Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Payments Built for however you do business

Flexible, reliable payment methods

Secure, compliant processing

Instant access to sales revenue 24/7¹

No contracts required, no hidden fees

Accept payments anywhere

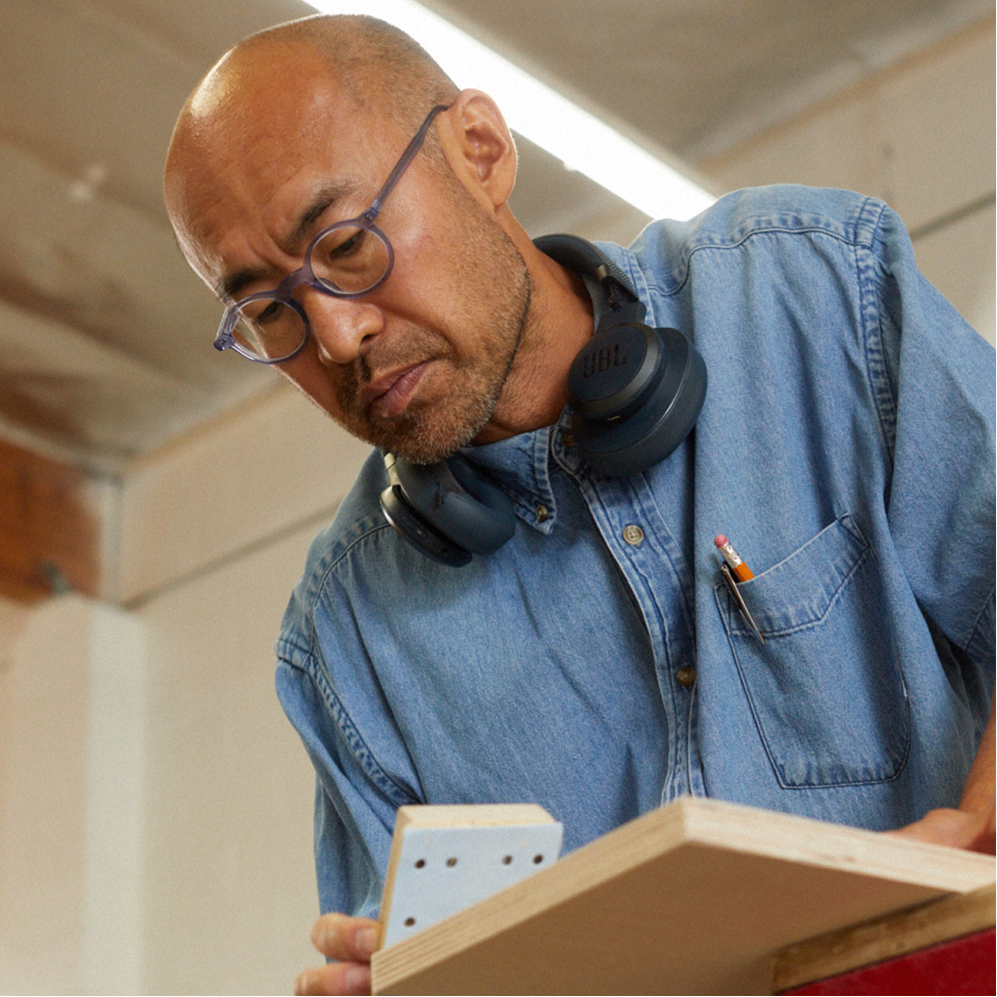

In person

Take payments at your counter or on the go with hardware built for your business, supported by reliable payment processing software.

Online

Set up a free online store or send payment links, backed by secure online payment processing. You can also connect your existing store or app to one of our trusted payment APIs.

Remote

Send invoices customers can pay with a credit card or by ACH transfer. Take over-the-phone payments just as easily by keying in credit cards online with Square Virtual Terminal or with the Square app.

Buy now, pay later

Let customers pay over time with Afterpay. You get paid in full immediately, and they pay in four interest-free installments.

Simplify checkout with any device

Take contactless payments with just your phone

Peace of mind in every payment

Accept payments offline

Keep making sales even when you lose service or Wi-Fi connection. We’ll store your offline payments and receipts for 24 hours.⁴

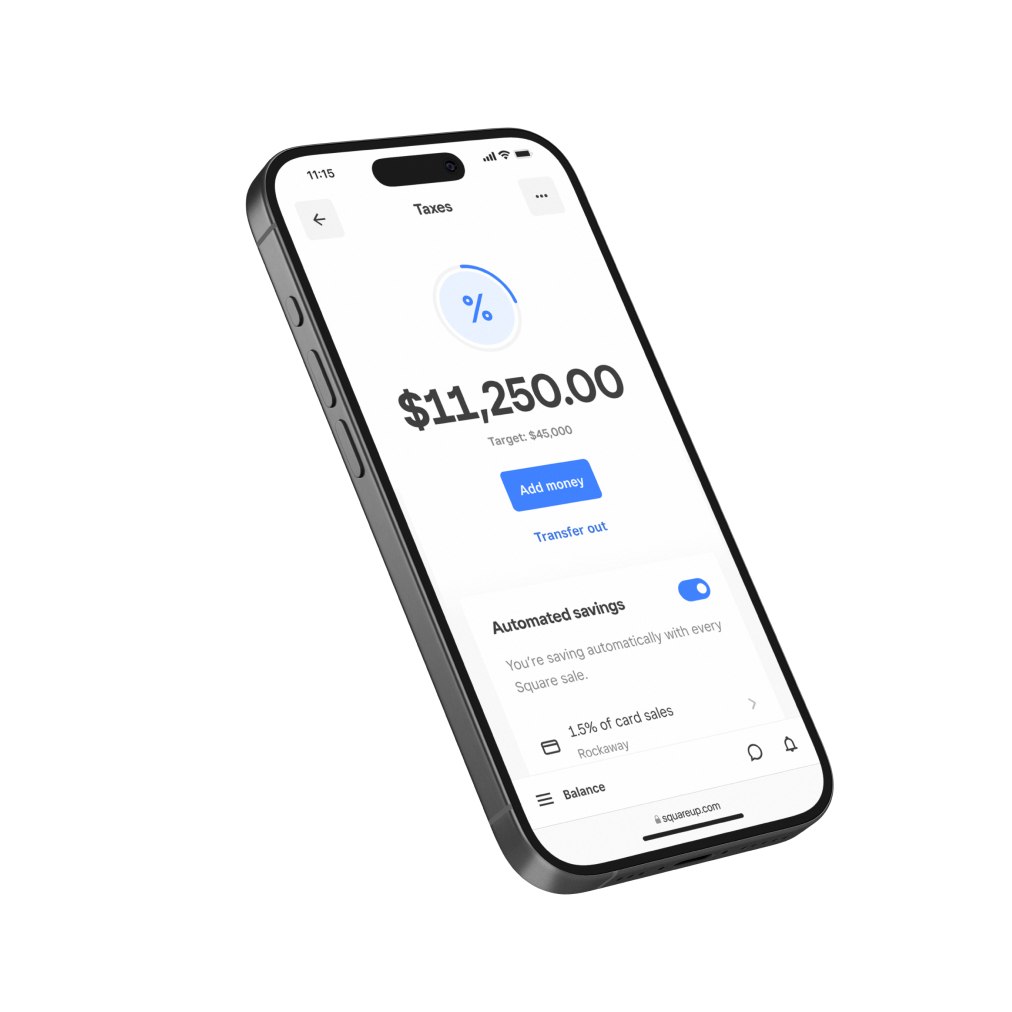

Move money fast

Transfer funds to an external bank account for free the next business day or instantly for a fee.⁵

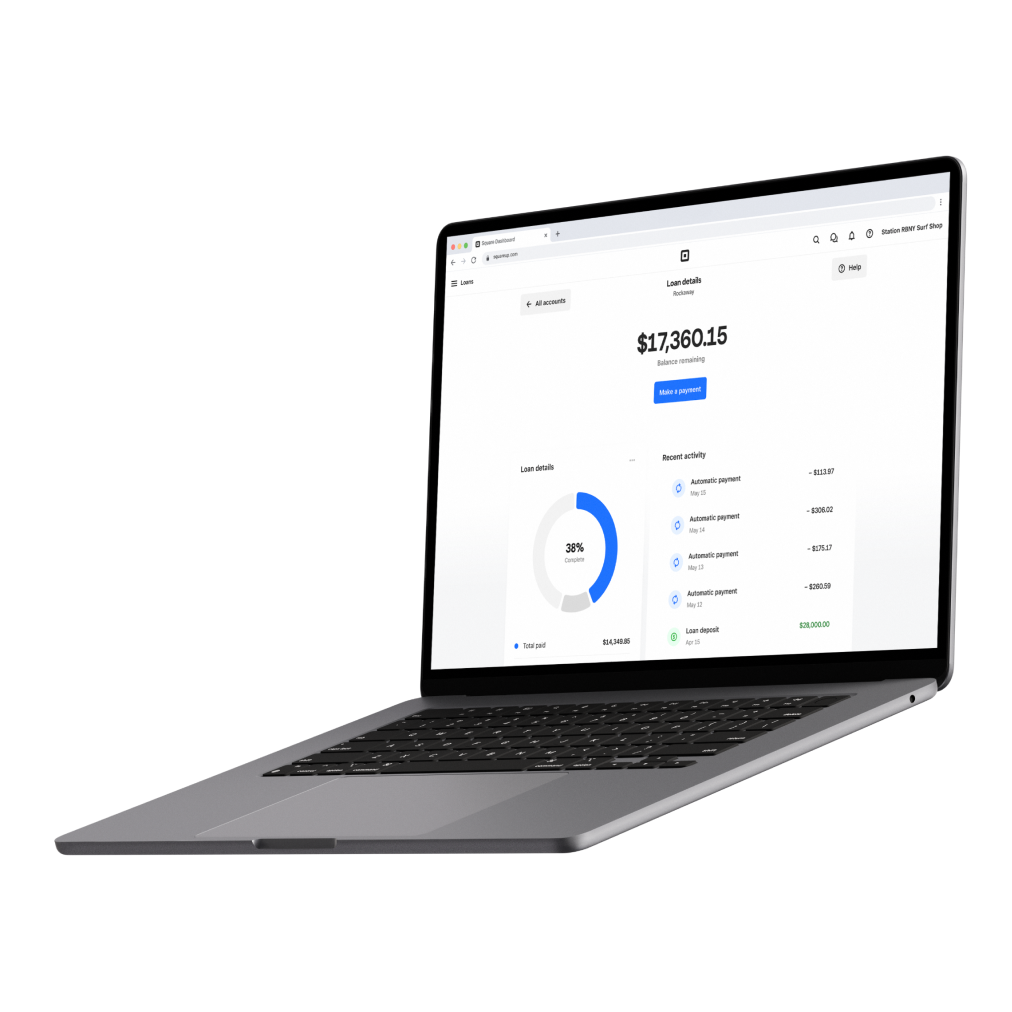

Make smarter business decisions

Get immediate business insights and detailed reporting to know where to invest your time and money.

Keep transactions secure

Fraud protection, data security, dispute management, and PCI compliance are built right in.

Payments, banking, and cash flow working as one

Serving complex businesses at scale

“The wonderful thing about Square is I can launch a product, wake up in the morning, and I can pull out my phone and get a snapshot of sales for all the stores and what percentage of sales are from the new product.”

Matt Longwell

Product Manager Coffee & Equipment

Blue Bottle Coffee

“As of today we're processing millions of dollars in revenue per day with more than 523 locations using Square. They were able to help us truly customize a solution for our franchises with our proprietary POS system.”

Robyn Powell

VP of IT

HOTWORX

“Square allowed us to build a solution that was very much tailor-made for SoFi Stadium. You walk up to the Square Terminal, and it’s immediately familiar to the customer. It’s efficient, fast, and reliable as well.”

Skarpi Hedinsson

Former CTO of SoFi Stadium & Hollywood Park

SoFi Stadium

Get one plan to run your entire business

Square Pro

Get custom pricing

If you process over $250,000 per year, talk to our team to see if you’re eligible for custom pricing and processing fees. You can also ask about hardware discounts, onboarding and implementation support, technical specialists, and account management.

Quick reads to get you going

FAQ

How do I start taking payments with Square?

You can sign up for Square and begin accepting payments right away — or connect with our sales team if you’d like help finding the right solution for your business. We offer a range of hardware options for in-person payments, all powered by secure, built-in payment processing. Square is built to support businesses of all sizes, with flexible tools that can grow and adapt with you.

Does Square have processing fees?

Yes. Standard processing rates will apply to each transaction but vary depending on the payment method.

Are payments through Square secure?

Yes. Security features are built into Square’s payment processing software to make every transaction safe. Square also follows industry requirements to monitor your account for suspicious activity and supports PCI compliance. Every Square payment includes:

Dispute management

Active fraud prevention

End-to-end encrypted payments

Built-in PCI compliance

How do Tap to Pay on iPhone and Tap to Pay on Android work?

Tap to Pay on iPhone and Tap to Pay on Android let you take payments directly on your phone, with no additional hardware necessary. At checkout, select Tap to Pay and have your customer tap their card or contactless payment to complete the transaction.

Does Square have payments solutions for large businesses?

Square Payments solutions are here to support businesses at any scale. Our payments platform offers a range of in-person and online payments APIs and SDKs so you can accept payments from your eCommerce site, mobile app, custom point of sale, and more. Get in touch with our sales team to get started.

What is payment processing software? How does Square’s payment processing work?

Think of payment processing as your business's financial highway — it's how money moves safely from your customer's card to your bank account. With Square Payments, you get everything you need in one simple package:

Accept payments where your customers are (in-store, on the go, or online)

Get your money fast with transfers in 1-2 business days

Rest easy with fraud protection

Stay secure with built-in Payment Card Industry (PCI) standards

No technical expertise needed. We handle the complex stuff so you can focus on running your business.How does online payment processing with Square work?

Square makes accepting online payments simple and secure. Once your account is set up, you can start taking payments through your website, online store, app, digital invoices, or even checkout links. Every transaction is encrypted to protect you and your customers. Funds are deposited quickly, in 1-2 business days, with real-time tracking of payments, refunds, and customer activity in your Square Dashboard. It’s everything you need to manage your online sales, all in one place.

What types of payment methods can I accept with Square?

Square gives you the flexibility to accept a wide variety of payment methods — both online and in person. You can take all major credit and debit cards, including Visa, Mastercard, American Express, and Discover. Customers can also pay using digital wallets like Apple Pay and Google Pay, or choose installment options through Afterpay.

For in-person sales, Square hardware lets you accept chip cards, magstripe swipes, and contactless payments with ease. No matter how your customers prefer to pay, Square has you covered.

*Late fees may apply. Eligibility criteria apply. See afterpay.com for more details

Try Square

Block, Inc. is a financial services company, not a bank. Banking services are provided by Square’s banking affiliate, Square Financial Services, Inc. or Sutton Bank; Members FDIC.

¹Instant availability requires a Square Checking account. Funds generated through Square payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met.

²Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. The contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. For Tap to Pay on iPhone countries and regions, see: https://developer.com/tap-to-pay/regions/.

³Android is a trademark of Google LLC. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

⁴Offline payments are processed automatically when you reconnect your device to the internet and will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined, or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. Offline payments are not supported on Square Reader for contactless and chip (1st generation, v1 and v2). Learn more about how to enable and use offline payments here.

⁵Instant transfer requires a linked bank account or supported debit card and costs a fee per transfer. Funds are subject to your bank’s availability schedule. Minimum amount is $25 and maximum is $10,000 in a single transfer. New Square sellers may be limited to $2,000 per day. Fund availability times may vary due to technical issues.

⁶Late fees may apply. Eligibility criteria apply. See afterpay.com for complete Cash App Afterpay terms.

Apple Pay is a service provided by Apple Payments Services LLC, a subsidiary of Apple Inc. Neither Apple Inc. nor Apple Payments Services LLC is a bank. Any card used in Apple Pay is offered by the card issuer