Table of contents

Taxes are complicated. Which is why we’re thrilled to have our friends over at TaxJar as regular contributors. Each week, they break down the need-to-know tax information for small-business owners.

Today, they explain form 1099-MISC.

It’s that time again. Whether you’re sending one, receiving one, or both, nearly every business owner has form 1099-MISC on the brain this time of year.

Form 1099-MISC is an “informational return.” It’s a way for the IRS to keep track of the money flowing from business owners to contractors around the country. It’s sent when a business owner pays someone else:

- At least $600 in rents, services (including parts and materials), prizes and awards, other income payments, medical and health care payments, crop insurance proceeds, cash payments for fish (or other aquatic life) purchased from anyone engaged in the trade or business of catching fish, or, generally, the cash paid from a notional principal contract to an individual, partnership, or estate

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest

- Any fishing boat proceeds

- Gross proceeds of $600 or more paid to an attorney during the year

- Any federal income tax withheld under the backup withholding rules regardless of the amount of the payment. (Source: IRS.gov)

Pay attention to that first bullet point. It’s about to become important to you and your business.

Some small-business owners issue form 1099-MISC, some small-business owners receive form 1099-MISC, and some small business owners do both. As a small-business owner, this is what you need to know — whether you’re on the sending or receiving end of this U.S. tax form.

Who sends form 1099-MISC?

If you own a business and pay a contractor $600 or more in the calendar year, then the IRS requires you to send that contractor a form 1099-MISC.

Here’s what to do, step by step:

-

Use the information from your contractor’s form W-9 to fill out form 1099-MISC. Didn’t collect a W-9 at the time you hired the contractor? No problem. Go ahead and collect it now. And if you have questions, use the General Instructions for Certain Information Returns form over at the IRS website.

-

Make sure this form gets to your contractor by January 31, 2018. The 31st falls on a Saturday this year, but according to the IRS website, the due date hasn’t been extended.

-

Prepare a form 1096 summary of all the 1099s you prepared. Make sure this gets to the IRS by February 28, 2018 if you file by paper or April 2, 2018 if you file electronically.

Fortunately, you can also automate this process. Square Payroll for Contractors can generate, prepare, and file Form 1099-MISC online for you. And there’s no need to manually send out Form 1099-MISC to contractors since they can download it themselves from their online accounts.

But don’t be late. If you don’t get a form 1099-MISC to the recipient on time, or if you filled out the form incorrectly, you could face fines. You can even be fined if your 1099-MISC forms aren’t machine readable, so don’t fill them out by hand.

Fines for an erroneous or late 1099-MISC are anywhere from $15 to $50 per return, depending on how late you file. If you hired a lot of contractors, this can quickly become a major expense.

With that, you’re all set when it comes to sending 1099s.

Who receives form 1099-MISC?

You may also receive form 1099-MISC. If this is the case, you should see form 1099-MISC show up in your mailbox or inbox by January 31.

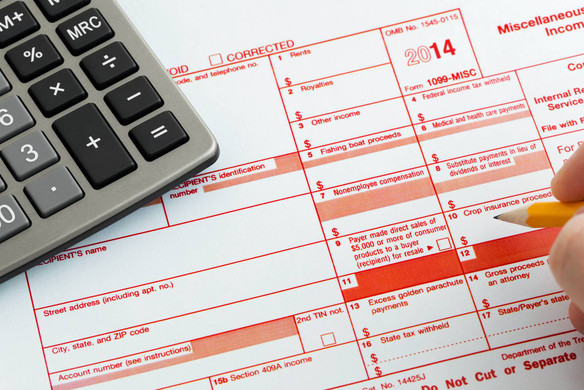

It looks a little something like this:

So what do you do with this thing?

First, check form 1099-MISC against your own records. Does this match the income you think you made from that client? It’s very easy for your client to make a calculation error, such as including an invoice twice. The trouble is, the IRS takes this amount as gospel and expects you to pay income tax on the amount reported on your 1099-MISC. So don’t skip this step. If you do find a problem, report it to the company that issued your 1099-MISC. If you report it in time, the client can correct your 1099 before it reports that income to the IRS.

What if you didn’t receive a form 1099-MISC but were expecting one?

This is one situation in business where you can truly say this isn’t your problem. It’s up to the business that hired you to comply with the law. If you want to be a good guy or gal, you might give them a heads up about this obligation, but you aren’t liable for any wrongdoing if you don’t receive a form 1099-MISC when you believe you should have.

And those are the basics. You should be squared away when it comes to form 1099-MISC.

About TaxJar

Sales tax is complex. That’s why we created TaxJar — to handle the burden of sales tax while you get back to running your business. TaxJar pulls in sales tax collected from all the channels where you sell, compiles your data into return-ready reports, and can even AutoFile your sales tax returns for you in 26 states (and counting). Sign up for a 30-day TaxJar free trial today and put a lid on sales tax. And check out Square App Marketplace for more information on how to link your Square account to TaxJar’s tools.

![]()