Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Loans Fund what’s possible

Apply in minutes, no long forms

No interest, just one flat fee

Get money instantly1

Quick, easy funding for every stage of business

Process sales with Square to get a custom offer

Loan offers range from $100–$350K, depending on your business performance. We take into account your time using Square, your processing volume and frequency, your customer mix, and more. You’ll receive offers in your Square Dashboard and via email.

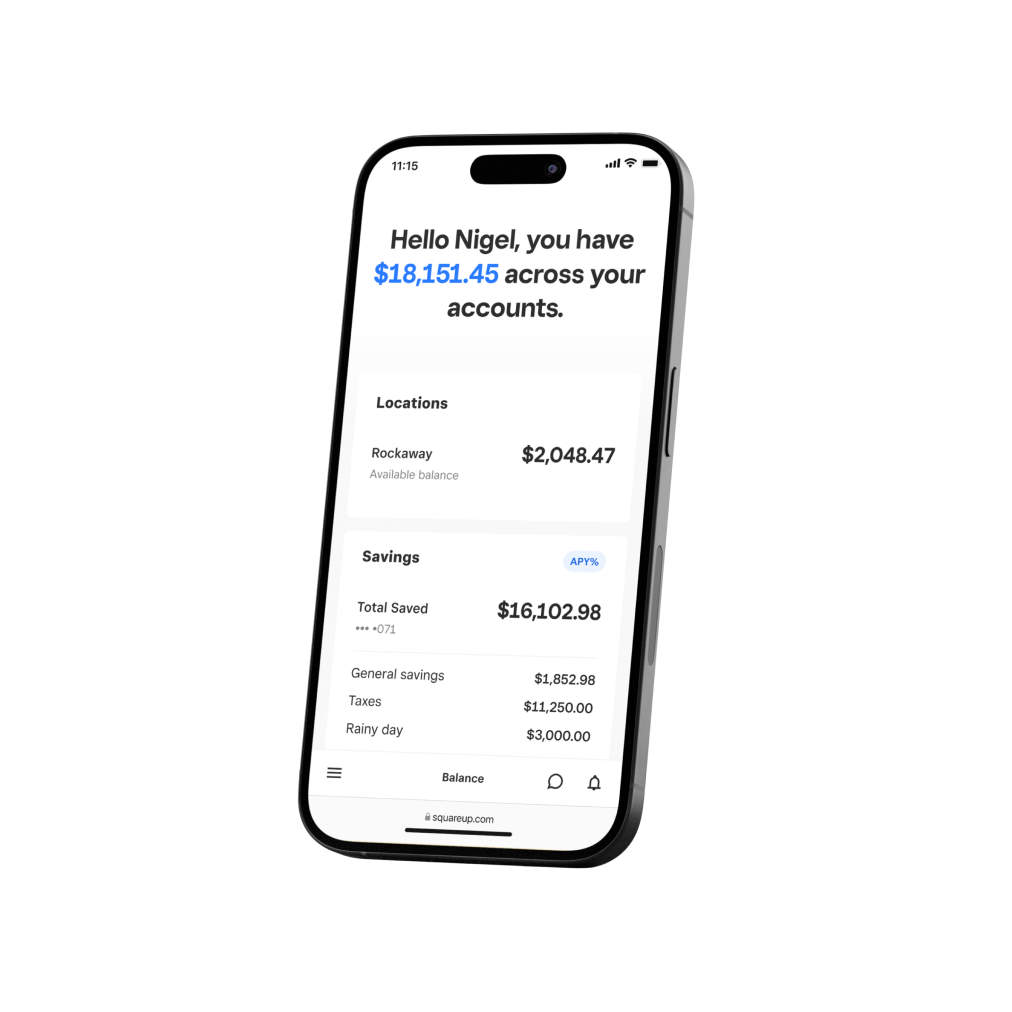

Simplify your to-do list with automated repayments

Repayments are made automatically through your daily Square sales, so you have one less thing to think about. The percentage you pay stays the same — the amount adjusts to match your cash flow. Plus, there’s no interest, so your balance never grows.

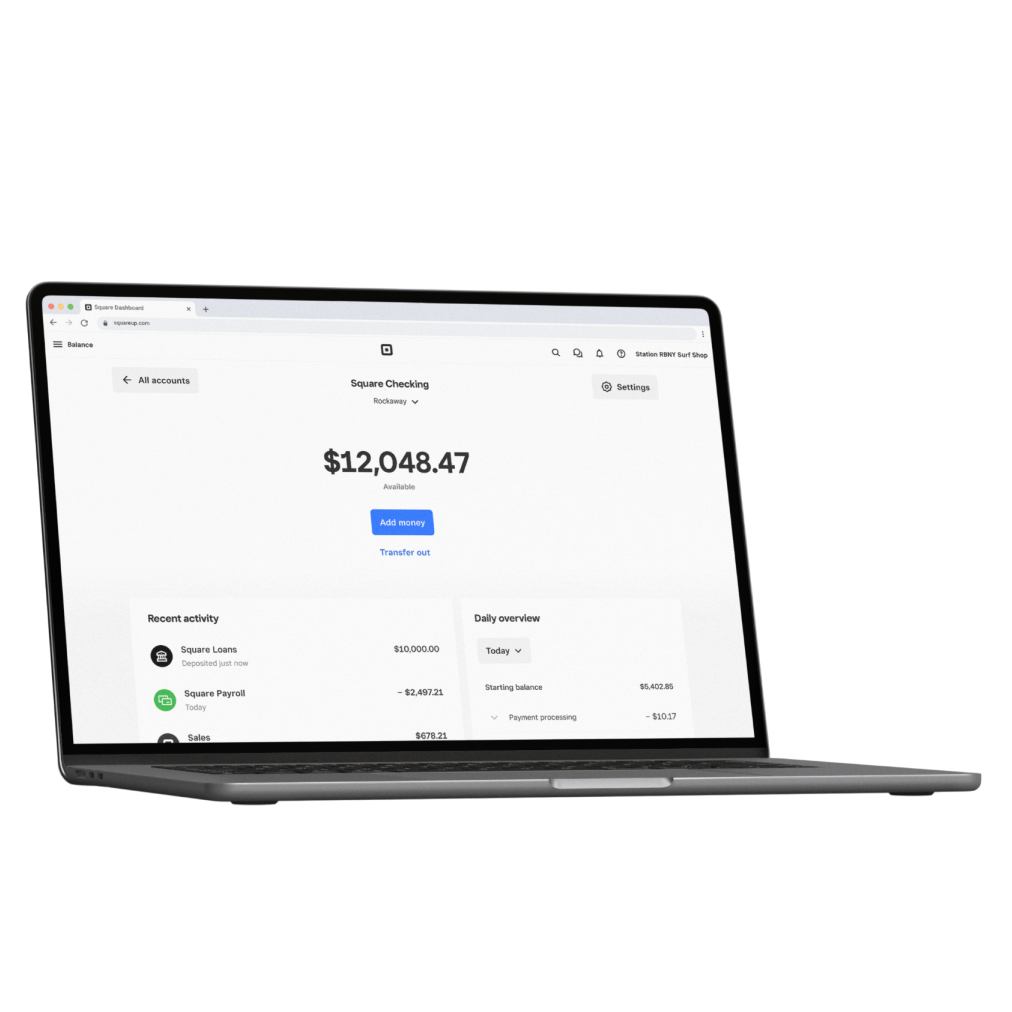

Faster access to funds

Easy application

It only takes a few minutes to apply. You’ll be notified in your Dashboard and via email once you’re eligible for an offer.

Fast deposit

Once approved, money will be deposited in your account the next business day — or instantly with Square Checking.

“That loan really helped us get through when we didn’t have anything at all. And when you pay it off, you feel so good.”

Barb Batiste

B Sweet

Los Angeles, CA

“Square’s financing allowed me to renovate my store interior after having been closed due to the pandemic. This enabled me to reopen for indoor dining, which enabled me to increase my sales by over 60%.”

Fumio Tashiro

Mirror Tea House

Brooklyn, NY

$26.5B+

funds extended globally

Includes MCAs, SBA PPP loans, and business loans from October 2013 to September 2024.

900K+

businesses funded

Internal Square data, 2025.

88%

of businesses with Square Loans report growth

Square survey data, 2025.

Get your money moving at your speed

Talking money

FAQ

How do I become eligible for Square Loans?

Square Loans are currently offered by invitation. While you are processing with Square, we automatically review your processing activity to evaluate loan eligibility. If we spot that you’re eligible to apply for Square Loans, we’ll proactively reach out to you (via email and in your Square Dashboard) with a customized loan offer.

You can also use the eligibility page located in your Square Dashboard to gain more insight into the status of your Square Loans eligibility.

How do I request a loan from Square?

If a loan offer is not available in your Square Dashboard, your business is not eligible at this time. Rest assured, we automatically review Square accounts on a daily basis to evaluate the many factors about your business that we already have to assess your loan eligibility. We will notify you if you become eligible for Square Loans at a later time. You do not need to contact us or provide any additional information to become eligible for a loan offer.

How do you determine my business’s loan offer?

Loan eligibility is based on a variety of factors related to your business, including its payment processing volume, account history, and payment frequency. Learn more about eligibility for Square business loans.

How do I repay a loan from Square?

A fixed percentage of your daily card sales is deducted automatically until your loan is repaid. If sales are up one day, you pay more; if you have a slow day, you pay less. A minimum of 1/18 of the initial balance must be repaid every 60 days. Learn more about Square loan repayment.

Is there interest for a loan from Square?

No, loans from Square have no ongoing interest charges. The total cost of the loan is simply the loan fee, which is the difference between the total owed amount and the initial loan amount you apply for on your Dashboard. The total cost of the loan never changes.

Can I prepay the loan?

Yes, you can make prepayments at any time at no additional cost. The total amount you owe does not change due to prepayments.

What happens if I miss a payment?

If your daily card sales cannot cover the 60-day minimum payment, Square Financial Services may debit the remaining minimum payment amount due from your Square balance or your Square-linked bank account.

Are there late fees?

No, there are no additional late fees added to your total amount owed.

Does applying for a loan affect my credit score?

No, applying for Square Loans doesn’t affect your credit score. Additionally, we don’t require a personal guarantee for your business to take a loan.

Ready to bank with Square?

Get financial tips and hear how other businesses manage their cash flow with Square.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc.

1Loans deposited instantly in a Square Checking account.

All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.