Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

New for Services

Build the business that keeps projects and payments moving

Now launching: New features to centralize your payments, manage your projects, and solidify your reputation.

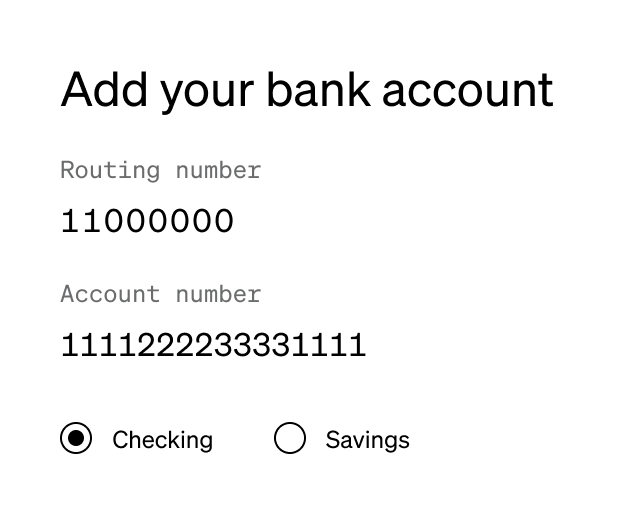

Get paid fast with ACH bank payments¹

Accept ACH bank payments easier than before by allowing customers to pay using just their bank account and routing number.

"I didn't quite realize that fees are lower for ACH bank transfers, and I could cut fees back for myself."

Emily Yates

Owner & lead designer, Flower Friends

Oakland, CA

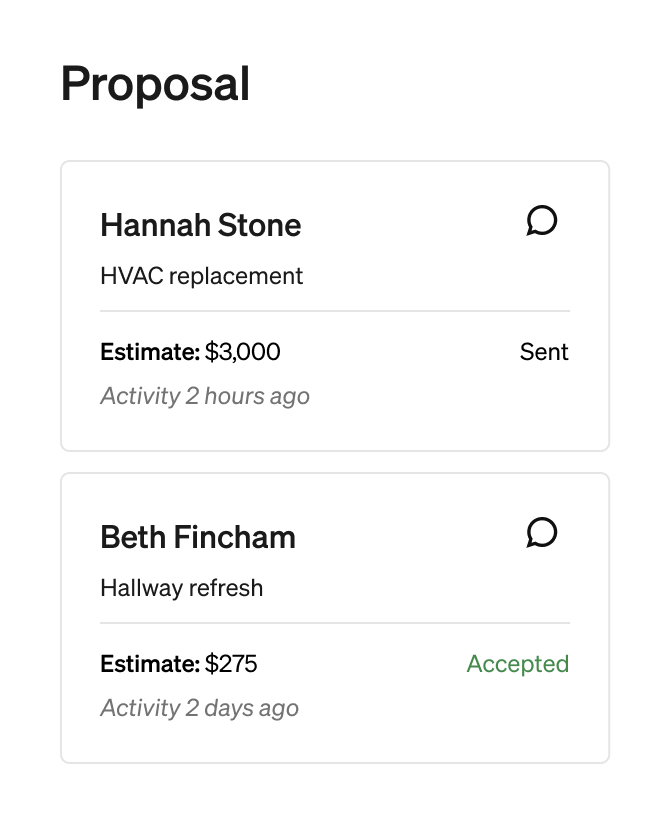

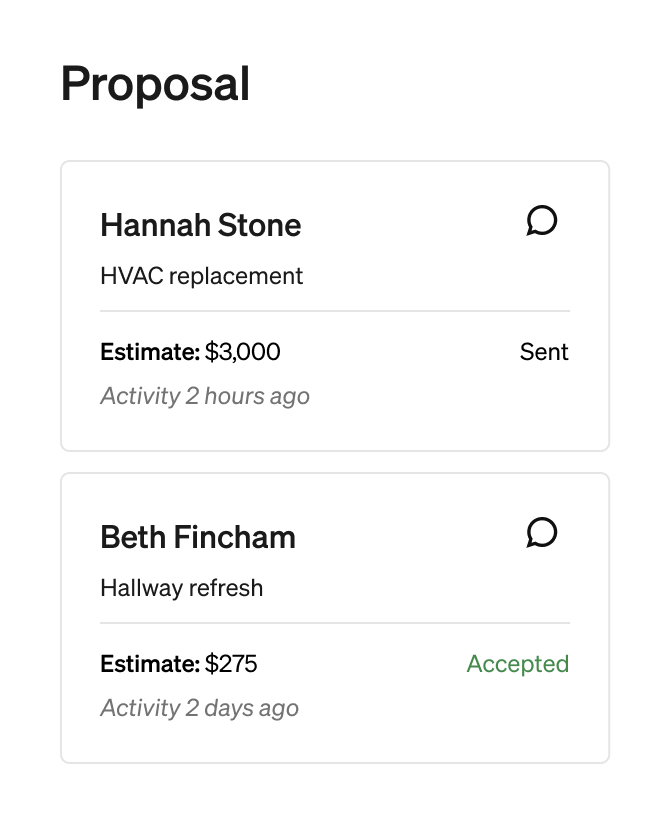

Stay organized and better manage your projects

Take control of your projects from inquiry to payment. Get a clear overview at a glance on estimates and invoice status to linked documents and customer communications.

Accept bitcoin² payments. Skip the fees.

Accept bitcoin just like card or tap-to-pay — only with faster payment settlement and with zero processing fees through 2026. Learn more about how you’ll keep more of every sale, and how money settles instantly into your bitcoin wallet or USD account.

Stay organized and better manage your projects

Take control of your projects from inquiry to payment. Get a clear overview at a glance on estimates and invoice status to linked documents and customer communications.

Grow your business with insights from Square AI

Chat with Square AI to get actionable recommendations on how to scale your business, using data from your business, industry trends, and web search. Square AI can also help you discover new Square features so you can better understand how our tools can work for you.

SQUARE AI

Make decisions about your restaurant — fast — with Square AI

Square AI helps you make smarter choices quickly using real-time data from your own business, and from your own neighborhood. Discover how you can spot trends, catch problems early, and focus on what’s working just by asking a question — and all right from your Dashboard.

SQUARE AI

Make decisions about your restaurant — fast — with Square AI

Square AI helps you make smarter choices quickly using real-time data from your own business, and from your own neighborhood. Discover how you can spot trends, catch problems early, and focus on what’s working just by asking a question — and all right from your Dashboard.

SQUARE AI

Make decisions about your restaurant — fast — with Square AI

Square AI helps you make smarter choices quickly using real-time data from your own business, and from your own neighborhood. Discover how you can spot trends, catch problems early, and focus on what’s working just by asking a question — and all right from your Dashboard.

There's more to explore

Feature log: Services

Check out all the products and features we’ve already launched.

Roadmap

See what we’re working on: Get a sneak peek at the features and products launching soon.

More for services

Dig into more ways Square can serve your service business.

Join the 4M+ businesses running with Square

1Some eligibility required. Please visit our Support Center to check if your business meets the criteria, or reach out to Square support if you have any questions.

2Square Bitcoin is not offered to NY Sellers or non-US Sellers. Availability subject to change and regulatory approval. Bitcoin’s value is volatile and can change quickly. Bitcoin transactions are irreversible and may experience occasional delays or payment failures. Bitcoin services are provided by Block, Inc., licensed where required. Block, Inc. operates in NY as Block of Delaware and is licensed to engage in virtual currency business activity by the NYDFS.