Table of contents

Whether you’re just starting out or are ready to take things to the next level, you need capital to power your small business. And if you don’t have the money readily accessible, it’s likely you’ll need to get a small business loan.

But before you start to research what getting a small business loan entails, there are some key things to nail down. First on that list is figuring out exactly how you’ll use your influx of cash (closely followed by how you’ll pay it back). Without a strategic, targeted plan for how you’re going to put that money to work, it’s unlikely to help you move the needle.

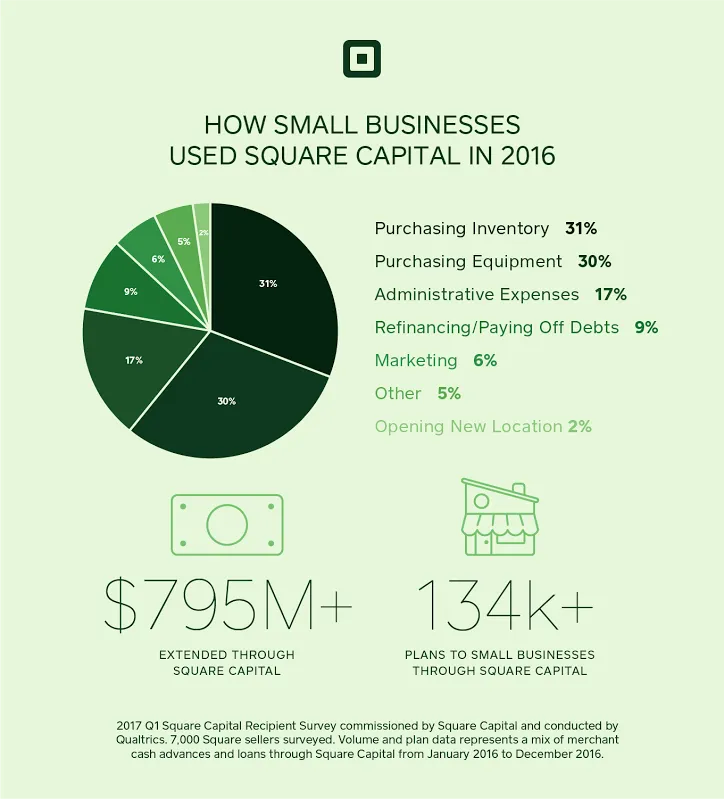

In 2016, we extended more than $795 million through more than 133,000 (1) plans to smart, growing small businesses through Square’s small business financing arm, Square Loans. The average size of a plan was around $6,000.

At the beginning of 2017, we asked 7,000 sellers who accepted loans to tell us how they used their funding.

Twenty percent of those sellers surveyed were first-time borrowers, while 80 percent had used Square Loans before. Of those sellers who were repeat borrowers, 66 percent used their subsequent plan to fund the same business purpose, while 34 percent used it to fund a new purpose.

Here’s what they invested in:

1. Purchasing inventory

Many businesses — 31 percent — put Square Loans toward purchasing inventory. Among retailers, this number was even higher, with over 60 percent using their funds this way. Using funds to purchase inventory is a good way to manage seasonal dips, replenish stock, or try out new products.

2. Purchasing equipment

It’s common for small businesses to need a loan to fund those heavy-hitting purchases. The second-most popular way businesses use Square Loans is to make capital investments in equipment. Thirty percent of businesses use Square Loans funds this way.

3. Day-to-day expenses

Keeping the lights on — and things running smoothly — requires both time and money. Seventeen percent of Square Loans recipients use their loan to help cover the expenses of their day-to-day operations.

4. Refinancing or paying other debts

Consolidating debt can be a smart way to use small business financing. Nine percent of Square Loans recipients use their advance to help refinance or pay down other debts.

5. Marketing

To grow your business, it’s imperative to get new customers in the door and keep loyal customers, well, loyal. Whether it’s through social media, email, events, or more traditional paid media, marketing is one of the best ways to grow business. Six percent of businesses put their advances toward marketing.

Having a game plan for how you’re going to spend your small business loan is crucial. Maybe one of the investments listed above makes the most sense for your business. Or maybe your business would benefit from adding new products, entering a new marketing, or opening a new location.

Whatever it is, before you apply for (or accept) small business financing, make sure you’ve thought through the most strategic way to use it.

(1) Represents a mix of merchant cash advances and loans through Square Capital from January 2016 to December 2016.

Square Loans, LLC and Square Financial Services, Inc. are both wholly owned subsidiaries of Square, Inc. Square Loans, LLC d/b/a Square Loans of California, LLC in FL, GA, MT, and NY. All loans are issued by either Celtic Bank or Square Financial Services, Inc. Square Financial Services, Inc. and Celtic Bank are both Utah-Chartered Industrial Banks. Members FDIC, located in Salt Lake City, UT. The bank issuing your loan will be identified in your loan agreement. The individual authorized to act on behalf of the business must be a U.S. citizen or permanent resident and at least 18 years old. Loan eligibility is not guaranteed. All loans are subject to approval.

![]()