Features

Get everything you need to run payroll quickly and easily.

Run payroll in minutes.

Save time with simple, easy payroll. No commitment, no long-term contracts required.

Pay W-2 employees and contractors.

Pay W-2s and 1099s with hourly, salary, or custom amounts in just a few steps with unlimited pay runs per month.

Pay your team faster.

Qualifying businesses have the option to run payroll up to two business days before your team’s pay date, giving you more time and flexibility to run payroll.

Automate pay day.

Set your payroll to run automatically to pay your employees every pay period.

Run payroll on the fly.

Manage your team and run payroll anytime, from anywhere, with the mobile Square Team App.

Onboard with ease.

Streamline onboarding for you and your employees. Invite your team to enter their own details so you can get up and running in just a few steps.

Manage your team.

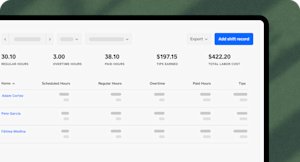

Import timecards and tips to reduce human error.

Import timecards.

Access timecards from Square POS or the Square Team App and easily import them into payroll.

Import tips.

Calculate direct tips automatically and import them into your payroll run.

Schedule your team.

Create, manage, and publish schedules for yourself and your entire staff.

Get labor-cost reporting.

Gain visibility into your labor costs, including all wages.

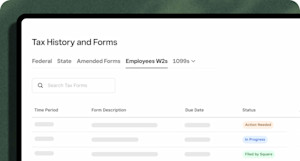

Automate tax filings.

We handle your quarterly and annual filings to help you stay compliant and on time.

Automatic payroll tax calculations and filings

We calculate, withhold, and file federal and state payroll taxes on your behalf.

W-2s and 1099-NECs

We generate and file W-2s and Form 1099-NECs for your team in January for the prior tax year.

Multiple tax jurisdiction support

For each state or tax jurisdiction in which you process payroll, we will remit your tax payments and complete your tax filings to the applicable tax agency on your behalf.

New-hire reporting

We report new hires according to the regulations for your state if requested to do so when adding an employee to payroll.

Empower your team.

Provide easy access to payroll information in the Square Team App and employee benefits.

ADD-ON Health insurance

Offer medical, dental, and vision insurance to your employees with our partner, SimplyInsured.

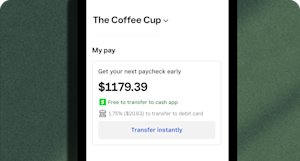

Instant Deposit

Eligible team members that use Cash App can use the Instant Deposit feature to access their pay two calendar days before the original pay date. Available in qualifying states.

ADD-ON 401(k) retirement benefits

Offer 401(k) retirement benefits to your employees with our partner, Guideline.

Square Team App

Let your team use their phones to clock in and out, to track hours worked, and to view estimated earnings and pay stubs.

Get support when you need it.

Live payroll service specialists are available to help every step of the way.

Onboarding guidance

Get customer support as you onboard to ensure that you are set up for success.

Payroll specialists

Get your payroll questions answered from live specialists, available M–F 6 a.m.–6 p.m. PT.

Have questions?

Square Payroll is fully integrated with Square, so everything from onboarding to scheduling to paying your team is simple. We offer flexible payroll solutions, including unlimited monthly runs and faster direct-deposit options, to meet your business needs. Square Payroll comes with automatic payroll tax filings and integrated benefits so you can have peace of mind when running payroll.

Onboarding to Square Payroll is easy through the Square Dashboard. We’ll ask you a few questions about your business to get started, and we have dedicated payroll specialists to help answer any questions along the way.

Square Payroll offers unlimited payroll runs at no extra cost.

Yes, Square online payroll services handle your federal and state tax filings and payments on your behalf at no additional charge. Team members — both W-2 employees and 1099 contractors — are provided with digital copies of their tax forms.