Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

New for Retail

Build the shop that shapes your community

Now launching: Flexible new features to help you sync your sales channels, speed up your workflow, and power your decision making.

Turn real-time data into long-term growth with Square AI

Ask Square AI right from your Dashboard or Dashboard App to spot top customers, push the right promos, get help faster, and optimize inventory decisions all in one smart, synced system.

"We use Square AI to project sales, make inventory decisions, and engage loyal customers. With five stores and thousands of items, I used to spend hours in Excel. I estimate Square AI will save me about 100 hours this year."

Ryan Hester

Co-owner, Comfortably Chic

Chester, NJ

Clean up your product photos — automatically

Create professional-looking product images with a single click, right from your POS. Auto-polish instantly removes backgrounds so your products stand out — no photo editing needed.

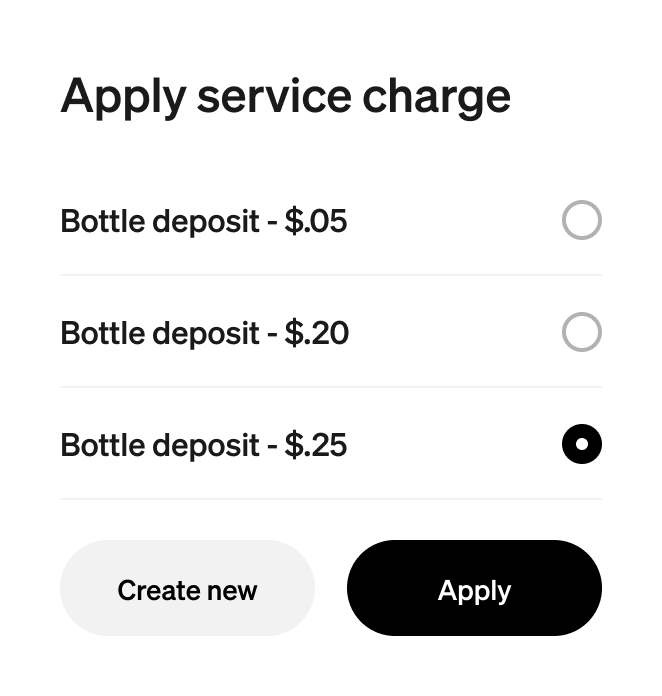

Speed up checkout with bottle deposits

Make checkout quicker with configurable deposit charges. Set up a bottle deposit per item, and it’ll be added to the order at time of checkout automatically.

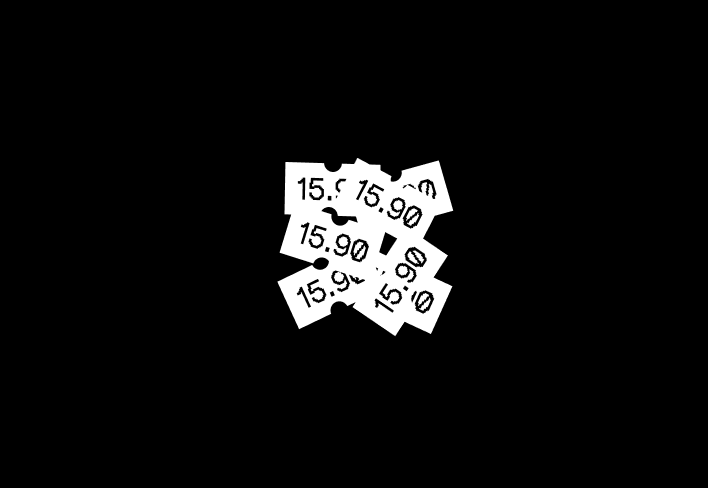

Clean up your product photos — automatically

Create professional-looking product images with a single click, right from your POS. Auto-polish instantly removes backgrounds so your products stand out — no photo editing needed.

Launch your site fast. Sync your store automatically.

Build a professional online store in minutes with Wix’s AI-powered onboarding, and connect it seamlessly to your Square catalog. Inventory, orders, and discounts stay in sync across online and in-person channels, so you can sell everywhere without the manual work.

SYNC WITH SHOPIFY USING THRIVE

Keep your inventory in sync across platforms

Sell online and in-store without worrying about double entry or mismatched stock. With Thrive Inventory, you can sync your Square catalog and inventory with Shopify, so you can sell in-store and online while managing products in one place. Keep Square as your source of truth and cut down on manual work.

RECONCILIATION REPORT

Connect the dots between sales and deposits

Understand where your money’s going. The reconciliation report breaks down sales, refunds, fees, and deposits — making it easier to match your daily earnings to what hits your bank account.

CUSTOM WORK WEEK

Make reports match your shop’s schedule

Set your business week to start on any day — not just Monday — so your sales and labor reports align with your actual shifts. Especially helpful for businesses that close on Mondays or run unique schedules.

There's more to explore

Feature log: Retail

Check out all the products and features we’ve already launched.

Roadmap

See what we’re working on: Get a sneak peek at the features and products launching soon.