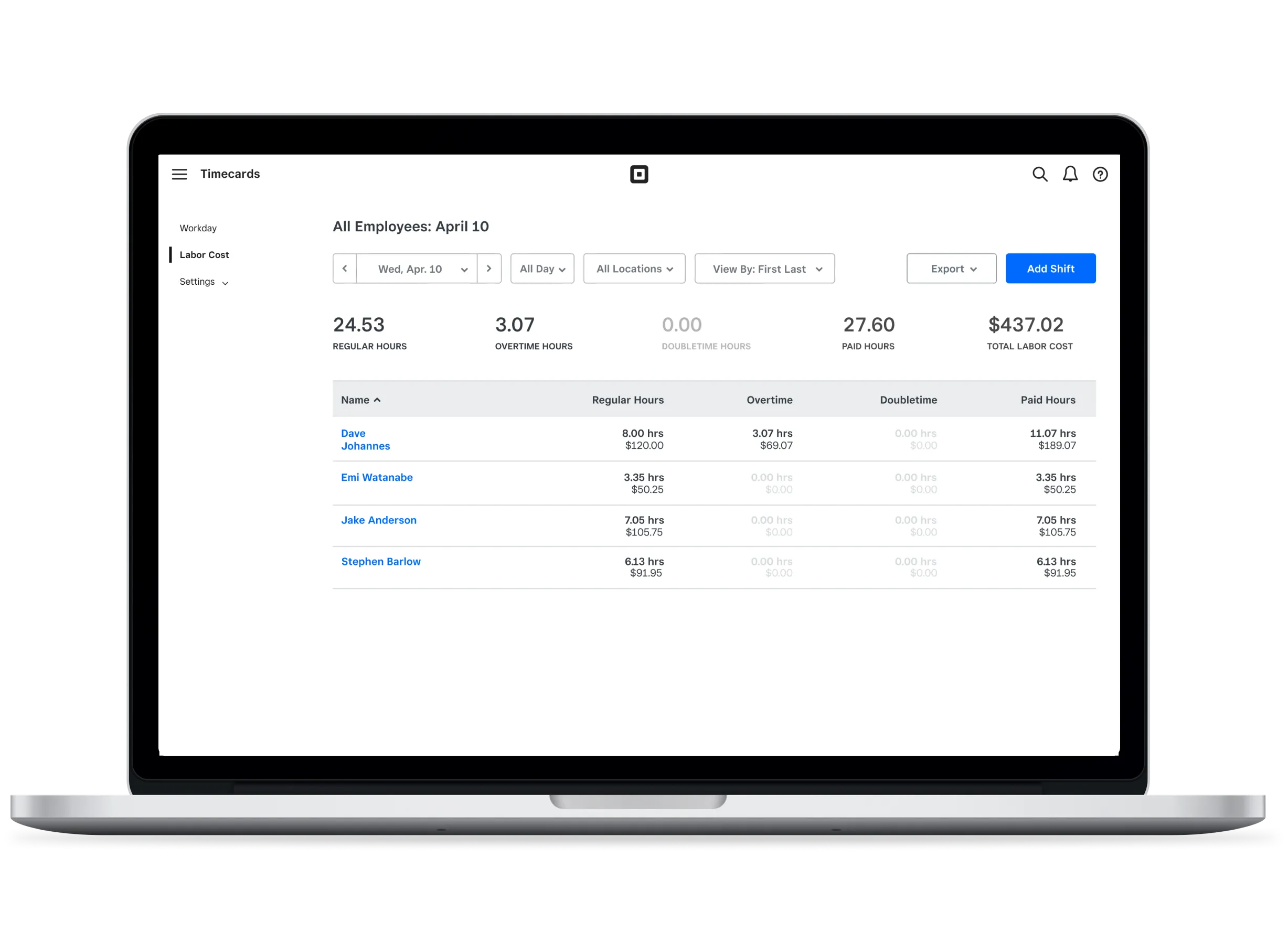

While managing your labor costs is important, you probably started your business with the hope that you wouldn’t have to be an expert mathematician. Square Team Management offers powerful reporting and detailed analytics that help you better manage your team and understand how the cost of labor affects your total profit.

Let’s take a look at a couple of options you have that can be essential to determining your cost of labor formula.

Labor vs. sales reporting

The Labor vs. Sales Report can help you compare your hourly labor costs with your net sales in a way that’s easy to understand and make decisions. You’ll be able to see labor costs by hour, date, and even location to better understand when your business is most profitable in comparison to how much your labor costs are at that time.

Having this report allows you to make better decisions regarding staffing for peak hours and open and close times for your business. Instead of trying to use a detailed calculation with a chance of possible human error, the Labor vs. Sales Report can help you get a quick overview of where you could potentially cut labor costs where they’re not needed.

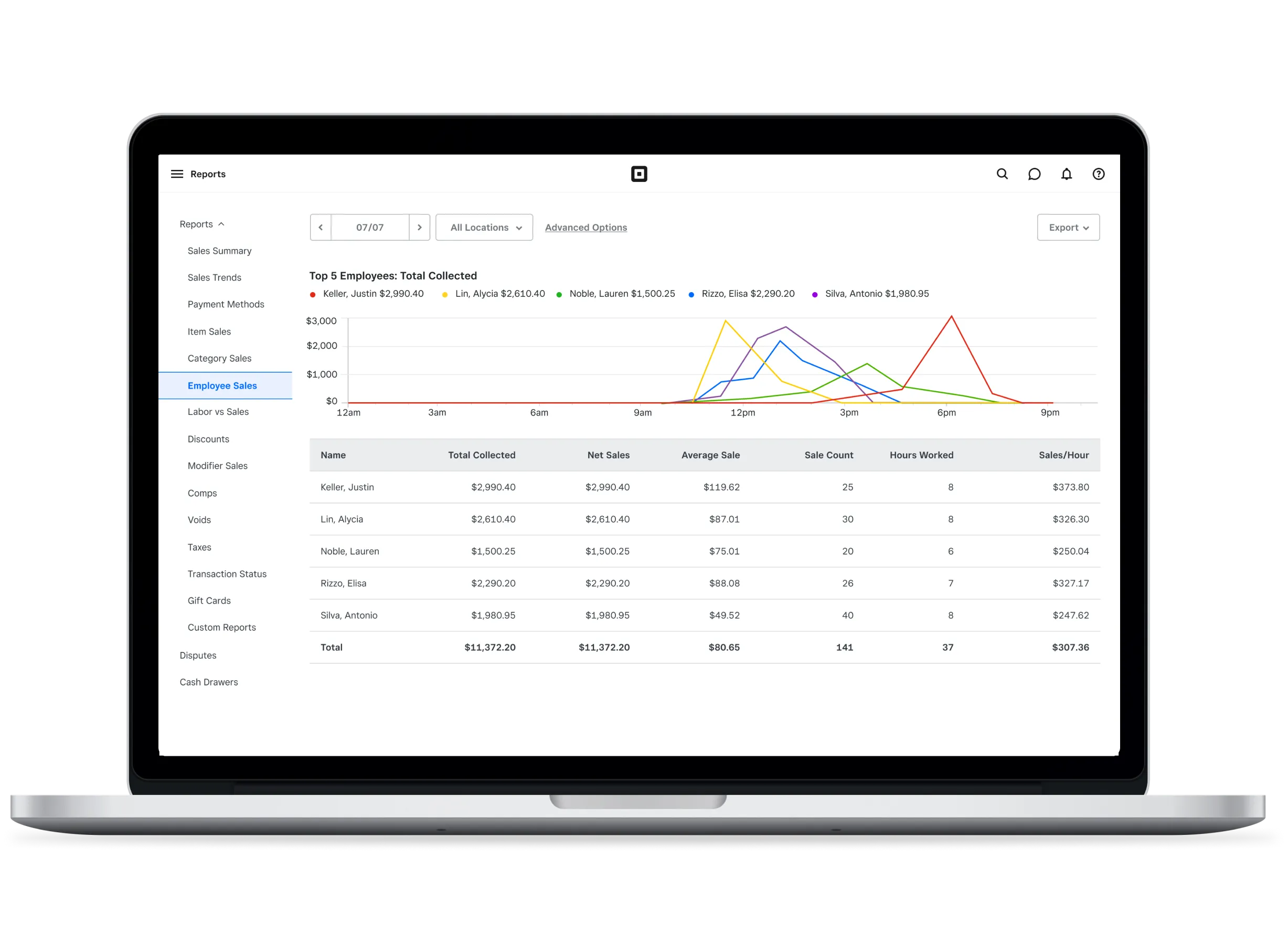

Employee sales report

The Employee Sales Report lets you see your sales by each employee, so you can see how much revenue is being brought in versus the hours that employee is working. You can view the top-five employees by sales amount at a glance, or you can create a custom report.

Knowing the cost of labor in comparison to your business’s revenue is crucial to the success of any small business. If you’re looking to have greater control over your business, it’s time to understand how to better manage your labor costs.

![]()