Table of contents

You don’t need to know the ins and outs of credit card processing to own and operate a business. But it definitely helps to get the lay of the land. In this guide, we walk you through everything you need to know about credit card processing — and how to select the best option for your business.

What is credit card processing?

Taking a credit card payment may seem simple enough. A customer hands over a card and you process it. With Square payment processing, the money usually lands in your account within one to two days. With Square instant transfers, it lands instantly. The fee is 1.75% per deposit.

But under the hood, there’s a lot more going on. From the time you swipe or dip the card until the money is deposited into your bank account, there are a number of different parties involved. And each of them handles a crucial step in the chain of events. Having a general knowledge of how credit card processing works helps you understand where you might incur fees—and informs your decision about what credit card processing system makes the most sense for your business

A credit card processing company (like Square) handles credit and debit card transactions for businesses.

Why is credit card processing important?

Credit card processing provides convenience to your customers and expands your sales opportunities. Customers expect seamless and secure payment options. Cash-only businesses can be self-limiting, whereas credit card processing provides opportunities to expand your reach to eCommerce by enabling online and mobile payments. Acceptance of credit cards often leads to larger transaction sizes.

Understanding online and in-person payments

If your business uses credit card processing, you’ll have the ability to accept both point-of-sale (POS) transactions as well as digital transactions. While in-person payments support personal interactions that help build rapport with customers, online payments offer options for your business to expand to include mobile ordering or online shopping.

The parties involved in credit card processing

Let’s say you go into Cup of Joe Coffee and pay for a latte. Here are the official names of the players involved in the transaction:

- The cardholder: the person with the credit card (aka you)

- The credit card: that rectangular piece of plastic with your payment credentials on it (e.g., Capital One Quicksilver Rewards card)

- The merchant: the business accepting your credit card as payment for goods or services (Cup of Joe Coffee)

- The point-of-sale system: the interface used by the merchant to accept the credit card payment

Now let’s zoom in for a second. There are a few additional parties represented on the credit card and in what’s happening during the transaction itself:

- The issuing bank

- The acquiring bank

- The merchant services provider

There are a number of participants involved in processing credit card payments. Let’s look at each.

What is an issuing bank?

The issuing bank is the financial institution that provides you with your credit card and accompanying line of credit. It’s your credit card company. Issuing banks act as middlemen between you and the credit card networks by issuing contracts with cardholders for the terms of the repayment of transactions. For example, your issuing bank could be Capital One.

What is an acquiring bank?

The acquiring bank (also known as a merchant bank or acquirer) sends the transactions to the network, which then passes it on to the issuing bank.

What is a merchant services provider?

A merchant services provider is an entity that allows businesses to accept payments by credit card, debit card, and NFC mobile wallets like Apple Pay, Samsung Pay, and Android Pay. A merchant services account is established with an organization that has relationships with the issuing and acquiring banks. Your merchant services provider allows the processing of electronic payments when your customers want to pay for things.

What is a payments gateway?

Say Cup of Joe Coffee had an online store to sell things like t-shirts and mugs. A payments gateway would be involved in processing those online credit card transactions. A payments gateway facilitates the transfer of information between a payment portal (like a business’s website) and the acquiring bank. It encrypts sensitive information like card numbers to make sure everything is secure throughout the process.

Merchant credit card processing

How do you get a merchant services account?

Conventionally, if you wanted to start processing credit cards, you’d apply for a merchant services account at a bank, which can be a cumbersome process. After you were approved, you would then associate your point-of-sale system with your merchant account and start accepting credit cards.

But with Square, things work a little differently. Square has a merchant services account with acquiring banks and essentially acts as one giant merchant services account for all businesses that use Square payment processing.

What is a high-risk merchant services account?

In the credit card processing world, some businesses may be considered high risk. High-risk merchant services accounts can have steeper fees and stricter terms. Institutions may also deny high-risk merchants an account.

There’s no hard rule, but certain types of businesses tend to be flagged as high-risk merchants more than others. These can include businesses that sell goods or services that border on illegal, buyers’ or membership clubs, credit counseling or repair services, and businesses that engage in questionable marketing tactics. Read the Square General Terms of Service for more information.

How does credit card processing work?

Now that we’ve gone through all the parties involved in credit card processing, we’ll walk through how everything actually works. Let’s go back to Cup of Joe Coffee. You hand the barista your card and she processes it. What happens next?

Here is how a credit card is processed with Square:

Authorization

When a merchant swipes or dips (in the case of EMV) a customer’s card, the request is submitted to Square. We then send the transaction to the acquiring bank, which then sends it to the issuing bank for authorization. The issuing bank is checking for sufficient funds. It is also running the transaction through fraud models to determine if the transaction is safe (to protect the cardholder and the issuing bank).

Batching

This is the settlement stage, i.e., how the money from a transaction is sent to the acquirer to begin the process of depositing it into the merchant’s account. It’s called batching because payments are sent in a large group.

Funding (aka settlement)

The funding (or settlement) step is when businesses get the money from a credit card sale deposited into their account. The Square deposit schedule is usually within one to two business days. But if you set up Square Instant Transfers, you get your money instantly, 24/7. The price is just 1.75% per deposit.

Credit card processing fees

Many companies have of hidden fees when it comes to credit card processing. These can include transactional fees (like interchange reimbursement fees and assessments), flat fees (PCI fees, annual fees, early termination fees, and monthly minimum fees), and incidental fees (chargebacks or verification services). Square, on the other hand, has none of these.

Choose your credit card processing solution carefully, as some companies can have hidden fees.

Square pricing is simple — there are no hidden fees. It’s just 2.6% + 15¢ for magstripe card transactions, chip card transactions, and contactless (NFC) payments. For manually entered transactions, it’s 3.5% + 15¢. These fees apply to all business types, including nonprofit organizations.

Accepting credit cards

What is a credit card machine?

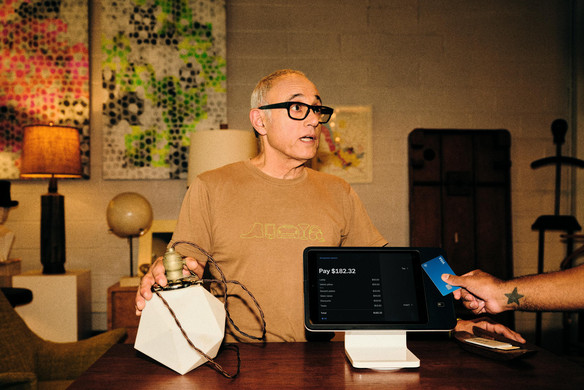

You need to get a new piece of technology to process credit cards. A credit card machine, aka a point of sale (POS), is a device that interfaces with payment cards to make electronic fund transfers. Newer point-of-sale systems like the Square Reader for contactless and chip also accept mobile NFC payments like Apple Pay, Android Pay, and Samsung Pay.

Mobile credit card machines

A lot of point-of-sale systems are big and clunky. Square POS products are sleek and completely mobile. They’re designed to look great on your countertop when you’re selling at your brick-and-mortar shop and fit in your pocket if you’re selling on the go.

How to set up credit card processing for your small business

If you’re new to all this or are just starting your first business, getting set up to process credit cards may seem daunting. Luckily, that doesn’t have to be the case. Nowadays, with tools like Square, it’s very easy to get up and running and accept credit cards at your small business. In fact, all you need is your mobile device. Square payment processing works directly with the device you already have to accept credit card payments and, with our new reader, NFC payments like Apple Pay.

Step-by-step guide for how to start accepting credit card payments

- Order the Square Reader for contactless and chip and tell us where to mail it.

- Create your free Square account.

- Download the free Square app and link your bank account for fast deposits.

- Connect the reader to your smartphone or tablet and start taking payments.

How to process credit cards

Credit cards are processed differently based on the type of card. Magstripe cards are swiped horizontally through the credit card reader. EMV chip cards are dipped vertically into the payments reader for the entire transaction. You can spot an EMV card by the tiny chip in the corner of the card.

EMV chip cards are a much more secure form of payment than magstripe cards.

What type of credit cards should you accept?

You should set your business up to accept EMV chip cards as soon as possible. EMV chip cards are far more secure than magstripe cards (which have been around for decades). Magstripe cards are relatively easy to counterfeit and have skyrocketed fraud rates in the United States. EMV chip cards have enhanced security features that protect against cloning and counterfeiting. To help curb fraud, U.S. banks are rolling out EMV chip cards to consumers en masse. Soon, most people will have them.

But there’s another reason you should accept EMV chip cards at your business—the liability shift. Under the liability shift, which went into effect in October 2015, businesses that aren’t set up to accept EMV chip cards could now be on the hook for certain fraudulent transactions, whereas previously the banks ate this cost. So to protect your business from unwanted charges, it’s smart to get a point-of-sale system that is EMV compliant.

What other types of payments should you accept?

In addition to EMV chip cards, it’s a good idea to also accept NFC mobile payments like Apple Pay, Android Pay, and Samsung Pay. These new payment methods are just as secure as EMV but offer a far better customer experience. Whereas EMV chip cards take several seconds to process (which is actually slower than magstripe cards), NFC mobile payments are instantaneous. They’re also picking up steam. Research firm BI Intelligence projects that merchants will quickly begin to unlock the potential of mobile payments this year, forecasting that U.S. in-store mobile payments will grow from $120 billion in 2016 to $808 billion by 2019.

On February 25, 2025, Square updated its in-person payment rate to 2.6% + 15¢. Learn more about Square’s fees here.

![]()