Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square for Coffee Shops & Cafes A fast, reliable POS to ease your daily grind

Keep the lines moving and the coffee brewing

Take fast payments, even offline

Accept every type of payment and offer max convenience for customers. Power through the morning rush with a fast POS, and make sales with offline mode1 if the Wi-Fi’s down.

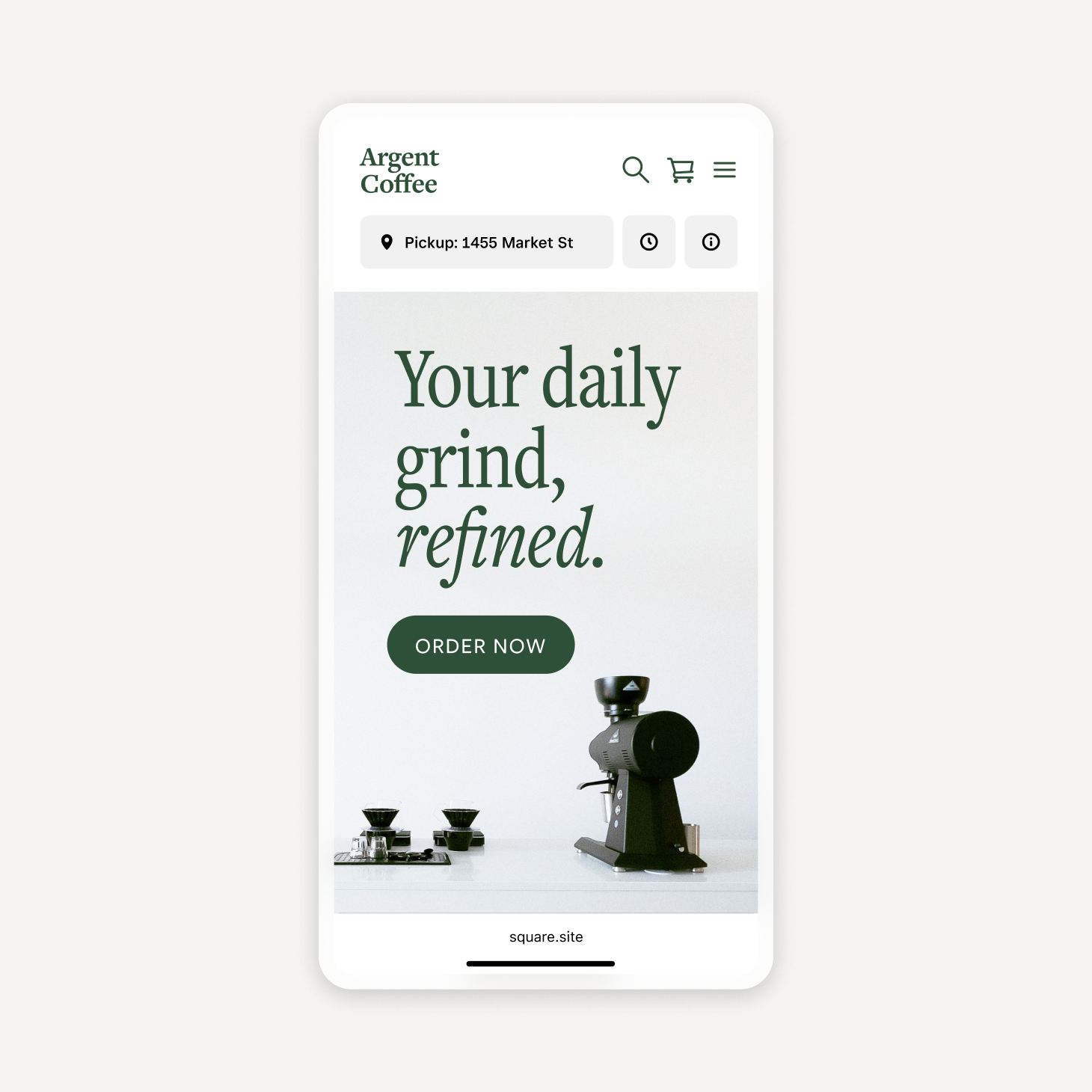

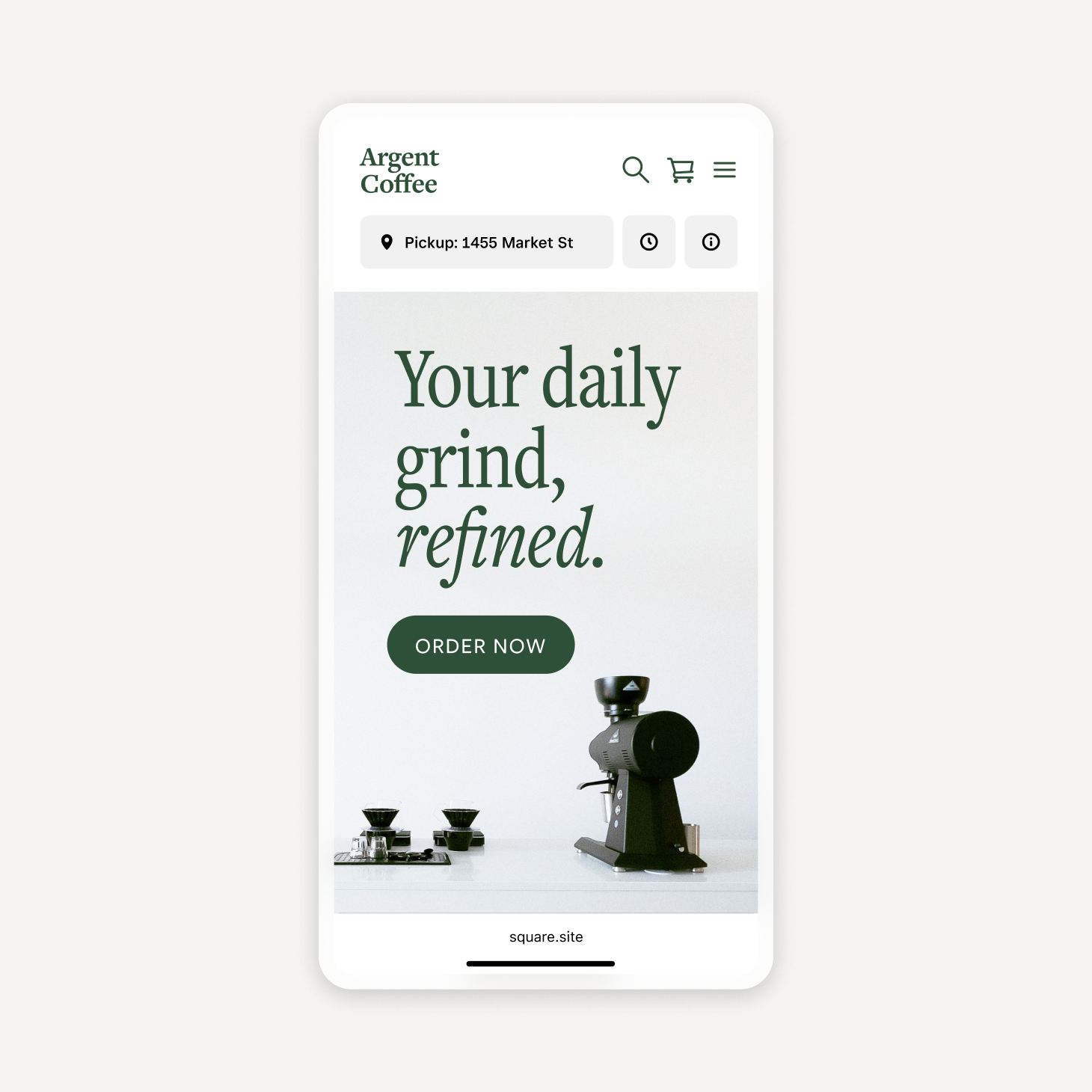

Let customers order and pay online

Quickly set up a branded online ordering page to drive bigger sales and save up to 30% on every online order with commission-free pickup and delivery.2

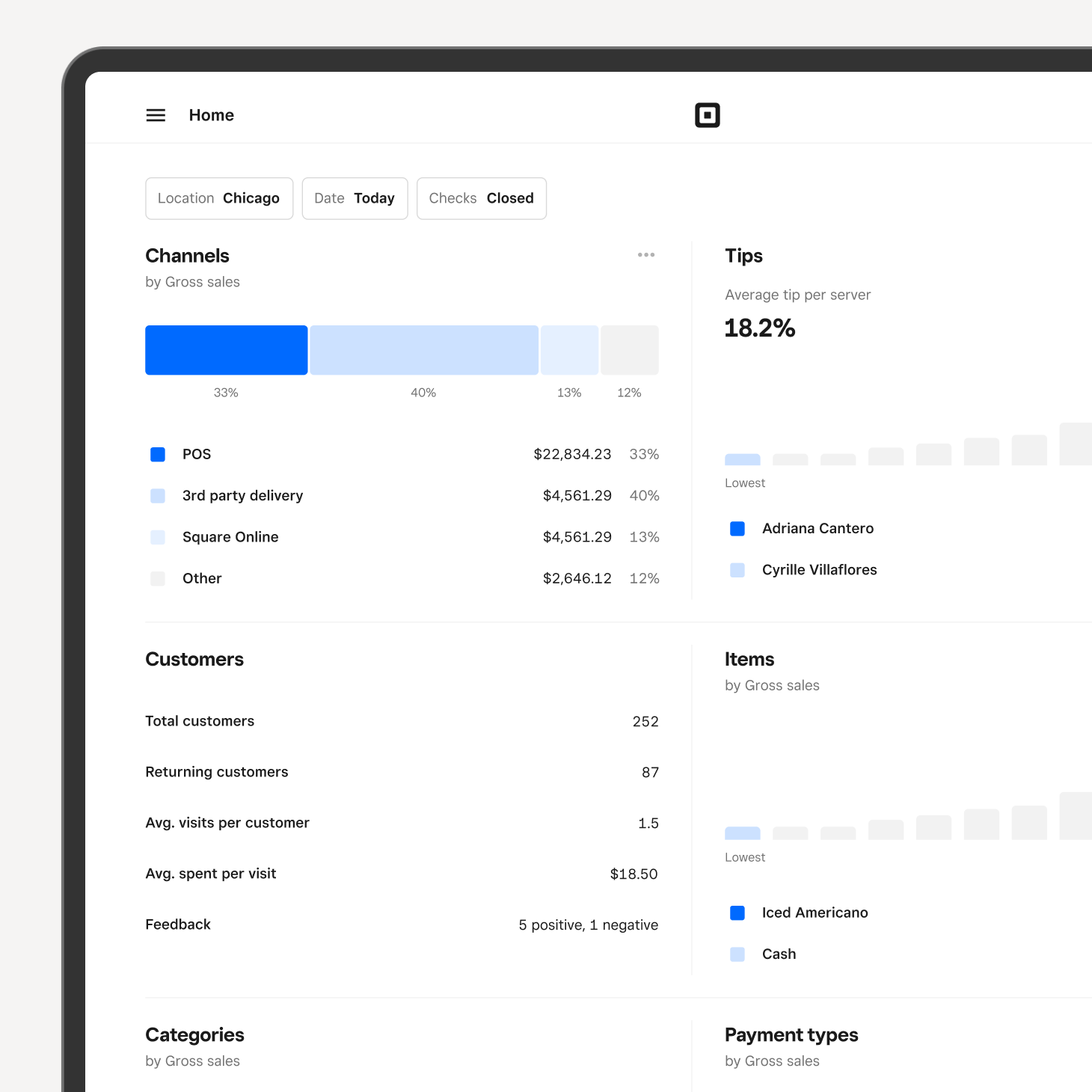

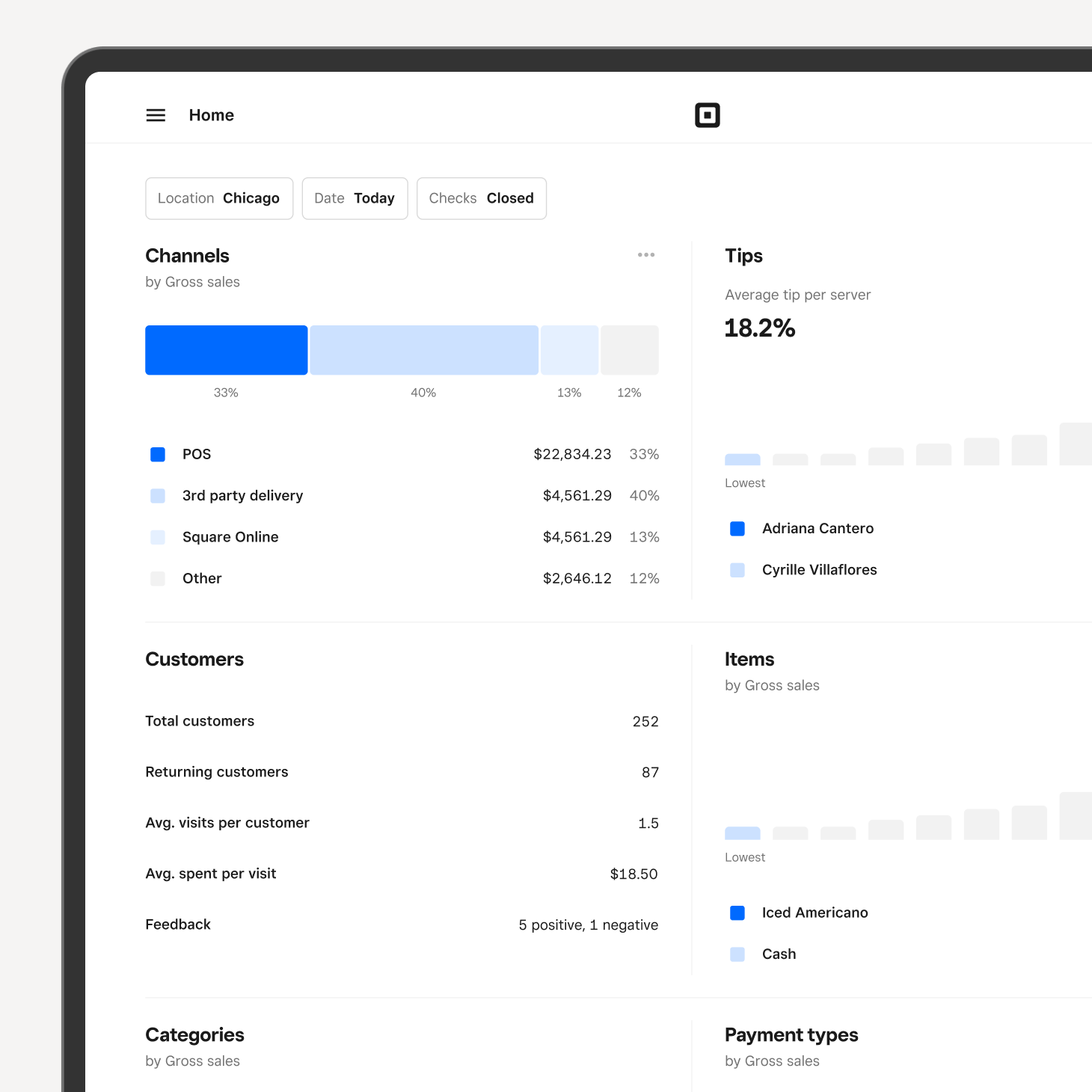

Steer your business based on data

Pull reports on everything from your bestselling beans and busiest hours to your most loyal customers. Use numbers to pinpoint exactly where to invest your time and money.

Expand your earning potential

Increase your order volume3 with the self-service Square Kiosk, which reduces wait times and frees up staff. Explore solutions for new revenue streams like catering and merch.

Hit your volume goals

Support your roadmap with growth-minded features like automated marketing and loyalty, branded gift cards, and built-in financial solutions.

More tools to grow your business

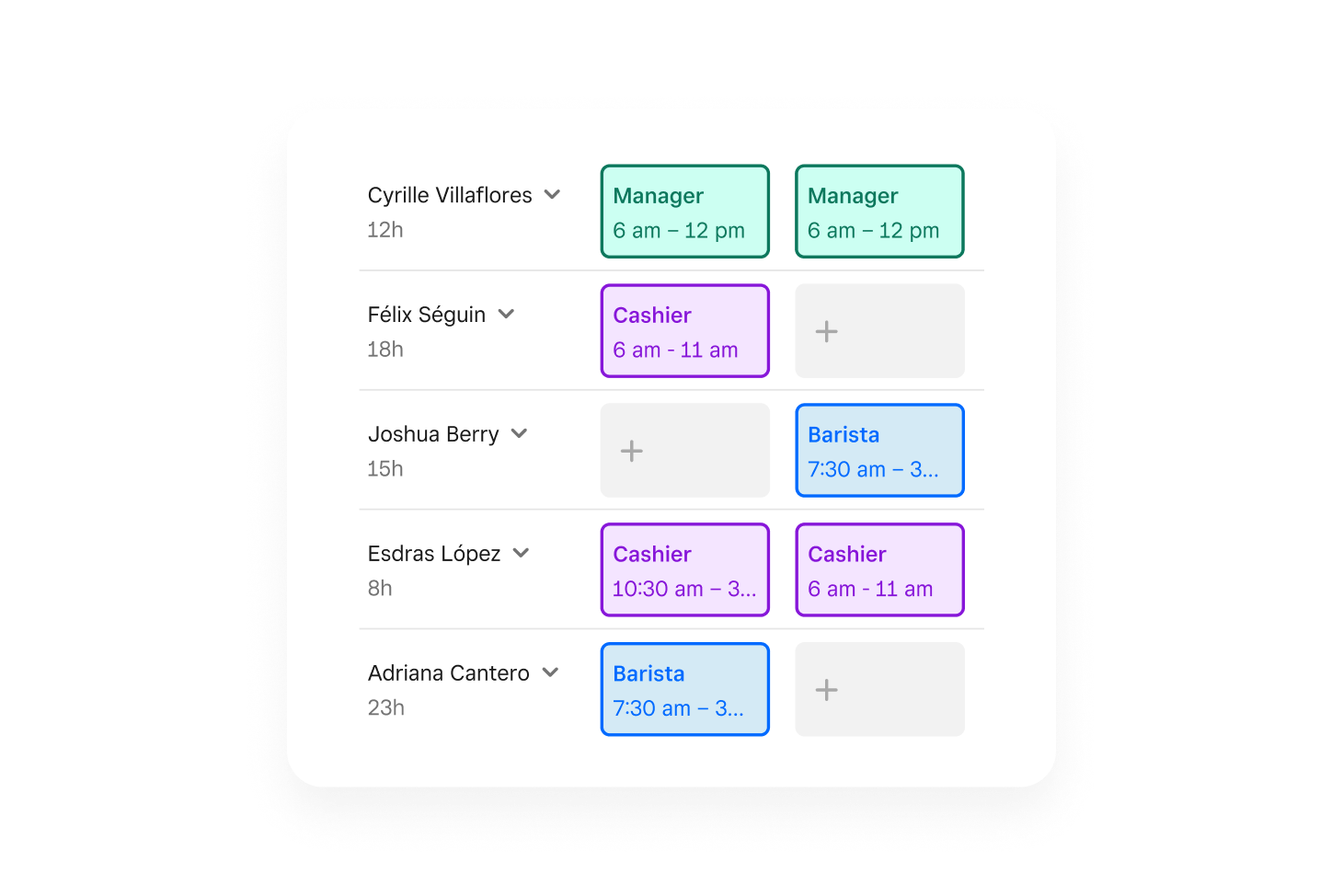

Staff management and empowerment

Onboard and communicate with your team, create schedules, and track hours. Save on time and labor costs by simplifying payroll and taxes.

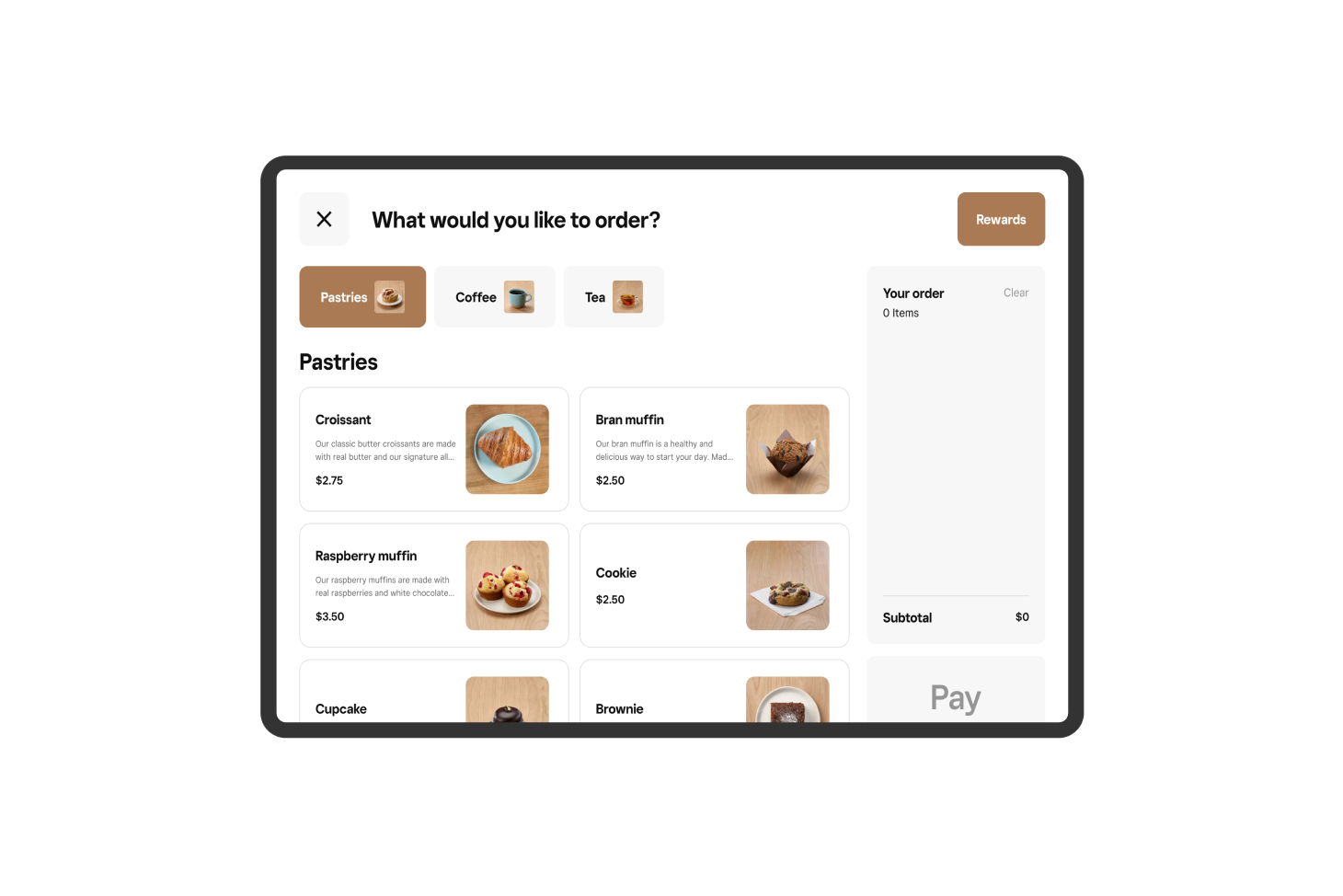

Self-service kiosk

Boost check sizes with a flexible kiosk that lets customers easily upgrade, add on, and customize. Capture orders by table number to avoid customers crowding the counter.

100+ popular app integrations

Easily connect third-party marketplaces and get the integrations you need to

keep your business flowing.

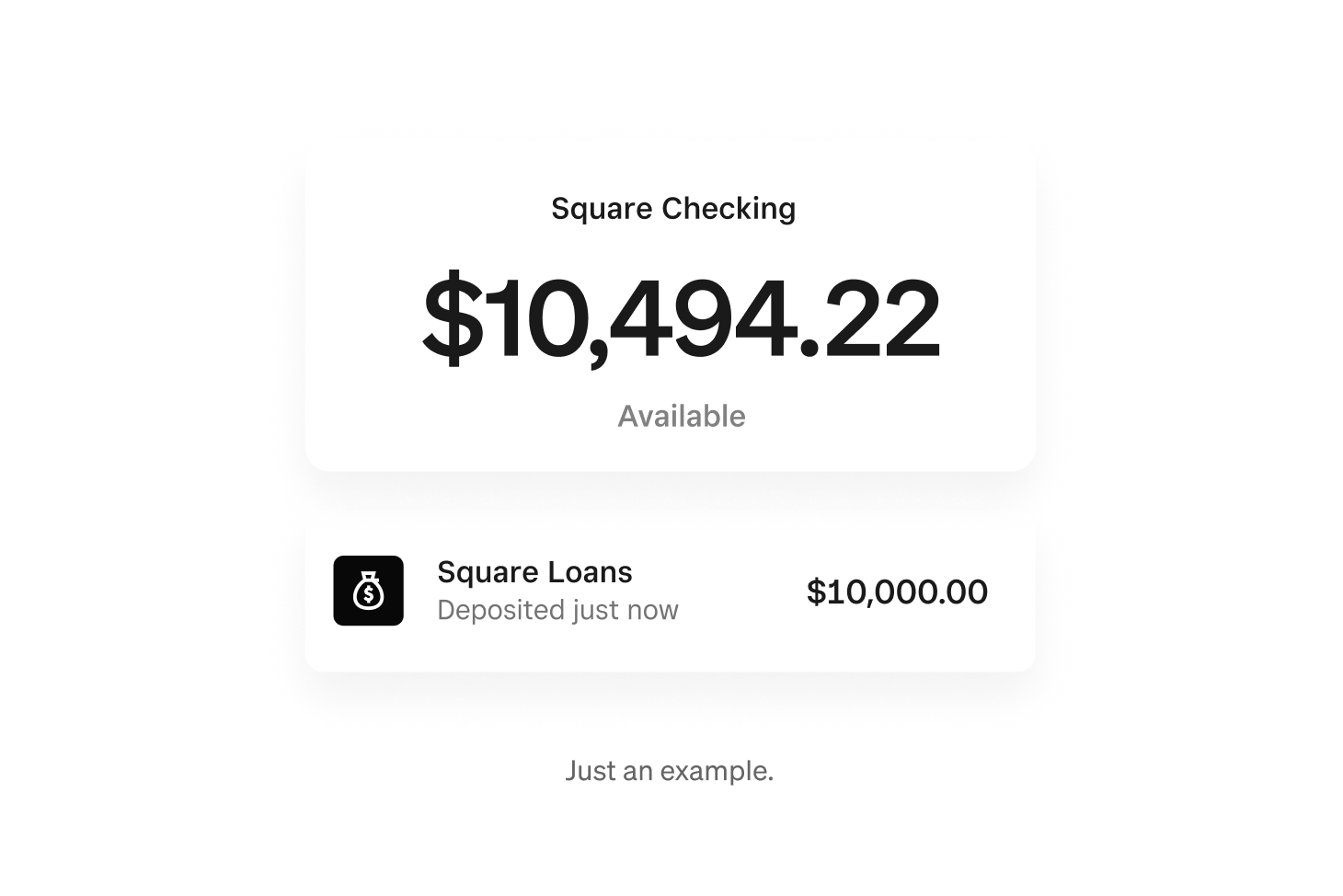

Better control of your cash flow

Turn your sales into savings and grow your business with banking products like loans3, instant transfers4, and more.

“Ultimately, you’re leaning into what people are already buying. So by relying on that data, we saw a huge jump in interest from the spritzer to the oak milk mocha.”

Keba Konte, founder

Red Bay Coffee

Oakland, CA

Hardware that lets you focus on the perfect pour

Square Register

Run your entire business right out of the box with a fully integrated, two-screen solution.

Square Handheld

Cut queues, take tableside orders and payments, and expedite checkout with a pocketable POS.

Square Stand

Simplify checkout in just one swivel with an iPad POS you already know how to use.

Square Kiosk

Bust lines and free up staff with an iPad-run kiosk that you can set up entirely on your own.

Get one plan to run your entire business

Top food and beverage features

Item and menu management

Operations, pickup, and local delivery

Branded online ordering page

Details

Top food and beverage features

Item and menu management

Operations, pickup, and local delivery

Branded online ordering page

Top food and beverage features

$30/mo. for the Square KDS app per device

$50/mo. for the Square Kiosk app per device

Close of day procedures and reporting

Details

Top food and beverage features

$30/mo. for the Square KDS app per device

$50/mo. for the Square Kiosk app per device

Close of day procedures and reporting

Square Pro

Get custom pricing

If you process over $250,000 per year, talk to our team to see if you’re eligible for custom pricing and processing fees. You can also ask about hardware discounts, onboarding and implementation support, technical specialists, and account management.

Tips to fuel the next steps on your journey

Get the tech trusted by coffee shops since 2014

1Offline payments are processed automatically when you reconnect your device to the internet and will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined, or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. Offline payments are not supported on Square Reader for contactless and chip (1st generation, v1 and v2). Learn more about how to enable and use offline payments here.

2Delivery commission saving is an estimate based on an assumed 30% commission charged by third-party delivery partners on premium plans.

3Based on an October 2024 comparison of Square sellers' order volume pre- and post-Kiosk implementation, a 30% in order volume was observed.

4Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc. All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

5Instant and same-day transfer require a linked bank account or debit card and costs a fee per transfer. Funds are subject to your bank’s availability schedule. Minimum amount is $25 USD and maximum is $10,000 USD in a single transfer. New Square sellers may be limited to $2,000 per day.