Repay your loan

About repaying your loan

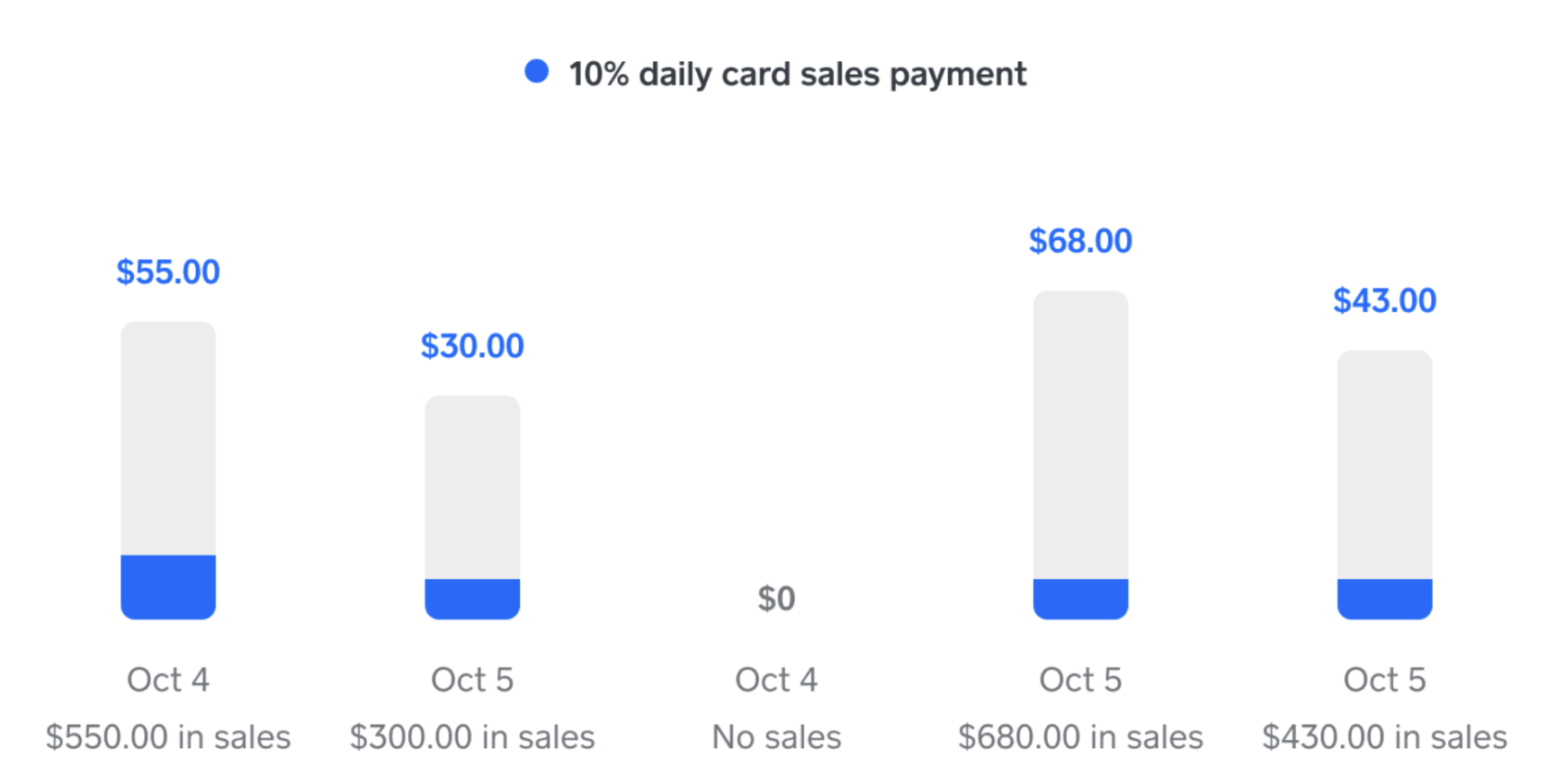

Square loan repayment starts two business days after loan origination, and the exact date is reflected in your loan agreement. Repayment happens automatically through a fixed percentage of daily card sales, so you’ll pay more when business is strong, and less if things slow down.

Numbers are for illustrative purposes only

We take your business’s Square payment processing volume, account history, and payment frequency into account when determining your loan offers. Square loans are designed to be paid back within 12 months if your business’s payment processing does not change based on our initial estimations.

If there hasn’t been any changes to your business and you maintain regular processing volume through Square, making your minimum payments on time shouldn’t be an issue. We encourage you to review the minimum loan payment requirements so you know what to expect if your business’s card sales change during repayment.

Before you begin

There are no ongoing loan interest charges. You’ll pay one fixed loan fee to borrow the loan, which is the difference between the total owed amount and the initial loan amount. This is not an interest rate, and the fixed fee will never change regardless of how quickly or slowly the loan is repaid.

The repayment rate is applied to your gross card sales, including tips and taxes paid by your customers using a credit or debit card, invoices, ACH payments and QR code payments made with the Cash App. Note that your repayment rate applies in addition to Square’s processing fees for these transactions.

The repayment rate will be automatically applied to all card transactions until your loan is repaid in full, even when the minimum payment is met.

Loan maturity is the date your outstanding loan balance must be paid in full. You can find the maturity date of your loan in the summary box at the top of your loan agreement, and you’ll be notified via email before your loan matures. Once your loan has matured, the outstanding balance is due in full.

If you don’t meet your minimum payment requirement or pay the entire loan balance on the maturity date, the repayment rate applied to your daily card sales may increase and a debit may be initiated from your linked bank account for the remaining minimum payment amount or the remaining loan balance.

The cost of your loan does not change by making prepayments, and you can make additional payments to your loan at any time at no additional cost. All payments are considered final, and can’t be reversed or refunded.

Forms of accepted payments include online dashboard payments, debit card payments over the phone, personal checks, cashier’s checks, and money orders from a local USPS branch. We don't accept credit card payments, wire transfers, or money orders that are not issued by USPS.

If you make a payment and have a past-due balance, the payment will apply to the past due balance.

Make a loan payment

To make a payment on an outstanding loan online through Square Dashboard:

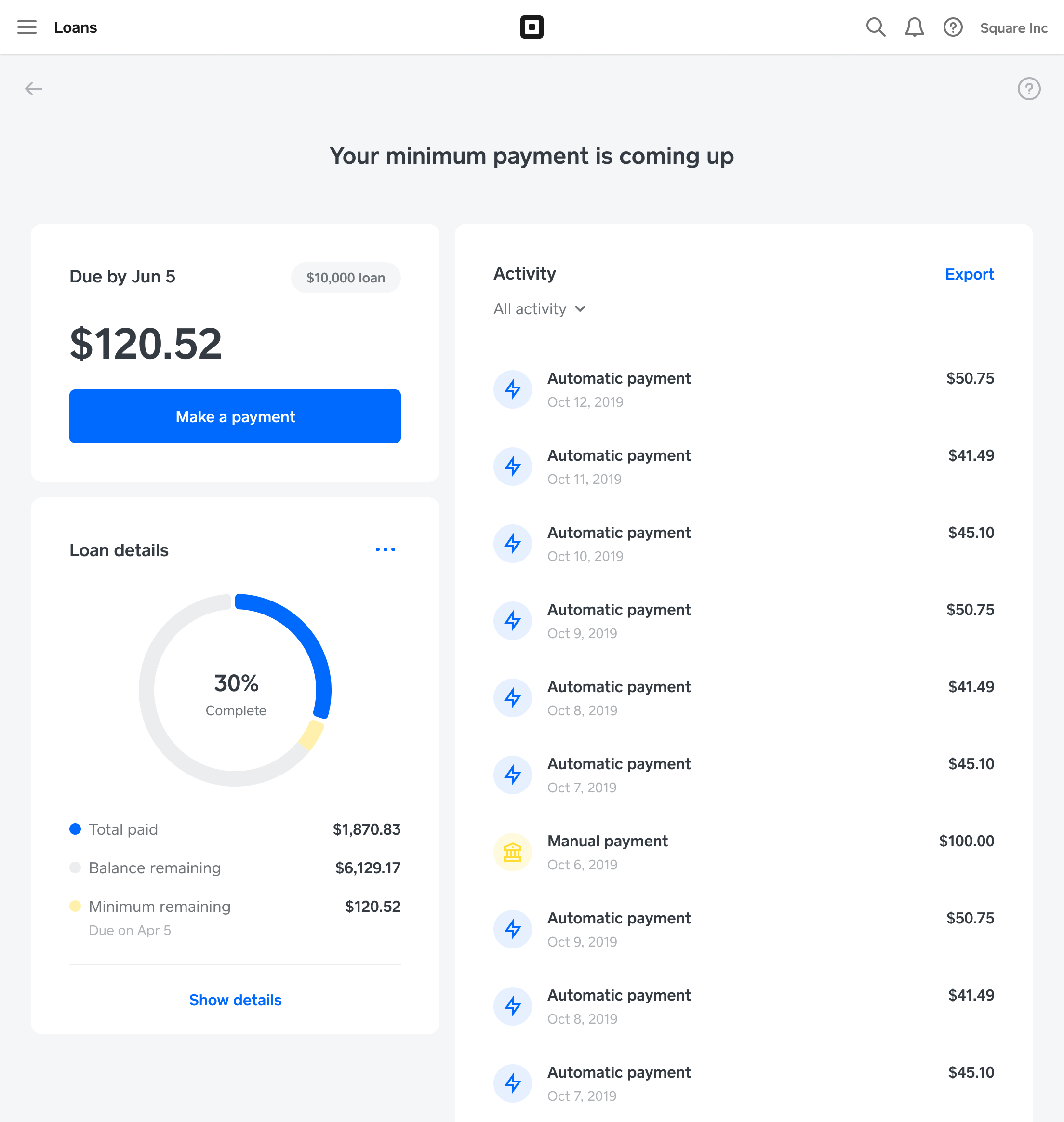

- Sign in to Square Dashboard and go to Banking > Loans.

- You’ll see an overview of prior payments, how much you have left to cover of your current balance, and a breakdown of each payment.

- Select Make a payment and provide the desired payment amount.

- Click Continue > Make a payment.

When submitting a prepayment, Square Financial Services may first apply any pending funds from your card sales and then debit any remaining amount from your linked bank account. A debit will only be initiated if the pending funds don’t cover the entire prepayment.

If you fully prepay your loan, your business’s loan eligibility will be re-evaluated. We can’t guarantee that you’ll receive a new offer after you make an additional payment or pay off your loan.

It can take up to 10 business days for payment confirmation and for your account to be evaluated for new loan offers, during which time you will not have any loan offers visible in Square Dashboard. If you had a Square loan offer prior to paying off your loan, submitting a prepayment will expire any existing offers.

We accept debit card payments for Square loans over the phone. To make a debit card payment, you can call the Square Loans team at 855-897-1838 between Monday to Friday from 7am - 5pm PT.

If you choose to repay your loan by check or money order, make all payments payable to Square Financial Services and mailed to the following address:

JP Morgan - Lockbox Processing

Attn: Square Financial Services - 22402

4 Chase Metrotech Center

7th Floor East

Brooklyn, NY 11245

Include the email address associated with your Square account as well as Square loan repayment in the memo line of your check. This is needed to ensure that your check is correctly applied to your loan. Once your check is received, it can take up to 14 calendar days to apply it to your account. If you don’t see your loan closed out within this timeframe in your Square Dashboard, contact us.

Businesses can pay off an existing loan with a payment from a third party, such as a financial institution.

You can find your outstanding balance by visiting the Loans tab in Square Dashboard. The amount reflected below Balance Remaining is what is still owed by your business. You can refer to this balance if you’d like to pay off your loan in full.

You can also contact us to request a payoff statement. Note that the total outstanding amount provided in the payoff statement only reflects your balance at the time specified in the payoff statement. Since we do not suspend loan repayment when a payoff statement is requested, any card transactions processed after the payoff request will have a portion applied to loan repayment. Continuing to process payments through Square will cause your actual outstanding balance to differ from the amount provided in the payoff statement.

Instructions to mail in a check for the third party loan payment are above. Wire transfers for loan payments are not accepted.

Add multiple business locations or accounts to repay a loan

Upon loan approval, the loan is tied to the specific account location that applied for the loan. If you have multiple locations, you may have the option to add additional Square locations as payers towards the loan. The repayment rate will apply to the other locations’ daily card sales and sales you process at your locations will go towards paying down the loan balance.

Additionally, each individual Square account is tied to a unique email address. If your business takes payments while logged into another Square account, your card sales on that account don’t automatically go towards the repayment of your loan. If you want to continue processing on another Square account, you may have the option of adding that account as a payer toward your loan.

If you want to link other locations or accounts to your loan, contact us.

Currently, bitcoin payments will not impact loan offers or underwriting decisions, and bitcoin payments made by customers will not be applied when calculating your automatic loan repayment. Your repayment rate applies only to your gross card sales — including tips and taxes paid with credit or debit cards, invoices, ACH payments, and Cash App QR code payments.

If you’ve opted into converting sales into bitcoin, your loan repayments will continue to be automatically deducted from your eligible card sales as usual. Square will deduct your loan repayment from your card sales before your funds are converted into bitcoin.

Request loan repayment assistance

If you have any issues regarding your upcoming payment or need assistance with alternative payment options, contact us at least five business days before your payment due date.

Use military benefits for loans

Under the Servicemembers Civil Relief Act (SCRA), you and your qualifying family members and dependents may be eligible for military benefits if you’re a service member or military personnel called to active duty or active service. To learn more about SCRA benefits or to submit a benefit request, contact us.