Applying for small business financing through traditional channels can be overwhelming — and may take loads of paperwork. Not to mention that after all that time and effort, there’s no guarantee that you’ll be approved.

That’s why we offer Square Loans — a program designed to take the headache out of the business financing process.

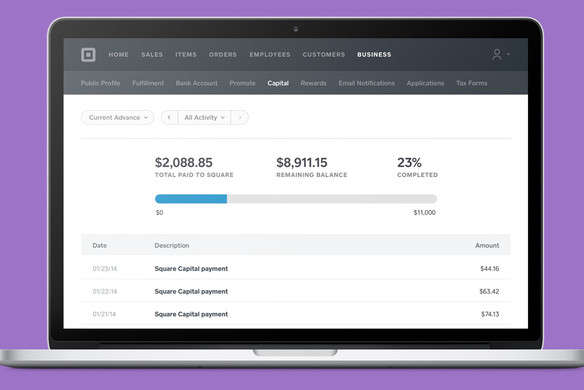

If we spot that you’re eligible to apply for a loan through Square Loans, we’ll proactively reach out to you (via email and in your Square Dashboard ) with a customized loan offer. You get just the right amount of financing that your business can support.

If you apply for a business loan, we’ll do a quick review to confirm that your business is healthy and you’re in good standing with Square (for example, not a fraudster). Upon approval, the money will be transferred straight into your bank account as soon as the next next business day. (Check here to see if you are eligible).

Our sophisticated tools are running every single day to find sellers who would be a good fit for offers through Square Loans. To date, over $1 billion in financing has been extended through Square Loans to over 105,000 independent businesses using Square.

So how do we determine if you may be eligible for a loan through Square Loans?

We look at many factors to determine where to extend loan offers. But generally, the more active you are on Square (and the more aspects of your business you run with Square), the more likely we are to offer you financing.

Key among those factors are:

- Processing volume: In general, we look for businesses that have processed at least $10,000 or more in a year. So the more you process with Square, the better.

- Recent payments: How recently have you taken a payment? One of our indicators is whether you’ve taken a payment at least once in the last week.

We also look at factors such as:

- Your history with Square: Seeing your history with Square helps us spot trends and understand how your business might grow in the future.

- Your activity level: Are you an active Square seller? The number and frequency of payments matters, too. If you take a bunch of payments often (say, every week), you’re more likely to get noticed.

- Your customer mix: Do you have a mix of new and returning customers? A diversity of new and returning customers shows us that you’re growing in different ways. You can use Square’s analytics tools to get a grasp on your mix of customers.

- Whether you have a healthy, growing business: The size of your loan offer can be correlated to your growth. The more you’re growing (and the speed at which you grow), the larger your loan offer.

The goal of Square Loans is to help promising sellers grow their business (minus the friction of traditional financing programs). We’re here to help.

Learn more about Square Loans.

Square Loans, LLC and Square Financial Services, Inc. are both wholly owned subsidiaries of Square, Inc. Square Loans, LLC d/b/a Square Loans of California, LLC in FL, GA, MT, and NY. All loans are issued by either Celtic Bank or Square Financial Services, Inc. Square Financial Services, Inc. and Celtic Bank are both Utah-Chartered Industrial Banks. Members FDIC, located in Salt Lake City, UT. The bank issuing your loan will be identified in your loan agreement. The individual authorized to act on behalf of the business must be a U.S. citizen or permanent resident and at least 18 years old. Loan eligibility is not guaranteed. All loans are subject to approval.

![]()