Table of contents

Have you been thinking about switching payroll providers? The beginning of the year is the best time to do it. By starting with a new provider at the beginning of the year, you won’t have to go through the hassle of collecting all your year-to-date and quarter-to-date information from your old provider. Your new payroll provider can start fresh for the new year.

On November 21, 2024, the Square Payroll team hosted a webinar event where they covered what you get with Square Payroll, how to make the switch as easy as possible, helpful integrations, a live demo, and a live Q&A.

You can watch the webinar recording and leave questions below the video on the Seller Community.

Watch: New Year, New Payroll Webinar Event ->

We’ve outlined five simple steps to transition payroll processing at the start of a new year. (Be sure to check with a professional for any details that might apply to your specific situation.)

If you have never used a payroll provider before, you can skip to step three.

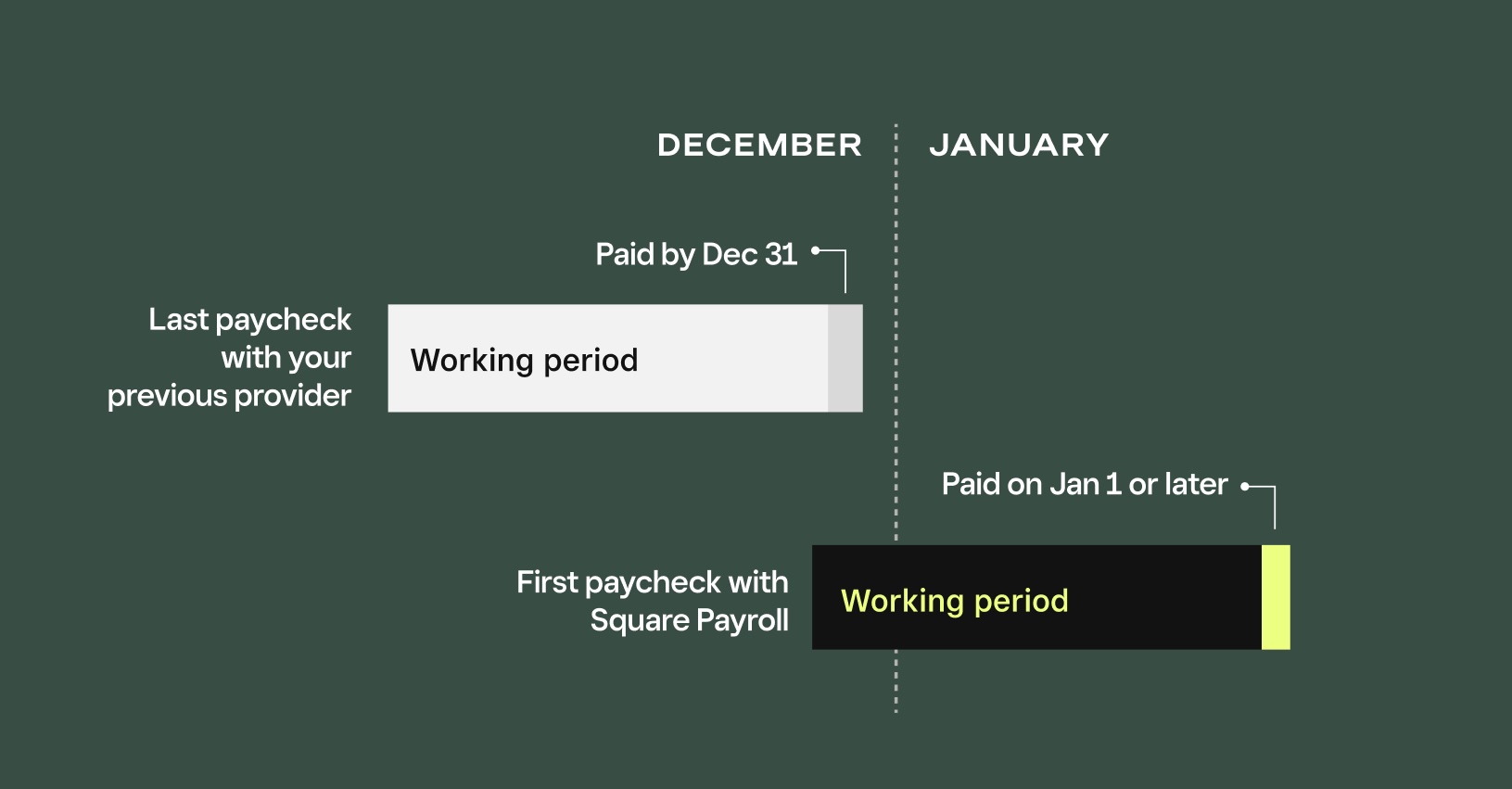

1. Set your last pay date of the year to be paid by December 31.

To make things as clean as possible, be sure your last pay date of the year is with your old provider and your first pay date of the year is with your new provider. Make sure the final pay date is before December 31, being mindful of weekends and holidays.

For example, if you have a pay period of December 16 to December 31, 2024, with a pay date of January 5, 2025, that cycle should ideally be with your new provider since it will be reported on your 2025 W-2s, which your new provider will prepare. Your previous provider will prepare the 2024 W-2s.

Payroll taxes are based on when wages are paid, not when employees worked. Any wages you pay in January, regardless of the actual pay period, will be included in the new year’s wages and annual W-2s for tax purposes.

2. Close your payroll account with your previous payroll provider.

Before you close your account with your old provider, don’t forget to save copies of all employee information, payroll reports, and annual tax forms for your own records. Keep in mind that some payroll providers restrict access to this information after you close your account, so be sure to download or ask for this data before you cancel.

Read more about how to find payroll history from your previous provider.

3. Get your business information ready.

Have the following information on hand when switching providers at the start of the new year:

- Federal Employer Identification Number (EIN)

- State EIN

- Business type

- Legal business name and address (as registered with your EIN)

- Bank account details for payroll withdrawals

4. Set up your Square Payroll account.

Signing up for Square Payroll is quick and easy. We do not require you to process payments or use any other services with Square to use Square Payroll.

Read more about how to set up Square Payroll.

5. Set your first pay date of the new year with Square.

To make the switch as simple as possible, set your first pay period after January 1. Then you won’t need to report any previous payroll history.

Let’s walk through an example, using Square Payroll as your new provider.

- December 2024: Joe hears about Square Payroll and decides to switch over in 2025. He informs his provider that he will be canceling service at year end and schedules his last pay run with a 2024 pay date.

- December 2024/January 2025: Joe sends his first pay run through Square Payroll with a 2025 pay date.

What to expect from your previous provider:

- Joe gets his 2024 W-2s, Q4 2024 quarterly tax filings, and 2024 annual filings from his previous provider.

What to expect from Square:

- Joe’s 2025 federal and state tax payments and filings are processed by Square Payroll.

What if you’re not switching at the beginning of a year?

If you’re switching in the middle of a quarter, talk to your former payroll provider and clarify which tax payments and filings they will make on your behalf. Your previous provider should refund any quarterly taxes collected, but not submitted, to the IRS and/or state to you. If you work with a new provider like Square Payroll, they will re-collect and submit those specific taxes on your behalf.

Square Payroll will guide you through the entire process. If you have an accountant or financial advisor, they can also offer valuable insights on how to switch payroll providers effectively.

![]()