You probably rely on your employees for quite a bit. But sometimes, there’s just not enough time in the day to get everything done. That’s why overtime pay is common for a lot of businesses — especially those that are expanding.

But if you have employees that work more than 40 hours in a week, there’s a new rule you’ll want to pay attention to. The U.S. Department of Labor updated the overtime regulations that determine who qualifies for overtime pay. The ruling, which goes into effect in December of this year, more than doubles the salary threshold that determines overtime eligibility, from $455 a week ($23,660 annually) to $913 a week ($47,476). The Labor Department calculates that 4.2 million workers will become newly eligible for overtime.

The suggested change is part of President Obama’s goal to modernize the way we handle compensation — ensuring that workers receive a “fair day’s pay for a fair day’s work.” Surprisingly, the overtime threshold for salaried employees has only been changed once since 1975, when the initial exemption level was set at $250 a week.

The new rules affect businesses of all types and sizes. Around 30 percent of businesses that use Square Payroll have paid out overtime in the last three months, with employees working an average of one hour of overtime for every 10 regular work hours.

But according to Square data, certain types of businesses are more likely to have employees who work overtime than others. Employees in the food industry are 36 percent more likely to work overtime than the average business that uses Square Payroll. On the flip side, professional services (consulting, real estate, design, child care, and photography) and the health and beauty industries tend to have employees that stick to regular work hours. Those industries are 31 percent less likely to have employees who work overtime.

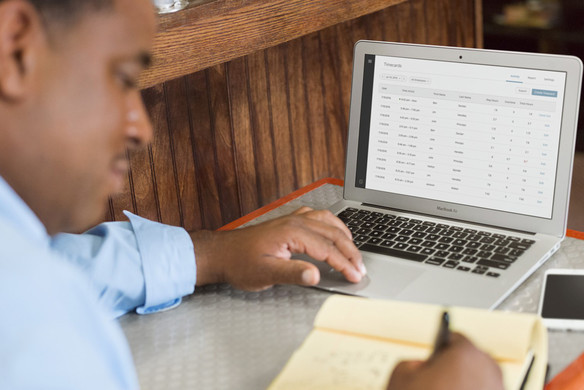

Regardless of which boat your business is in, you should ensure you’re tracking overtime according to the regulations in your state and industry. It’s also a good time to consider the system you have in place to keep track of employee overtime. With Square’s Employee Management features, your employees can clock in and out right at the point of sale, overtime is calculated automatically, and you can import the hours to Square Payroll in a click — so you can focus on growing your business.

![]()