Fumio Tashiro and his wife were both raised in households that had deep ties to food. Tashiro’s family owns a restaurant, while his wife’s mom has been a school caterer for many years. Naturally, when Tashiro wanted to start a business, he chose something he knew well: food. In 2017, Tashiro started Mirror Tea and Sake House, a Japanese café in Brooklyn, New York. Tashiro describes the cafe as “a small, family-owned business dedicated to providing organic, nutritious teas and meals [using traditional Japanese cooking techniques] that nourish the body and soul.”

“We have a genuine desire to introduce the essence of tea, health food, Japanese sake, and aesthetics to people from diverse cultural backgrounds and different generations. Our cozy Brooklyn location serves as a peaceful oasis where guests can enjoy the transformative power of tea while learning about and appreciating Japanese cuisine, sake, and hospitality. We aim to make wellness and cultural exchange accessible by curating exceptional teas, meals, and sake while fostering community engagement,” said Tashiro, adding that a key mission for Mirror Tea and Sake House is introducing Japanese sake to newcomers in a setting that’s both approachable and refined.

Tashiro’s commitment and efforts have paid off. Reviews from tea house regulars show that the brand is more than a café’ it’s an arts-focused and community-building space loved by creatives and locals alike.

Early business growth made possible with Square Loans

Like many business owners, Tashiro needed funding to grow his business. However, his experience with traditional loan applications led Tashiro to believe that loans were not only challenging to get, but reserved only for established businesses with strong credit. “As a new business owner, I didn’t think I qualified or that loans were right for me. I applied for a loan with a traditional bank, but the bank’s application process took over a month and required tax returns, profit and loss statements, and business plans. Ultimately, I was denied by the bank,” said Tashiro.

In search of a solution, Tashiro tried Square Loans and was pleasantly surprised by the process. The loan helped Mirror Tea and Sake House get tangible sales results for the next phase of business.

Square Loans enabled me to increase my sales by over 60%. The installment loan funded our liquor license, allowing us to expand our offerings and attract more revenue. This facilitated early growth. ”

“After my experience with the Square fast and simple loan process, my perspective changed completely. I realized that responsible financing can be a strategic tool to help my business grow when used properly. Square opened my eyes to the possibilities available through financing,” said Tashiro, adding that his view of taking on loans has changed for the better thanks to this experience.

Receiving a lifeline during the pandemic

Like many small businesses, Mirror Tea and Sake House experienced financial challenges during the pandemic. These challenges inspired a GoFundMe campaign to keep the cafe’s doors open. Tashiro recounts that Square Banking and lending products played a significant role in helping the business stay afloat during those critical times.

“When COVID-19 led to a significant drop in revenue, our Square Loan gave us essential operating capital to stay afloat. Without access to that financing, we may not still be in business today,” Tashiro explains. “Square financing allowed me to renovate my store interior and outfit it with decorations after having been closed due to the pandemic. This enabled me to reopen indoor dining, which led to a significant increase in my previously depressed sales. This helped us retain staff, sustain inventory, and survive the crisis,” said Tashiro.

Saving time and building an efficient business powered by the Square ecosystem

Beyond financing, Square has supported other areas of Mirror Tea and Sake House operations for almost a decade, helping Tashiro and his wife run a more efficient and tight ship. “We have been using Square for nearly 10 years, and it has been an extremely positive experience. The system is very user-friendly, with an intuitive interface that makes transactions easy for both us and customers,” said Tashiro.

Mirror Tea and Sake House uses Square Point of Sale, payment processing, and inventory management in addition to banking services. This has helped to streamline its operations and ensure the smooth running of the business.

“Having our sales, payments, and financing all integrated into one Square ecosystem has significantly simplified managing Mirror Tea and Sake House. Rather than juggle multiple systems, the Square Dashboard neatly centralizes data and tools in one place,” said Tashiro, while admitting they had limited financial expertise before Square. “Being able to seamlessly accept payments, apply for financing, and monitor accounting in one login has reduced the time and headache of administrative tasks.”

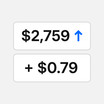

“Square real-time reporting shows me sales, deposits, payroll, loans, and other transactions in one dashboard. I have a complete financial overview, rather than piecing together reports from separate systems. By having everything connected in Square, I save so much time and eliminate the hassles of syncing disparate systems,” said Tashiro. Tashiro added that Square helped him gain key insights into how his business performs, so he can make crucial business decisions with confidence.

Getting a handle on cash flow with Square

Finding an easy and reliable way to manage cash flow was a priority for Tashiro, and Square has helped him stay in control. At first, Tashiro tried to field cash flow challenges with spreadsheets and manual methods, but he quickly realized he needed something more efficient. “Before using Square, I struggled to manage cash flow efficiently. I was doing everything manually on spreadsheets, which was error-prone and time-consuming,” Tashiro recalls. “With everything manual, I didn’t have up-to-date visibility, so it was guesswork budgeting for expenses and growth. I wasted time worrying about cash flow.”

Tashiro explains that the business leverages several Square tools specifically for tracking cash flow and generating financial reports. Square Point of Sale app shows the business’s daily sales, allowing Tashiro to forecast revenue. Square Dashboard provides an overview of Mirror Tea and Sake House’s account balances and upcoming payments. With the transactions list, Tashiro gets granular data on deposits and payments, which helps him manage cash flow more effectively. He can also generate custom reports to analyze sales, profitability, inventory, and other metrics.

“I can instantly see what I have available to spend versus what should be held back. Square centralized data and reporting saves us significant time compared to manual bookkeeping,” said Tashiro.

Planning for the future with Square Savings

For Tashiro and Mirror Tea and Sake House, the journey has just begun. Tashiro intends to open a second location in Japan or New York City and is using Square Savings to edge towards that goal. He is also saving for equipment upgrades, marketing campaigns, and emergencies like slow seasons or repairs. “I actively use my Square Savings account to set aside money for future business needs. We use the automated savings feature to automatically transfer 1.5% of my weekly revenue into savings. The automated transfers save me time reconciling accounts each month. I also have peace of mind knowing funds are automatically set aside for the future,” said Tashiro.

All loans and savings accounts are issued by Square Financial Services, Inc., a Utah-Chartered Industrial Bank. Member FDIC. Actual fee depends upon payment card processing history, loan amount, and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days, and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. Accounts are FDIC-insured up to $250,000. Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

![]()