Table of contents

This article was updated in July 2022.

If you manage your business on the go or over the phone, a virtual terminal can be a game-changer when it comes to safely accepting payments from your customers. Without the need for your customer to be present, a virtual terminal allows you to run their credit card information from any computer, anywhere.

What is a virtual terminal exactly and how can it work for your business? In this article, we’ll help you better understand your options for taking payments remotely via an online terminal.

What is a virtual terminal?

A virtual terminal is just like a physical credit card machine. However, because it’s hosted online, it can turn any computer into a credit card terminal. You can accept payments from anywhere, at any time, making it perfect for remote billing or taking credit cards over the phone.

Virtual or online terminals give you freedom as the business owner to collect payment in a timely manner without the need to have your customer present. While they can be useful to businesses of all sizes, they can be slightly more time-consuming than a typical card reader since you’ll need to manually enter in the payment information instead of swiping or tapping like you would with a reader.

Types of virtual terminals

A virtual terminal is a payment option intended for payments when the cardholder is not present to complete the sale. And while the most common way to access a virtual terminal is through a web browser, there are other types of virtual terminals available.

-

Web-based: Merchants enter customer information and payment details via their preferred web browser to complete the payment.

-

Mobile and desktop apps: Merchants key in credit card information into a mobile app, like the Square Point of Sale app or via a desktop app like Square Charge for Desktop, that can be downloaded onto any Mac computer, allowing you to process payments without ever leaving your desktop screen.

-

Card machine screen: Merchants use a card machine screen, like Square Terminal, that allows you to manually enter the credit card information right on the terminal.

How does a virtual terminal work?

Virtual terminals allow you to manually enter credit card information to complete the transaction. The benefit of virtual terminals is that they’re accessible from any computer. No extra hardware is needed, and a transaction can be completed from virtually anywhere with just a few clicks.

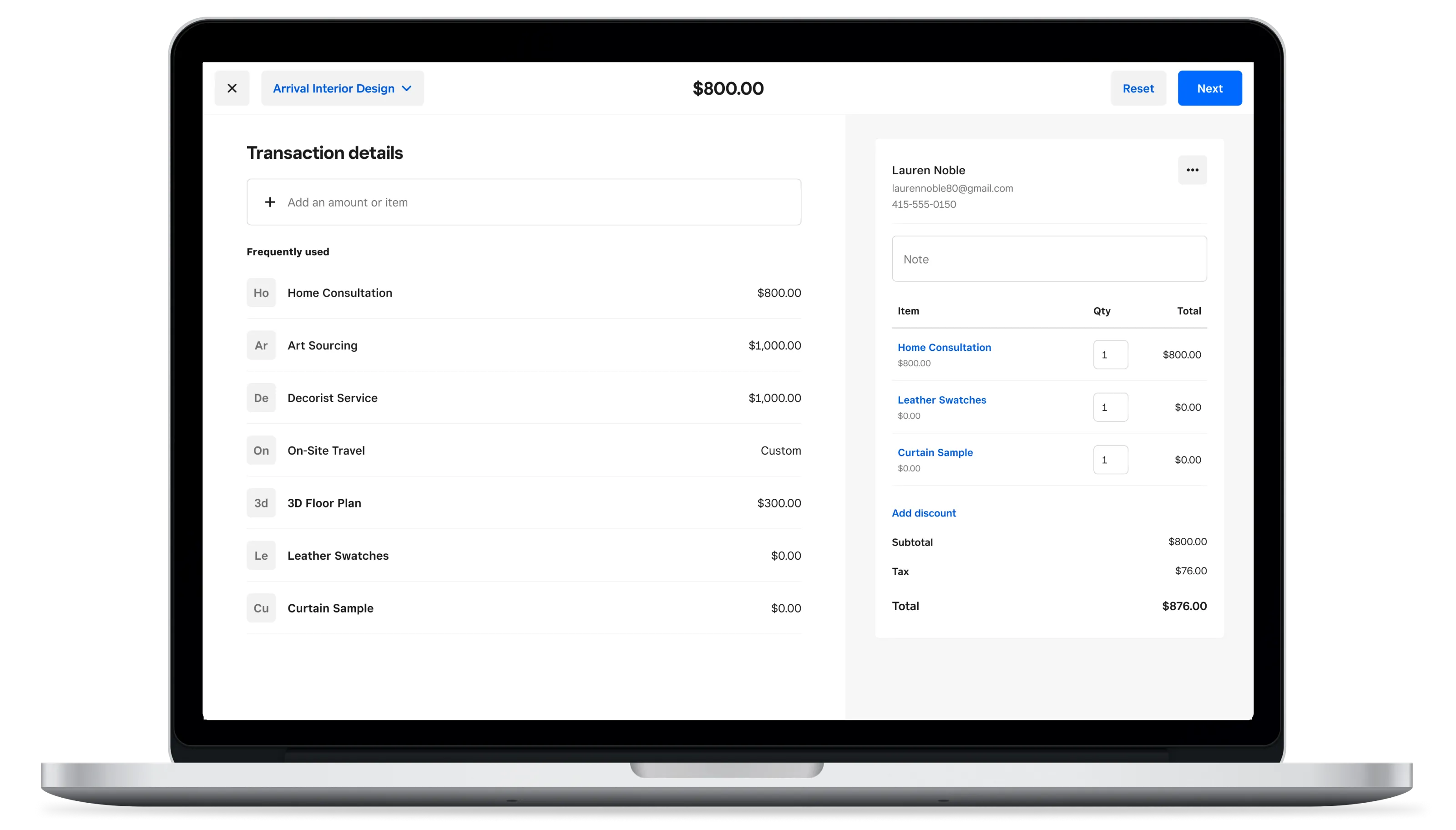

1. Ring up the sale

Square Virtual Terminal allows you to do a quick charge or an itemized sale. A quick charge is when you want to enter just the amount of the transaction, with no details or itemized items. This might be a simple one-time charge or a single invoice amount for your business. An itemized sale, on the other hand, is possible with Virtual Terminal once you set up an item library for your items or services. This can give you better insights into your sales and trends over time.

2. Enter the payment information

With a virtual terminal, there are a few ways you can accept payment. A virtual terminal requires you to manually type in the payment information for the sale to be completed. Depending on your payment processing tool, this can range from name, address, currency type, phone number, and invoice number or amount.

Square Virtual Terminal requires you to enter at least these details to complete the sale:

-

Billing zip code

-

Invoice or order amount

-

Credit card number

-

Expiration date

-

CVV

As long as you have this information, you can manually key in their credit card information or you can text an online payment link for the customer to fill in their own information.

3. Charge

Once the sale is completed, you’re able to email, text, or print receipts from your computer. If your business offers subscription-type services, you may want to consider setting up recurring payments so you can bill your customers on a weekly, monthly, or yearly basis by securely storing their credit card information on file and processing future payments automatically.

What to look for in a virtual terminal

Businesses that operate from a computer or who need to take remote payments over the phone can greatly benefit from using a virtual terminal to more efficiently collect payments. You’ll want to be aware of a few features in a virtual terminal that can keep your business and your customers’ information safe.

End-to-end encryption and security should be a top priority when looking for a virtual terminal option. This will help protect your customers’ data as well as yours within the payment system and during the transaction transmission. This encryption will mask the customer’s account number and create an anonymous token to be used. This allows you to store and charge your customer’s credit card information securely and safely.

When it comes to further protection, you’ll also want to be aware of the fraud management protections that are in place. A virtual terminal should include such protective tools as address verification service (AVS), credit card verification value (CVV) or card identification number (CID), or a two-factor authentication method.

Additionally, any business that processes credit card payments must adhere to the Payment Card Industry Data Security Standard, more commonly known as PCI compliance. There are four levels of PCI compliance; each level has unique requirements for a business to validate its compliance. The level under which your business falls is based on your total transaction volume annually. Square hardware and software is PCI Level 1 compliant, meaning that Square merchants do not need to individually validate their state of compliance to process credit card payments.

Other benefits of a virtual terminal

Online terminals can offer more than just credit card or payment processing. In fact, with the right virtual terminal tool, you can streamline your customer and inventory management all within one place. For example, with Square Virtual Terminal, your customer profiles, notes, purchase history, and payment information is stored within a customer directory and integrated with your virtual terminal.

Certain virtual terminal payment processing providers allow you to accept echeck or ACH payments. This can help mitigate the usually higher cost of card-not-present transactions. Another option for saving on transaction fees is to choose a virtual terminal that connects to a physical credit card terminal for in-person payments. For example, when you wirelessly connect Square Terminal to your computer, you ring up sales on your computer and let customers tap, dip, or swipe any card to pay.

In order to better streamline your cash flow processes and accounting, some virtual terminals have the ability to integrate directly with your accounting software. This allows you to automatically record each of the transactions through the terminal without the need to manually add or edit them later on.

Lastly, you’ll want to ensure you can access your money in a timely manner. Having an invoice paid but not receiving the funds for days can not only throw off your accounting, but pose real cash flow challenges for freelancers and small businesses.

Is a virtual terminal the same as a payment gateway?

Not sure how a virtual terminal is different from a payment gateway? Sometimes there’s confusion on how the two differ, but they actually have different features and abilities.

You may be familiar with a payment gateway when checking out your favorite online retailer or filling up your online shopping cart. A payment gateway is used for these types of eCommerce transactions and is typically customer-facing. Virtual terminals, on the other hand, are primarily used by the business or merchant directly.

What types of businesses use a virtual terminal?

Any business can use a virtual terminal, but because it can take more time than a physical card reader, virtual payment terminals can be more suited for certain types of businesses. Any business that operates from a computer as its primary device or wants to accept payments remotely can benefit from a virtual terminal. A few examples of businesses like this could include reception-based businesses like medical offices, freelancers such as photographers, and home repair professionals.

Businesses that often take orders or payments over the phone can also find a huge benefit in using virtual terminals. Service providers such as lawyers or tax consultants who might see their clients in the office at first, but often take payments over the phone can use a virtual terminal. Restaurants and retailers can also benefit from using virtual terminals when they take orders over the phone. Businesses that confirm bookings, such as catering services, often use virtual terminal credit card processing.

Managing your business on the go doesn’t have to be a challenge when it comes to getting your invoices paid. With Square Virtual Terminal, you can accept payments any time and anywhere, saving you time and allowing you to focus more on the work you love to do.

![]()