Table of contents

Nothing in this article constitutes tax or accounting advice. If you have questions about your 1099, please consult a professional.

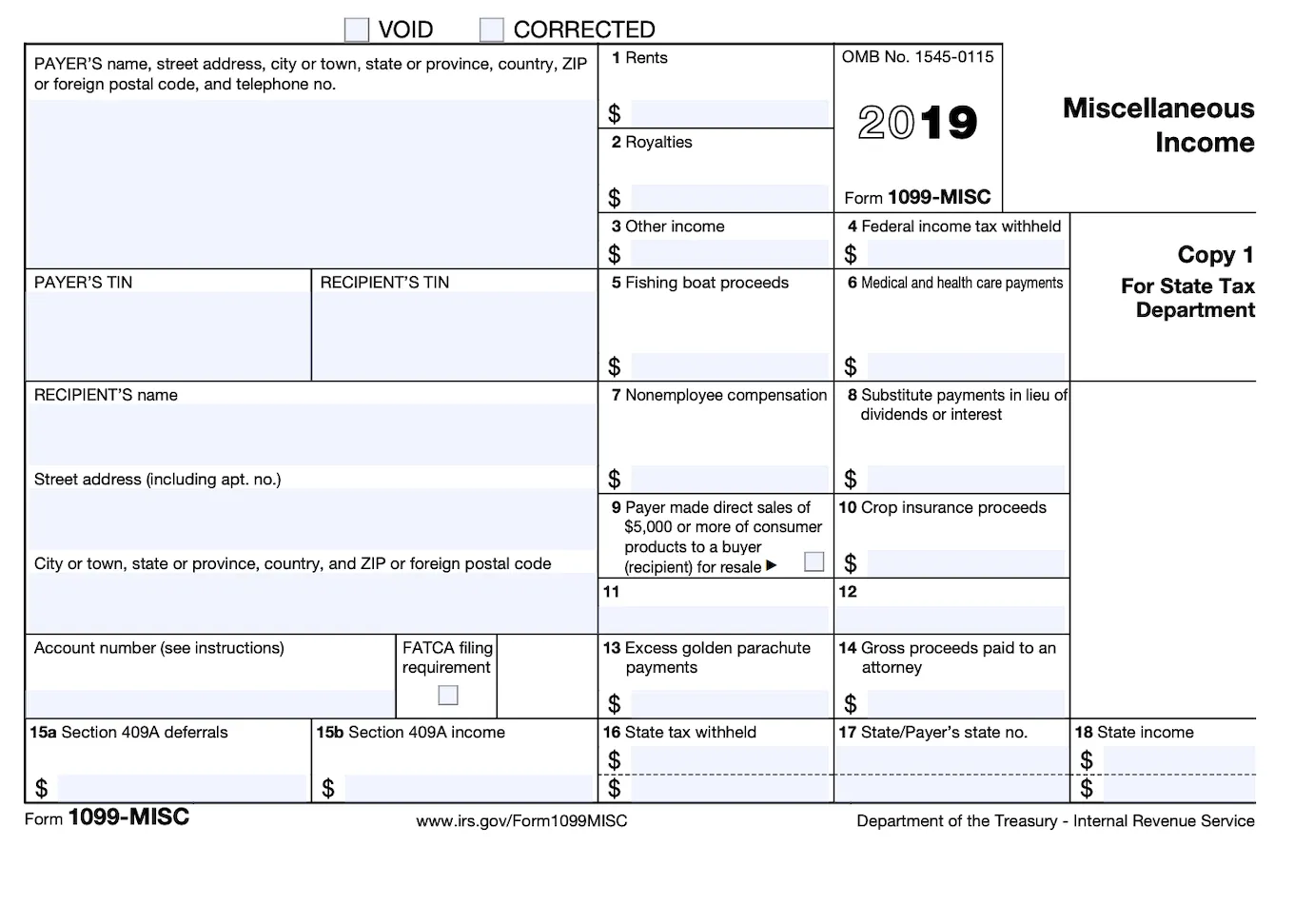

As you grow your business, you’ll come to a point when you need to hire some helping hands. If that help comes in the form of independent contractors, you’ll need to file 1099-MISC forms with the IRS. Tax forms like these can be difficult to interpret, so we’re breaking down for you what a 1099 is, along with instructions to help you fill it out.

Businesses that pay contractors through Square Payroll have one less item on their to-do list because Square Payroll fills out, files, and sends copies of the 1099-MISC to contractors, all on the employer’s behalf.

What is a 1099-MISC?

A 1099-MISC reports the amount you paid to an independent contractor throughout the year. It serves a similar purpose as the W-2 does for an employee.

How can you distinguish an independent contractor from an employee? An independent contractor is someone you bring on to fulfill a specific role or task who work for themselves. This means they set their own rate and hours, and can work for multiple businesses at the same time if they choose. Because they are self-employed, you don’t withhold any taxes from their paychecks or provide any benefits.

For people who work for you and fit this description, you need to file a 1099-MISC form rather than a W-2 form. There are strict legal requirements around what distinguishes a contractor from an employee, so you should review the guidelines to ensure you’re clear and file the correct tax forms accordingly.

How do I read a 1099-MISC form?

If you’re filing the 1099-MISC yourself, it can be hard to know where to begin (there are so many boxes). Here’s what each box means on the 1099-MISC form and what you’re meant to do (or not do) with each of those empty spaces.

PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.

This box is relatively clear. Here you enter all the information about yourself, the payer.

PAYER’S TIN

This is where you put your tax ID number. You can use your EIN for this.

When you enter a contract with an independent contractor, you typically have them fill out a W-9, which has information about the contractor on it, like tax ID number, address, and the correct spelling of their name. You can use the W-9 to gather the correct information for the following boxes.

RECIPIENT’S TIN

This box is where you put the tax ID number of the person you paid.

RECIPIENT’S name

This is where you put the name of the person you paid.

The following boxes reflect the indicated information about the person you paid.

Street address

City, town, state or province, country, and ZIP or foreign postal code

The rest of the form has boxes numbered 1–18. Below are explanations of what each of these boxes is for. Remember, you only put the total amount paid in the box that applies to the person you are paying. (And more likely than not, you’ll fill out box #7.) The rest of the boxes that don’t describe the work this person performed can be left blank.

1. Rents

If you paid rent for space or equipment for your business to an individual, you would report that number in this box.

2. Royalties

If you are paid royalties of any kind, such as paying for property or intellectual rights, to an individual, state that amount in this box.

3. Other income

This is where you put any payments to an individual that don’t fit into any of the other boxes on this form.

4. Federal income tax withheld

If you withheld any of your contractor’s pay for federal taxes, report that number in this box.

5. Fishing boat proceeds

This box only applies if you are the owner of a fishing boat. If you are the owner of a fishing boat, this is where the amount paid to a contracted member of your crew goes.

6. Medical and healthcare payments

If you made a payment to an individual who provided health/medical services this year, report it in this box.

7. Nonemployee compensation

This is most likely the box you need to fill out. This is where you report the total amount you compensated a contractor during the year.

8. Substitute payments in lieu of dividends or interest

This box only applies if you have shareholders. This payment occurs if that stock is loaned out to short-sellers.

9. Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient for resale)

Check this box if you sold products to an individual for resale that amounted to more than $5,000.

10. Crop insurance proceeds

Most likely not relevant to you, unless you’re an insurance company issuing insurance to a farmer for crop insurance, in which case fill in this box with the proceeds of that insurance.

[11–12. These are for taxes that used to be reported on this form but no longer are.]

13. Excess golden parachute payments

This is for payments made to a disqualified person (i.e., shareholder).

14. Gross proceeds paid to an attorney

If you hired an attorney, put the amount you paid that attorney here.

15. Deferrals and income

A and B. This section refers to Section 409, which applies to compensation that a worker earned in one year but is not paid until a future year. In A, you state the deferred amount to be paid in a future year. In B, you state the total income.

16. State tax withheld

Only fill out this box if your state doesn’t participate in the Combined Federal/State Filing Program. Enter any amount you withheld for the contractor’s state taxes here. This box is divided in two in the event this individual is filing in two states (name the states in box 17 and the total income to report to each state in box 18), and you withheld taxes for both. However, because this individual you paid is a contractor, it is unlikely you withheld any taxes from their pay.

Key dates to remember when filing and mailing 1099-MISC forms

- January 31: Make sure you’ve mailed your 1099-MISC forms by this date. They must be postmarked by this date.

- February 28: If you’re filing your taxes via mail, you need to make sure your 1099-MISC and your 1096 form are postmarked by this date.

- March 31: If you’re filing electronically, you must submit your 1099s and 1096 by this date.

The 1099-MISC is just one of the multiple tax forms you need to file to make sure you’re compliant. If you pay your independent contractors through Square Payroll, you can rest easy knowing that we take care of forms like the 1099-MISC for you, so you can focus on growing your business.

![]()