Accessing capital as a small business can be challenging, which is why Square Loans set out to change that for our sellers. We wanted to end the lengthy application process and long waiting periods for approval and funding, and help get capital into the hands of businesses that need it quickly, efficiently, and with terms that are both flexible and straightforward.

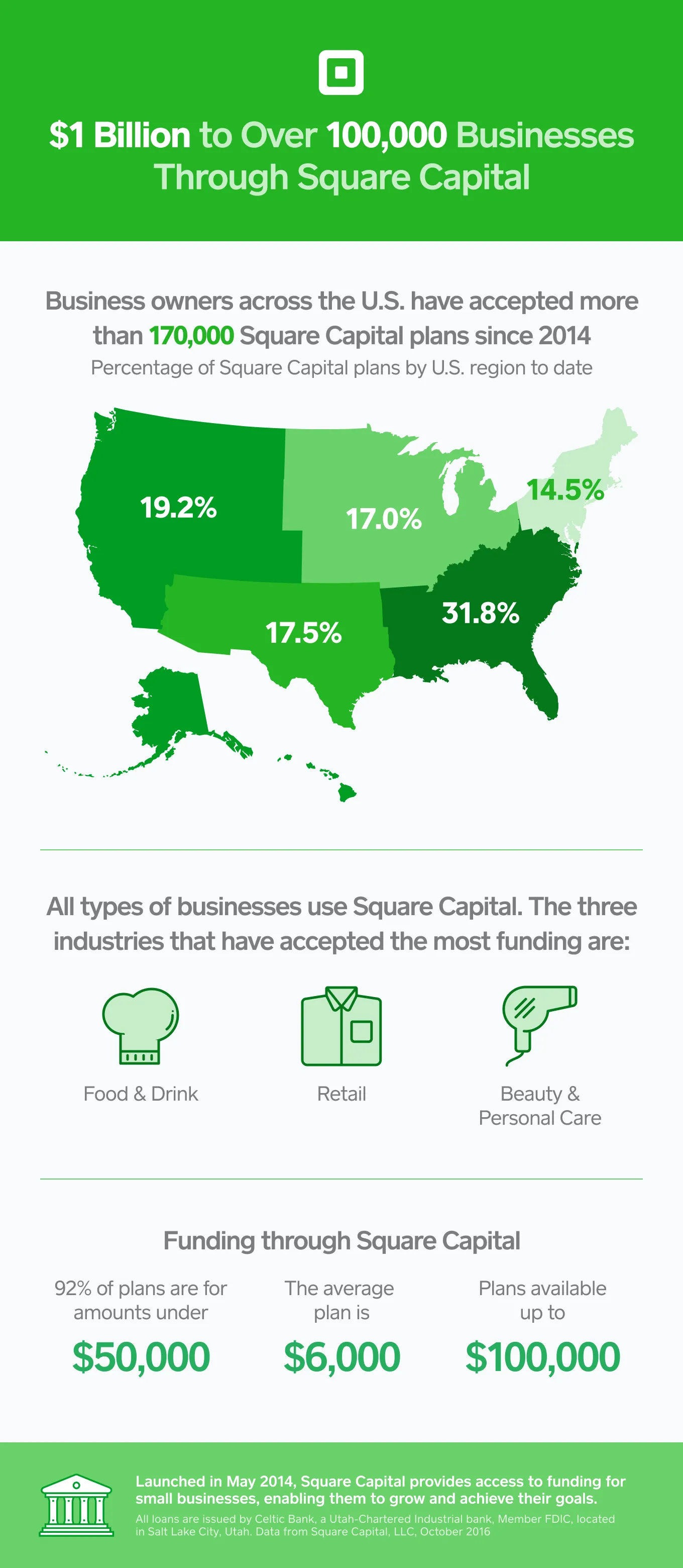

The result: Over the past two years, over $1 billion has been extended to more than 100,000 sellers through Square Loans, giving them quick access to funding to meet their business needs — whether to purchase inventory, open a new location, launch a new product, or buy equipment. The impact can be seen across industries throughout the country as business owners like Carmen Rodriguez of Brooklyn Cupcake put their funds to good use.

“Receiving funding was next to impossible as a young business, but Square Loans was a game changer for me and my family,” says Rodriguez, one of the many sellers who has taken repeat funding through Square Loans. “With our first Square Loans plan, we were able to secure new equipment and a new kitchen space, which resulted in about $100,000 in additional revenue over the next year. Each time we accept funding through Square Loans, the process is seamless and the funds are there the next day.”

While access to capital can be a major hurdle, getting a loan at the size that’s right for your business is another challenge. Historically, there has been no path to loans at smaller amounts within the traditional financial system, leaving a huge gap in funding for many businesses. We’ve addressed this head on. Of the more than 170,000 Square Loans plans sellers have accepted, 92 percent have been for amounts under $50,000, with an average size of $6,000.

We are able to do this by leading with a data-driven approach. We apply machine-learning models that take into account up-to-the-minute data on the health of a seller’s business to determine eligibility. This can include processing volume, business activity, and business growth, among other information. Using these unique data sets allows us to more quickly evaluate a business’s eligibility and, in turn, extend loan offers through Square Loans to sellers who may have been unable to secure funding elsewhere. Sellers can then accept offers in as little as three clicks. Once approved, funds are transferred into their bank account within one business day in most cases.

Many businesses still face barriers to accessing capital, and we are committed to building flexible and transparent financial services to meet their needs. Every day, sellers tell us how Square Loans has helped transform their business and take it to levels that were not possible before, and we look forward to celebrating more of those successes together.

Square Loans, LLC and Square Financial Services, Inc. are both wholly owned subsidiaries of Square, Inc. Square Loans, LLC d/b/a Square Loans of California, LLC in FL, GA, MT, and NY. All loans are issued by either Celtic Bank or Square Financial Services, Inc. Square Financial Services, Inc. and Celtic Bank are both Utah-Chartered Industrial Banks. Members FDIC, located in Salt Lake City, UT. The bank issuing your loan will be identified in your loan agreement. The individual authorized to act on behalf of the business must be a U.S. citizen or permanent resident and at least 18 years old. Loan eligibility is not guaranteed. All loans are subject to approval.

![]()