Table of contents

Taxes are getting down to the wire. Are you one of those people who has absolutely no idea how you’re going to get them done? You might want to consider filing for an extension. We asked Jennifer Dunn, Chief of Content at TaxJar, to give you the rundown on filing tax extensions as a small-business owner.

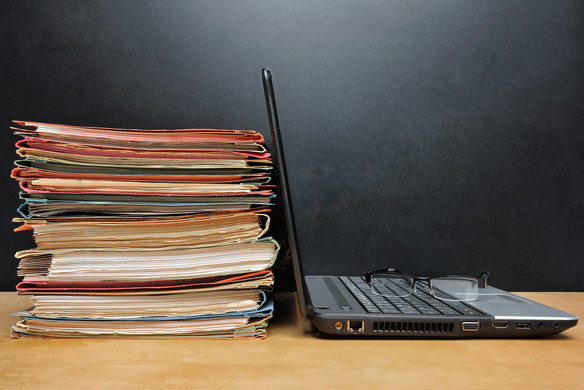

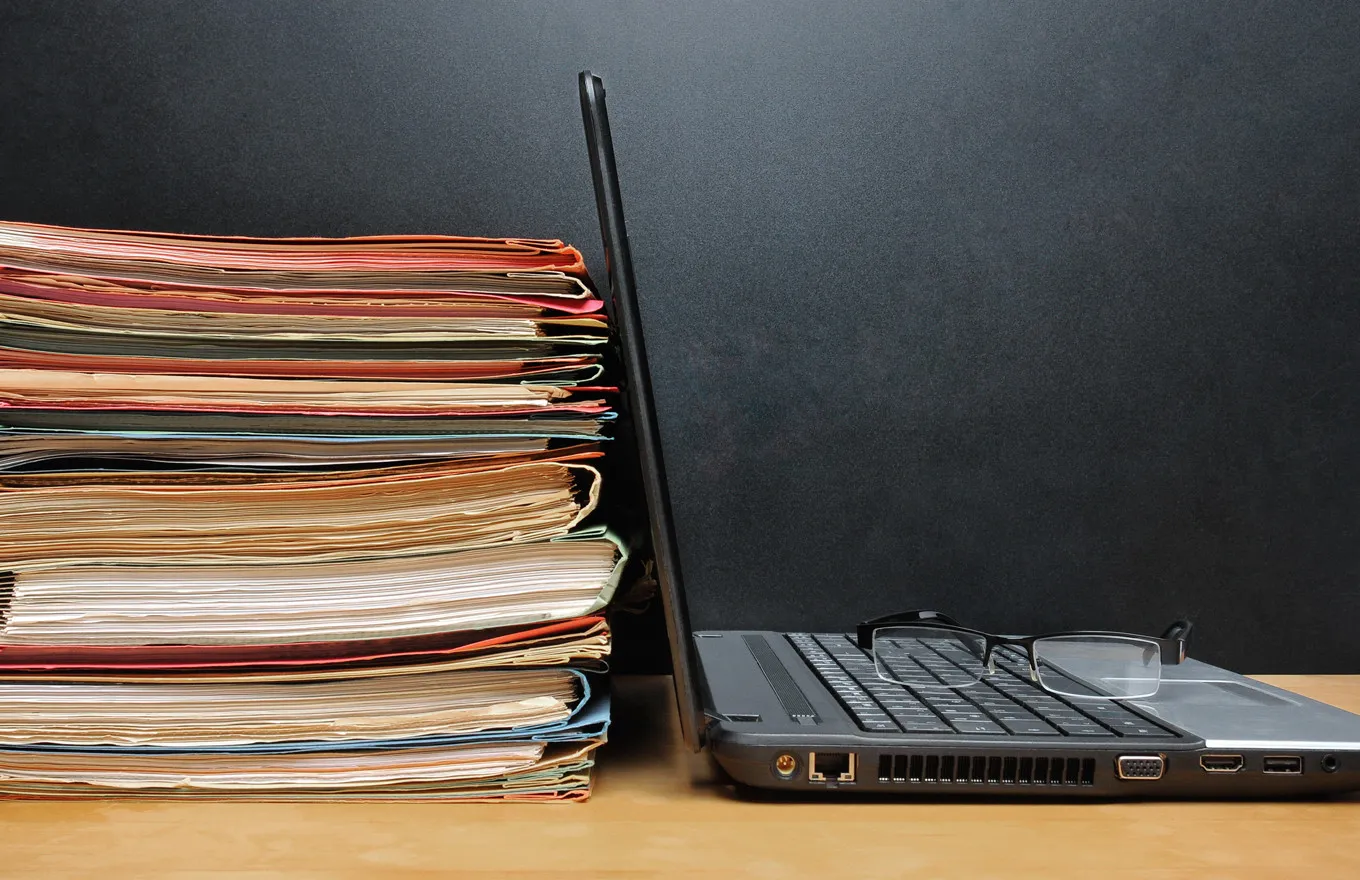

If you’re a small-business owner, taxes probably take up a ton of your time. From employment taxes to income tax, it’s a wonder you have time to run your business. And as you’re well aware, filing your incomes taxes isn’t straightforward or simple. Wouldn’t it be nice if the government gave you a hand in all this mess? Well, the IRS does, to a certain extent, with tax extensions.

Unfortunately, if you’re an S or C corporation, the deadline to file for an extension has already passed—it was March 15. But if you’re an individual (which includes sole proprietors and single-member LLCs), you’re in luck—you can file for an extension up until April 15. And if granted, you’ll have until October 15 to get your taxes in. But there’s a catch.

One thing you absolutely must know about tax extensions

The catch? The extension is only for filing your income tax return, not for actually paying any income tax due. If you get an extension, you still need to pay the amount of taxes you owe by the original deadline or face penalties. As a general rule, you should pay 100 to 110 percent of the amount you owed in the previous year to avoid underpayment (and penalties).

So should you file for an extension? Let’s go through the pros and cons of each:

The pros

- More time to save yourself some money. When you have more time to prepare your tax return, you have more time to find deductions or credits—like an automobile or home office deduction.

- Actually find a CPA to help. Many CPAs are so busy at tax time that they stop taking on new clients. If you need professional help but are having trouble finding it, file an extension. Tax accountants’ calendars will clear up significantly after April 15.

- Extend your state tax filing deadline, too. Often when you’re granted a federal tax extension, you automatically receive a state extension as well. Don’t just assume that this is the case, however. Be sure to check with your state to make sure you have an extension for both.

The cons

- Not all tax extensions are granted. While 97% of tax extensions are granted automatically, it’s not guaranteed. If you’ve had tax trouble in the past, you may not be granted an extension this year.

- Time to procrastinate. For habitual procrastinators, the six-month tax extension may be just another way to put off this troublesome task. If you’re stuck the night before your extension deadline in the same place you are today, maybe you should just get it over with now.

Ready to file your tax extension?

If you’ve decided to file for one, here’s how you do it. If you’re an individual, fill out IRS Form 4868. (If you’re an S Corporation or C Corporation, you’d would fill out Form 7004. You can also use an automated service like FileLater to file your income tax extension for you for a small fee.

Whichever way you spin it, taxes are a drag. To make them easier next year, sign up for Town Square News to get monthly tips and tricks for getting your finances in order.

About TaxJar

Sales tax is complex. That’s why we created TaxJar — to handle the burden of sales tax while you get back to running your business. TaxJar pulls in sales tax collected from all the channels where you sell, compiles your data into return-ready reports, and can even AutoFile your sales tax returns for you in 26 states (and counting). Sign up for a 30-day TaxJar free trial today and put a lid on sales tax. And check out Square App Marketplace for more information on how to link your Square account to TaxJar’s tools.

![]()