Table of contents

Staying up to date with tax filing guidelines is essential to running your business. This is especially true when paying sole proprietors, an independent contractor, and operators of single-member LLCs.

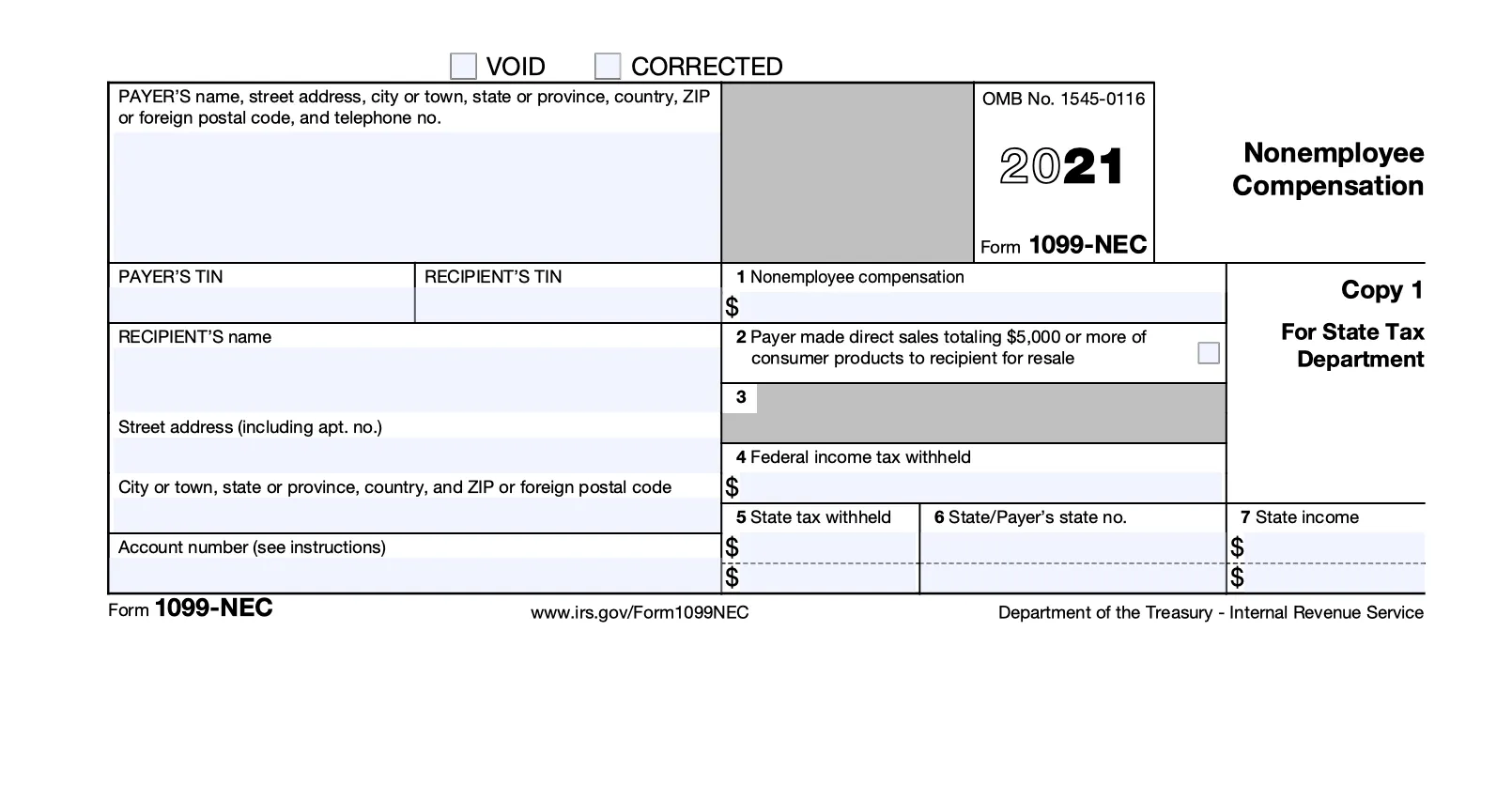

Before the 2020 tax year, employers used Box 7 of Form 1099-MISC to report nonemployee compensation for sole proprietors and other self-employed parties. With the recent reintroduction of Form 1099-NEC, Nonemployee Compensation, employers are working with a different form than they’re used to when it comes to paying independent contractors and freelancers.

What is Form 1099-NEC?

The IRS reintroduced Form 1099-NEC, which had fallen out of use in the 1980s, to simplify nonemployee compensation reporting. The IRS requires you to file Form 1099-NEC for each person in the course of your business to whom you have paid at least $600 during the year in:

- Services performed by someone who is not your employee, including parts and materials

- Cash payments for fish or other aquatic life you purchase from anyone engaged in the trade or business of catching fish

- Payments of legal fees to an attorney

Businesses that typically need to issue a 1099-NEC include those that pay independent contractors, freelancers, LLC sole proprietors, and other providers of products or professional services who are not on payroll. For example, real estate agents might issue a 1099-NEC to property management service providers, and construction companies would do the same for subcontractors.

The key criterion is that these payments must total $600 or more in a year for services rendered in the course of the business.In general, you don’t have to issue 1099-NEC forms to C corporations and S corporations. But there are some exceptions, including legal, medical, and health care payments. Personal payments do not require a 1099-NEC.

How do I file Form 1099-NEC?

Form 1099-NEC can be filed by mail or online, known as an E file. A version of the form is downloadable, and a fillable online PDF format is available on the IRS website. You can complete the form with IRS Free File or a tax filing software. Recipients of Form 1099-NEC must report this income on their federal tax income returns.

In Box 1 of Form 1099-NEC, you will enter the individual’s nonemployee compensation (NEC) of $600 or more. This includes fees, commissions, and prizes and awards for services they performed as a nonemployee. See a sample version of the form below.

Before filing a Form 1099-NEC, double-check your state filing details, as some states have their own filing requirements, such as different deadlines or reporting thresholds.

When do I file Form 1099-NEC?

You are required to file Form 1099-NEC on or before January 31, 2025, using either paper or electronic filing procedures.

Do I need to send Form 1099-NEC to contractors I pay via digital payments?

If you make payments to 1099 contractors via credit card, debit card, or third-party payment systems, such as PayPal or Venmo, you don’t need to send a 1099-NEC. This is because the financial institution will report these payments on your behalf.

When do I use Form 1099-NEC versus Form 1099-MISC?

Now that Form 1099-NEC has been reintroduced, business owners need to understand its distinction from Form 1099-MISC. Essentially, Form 1099-NEC is now used to report payments for nonemployee compensation for services, whereas Form 1099-MISC is now used for reporting “miscellaneous information,” such as royalties, rents, and prizes and awards that are not for services performed.

It’s worth noting that, while payments to an attorney go in Form 1099-NEC, there are some instances in which payments to an attorney are reported in Box 10 of Form 1099-MISC. The IRS provides clear instructions for filing both Form 1099-MISC and Form 1099-NEC that address payment to attorneys and other considerations.

Form 1099-NEC and Form 1099-MISC are just two of the multiple tax forms you may need to file to make sure you’re compliant. Failure to file the correct forms and make the required payments can result in IRS penalties, so it’s worth speaking to a tax professional to ensure you don’t miss anything.

If you pay an independent contractor with Square Payroll, however, Form 1099-NEC will be generated, filed, and mailed to the mailing address provided for each of your contractors at year-end, enabling you to focus on your business instead of worrying about tax filing guidelines.

![]()