Table of contents

Payment links are a simple way to accept direct payments whether you do business in person, on social media, or through email and text communication with customers. Are you aiming to streamline your process? Here’s how to use payment links to simplify the payment process as you sell anywhere.

What is a payment link?

A payment link, or a checkout link, is a clickable link or scannable code that allows a customer to complete a purchase. Payment links are offered in the form of digital links, buy buttons, or QR codes. They are used across websites, social media platforms, apps, messaging tools, and in person. When a customer uses a payment link, they’re typically taken to the merchant’s online checkout page to complete their transaction. Payment links can be used both for a single transaction, such as a customer invoice, and for multiple transactions, such as a buy button on a social media platform.

What are the benefits of using payment links?

Payment links facilitate simple, direct payment and don’t require additional infrastructure, a website, or any code to set up and use. Any merchant can create a payment link that takes customers to a straightforward checkout page to complete a transaction.

Payment links are used to:

- Take payments anywhere you sell products or services: Whether you send clients a payment link via text message or direct customers to your online checkout page from multiple social media platforms, payment links allow you to get paid however you do business.

- Customize a purchase: Payment links come in different forms, so choose the ones that work best for the platforms on which you sell. Direct payment links work well for customer interactions and conversational commerce, while buy buttons and QR codes work well for online, social media, or in-person selling.

- Offer customers multiple ways to pay: Once customers have accessed your payment link, you can accept credit or debit card payments or digital payment methods, such as Apple Pay, Google Pay, Cash App Pay, or Afterpay.

- Keep payments simple: Customers don’t need an account or a special app to use a merchant’s payment link. They can access your payment link from any device for direct payment.

How to use payment links

A wide range of business types use payment links to collect payments or fees; to set up automatic charges for their services; and even to bill clients for individual classes, sessions, or appointments. The Square payment decision tree offers a detailed view of how and when businesses use direct payment links. These are some of the most common uses:

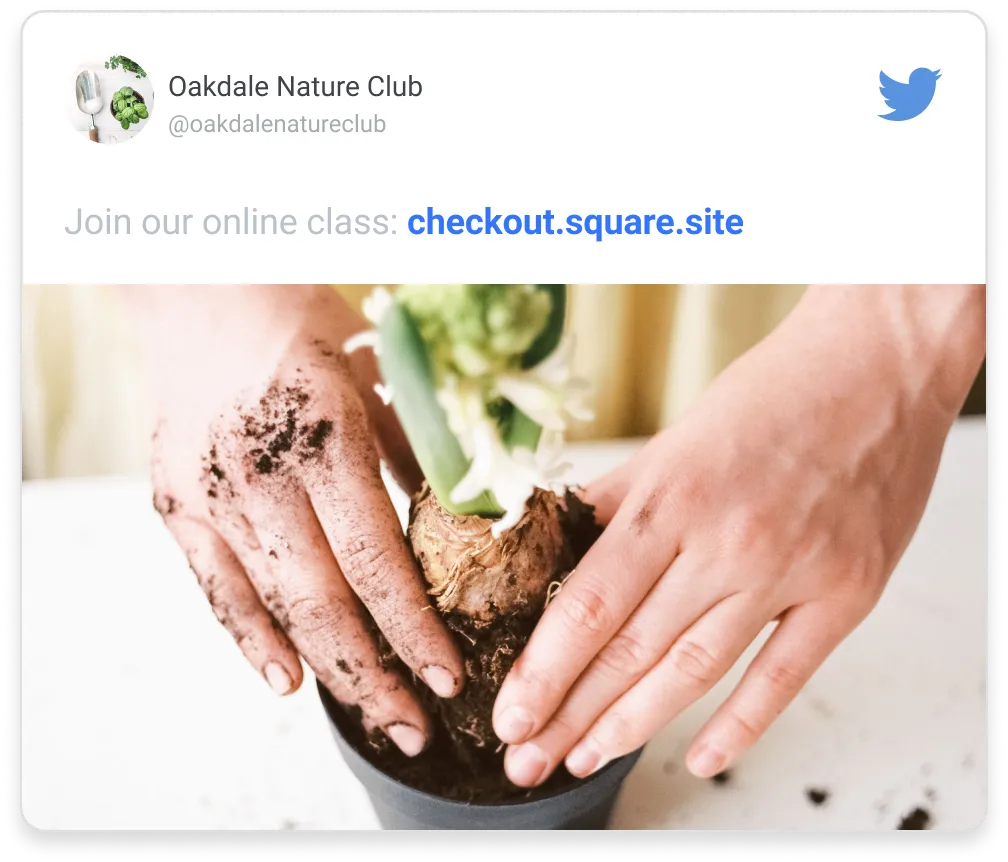

Social media platforms

If you sell your products on social media platforms, payment links are a direct way to get customers from social channels to your online checkout page. Provide a payment link in your posts on any social media channel so shoppers know exactly how and where to pay for the items they want.

Emails and text messages

Payment links are a useful tool in email and text message marketing to help point customers toward a purchase. Buy buttons embedded in marketing emails and payment links sent in text messages offer an easy way for customers to engage, to shop, and to complete a transaction. Payment links can also be sent to a customer via email or text for specific transactions, such as a one-time invoice link, a recurring monthly payment for products or services, or with a personalized message to let customers know you have a product back in stock that’s ready for purchase.

On a website or blog

Payment links in the form of embedded buy buttons on a website, an online store, or a blog are one of the most direct ways to move a customer toward a purchase. Customize buy buttons with specific text or color and place them strategically on a site to alert customers that items are for sale.

In-person selling

Even in–person selling can offer digital advantages: QR code payment links are a quick way to direct in-person customers to an online store or checkout page. QR code payment links are especially useful for pop-up shops, mobile selling, or professional services that only sell a handful of items or products, since a point-of-sale system isn’t needed.

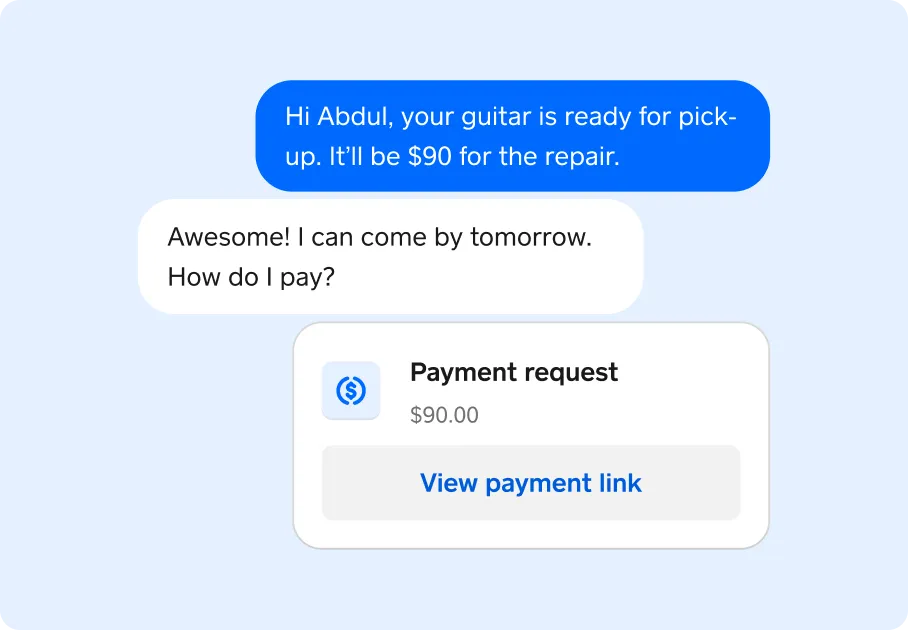

In customer service chat

Now that many businesses offer personalized chat or chatbots as a part of their customer service, direct payment links are a way to point customers toward an item or a transaction. Payment links used within customer service chats can help direct customers to in-stock items, cross-sell, and even facilitate customer purchases directly from the chat itself.

Who can use payment links?

Payments links are particularly well-suited for professionals and businesses that rely on remote sales, invoicing, and social media selling, such as:

- Freelancers and independent contractors: Payment links provide a simple way to alert clients and receive payments, whether you bill hourly or by project.

- Service providers: If you offer services such as pet-sitting, house cleaning, or health and beauty treatments, payment links can help you get paid quickly and easily after each session.

- Remote sellers: Payment links are ideal for online store owners or those who sell primarily through social media channels.

- Online coaches and consultants: Whether you offer one-on-one coaching or group consulting services, payment links provide a convenient way to accept payments from clients.

- Creators and artists: If you sell digital products, art, or handmade goods, payment links provide a convenient way to accept payments from fans and customers and sell anywhere.

- Nonprofit organizations: Charities, fundraisers, or community groups can use payment links to collect donations or sell merchandise online.

How to create sharable payment links

Payment links are easy to set up and share with customers. First, decide which type of payment link you want to create — a sharable link, a buy button, a QR code, or all three — and how you want to use that payment link. Next, tailor your link to your brand and business by adding custom fields, your logo, and business name. You can even add options for accepting buyer-entered amounts and tips. Once it’s generated, distribute the link to customers or clients over the channel that works best for your business.

Learn more about how to set up payment links with Square.

Payement Links FAQ

Is a payment link safe?

Yes, payment links are a safe and secure way to accept direct payment online. Reputable payment link providers use robust security measures, such as:

- Encryption: Protects payment information from unauthorized access

- Secure Sockets Layer (SSL) certificates: Ensures data transmitted between the customer’s browser and the payment provider’s server remains confidential

- Two-factor authentication: Adds an extra layer of security to prevent unauthorized transactions

How do I send someone a payment link?

Sending a payment link is a straightforward process. Here are the general steps:

- Create a payment link: Log in to your payment provider’s dashboard and create a new payment link. You can enter a predefined amount that the customer will see when they visit the payment portal, or you can leave it open-ended, allowing the visitor to choose from different products or services. Some payment providers may allow you to send automated reminders to the recipient if the payment hasn’t been made.

- Choose a sharing method: Select how you want to share the payment link, such as via email, SMS, messaging apps, or social media platforms.

- Share the link: Copy and paste the payment link into the preferred channel.

What is the difference between a payment link and an invoice?

While both payment links and invoices are used to request payments, they serve slightly different purposes. A direct payment link is a simple, clickable link that allows customers to make a payment online so you can sell anywhere and be paid immediately. An invoice is a detailed document that outlines the goods or services provided, quantities, prices, and payment terms. Invoices typically include more formal and structured information, such as company logos, addresses, and payment instructions.

How do I receive money from a payment link?

When customers click the link you’ve shared, it takes them to a secure payment gateway. There they will enter their payment information, such as credit card details or banking information. The payment is processed in real time, and the funds are transferred to your account. Funds are available within a few minutes to a few days, depending on the payment provider and your account settings.

![]()