Table of contents

Please note that the information contained in this article is limited in scope and is only intended as a high-level overview of the topics discussed. The information is current as of the publication date only, and the laws (and associated agency and/or judicial interpretations) on the topics discussed could change at any point in the future. Block, Inc. (including its affiliates, subsidiaries, employees, officers, directors, attorneys, and tax advisors) undertakes no obligation to update this article for future changes in the law. In addition, laws vary by jurisdiction, and this article does not attempt to address all jurisdictions — for example, states, counties, or cities often have requirements that differ from federal law. Nothing in this article is or should be used as tax or legal advice. In particular, this article cannot be relied upon for the purposes of avoiding taxes, penalties, or other obligations under applicable law. For guidance or advice specific to your business, you should consult with a qualified tax and/or legal professional.

While a new year means a fresh start, it also means tax season is right around the corner. Set yourself up to save time and stay organized with the right set of tools for your business. The Square App Marketplace offers a host of apps that can help make tax time easier by connecting seamlessly with the Square financial tools you’re already using and automating some of the more tedious tasks involved in tax preparation. As tax season approaches, prepare ahead of time and assemble a tax-time dream team for your business.

Tip 1: Prepare ahead of time

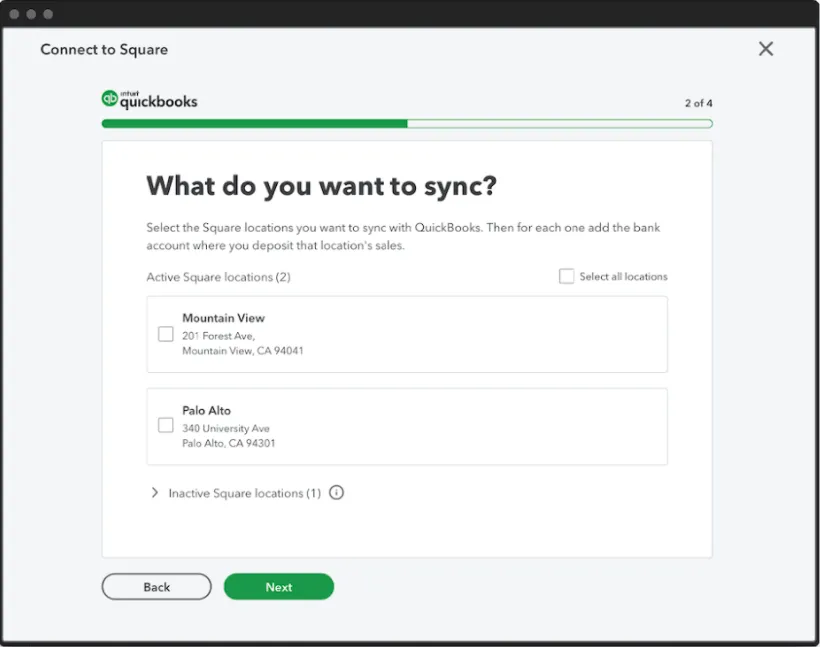

Planning ahead means getting your bookkeeping in order from day one. Introduced a new flavor this quarter? Or added a new class? Sync your Square transactions to QuickBooks Online to monitor the performance. QuickBooks Online allows you to import individual transactions as well as daily summaries so you can view a holistic summary of your sales data. Additionally, you can sync Square Payroll data with QuickBooks and add in other expenses and inventory costs for a full analysis. Tax time is an opportunity to gain a better understanding of your business health. QuickBooks has the ability to keep all the necessary data in one location (even if your business has multiple locations). Income, expenses, and invoices are pulled in to create detailed reports. No matter the size of your business, view specific analyses across large data sets to monitor performance.

Tip 2: Get — and stay— organized

Deducting business expenses can help offset taxes owed and maximize your profit. If you’re a side hustler, freelancer, or independent contractor, small expenses can add up and make a big impact on your margin. Tracking and totaling these expenses is often inconvenient and time-consuming.

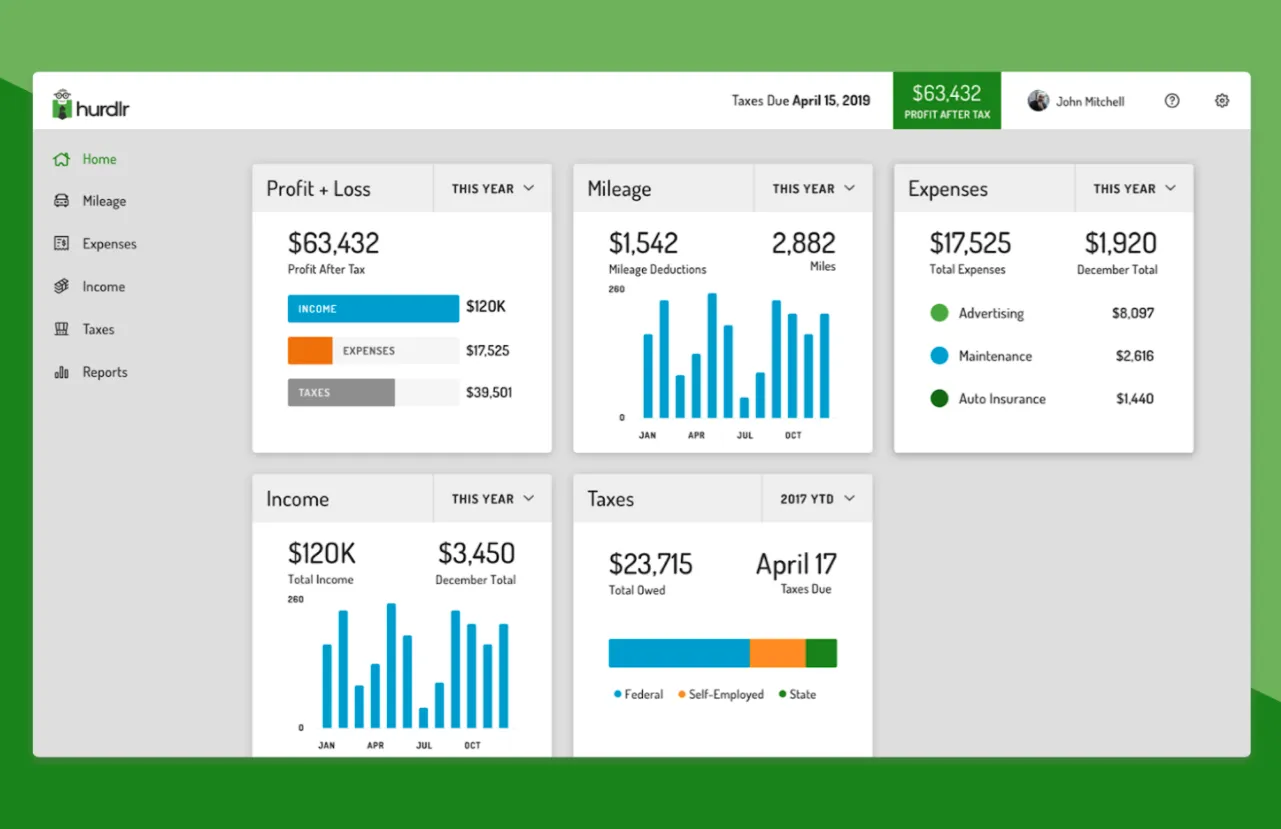

Hurdlr is a simple tool that syncs your Square transactions to track and manage expenses, refunds, and mileage. It uses a tagging system and machine learning to sort transactions, save time, and find deductions that can slip through the cracks. Capture that quick drive to drop off inventory or coffee with a client, and categorize these expenses with an automated app.

If your business involves professional services and billing customers by invoice, FreshBooks helps automate the billing, expense-tracking, and getting paid. It automates payment reminders, time tracking, and makes it simple to monitor profitability. The FreshBooks mobile app is a useful tool for tracking mileage and storing receipts. At tax time, FreshBooks can sync all your Square sales with your invoices and expenses to provide detailed reports for automatic filing.

Tip 3: Assemble a tax-time dream team

As a sole proprietor, small business taxes can be daunting and require a serious time investment. Leveraging tools and experts for your taxes, just as you might for legal or IT support, will help you stay on track and enable you to invest your time in other areas of your business.

Read more: 6 Things You Can Do Right Now to Make Filing Taxes Less of a Nightmare

Square partners with Bench to offer tax-time support. Bench automatically syncs your transactions to prepare a year-end financial statement which you can use to file your taxes on your own or through them. Bench offers you the option to be paired with a licensed tax specialist if you have questions or need one-on-one support. With peace of mind around your tax filings, you can focus on your products, marketing, and growth strategies for the year ahead.

You’ve turned to Square to simplify and save time. That efficiency and simplicity should extend to the more taxing parts of your work. Powered by the Square ecosystem of tools, you can fly through tax time and get back to savoring the best parts of owning a business.

![]()