The biggest issue affecting your bottom line might be the most obvious: not getting paid fast enough. The invoicing process will probably never be 100 percent headache-free, but with these strategies, you can make it as seamless as possible.

Tell them what you want (nicely)

When you send invoices, don’t leave any room for interpretation. That is, add due dates and reinforce them with a friendly message thanking your customers for their business and reiterating the deadline. This way, it’s clear that you want the payment next week, not when they get to it.

Cast a wide net

Sometimes the reason you’re not getting paid on time is that you’re sending the invoice to the wrong person. For example, your contact might not be the person who does the books, and it could take several rounds of phone calls and email to figure that out, further delaying your payment. With Square Invoices, you can send the invoice to multiple recipients, making sure it lands in the hands of the person who can take care of it the fastest.

Pay attention to timing

Like so many situations in life, timing is everything. So while you might not think it matters when you send your invoices, it does. Square’s research shows that when you send invoices to clients on Thursdays, you’re most likely to be paid within two days. But when you send invoices on Sunday, you’re out of luck — paying bills is not high on anyone’s Sunday Funday agenda.

Follow up

If your payment deadline has come and gone, resend the invoice with a gentle reminder email. And if that doesn’t work, print the invoice and mail it. Keep checking in every week until the issue is resolved.

Streamline the process

Sending a bill via email is faster than mailing a paper copy, but you’re still wasting time unless you have a simple means of tracking the invoice, altering the contents, and sending reminders. You can send invoices through the POS app or from your dashboard software; you can also track paid and unpaid invoices from your Dashboard. Customers can pay online with a credit or debit card (don’t worry, you can also record payments made by cash or check).

Incentivize early payment

Clients who pay on time are great. But the early birds? Invaluable. Show your gratitude for pre-deadline payments by offering clients a bonus, like a slight discount for paying a certain amount of time in advance, or by offering a discount on future purchases. Once they experience the benefits of early payments, they’ll never settle for being just on time again.

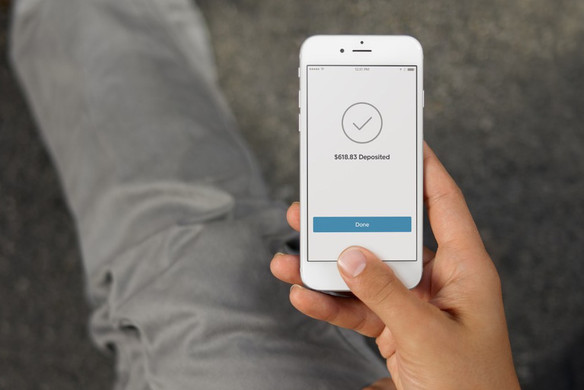

Transfer funds faster

Once you do get paid, there’s the matter of transferring that money, which can be complicated by inconvenient bank hours. This can cause some freakouts about not being able to cover bills and payroll. But with Square’s instant transfer, you can do just that: transfer funds into your bank account instantly, no matter the day or time.

![]()