Table of contents

Soon, most people will have chip cards. And this has big implications for your business. That’s because you’ll need a new type of payments reader to accept chip cards. And you’ll need it a lot sooner than you think. In less than two months, something called the “liability shift” goes down. Come October 2015, if you aren’t set up to accept EMV or NFC payments, you could be on the hook for certain types of fraudulent transactions. Previously, banks absorbed this cost. But if you aren’t equipped with an EMV or NFC reader in October, it could be passed along to you.

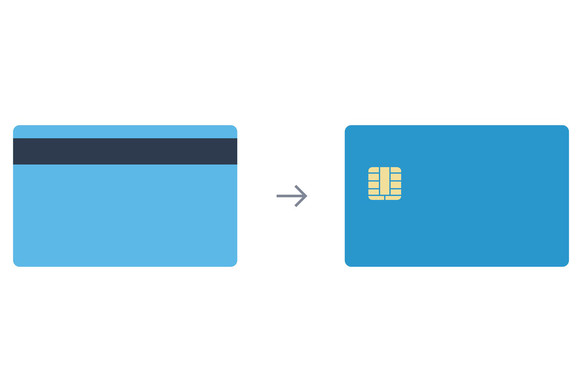

But first, a refresher on EMV

Blanket statement: Chip cards are far superior to the magstripe cards we currently carry. They’re leagues more secure. To say magstripe cards are old school is an understatement. The technology in magnetic-stripe cards has been around since the 1960s. (Crazy fact: magstripe cards use the same technology that powers cassette tapes. Cassette tapes. Yeah.)

Not only is the technology outdated, it makes magstripe cards pretty vulnerable to counterfeiting. The data that’s on magstripe cards is static — it’s just right there on the back. That means that if anyone were to get ahold of your card (i.e., fraudsters), they could pretty easily lift and clone your bank information onto a new card. And then go on a fraudulent shopping spree.

On the other hand, the data on EMV cards is encrypted. The chip is actually a tiny computer that talks back and forth with an EMV-enabled terminal to make sure everything checks out. The data that’s passed back and forth is dynamic and constantly changing, which makes it extremely hard to extract and then clone onto a new card.

So in an effort to stop this, the United States is making EMV the standard. EMV has long been the standard for the rest of the world (you’ve probably noticed this if you’ve been to Europe), where it’s helped dramatically to reduce certain types of fraud.

So it’s high time we make the switch. Here’s what you need to do to get your business prepped for the switch to EMV this fall:

Educate yourself

We get it, you have a million things on your plate as a small business owner. But taking the time to educate yourself about the switch to EMV — and other secure payment methods like NFC and contactless — is worth it. We regularly update the New Payment Technologies section of this blog with everything you need to know about the shift to EMV and NFC. We also send out a monthly newsletter that contains essential intel about the switch to EMV and NFC, as well as other tips for how to run your business. You can sign up for that here.

Get a new reader that accepts chip cards

Like we mentioned, you’ll need a new credit card reader to accept chip cards. But don’t worry, it won’t cost you an arm and a leg. At Square, we’re committed to making the shift to EMV as painless and affordable as possible for small businesses everywhere. The Square Reader for contactless and chip — which accepts both chip cards and contactless payments like Apple Pay — allows you to securely process payments from any customer who walks through your door.

Learn how to accept chip cards

What many people don’t realize is that the way you actually process a chip card transaction is different than a magnetic-stripe card transaction. With magstripe cards, you swipe the card through the reader horizontally. With an EMV transaction, you actually dip the card into the reader vertically — chip side down.

Another thing to know is that EMV transactions actually take longer than magstripe transactions. That’s because you have to keep the chip card inserted in the reader for the entirety of the transaction (when all the dynamic “talking back and forth” goes down to make sure everything is legit). The fact that EMV transactions take so long may be the thing that accelerates the adoption of contactless transactions (like Apple Pay). Contactless/NFC transactions are just as secure as EMV transactions, but take a fraction of the time. The Square reader for contactless and chip accepts both contactless and chip card payments.

Educate your employees

Now that you’re solid on what the shift to EMV means for your business, it’s time to educate your staff. After all, they’re the ones on the front lines taking payments from customers. This means walking them through all you’ve learned about chip cards, how they work, and why they’re so secure. It also means walking them through other new payment technologies like NFC and Apple Pay. Because soon, more and more of your customers will want to pay via their mobile device. Knowing how to accept all forms of payment is really important so they can move your line quickly and help customers with any questions.

Big changes are coming — but they’re all in the name of protecting your business and reducing fraud. Square is here to help, both with education about EMV and NFC and products that will allow you to accept any form of payment.

Related Articles

EMV vs. NFC — What’s the Difference?

Everything You Need to Know About the Switch to Chip Cards

How to Accept Apple Pay (And Why You Should)

![]()