Table of contents

The United States Department of Labor (DOL) has revised tip regulations in its Fair Labor Standards Act (FLSA) and adopted what is now known as the 80/20 tip rule. The policy, which favors tipped workers, will take effect on December 28, 2021, and may impact the bottom line for restaurant owners who currently claim “tip credit.”

Here’s what you need to know about the 80/20 tip rule and what it could mean for your business.

What is the 80/20 tip rule?

As of the writing of this article, the Fair Labor Standards Act (FLSA) stipulates that employers pay workers a minimum wage of $7.25 per hour. But if an employee receives at least $30 per month in tips, then the employer can take a tip credit and pay the employee as little as $2.13/hour if the sum of all the employee earnings (cash wages plus tips paid by customers) equals at least $7.25 per hour.

A tip credit enables businesses to pay their employees less than the standard minimum wage as long as the employee earns enough tips to make up the difference. In some cases, an employer may be able to claim an additional overtime tip credit.

The problem is that this rule assumes that tipped workers spend all or most of their time on tip-generating activities. But this isn’t always the case. Tipped employees may also spend significant work hours on activities that do not result in tips. For example, in addition to serving customers, a server may refill salt and pepper shakers, vacuum floors, or fold napkins. The server does not earn any tips while performing these activities even though they may directly support the service they render to customers.

To try to solve this issue, the revised regulation differentiates between tip-producing work, directly supporting work, and work that is not part of the tipped occupation.

Tip-producing work refers to customer-facing tasks for which the employee earns tips. For a server, this may include retrieving prepared food from the kitchen and serving it to customers, collecting credit and cash payments, and clearing plates after a meal.

Directly supporting work does not generate tips but helps the tipped employee perform the work for which they earn tips. For a server, this could be setting tables, folding napkins, and rolling silverware.

Work that is not part of the tipped occupation does not generate tips nor support tip-producing work. Food preparation and cleaning kitchens and bathrooms are not part of the tipped occupation for servers.

While both tip-producing and directly supporting work are considered as “part of the tipped occupation,” under the revised final rule, employers are now required to pay the full minimum wage of $7.25/hour to any worker who spends a substantial amount of time — defined as more than 20% of their weekly work hours or a continuous period of time exceeding 30 minutes — on non-tipped directly supporting work.

According to the Department of Labor, the goal of the final rule is “to protect tipped employees” and to help employers address the “variable situations that arise in tipped occupations.”

What could the 80/20 rule mean for your business?

While the new rule is intended to clarify situations in tipped occupations, the revision adds one more item to the compliance checklist of small business owners and may further complicate timekeeping, scheduling, and overtime calculations.

For example, if you want to claim tip credit for the hours when a tipped employee performs directly supporting work, then you must ensure those activities do not exceed either the 20% or 30-minute limit. Doing this successfully will require careful shift planning and accurate time tracking. This may be a challenge when you have several employees performing various categories of work.

However, the rule could help with employee retention. The labor shortage in the restaurant industry has been partly fueled by low wages — a survey by One Fair Wage found that 53% of all restaurant workers are considering leaving their job, and 76% cited low wages and tips as their reason. If workers are sure that they will be adequately compensated for their work, you may have a lower employee churn and more committed employees.

Preparing for the updated rule: Steps you can take ahead of the effective date

Seek proper legal counsel

Wage laws require careful consideration and interpretation. The final rule contains several exceptions and stipulations that may or may not apply to your business, so you should consult with a qualified tax and/or legal professional on how the rules apply to your business.

Adopt technology to better manage employees

Whether you claim tip credit or not, it’s important to accurately track employee hours and manage shifts for maximum efficiency. Employee hours need to be tracked for compliance reasons, staffing reasons, and overall budgeting and overhead calculations for your business. If you intend to claim tip credit, then technology may be even more important for tracking hours. Manual and paper-based time tracking may not cut it. You’ll need to adopt technology that makes it easier to manage employees.

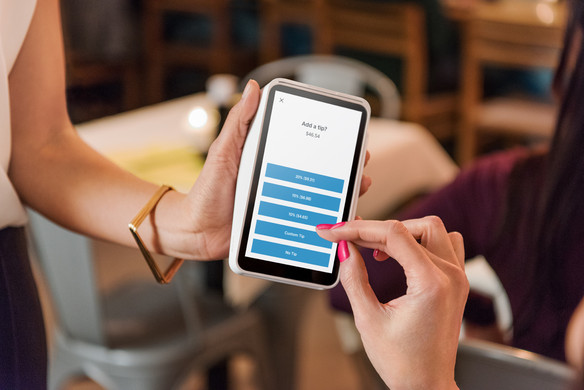

With Square Payroll tip importing, for example, you can automate the process of calculating tips and pull them into your payroll, with options for tip pooling or tipping directly synced to employee hours and wages. You can schedule and publish shifts, create accurate timecards, and automatically calculate overtime hours. Real-time data available in your dashboard can also allow you to make smarter staffing decisions.

![]()