Table of contents

As a business owner, it can be difficult to know what investments will yield the highest return for both your business and customer satisfaction. You may be considering a new marketing campaign, automation, or even new services or equipment.

As you think about what would resonate most with your customers, these are the trends customers say they’re looking for in a shopping, dining, or salon experience this year, based on data from the Square 2024 Future of Customers report.

Future of Customers: 2024 Edition

Customers are less optimistic about finances.

Consumers surveyed in the 2024 Square Future of Commerce report are feeling less optimistic about their financial situation compared to 12 months ago. Just 28% of total consumers reported feeling more optimistic, while 43% reported feeling less optimistic. Sentiment about finances also differs across countries, with Australian consumers feeling the least optimistic as a whole (50%), followed by Canadian, UK, and U.S. consumers.

Despite a dip in optimism around finances, consumers are still interested in dining at restaurants, shopping with retailers, and frequenting beauty salons. Many are game to experience these businesses in new ways altogether: 80% of global consumers are interested in trying a new type of business offering at a business known for something else, also known as a multihyphenate business.

Automation is top of mind for shoppers.

Customer sentiment around businesses using AI has remained consistent with last year. Of retail consumers surveyed, shoppers are most supportive of businesses using AI for automated checkout (31%), AI-based product search or AI-generated product descriptions (22%), and AI-based dynamic pricing (21%). For diners surveyed, the top AI-based tools consumers are supportive of are those that help with seating and reservations (26%), menu search based on photos (25%), and food delivery robots (19%).

Despite a steady appetite for AI from the past year to this one, customers are more interested in other types of technology, like automation. When it comes to automation, shoppers showed an increase in interest for businesses that used automation in retail for checking product inventory (29%), ordering out-of-stock products or gathering information about products in general (26%), and picking up an item they ordered online in person (24%). Restaurant diners say accepting payments (37%), followed by making reservations (35%) and tracking item availability in real time (28%), were automations they wanted to see.

Although there is global support for increased automation in different types of businesses, the majority of respondents are hoping to see those automations applied to specific instances like the ones above. These same consumers say automation and AI tools are not a replacement for live staff in instances where they’d prefer to speak to a person for assistance.

Loyalty programs drive foot traffic.

Consumers expect to hear from businesses they shop with. Not only do they expect communication, they are also interested in it. In fact, 91% of global consumers are interested in hearing from those businesses regardless of which channel they use, up from 86% in 2022. Consumers overall preferred email as a way to be contacted by a business, followed by Facebook, then text message. Gen Z customers were more open to social media communications like Instagram and TikTok than older generations.

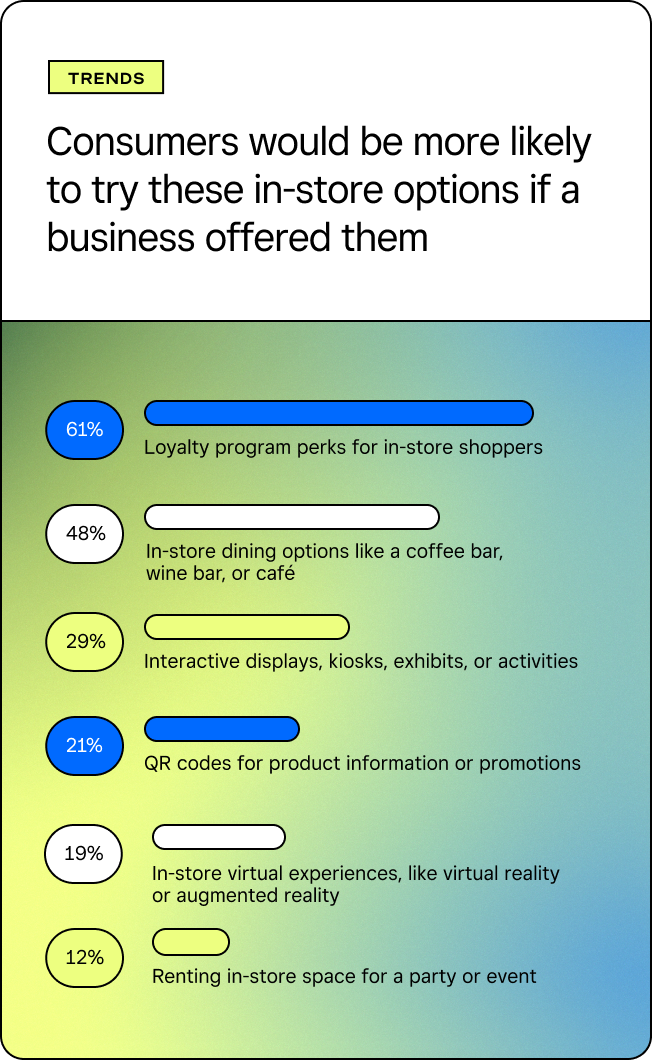

Across both retail and restaurants, loyalty was a big draw for consumers. Consumers would be more likely to try these in-store options if a business offered them:

Regardless of generation, all shoppers responded that they were most likely to go in-store to a business if loyalty program perks were offered to in-store shoppers only.

Shoppers want nontraditional offerings.

Businesses with expanded offerings, such as restaurants with retail products or retailers with events, are drawing in more customers. Gen Z customers, in particular, are interested in more alternative offerings.

Seventy-eight percent of Gen Z salon goers say they would be interested in offerings outside of traditional services, such as online tutorials (35%), in-person classes (33%), and at-home DIY boxes (31%). Although younger generations like Gen Z and millennials showed the most interest in expanded offerings at beauty businesses, all generations (63%) say they’ve bought a retail item from a beauty business and like the convenience of a one-stop shop.

Over half of U.S. consumers surveyed (61%) have also purchased a retail item at a restaurant in the past year. While US consumers were most likely to make these purchases, this is a burgeoning opportunity for restaurants globally, as the majority of respondents in Canada, the UK, and Australia also made retail purchases at restaurants this year.

Although 53% of global consumers say businesses in their area have not added any new, unrelated offerings, there is an appetite for more. The majority of global consumer respondents (80%) are somewhat or very interested (40%) in trying a new type of business offering at a business known for something else.

Whether you are considering new incentives for customers this year, like loyalty programs and noncore offerings, or investing in more technology like AI or automation, customers are clamoring for more. Despite a dip in optimism around finances, shoppers are interested in continuing to engage with restaurants, salons, and retailers they patron in the way that is most rewarding for them.

![]()