Table of contents

Setting aside savings for small business owners has become more of a focus than ever before. According to a 2023 Federal Reserve report, 94% of businesses faced financial challenges in the prior year, with 81% citing rising cost of goods, services and wages as a top challenge followed by 54% citing difficulties paying operating expenses as the second..

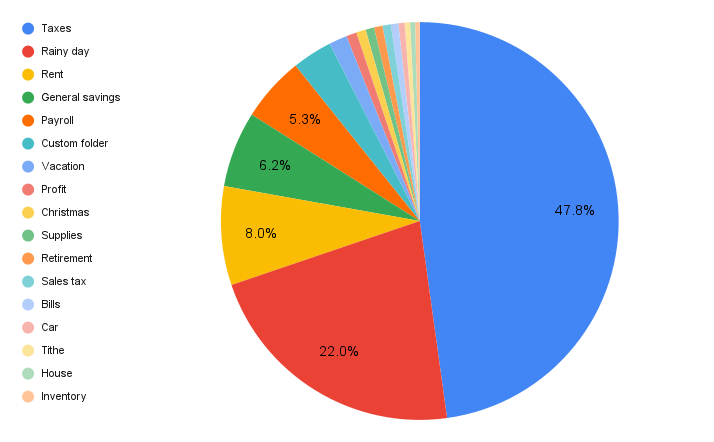

So, how are some business owners thinking about savings now? We took a look at Square Banking data from November 2022 to November 2023 to see how business owners are setting aside funds this year. Square Savings customers have the option to organize, fine-tune, and separate their funds within their savings account by dedicating folders with their intended plan. Here is a look at the top goals for those business owners:

1. Taxes

The largest amount of folders for the third year in a row for Square Banking customers were dedicated to taxes.

According to the Small Business Administration (SBA), the average effective tax rate of small businesses in the U.S. is 19.8%. As small business owners navigate business operations throughout the year, they keep this in mind when tax day rolls around. Small business owners have a multitude of taxes that they need to file, from industry-specific taxes to business entity-specific taxes. Within tax savings, some kept the folder broad to simply “Tax”, while others set funds aside for sales taxes, annual taxes, state taxes, or self-employment taxes.

2. Rainy Day Savings

Many business owners found themselves with little buffer room as the pandemic changed the way businesses could operate. Only one in five businesses felt they had sufficient cash reserves to continue operations if they experienced even a two-month revenue loss. The ability to plan ahead for unexpected events can be a challenge with or without a bank account.

In a 2021 Square survey 67% of respondents said they were planning to set aside some of their sales in a business savings account. Of this group, 20% planned to open a new savings account in order to do so.

Rainy day savings were split into a few categories: First, rainy day savings for emergencies or an unexpected business occurrences and, second, for forecasted savings events like retirement. These savings folders saw a range of labels like “BTC” for bitcoin or “IRA” to put towards an IRA for retirement.

3. Rent, Payroll, and General Savings

Although business expenses featured a range of savings goals, there were a few top-ranking expenses business owners were saving for.

- Rent: This category was most active for retailers and salon owners. Store rent and salon or booth rent were some of the top savings folders.

- Payroll: From payroll software to paycheck or labor savings folders, these business owners were setting aside money to put back into their employees.

Overall business expenses focused on setting funds aside for ongoing costs and costs associated with running the business, like insurance, electricity, or rent.

4. Vacation

Often, small businesses are open on holidays, catering to shoppers looking for last-minute groceries for Thanksgiving, holiday presents, or Mother’s Day flowers. One study by OnDeck showed only 57% of small business owners take vacation and of those, 67% still check in at work at least once a day. But small business owners have been navigating changing ways of doing commerce.

Square data shows that these business owners are now prioritizing taking some time off. Many have set aside vacation savings goals for Christmas — or trips to New Orleans, Mexico, and Italy to name a few.

5. Business Profit

Business profit savings goals were neatly split between profit and owners’ salaries. This category sits at number six as business owners might move this money or rename the folder when they decide what they may want to do with their set-aside profit. Setting aside an owner’s salary within your savings account can be a good way to make sure that you are paying yourself as you grow your business.

The business investments savings folders folders were focused on reinvestments into the business that would help grow the business. Set-asides in this folder included investment goals, like a tattoo machine, a new truck, a pedicure chair, a buzzer system, or even a new salon.

6. Holidays

While some Square sellers chose to set money aside for vacation, others focused in on a holiday. This encompassed the need to save for anything from gifts to travel at a specific time of year. The most popular holiday to save for was Christmas with 8% of all Square seller savings folders dedicated to the theme.

7. Supplies, Retirement, Bills

Personal savings folders ranged from money set aside for mortgage payments to student loans, or even event-focused personal goals, like weddings or a luxury car. For business owners, needs and benefits can vary depending on each business’s unique needs and the savings folders below reflect some of these nuances. Some business owners are setting aside money for maternity leave and many for child care. Another popular trend among the personal savings goals included funds set-aside for retirement.

- Bills: These types of folders featured internet and cable providers, such as Comcast, as well as utilities like electric or water bills.

- Supplies: Those saving for supplies set aside money for inventory as well as shop supplies, for example. Supplies as a savings goal was the smallest category of named business expenses folders.

- Retirement: Just over 5% of sellers set aside funds for retirement this year. With cash flow management issues being a common pain point across all industries of business, planning ahead of retirement can be a shared challenge by many business owners. Some sellers are proactively setting funds aside to plan ahead.

The remainder of the folders below these categories above included tithe, car, and housing related costs. Tithe is money set aside to be paid as a contribution to a religion organization like a Church or clergy. Typically a tithe is associated with a tenth or 10% so those folders may reflect about that amount of the overall business’s savings.

In our final episode of Paying It Forward, hear financial expert Priya Malani walk through the difference between APR, APY, and how interest rates can impact decisions, from what savings account you might pick to business credit cards. Then you’ll hear from Wasi Clothing owner Vanessa Acosta. When it comes to her small business, setting aside savings has meant being able to reinvest in her business, buying new equipment, and, this year, hiring new employees.

Listen to Square’s Paying it Forward podcast and hear firsthand from a small business owner who has taken out a loan and some of the unexpected obstacles she encountered along the way.

![]()