Table of contents

When you’re just starting out, it’s easy to run your business from your personal bank account. It’s one less thing to set up and technically it works. Until it doesn’t.

As your business grows, those blurred lines between personal and business finances can start to create real friction. Getting a quick read on business performance? Not so simple. Tracking cash flow? A constant challenge. Tax season? Even messier. And if you’re planning to apply for a small business loan, all that financial noise can make it harder to show that your business is ready for it.

I’ve been there. In the early days of building my business, I spent hours combing through Amazon orders, trying to sort out which purchases were business-related. I’d second-guess charges, miscategorize expenses, and constantly feel behind on my numbers. What should’ve taken minutes often turned into hours.

So how do you know when it’s time to separate your personal and business finances? In this article, we’ll break down why opening a small business bank account is more than just good housekeeping, and how it can lead to smoother tax prep, clearer cash flow, and stronger eligibility for small business loans to help with cash flow gaps.

Business vs. personal: Why your bank account setup matters

When you’re starting out, using your personal bank account for business can feel like the easiest path (especially if it means one less thing to set up). But over time, that shortcut can create more headaches than it solves. Your cash flow gets harder to track. Tax time becomes a mess. And it’s tougher to show lenders, or even yourself, how your business is really doing. And it’s not just about being organized.

Here’s where your personal bank account can fall short:

-

Mixing personal and business finances can slow you down, especially when cash flow gets tight or you’re trying to position your business for growth.

-

It can also blur your credit, slow your goals, and leave you with messy records come tax time or when talking to lenders.

-

And when you’re ready to delegate, business accounts make it easier. You can issue debit cards to employees so they can take care of expenses like buying inventory or fuel, without needing your card or constant oversight.

A business bank account brings clarity, structure, and legitimacy to your finances, all essential for running and growing a healthy business. Here’s how a personal account stacks up against one built for business:

When I went to raise investment for my business, one of the first questions was: Can you share your financials? At that point, I had already made the switch to a business bank account and I’m glad I did. Everything was clean, organized, and easy to share. It showed we were serious and ready to grow.

Bottom line: If you are planning to apply for a small business loan to bridge cash flow gaps or invest in growth, these tools do more than keep you organized — they help show lenders that your business is ready. And even if you’re not seeking funding yet, a business bank account brings structure, clarity, and confidence to how you run your business. Making the switch is one of the simplest, and most impactful, steps you can take.

So what does that look like in action? Let’s take a real example from Mirror Tea House, a Brooklyn-based tea and sake bar.

From friction to flow: How Mirror Tea House took control of their business finances

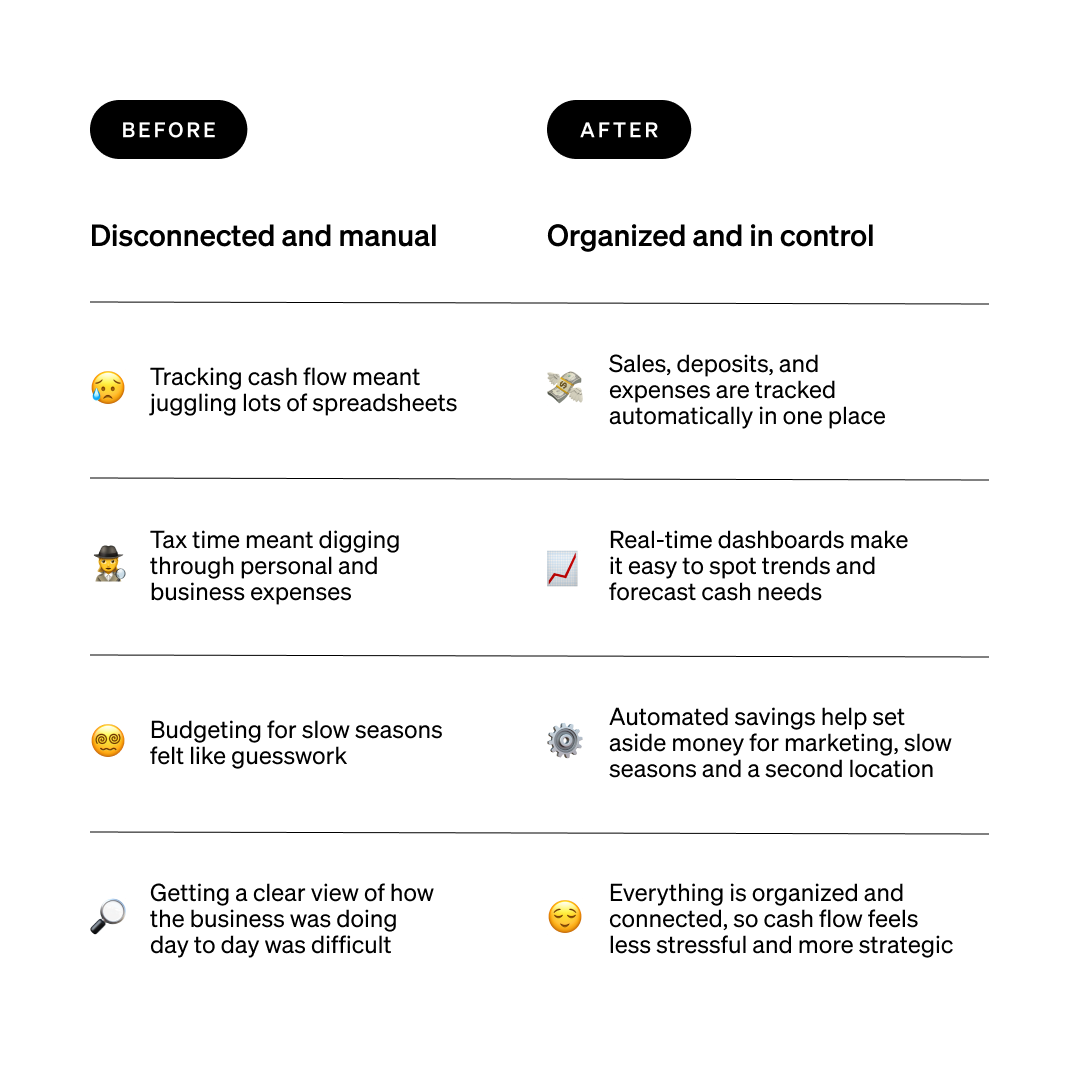

Like many small business owners, Fumio Tashiro of Mirror Tea House didn’t always have a clear picture of their finances. They started with manual tools and a lot of guesswork. Switching to a business bank account with Square Banking helped them get ahead of their cash flow, plan for growth and achieve more peace of mind. Let’s take a look at how things changed for Mirror Tea House:

Making the switch to a business account isn’t just about looking more professional, it makes your day-to-day more focused and a lot less stressful. And once you’ve got that clarity? That’s when things start to click. Because visibility is just the first step. The real impact comes when you use it to take control and manage your money with purpose.

You’ve switched to a business bank. Now run it like a pro.

So you’ve made the switch, your finances are cleaner, your cash flow is clearer, and tax time is already looking less stressful. Now it’s about setting up your account so it works hard for you every single day.

Here are a few smart habits that can help you get the most out of any business bank account:

1. Keep all your business income in one place

Route all your sales into the same account to avoid confusion and get a complete view of your cash flow. This makes it easier to track revenue trends, spot issues early, and present clean records to lenders if and when needed.

2. Separate money for taxes and key expenses

Open a dedicated account or sub-account to automatically set aside a percentage of every sale for taxes, payroll, or inventory. You’ll avoid last-minute scrambles and stay stress-free come tax time.

3. Track your spending in real time

Make sure your account offers tools to categorize expenses — supplies, subscriptions, vendor payments — so you always know where your money’s going. The more up-to-date your spending view, the easier it is to make smart decisions.

4. Keep a lender-ready record

If you think you might want a business loan in the future, start building your track record now. Most traditional lenders want to see steady cash flow and a clear separation between personal and business finances, since loans may be approved based on business performance, not just your credit score.

Want to dig even deeper into finding the right account? Check out our guide on How to Choose the Right Bank for Your Business for a full breakdown of the pros, cons, and key features to look for.

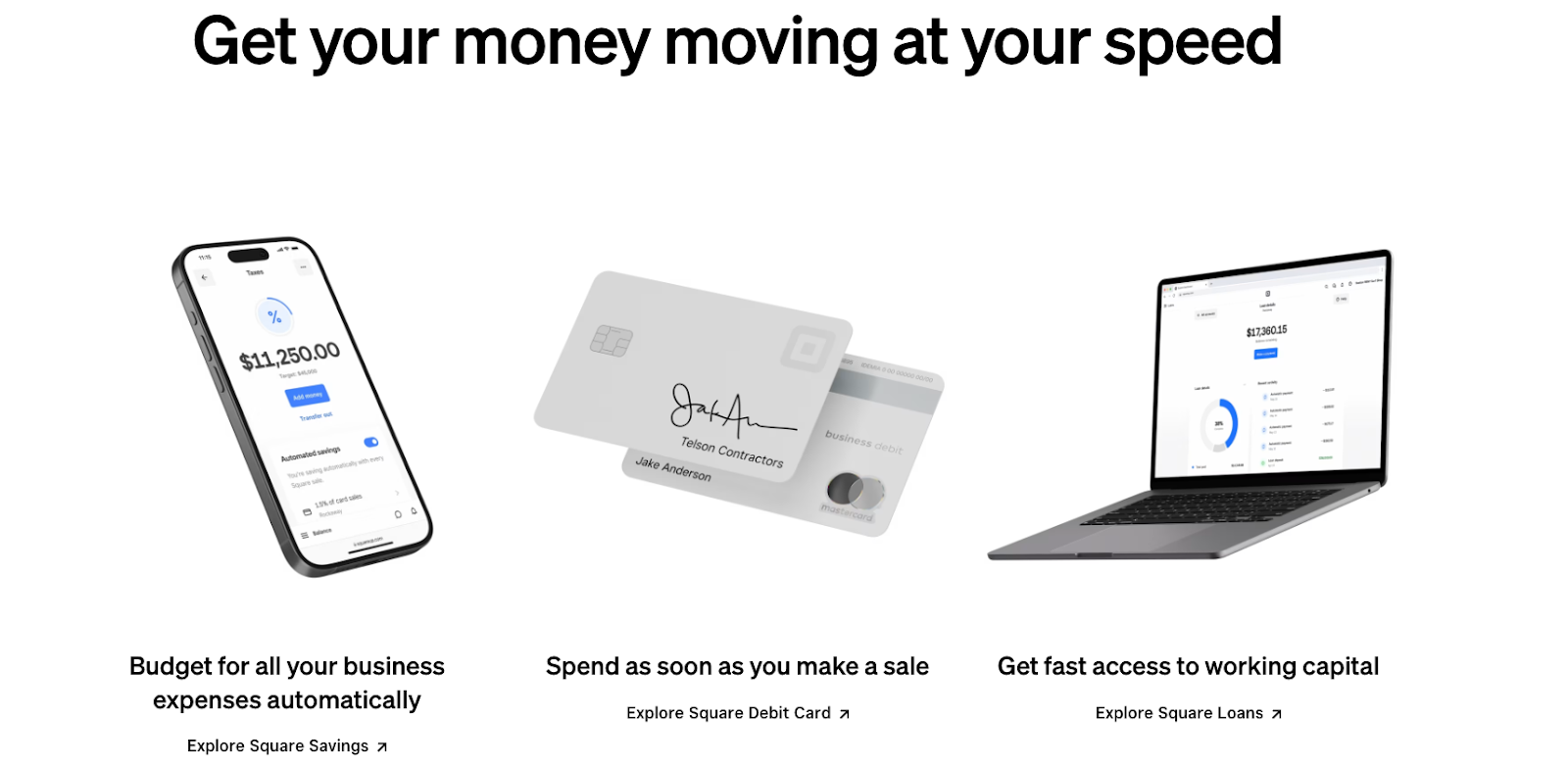

Your business, backed by the right tools

There’s no shortage of business bank accounts out there, but choosing the right one can make all the difference. When your account works hand in hand with the tools you already use to run your business, managing your money becomes effortless. Here’s how Square Banking helps you move seamlessly from sale to spend:

Square has given me much more confidence in managing cash flow. The real-time visibility and integrated tools simplify cash management. I can instantly see what I have available to spend versus what should be held back.”

Fumio Tashiro → Owner of Mirror Tea House

More than 370,000 sellers already trust Square Checking as their business bank account — because a better bank account doesn’t just make life easier, it keeps you ready for whatever comes next. Ready to take control of your cash flow? Get started with Square Checking today.

Block, Inc. is a financial services platform and is not an FDIC insured depository institution. Banking services are provided by Square’s banking affiliate, Square Financial Services, Inc. or Sutton Bank.

Square Checking is provided by Sutton Bank, Member FDIC. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. See Terms and Conditions.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC.

All loans are issued by Square Financial Services, Inc. Actual fees depend upon payment card processing history, loan amount and other eligibility factors. A minimum payment is required and you must repay your loan as specified in the loan terms. Loan eligibility is not guaranteed. All loans are subject to credit approval.

![]()