Table of contents

I started working for myself in the golden age of “the Girlboss.” It was a time when entrepreneurship seemed to follow one clear path: go all in, hustle, bet on yourself, and build something big. For me, that meant starting a bookkeeping business and consulting clients on business management. Earning my living this way — not through a traditional nine-to-five — felt empowering. The story many of us entrepreneurs have been told is that success belongs to the ones who burn the boats, the ones who grind harder, push further, and never look back.

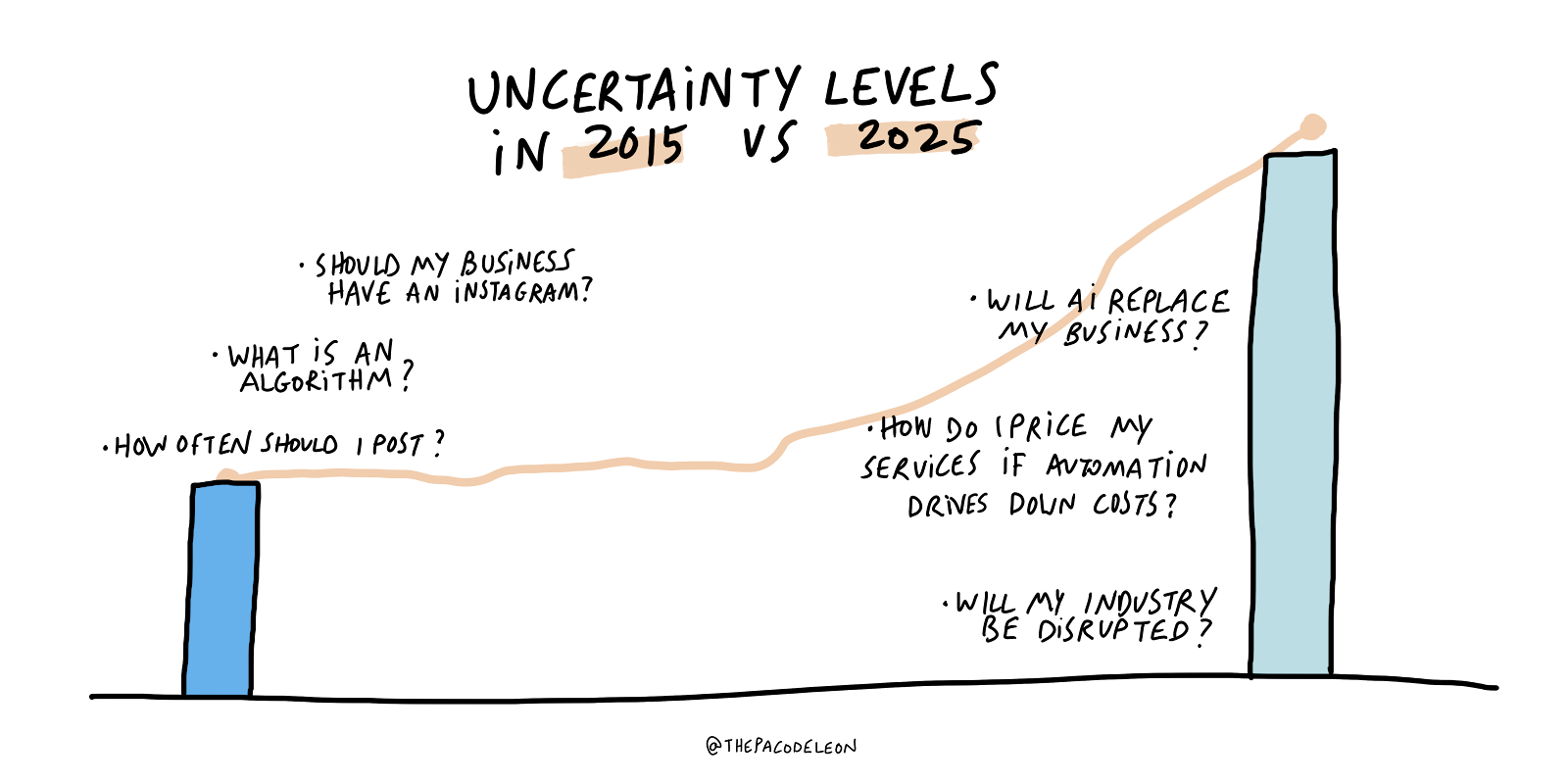

But over a short decade, the world has changed. Now more than ever, uncertainty seems to baked into the landscape. According to the Bureau of Labor Statistics, one in five new businesses fail in the first two years of being open. Technology is evolving faster than we can predict, markets are shifting, and the old “all in” mindset feels less like courage and more like a gamble.

That’s why more entrepreneurs, myself included, are adopting a different strategy: the portfolio career.

What is a portfolio career?

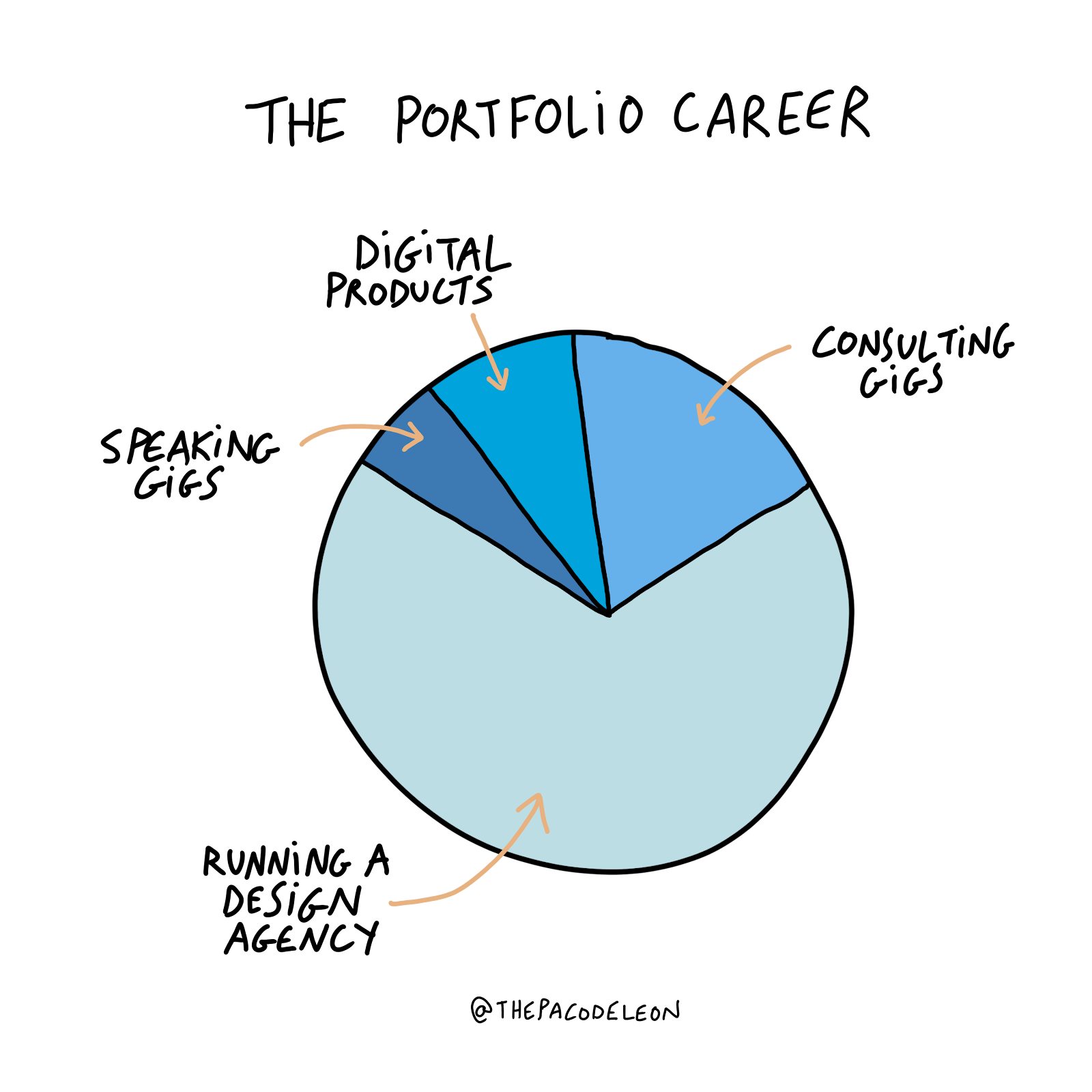

A portfolio career means building your career like an investment portfolio; diversifying income streams, skills, jobs, and experiences that create flexibility and resilience. Instead of putting everything on one big bet, you create multiple opportunities to succeed. Like an investment portfolio, the risks you’re taking now may change over time and you plant lots of seeds and see what will pop up.

For some, that might mean combining a service-based business with creative projects. For others, it might mean running a company while consulting on the side. And sometimes, a portfolio career even includes taking a full-time job, which historically might’ve been seen as a failure. Still, in today’s climate, it can be a strategic move to create stability while leaving room for growth.

Why portfolio careers are rising

More entrepreneurs are embracing this model for a few key reasons:

1. Uncertainty Is the New Normal

AI, automation, and economic shifts are changing entire industries. Betting everything on one idea feels riskier than ever. A portfolio career creates stability by spreading risk across multiple bets.

2. Diversified Income = Often, More Security

Relying on a single revenue stream leaves you vulnerable. Portfolio careers allow you to balance steady income with creative risks, helping to ensure you can weather unexpected downturns. However, this security isn’t guaranteed. Spreading yourself too thin may expose you to more risk if you don’t carefully consider your time and resources.

3. Curiosity Doesn’t Fit in a Box

It’s not just entrepreneurs who are rarely satisfied doing only one thing, I think most people are dynamic and interested in a variety of things and exploring more than one way to work in the world. A portfolio career creates space to follow multiple interests without abandoning stability.

4. Entrepreneurship Doesn’t Have to Be All or Nothing

The old idea that entrepreneurship means “no boss, no W-2, no safety net” is sadly outdated. A portfolio career reframes employment as one of many strategic moves in your entrepreneurial journey.

5. The Tech That Worries Us Also Enables Us

AI and automation are a double-edged sword. And while many of us are worried about the future of jobs, so far it seems like AI and automation have enabled more productivity. This will be especially impactful for entrepreneurs. With new tech, this path has become both riskier and more accessible.

How I built my portfolio career

Looking back, I realize I’ve been building a portfolio career all along. My bookkeeping agency, business management, and consulting have been my steady, reliable income stream – my defensive play. Writing, content, and creative projects were my higher-risk, higher-upside bets. My offense. Each move fed different skills, opened new doors, and created future opportunities.

Press play to hear 5 things I learned building my portfolio career.

Then, last year, I surprised myself. A tech startup offered me a full-time job. And after much hemming and hawing, I accepted it. It wasn’t because I was giving up on entrepreneurship. I still had my business. I was looking for a new big project at the time. And this move was a strategic decision. A chance to gain insight into the technology that powers my bookkeeping business. By working inside the kind of platform my business relies on, I was creating a form of vertical integration within my own career.

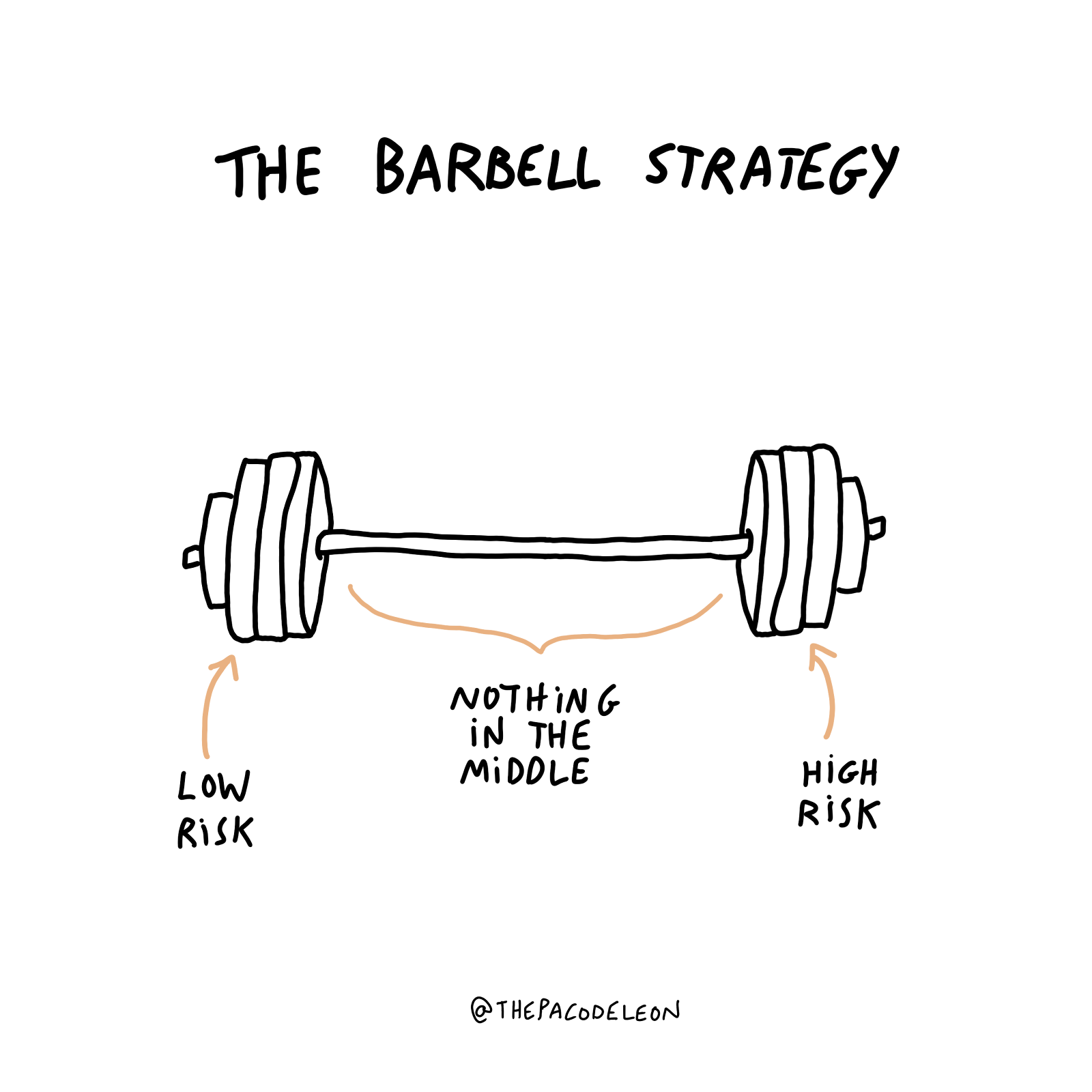

The Barbell Strategy: Balancing stability and risk

The Barbell Strategy, popularized by Nassim Nicholas Taleb, is a powerful framework that pairs perfectly with a portfolio career. The idea is simple: the best way to manage risk is by balancing extreme stability on one side and high-upside risks on the other. And in our uncertain world, the middle, where slow, incremental risk is, is actually the most vulnerable.

A well-built portfolio career follows this principle:

- On one end of the barbell, you have your stable income sources and the reliable foundation that keeps you afloat.

- On the other end, you take calculated, high-upside risks. This is where your creative projects, speculative bets, or big swings have the potential for major rewards.

The key is balance: a strong foundation that protects your downside while giving you room to take meaningful risks. Remember too, in an uncertain world, currency comes in more than one form. So putting out creative work might not be the highest pay, but it can be social and cultural currency in ways clocking in at a W-2 job simply can’t.

The new definition of success

The old entrepreneurial mindset told us that success meant total independence: no boss, no safety net, just you and your big idea. But the smartest entrepreneurs I know are redefining success as building optionality through portfolio careers.

It’s kind of nice that we don’t have to be defined by one thing. It takes the pressure off and allows us to be more dynamic. I’ve treated the side quest of W-2 employment like an artist taking on a residency or an actor taking a role in a movie. It’s been an intense chapter, but not forever. Now, I’m transitioning out of full-time and into a contract role at the company, freeing up time shift focus again because I’ve designed my career to bend without breaking.

What can this mean for you? If you run a small business, have a freelance practice, or wear multiple hats inside a growing company, the portfolio career model may already show up in your day-to-day, even if you haven’t named it. Embracing this approach allows you to take on new opportunities, test new ideas, and stay resilient in a fast-changing world.

In our unpredictable world, the entrepreneurs who thrive aren’t the ones betting it all on one big idea, they’re the ones who know that following one thread will reveal the larger tapestry.

![]()