Table of contents

Every week the highlight of my job is talking with some of the 713,000 retailers (and counting) who run on Square. I hear one thing again and again: their point-of-sale (POS) is the operating system for the entire business. When your POS system pulls together inventory, staff, and sales data, you can spend less time troubleshooting and more time delighting customers.

In this article, I’ll walk you through the retail‑specific POS features that matter most based on my conversations with retailers, share data‑backed insights, and compare leading platforms so you can choose the best fit, whether you’re just opening the doors or scaling to multiple locations.

What is a POS system and why it matters for retailers

A POS system is the combination of software and hardware that allows you to accept payments and run your business across multiple locations and sales channels. But for modern retailers who are making the most of their tech stack, it plays a much bigger role behind the scenes.

The best retail POS systems should also help you:

- Manage inventory in real-time

- Seamlessly merge data across channels and locations

- Generate performance reports with actionable insights

- Market to customers and track loyalty

- Manage staff and run payroll

In my time working with retailers, I’ve seen how unreliable technology makes it hard to run a business: disconnected in-store and online systems lead to inventory blind spots and overstocking, while unreliable processors cost businesses sales when it matters most. The right POS removes friction and guesswork so you can focus on customers, instead of systems.

Key features to look for in the your retail POS system

Not all retail POS systems are created equal. As you compare options, look for features that directly support the way your retail business operates:

Flexible checkout and payment options

The ability to accept chip cards, tap-to-pay, mobile wallets, and BNPL with support for retail-specific workflows, like refunds and exchanges, is paramount when satisfying how consumers want to pay.

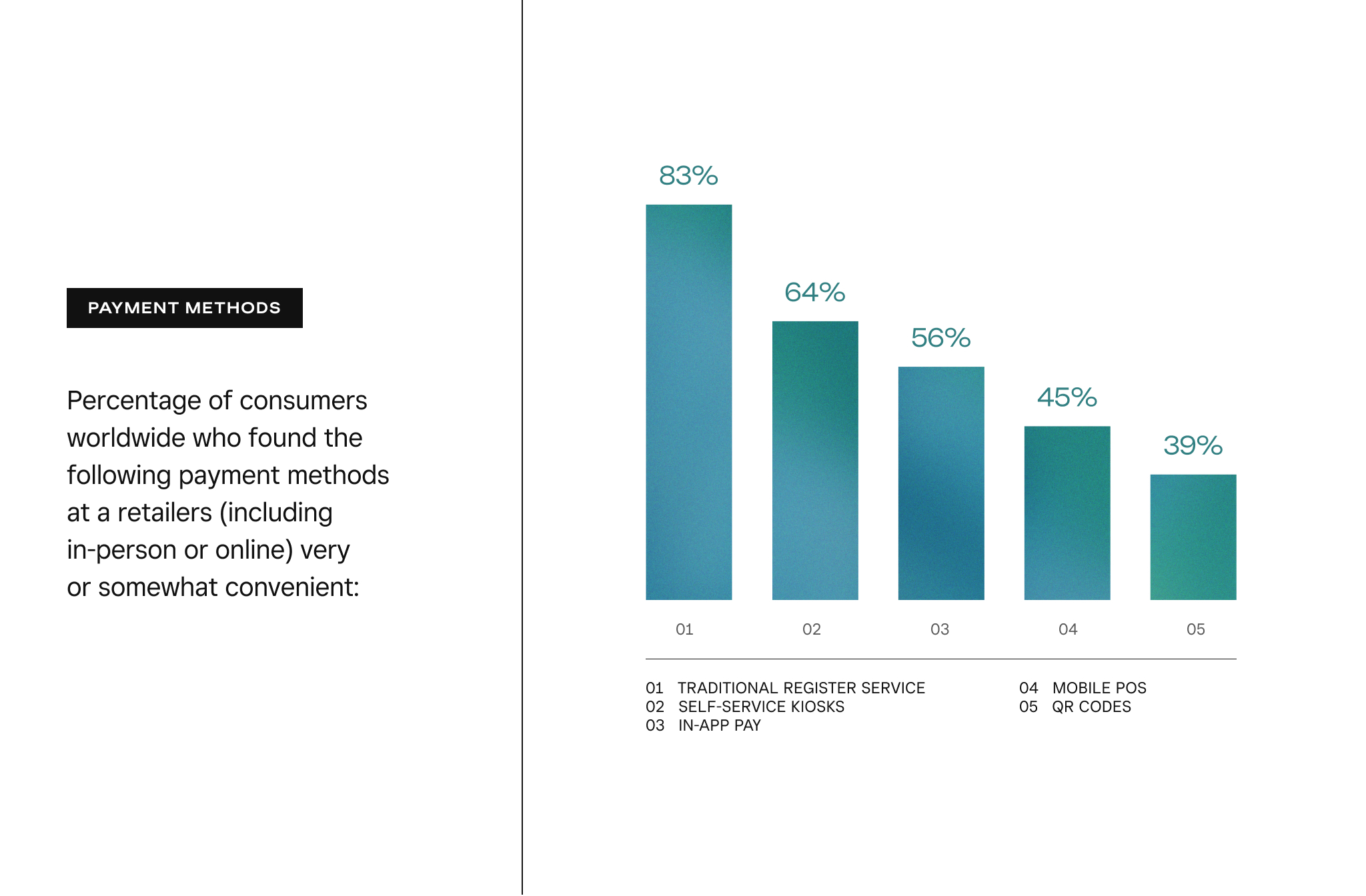

According to Square’s 2025 Future of Retail report, emerging payment technology like self-serve kiosks and in-app payment options are trending up and younger consumers are driving the charge. As a retailer you may conduct much of your business online, but for those who also have brick-and-mortar locations, embracing technology-forward payment methods with a modern POS provider will be pivotal to meeting your customers’ evolving preferences. An efficient checkout process improves the customer experience.

Remember to select an POS provider that captures sales even when the WiFi goes down so you never miss sale. Square’s offline payments feature does just that.

Real-time inventory management

I’ve worked with many successful retailers who manage inventory by instinct, a method that works, until growth makes it harder to keep up. Manual tracking can lead to missed reorders, stockouts, or excess inventory, especially as teams expand or operations get more complex.

A retail POS with built-in inventory tools takes the guesswork out by tracking stock levels across locations and channels, while surfacing both bestsellers and slow-moving items. You want to manage vendors in one place and streamline bulk stock receiving. The best systems make setup easy too, with bulk import tools and barcode printing that help you modernize operations without starting from scratch.

Clear, actionable reporting

Understanding what’s selling by product, category, or location, and when, is imperative when running a successful retail operation. Look for reporting tools that let you track cost of goods sold (COGS), identify seasonal trends, and compare sales across time periods so you can buy smarter and avoid overbuying. Square for Retail provides real-time reporting so you know what’s selling and why.

Omnichannel selling made simple

Retail consumers often browse online before visiting your store, or buy in-person and reorder online. Choose a POS that syncs inventory, orders, and customer profiles across all channels so you can manage it all from one place and keep the right inventory levels on hand.

Customer engagement tools

Use gift cards, loyalty programs, and email and text message marketing tools to turn first-time customers into regulars. If your POS lets you track customer purchases and preferences, you can personalize offers and build stronger long-term relationships. According to the same report, 70% of consumers want personalized shopping experiences like exclusive discounts informed by past purchases, personalized emails and text messages, and invitations to exclusive events.

[Square] worked perfectly for us and was able to check all our boxes. We’re able to see inventory a lot better, still able to have gift cards and the processing speed was definitely a big, big help.”

Liam Sehnert → Vice President, Annie Gunn's

Employee management

Your POS software should allow you to assign roles and permissions to protect sensitive data. The right POS systems will include built-in staff management features to assign shifts, track time worked, and manage payroll, reducing admin work and ensuring accurate pay.

Easy to learn, quick to set up

Choose a system that’s easy to set up and simple to use every day. Whether you’re importing your catalog, customizing your register layout, or training new staff, a user-friendly interface helps your team work efficiently from day one.

Training the staff on Square has been a breeze. Excellent customer service is very important to us, and Square has really helped us up our game when it comes to providing a pleasant, uncomplicated experience for people who shop at Amici.”

Ryan Nesci → Co-owner, Amici Food & Beverage

Transparent pricing that scales with you

Choose a provider with clear pricing and plans that adapt as your business grows. Understanding how pricing scales across locations or devices will help you avoid hidden fees for chargebacks, setup, or maintenance. Consolidate your tools under one POS plan if possible to save money.

What are the best POS systems for retailers in 2025?

There are several strong options on the market. Here’s a quick overview to help you evaluate:

| Feature | Square for Retail | Shopify POS | Lightspeed Retail | Clover POS |

|---|---|---|---|---|

| Best For | SMB to large retailers selling in-store and online and wants a solution that grows with them | Ecommerce focused brands with occasional in-store sales | Enterprise retailers with complex inventory or vendor management needs | Small retailers needing flexible hardware |

| Core Features | Payments, advanced inventory management, reporting, staff management, customer profiles, loyalty, and eCommerce | Ecommerce platform with customizable CSS/HTML, payments, inventory management | Advanced inventory management, vendor management, reporting | Payments, basic inventory management, employee management |

| Inventory Management | Real-time inventory sync, multi-location stock management, bulk item updates, inventory counting tool, purchase orders, COGS reporting, unit conversions | Real-time inventory sync, some advanced inventory functionality (purchase orders, stock transfer) only available on separate Stocky app, no unit conversions | Core inventory features plus work orders, and B2B catalog integration | Limited inventory management features with the option to add third-party apps for full functionality |

| Ecommerce Integration | Native Square Online store or integrations with platforms like Wix, WooCommerce | Native eCommerce platform | Native eCommerce platform | Available through partners (e.g., Ecwid) |

| Staff Management | Included in paid plans (shift tracking, permissions, timecards) | Permissions included in paid plan, requires third-party apps for shift tracking, timecards | Requires third-party apps | Requires third-party apps |

| Hardware | Wide range of proprietary hardware: Square Handheld, Register, Stand, Reader | POS Terminal Countertop available, plus Shopify proprietary card readers | Single all-in-one hardware solution with iPad and desktop setups | Terminals, stations, Go mobile readers |

| Third-Party App Support | Wide range of curated 3P apps | Extensive (many integrations, can get expensive) | Moderate range of curated 3P apps | Wide range of curated 3P apps |

| Banking Solutions |

Square Banking1: Full suite — Square Checking, Savings, Loans, and Debit Card; instant access to sales funds, automated savings, no fees | Shopify Balance: Integrated business account with cash back, faster payouts, and no fees; tailored to eCommerce merchants | Lightspeed Capital (funding only): Offers merchant cash advances based on sales; no banking account or card features | Clover Capital (funding only): Offers working capital loans; no checking/savings tools |

| Ease of Use | Exceptional ease-of-use, intuitive for staff to learn, quick setup | Easy if already using Shopify, but online store setup may require coding experience | Product experience can feel disjointed, steeper learning curve (especially for smaller businesses) | Generally easy, with intuitive hardware |

| Pricing |

|

|

|

|

| Notable Limitations | Some features gated behind paid plans | Relies heavily on add-ons; can become costly | Costly and complex for smaller retailers | Core features often require third-party solutions |

*This information is from Square, Shopify, Lightspeed, and Clover websites on June 23rd, 2025 and may be subject to change.

How to choose the best POS system for your retail business

Before committing to a system, take time to reflect on your business needs:

- What products do you sell, and how many locations do you have?

- Are you selling in-person, online, or both?

- Do you need real-time inventory tracking?

- How are you currently deciding what to restock?

- Which customer insights would help you serve better?

- What reports or dashboards would save you time?

- What is the total cost, including add-ons and hidden fees?

- Can you consolidate tools into one plan to save money?

The requirements for your unique business, your budget, and future growth plans should all play a factor in which POS you decide to move forward with.

How Square for Retail supports retailers

As your retail business grows, your needs will evolve beyond what basic POS tools can support. You might be using separate systems for payments, inventory, payroll, and eCommerce — each with its own login, fees, and learning curves. That can slow you down and increase the risk of errors.

Square for Retail offers a flexible, integrated POS system designed to support complex retail businesses at every stage of growth. It combines everything from payments and inventory to customer engagement in one intuitive platform.

Retailers often discover value in Square by:

- Setting up quickly with minimal technical support

- Streamlining operations by consolidating tools

- Training staff easily and customizing workflows

- Managing inventory confidently across channels

- Gaining insights from built-in reports without spreadsheets

One of the biggest advantages is how Square adapts as your business evolves. Whether you’re opening a second location, expanding your product line, or building your online store, you can add new features as needed, without starting from scratch.

Take Barn Owl Garden Center. They sell more than 11,000 unique SKUs of plants and gardening supplies online and in-person, provide landscape services, and even host community events. They started using Square in 2022, saw a 40% increase in repeat customers year-over-year. That translated into a 7% increase in transactions, without expanding their team or making other major investments.

The right POS should support your current operations while making future growth easier and more efficient. Having worked in the POS space for years, I’ve learned that the best systems don’t just support your business, they grow with it. They reduce friction, surface insights, and give you time back to focus on what matters most. Solving these kinds of challenges for retailers is what makes this work so rewarding for me.

1. Block, Inc. is not a bank. Banking services are provided by Square Financial Services, Inc. or Sutton Bank; Members FDIC.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC.

All loans are issued by Square Financial Services, Inc. Actual fees depend upon payment card processing history, loan amount and other eligibility factors. A minimum payment is required and you must repay your loan as specified in the loan terms. Loan eligibility is not guaranteed. All loans are subject to credit approval.

![]()