Table of contents

This article is for educational purposes and does not constitute legal, financial, or tax advice. For specific advice applicable to your business, please contact a professional.

Due in part to the rise in peer-to-peer apps and payment options such as credit or debit cards, the writing of checks has gone down significantly since 2000. However, according to the Federal Reserve there are still over 14.5 billion checks written by Americans each year.

For small business owners, writing checks and depositing checks can still be a convenient way to transfer money from one bank account to another. And with the rise of digital banking capabilities, such as mobile check deposit, it has become easier than ever to deposit checks without ever leaving your office or home.

How to write a check

You may be writing a check to pay a vendor, supplier, or rent. Before you get ready to pay this individual or business, there are a few things you’ll need to keep in mind.

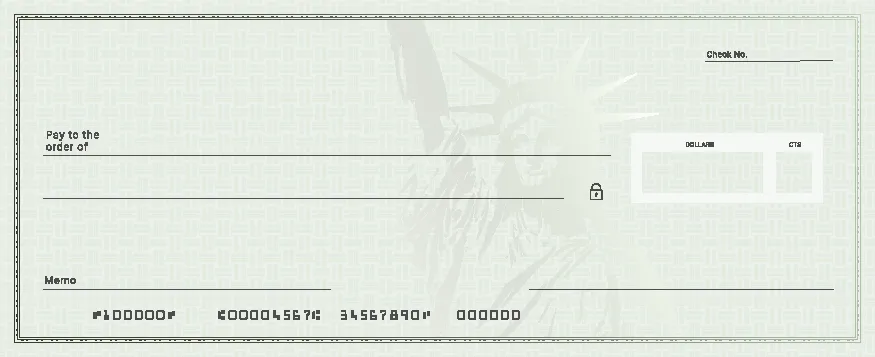

When writing a check, you’ll want to fill in the following information:

- Current date: This is where you fill in the date you are writing the check.

- Pay to the order of: On this line you will fill in the full legal name or business name you are writing the check to.

- Amount in words: Add in the amount in words for the check you are writing. For example, if the check is for $200.50, write out “two hundred dollars and 50/100” You can keep the cent amount as a fraction while writing out the rest in words.

- Amount in numbers: Typically there is a framed box for the dollar amount in numbers. Following the same example you would fill this in with $200.50

- Signature: Don’t forget to sign the check. A check without a signature could be difficult to deposit by the recipient. As you can see in the example above, the line for signatures is in the bottom right hand corner.

- Memo line: This line is for you to include a note describing what the check is for. For example, if you are paying for monthly rent you may write “September rent”. This step is optional, but filling it in can help you keep better track of your expenses.

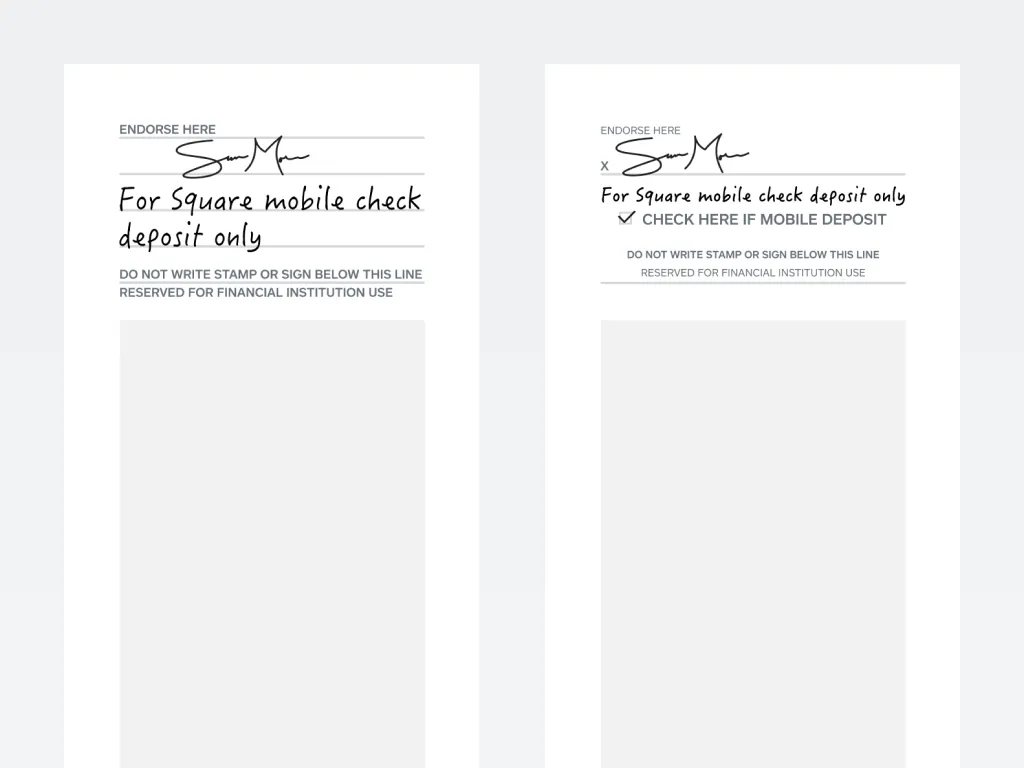

How to fill out the back of a check for deposit

Let’s say you are receiving a check and want to deposit it. Whether you are making a mobile checking deposit or one in person, here are a few things you need to fill out in order to deposit a check.

Before you make a deposit, make sure you endorse the check, without writing or stamping below the indicated line. Endorsing a check will allow you to cash it or deposit the funds into your checking or savings account. This serves as a verification you are attempting to redeem this check — without it your check could be rejected for deposit. If the check is written out to your business, an authorized person must endorse the check on behalf of the business. In this case you’ll want to sign the name of the business, your name, your title, and any restrictions.

If you are making a mobile deposit, you typically don’t need a deposit slip. Instead, you would endorse the check, fill out the above information, and upload it through your bank’s mobile app. Some banks will limit the amount of mobile deposits you make in a day, so check your bank’s guidelines to confirm how much and how often you can deposit money into your account. Once a mobile check has been deposited and approved, it can still take several days for the funds to be available in your account. Check with your bank as this timing can vary depending on the bank.

![]()