Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Savings Save automatically, budget effortlessly

Automatically save with every card sale

Organize with folders

100% free, no fees

Earn competitive APY¹

Savings tools at your fingertips

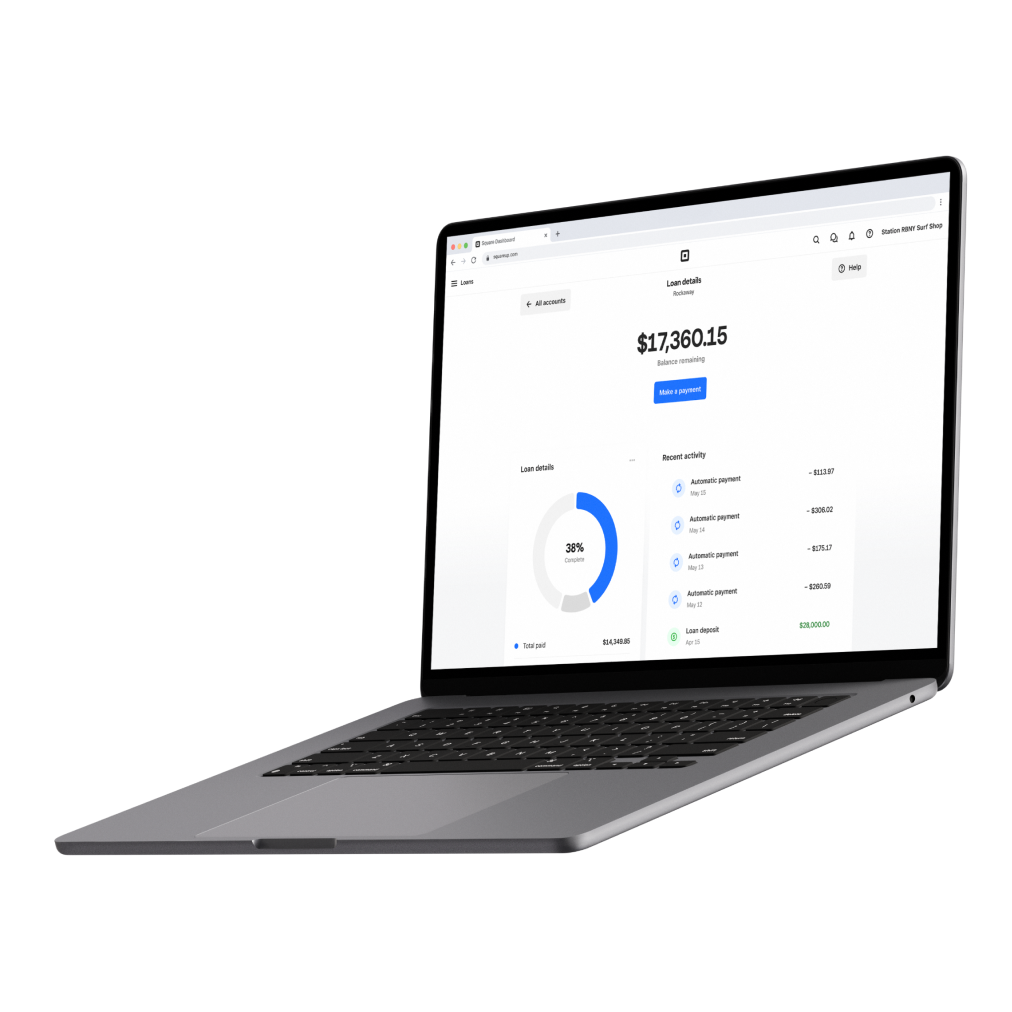

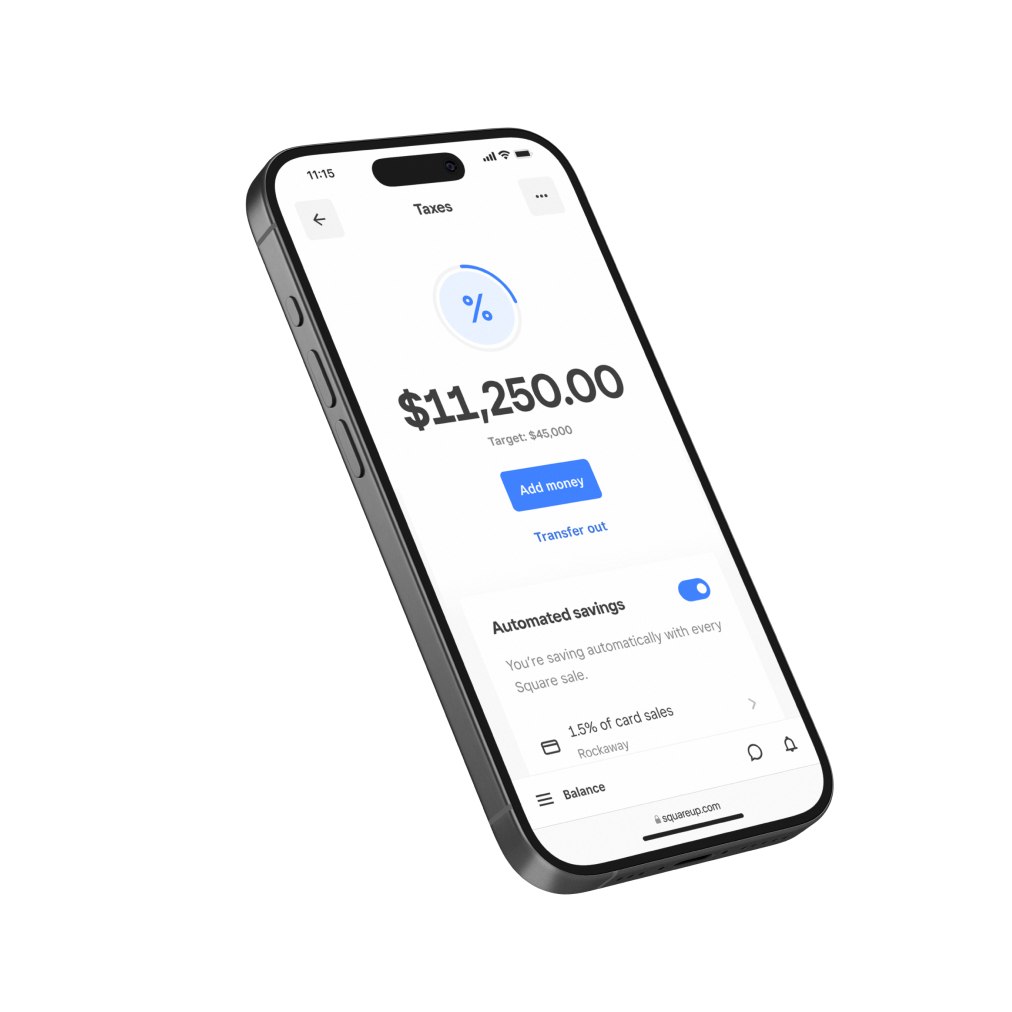

Budget automatically

Plan ahead for future expenses with predictable savings. Automatically set aside part of your card sales for taxes, supplies, and more with a business savings account. Track your progress, adjust goals, and pause at any time.

Stay organized with folders

Control where your money goes. Whether you're saving for business milestones or everyday expenses, folders help you easily stay on top of your savings — all in one place.

New

Get smart recommendations

Take the guesswork out of budgeting with personalized guidance on how much to set aside for top expenses, based on insights from businesses like yours.²

Grow your money with APY

Earn interest on your money up until the moment it’s spent, with 1.00% APY across all money in savings folders (that’s more than 2x the national interest average).³

Enjoy more peace of mind

Fast, free transfers

Transfer money out of Savings and into Square Checking instantly and for free. No more waiting.

FDIC-insured

Keeping your money safe is a priority — all funds in Square Savings are FDIC-insured up to $2.5M.¹

Absolutely no fees. Ever.

Square Savings

Other banks

Monthly service or maintenance fees

Square Savings

$0

Other banks

$4–$8 per month

Minimum balance requirement

Square Savings

$0

Other banks

$300–$500 minimum

Opening deposit

Square Savings

$0

Other banks

$25–$100

Overdraft fees

Square Savings

$0

Other banks

$10–$36 per item

Withdrawal limit fees

Square Savings

$0

Other banks

up to $10

Transfers to external bank accounts

Square Savings

$0

Other banks

$0

“I got into Square Savings when someone on the Square Community Board recommended it for saving for sales tax — and sales tax is the worst. It was genius that I could just set it up and automatically deduct 10% of my daily earnings or sales. It made this last tax filing so easy; it was incredible.”

Doran Tomako

Haute Beauty

Monterrey, CA

“I actively use my Square savings account to set aside money for future business needs. I'm saving for opening a second location, upgrading equipment, marketing campaigns, and emergencies like slow seasons or repairs.”

Fumio Tashiro

Mirror Tea House

Brooklyn, NY

"I’ve always saved for taxes. Growing up, I understood how important that was. Square tells you how much to put aside into Square Savings, and it’s easy. When it’s time to pay your taxes, there you go — the money’s already there."

Juan Saravia

La Pupusa Urban Eatery

Los Angeles, CA

"This is why I love Square: Square has a feature that makes saving for taxes out of sight, out of mind. As soon as someone pays me, it instantly takes out a certain percentage that I set up, and it goes right into that account. I don't have to do anything.”

Lisa Giles

Life of Lisa G

Newport Beach, CA

90%

of users love Square Savings

185K+

sellers use automated savings

$3.86B

saved for goals like taxes or new equipment

Get your money moving at your speed

Talking money

FAQ

What is Square Savings?

Square Savings is a free business savings account that makes it easy to automatically save, budget and organize your money from card sales – all while earning competitive interest. It is integrated with Square payments so you can automatically set aside a percentage of every card sale and budget for key expenses – all in one place. You can easily organize your savings into folders named after your goals, making it easy to see, track and manage your progress. All funds set aside earn an APY (annual percentage yield) of 1.00%, with no monthly maintenance fees and no minimum required to open an account.

Does Square Savings charge fees?

No! There are no monthly maintenance fees, sign-up fees, or fees associated with minimum balances. There are also no overdraft fees or withdrawal limits fees that are associated with traditional business savings accounts.

Is Square Savings FDIC insured?

Yes, your Square Savings account(s) are insured by the FDIC up to $2,500,000.

Can I access my money anytime, and are there limits on withdrawals?

You have 24/7 access to your Square Savings account with no limits on how often you can withdraw. You can instantly transfer funds to your Square Checking and spend them right away using your Square Debit Card, for free. You can also make standard ACH transfers to external bank accounts, which typically settle in 1–2 business days. If you're using automated savings, daily contributions are deposited at 5 PM MST.

Contributions made after that time will be deposited the following day.

Please note: ATM withdrawals are not enabled for Square Savings, however, you may use ATM withdrawals through Square Checking.

How does automated savings work?

With automated savings, you can choose a percentage of your Square card sales revenue to move into a dedicated savings folder. Many business owners automatically set aside funds for expenses such as income or sales tax, bills, supplies or longer term savings goals, in order to separate those funds from their primary business banking account.

How do I transfer in and out of Savings?

You can easily transfer money in or out of your Square Savings account. Just select the folder you want to transfer from, choose “Transfer,” and follow the prompts to move money to or from your linked Square Checking or external bank account.

Where do I find my monthly statements?

Monthly Savings statements are available in your Square Dashboard. Go to your Savings account, select “Statements,” and you’ll be able to view or download your past statements anytime.

Ready to bank with Square?

Get financial tips and hear how other businesses manage their cash flow with Square.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

¹Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

²Savings recommendations are for informational purposes only and do not represent financial advice.

³The rate of our savings account is more than 2x the national average of 0.41% APY, based on the national average of savings accounts rates published in the FDIC Weekly National Rates and Rate Caps accurate as of 1/21/2025.

© 2025 Square, Inc. and/or Square Financial Services, Inc. All rights reserved.