Table of contents

No matter what type of business you run, getting paid on time keeps your cash flow healthy and revenue reporting accurate. Whether you own a small business or are a freelancer or sole proprietor, a streamlined invoicing process helps you get paid faster and stay organized.

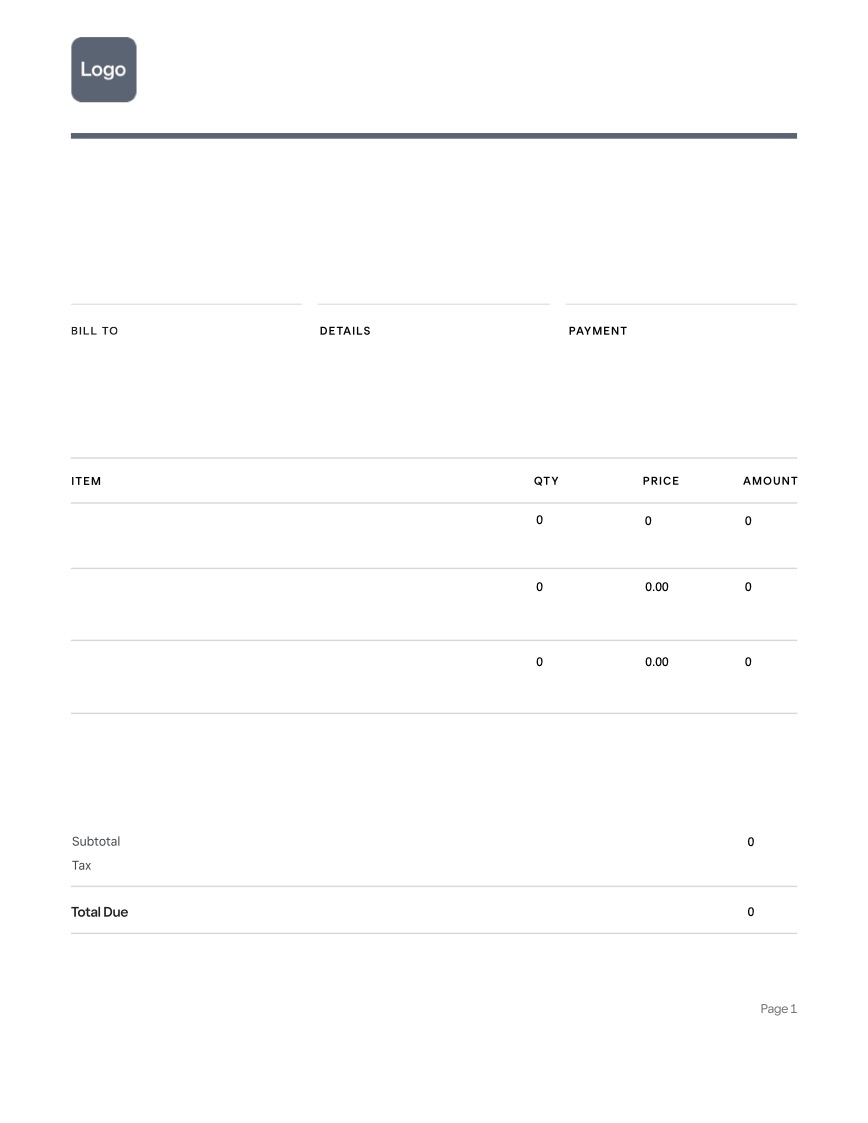

Providing a clean and detailed invoice to your clients is the first step in establishing a professional tone in the payment process. However, without the guidance of an invoice example, you may not know where to start or what to include on your invoices.

Never fear. We’ll guide you through invoices for various business types and help you access invoice templates that meet your business’s billing needs.

What is the purpose of an invoice?

A nicely branded and organized invoice not only presents you and your business professionally; it also provides your customers with transparency about the services you’ve provided or products you’ve sold. In addition, organized invoices offer strong legal protections if a product or service you sell ever goes unpaid or the payment is disputed. An invoice also serves as a tax record and receipt.

And thanks to all the invoice samples available online, they’ve never been easier to create. But even if you bill your customers using an invoice example you’ve found online, double-check that your invoice contains all the key information.

What to include on every invoice

If you’re wondering what an invoice looks like, it will vary depending on your industry sector and business type, but, at its most basic, invoices should contain key pieces of information that help you and your client track records of project timelines, payment deadlines, and profits:

- Date: This is the date that the invoice is being sent to the client or customer.

- Logo: Incorporate your branding in each part of your business communication. Make sure the logo is high resolution and prominently displayed on the invoice.

- Business name and address: Including your business name and address gives your client an easy way to contact you or send a physical form of payment or end-of-year tax forms.

- Customer’s billing information: This will allow you to easily reference and file invoices sent and paid under your customer’s name.

- Invoice number: Having a number associated with each invoice supports accounting and tracking purposes, especially when tax season arrives.

- Itemized list of products sold or services rendered: Your invoice should include details about the product or service you provided the client. This can can help you with inventory tracking and quarterly or end-of-year reporting.

- Payment terms/due date: Your payment terms should be clearly outlined on your invoice, along with the due date. You’ll also want to make sure to include any necessary taxes (like sales taxes or gross receipts tax) as well as any discounts you’ll apply if the client pays early or in full.

Industry-specific invoice examples

While the core structure of an invoice is universal, you’ll want to tailor the specific line items and terms to reflect the unique nature of your work and billing requirements.

Use our free, customizable invoice templates to create a customer-ready invoice in minutes, keeping the below examples and suggestions in mind for your specific industry:

Example invoice for freelancers and consultants

If you’re a freelancer or consultant, you’ll want to focus your invoice on the hours you worked or the projects you completed. In this example of an invoice, you’ll see the inclusion of project details and notes. Break out specifics about the project you worked on, including billed-for dates and project or milestone descriptions.

In addition to the basic invoice requirements covered earlier, here are some additional details you may want to add to your invoice:

- Itemized work by project, hour, or both

- Itemized software or licensing fees that you’ve incurred specifically for the project (for example, you may include font licensing if you’re a designer)

- A tip line if appropriate for your line of work

- A note on final project completion date and payment expectations.

Example invoice for contractual work

Similar to freelancing and consulting invoice examples, those for contractual work should be broken down into specifics of what you and your customer agreed to in the contract. Additionally, you’ll want to itemize work details, materials used, and labor costs.

Your itemized invoice might also include the following:

- Itemized list of any goods and tools used or purchased to complete the project

- Any permits or licenses necessary to complete the contracted work

- Number of labor hours it took to complete the project

- Additional sales tax to the final price, as contracted work is typically taxed

Example invoice for professional services

One concern of service industry professionals, like lawyers, accountants, or designers, is the chance of chargebacks if a client feels a job was not completed satisfactorily. Creating a professional and detailed invoice can often help you counter a chargeback.

Here are some additional details you might wish to include:

- A clearly displayed hourly rate

- A due date for project completion

- Notes on specific terms and conditions related to the service for which you are billing

Example invoice for retail

Product-specific invoices can be incredibly useful for retailers, as they allow for sales and inventory tracking. Not only can this help you estimate and adjust your inventory to avoid over- or under-stocking, but retail invoices can help you understand your sales trends and successful marketing initiatives month by month.

Be sure to include the following on a retail invoice:

- Product name, description, SKU number, and quantity sold

- Each product’s unit price and line total if multiple units were sold

- Sales tax, which will vary by state and locality, as well as by the type of products being sold

- Delivery and shipping terms and costs, if necessary (this may also include shipping address and tracking information associated with the shipment)

Examples of invoices for retail can also be categorized as follows:

- Recurring invoice for a fulfillment program or subscription.

- Pro forma invoice for advance notice to the purchaser or pending charges

- Commercial invoice for international sales and customs declarations.

Example invoice for restaurants and coffee shops

While both operate in food service, restaurants and coffee shops have distinct transactional rhythms, from quick counter-service sales to detailed table service. But a recurring invoice for a wholesale coffee bean order and a final bill for a private dining event will share some common features in addition to basic invoice details:

- A clear breakdown of menu items

- Separate line items for alcohol/beverages and food, if applicable

- Pre-applied gratuity for large parties (e.g., “18% party gratuity for 8+ guests”)

- Itemized tax calculations, often separated for food and alcohol if local laws require

- A field for a customer signature on copies for seated table service

Example invoice for catering

Because catering can vary across all types of events, you’ll want to have an invoice sample that you can customize to whatever catering service you’re offering. Whether it’s weddings, corporate parties, or buffet catering, your invoice can be flexible to fit them all.

Along with the basic invoice sample details, your catering invoice should include:

- An itemized list of the food you’re serving

- Descriptions of any specialized orders or meals offered

- Additional service charges, such as gratuity

- Deposit amount, if applicable

- A note on style of catering, whether full service or buffet

Example invoice for wholesale

Due to the large number of items and dollar amount of transactions, wholesale invoices are more complex than most. For example, if you are manufacturing beauty products to sell wholesale to spas, you’ll want to track those items, your cost, and the wholesale cost for your customer.

Wholesale invoices should include the following:

- The regular price of your product

- The wholesale discount you’re offering your customer

- The wholesale price you’re charging your customer

Not only can showing the difference in prices between regular and wholesale provide your customer satisfaction that you’re giving them a good price, but it also provides transparency and, thus, increases customer loyalty.

Example invoice for lump sum amounts

If you have a repeat client who prefers to pay all at once, you can offer a lump-sum invoice. You’ll use a lump-sum invoice to offer one rate for a number of your products or services, such as gym or fitness sessions, art classes, or flat-rate projects.

In this invoice example, you may also want to add the following:

- A description of the package or lump sum in an itemized section

- The number of sessions or products you’ll provide for the lump-sum payment

Be aware that you’ll often include tax in the initial product or service price, so additional tax may not be necessary.

Invoicing best practices

An effective invoice is a key tool for professional communication and cash flow management. To ensure clarity, accelerate payment, and maintain meticulous records, adhere to these core best practices for invoicing:

- Brand consistently with your logo and company colors for instant recognition

- Number sequentially to simplify tracking, auditing, and tax preparation

- Describe services clearly with unambiguous line items to prevent client disputes

- State terms prominently, including the due date, accepted payment methods, and any late fees

- Make payment easy by providing a direct link for online payments or clear instructions for bank transfers

- Follow up promptly on overdue invoices with a polite reminder

How to use online invoice generators

You can embrace the efficiency of automation when invoicing by using online invoice generators or AI tools. These platforms transform invoicing from a manual task into a streamlined process: simply input your client and service details, and the technology instantly generates a polished, professional invoice, automatically calculating totals, applying taxes, and ensuring brand consistency.

For example, Square Invoices helps you easily manage all your invoicing needs in one place, allowing you to accept multiple payment forms from customers, automate billing, set up specific customer discounts, view invoice statuses, and more.

How to get your invoices paid faster with Square

Invoices, especially digital ones, help you get paid faster. With Square Invoices, you can save time by customizing your invoices and sending recurring invoices, no matter what type of business you have.

Once you send off that invoice, you can set up payment options with ease. Your client or customer can pay you on the go, from any mobile device or desktop computer. If, for any reason, your invoice goes unpaid after the due date, Square gives you the option to set up automatic payment reminders to give them an extra nudge.

Transform your cash flow with professional, polished invoices designed to get you paid faster and with less hassle.

Invoice FAQs

What is an invoice and an example?

An invoice is a formal document issued by a seller to a buyer that itemizes and requests payment for products or services provided, such as a freelance designer billing a client for a completed website redesign.

What does a typical invoice look like?

A typical invoice features a clear header with the seller’s and buyer’s details, an itemized list of products or services with costs, a subtotal, any taxes or fees, a grand total, and payment terms and instructions.

What is legally required on an invoice in the U.S.?

In the U.S., an invoice must legally include the seller’s name and address, the buyer’s name and address, a clear description of goods or services provided, the date of supply, the amount due, and the payment terms.

Where can I find examples of invoices?

You can find professional invoice examples and templates within accounting software, on project management platforms offering templates, and through a basic online search for “free invoice templates.” Square offers free invoice templates that are customizable, so you can send a professional invoice to customers in minutes.

![]()