Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Eligible customers from Gravity Forms can get up to $3K in free processing credits¹

Accept payments like a pro

Whatever your type of business, collect payments effortlessly with business tools from Square and powerful forms from Gravity Forms.

Exclusive benefits for Gravity Forms customers

As a Gravity Forms customer, you're eligible for up to $3,000 in free processing credits in your first 180 days, plus $20 off Square hardware.¹

Manage your business from one place

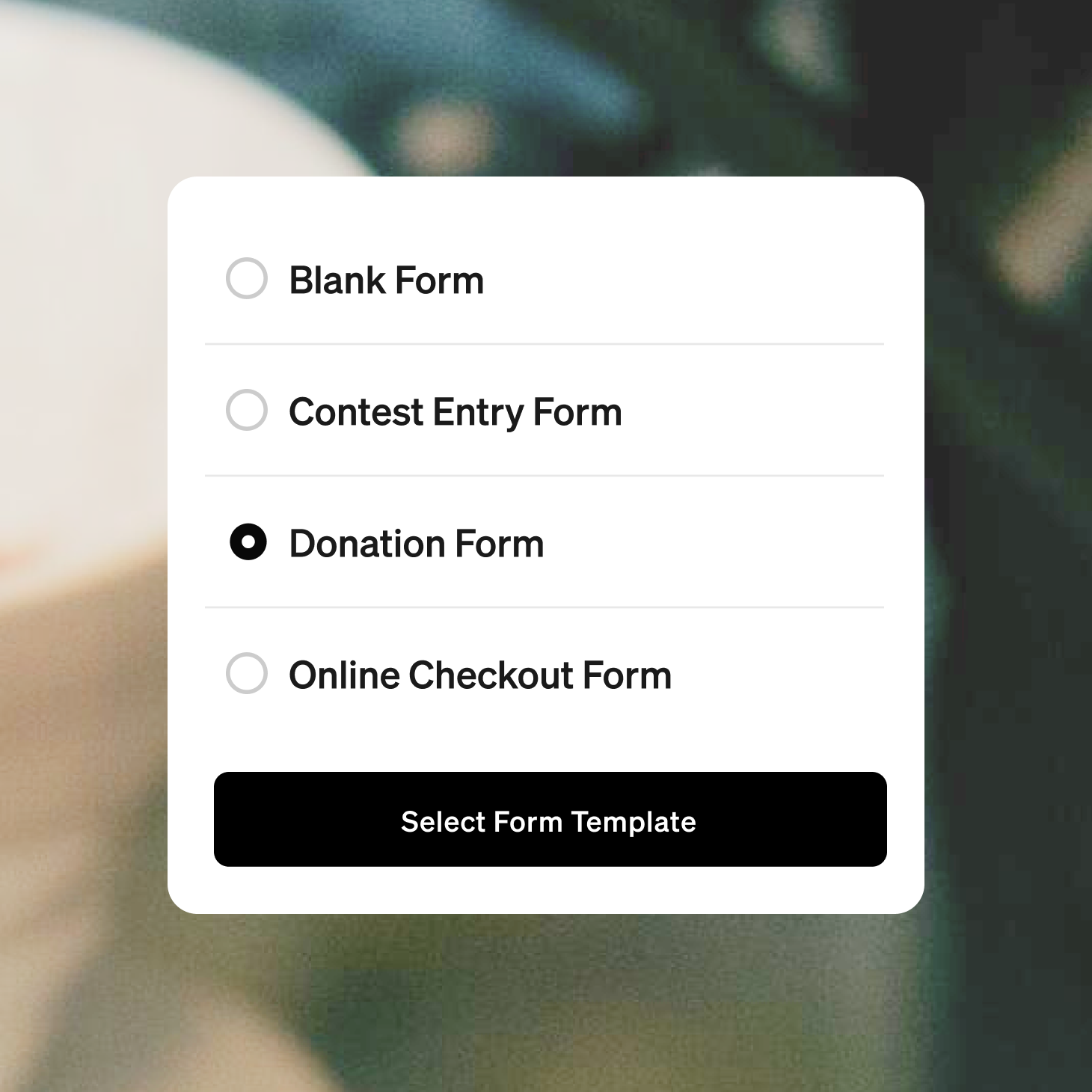

Accept payments 24/7

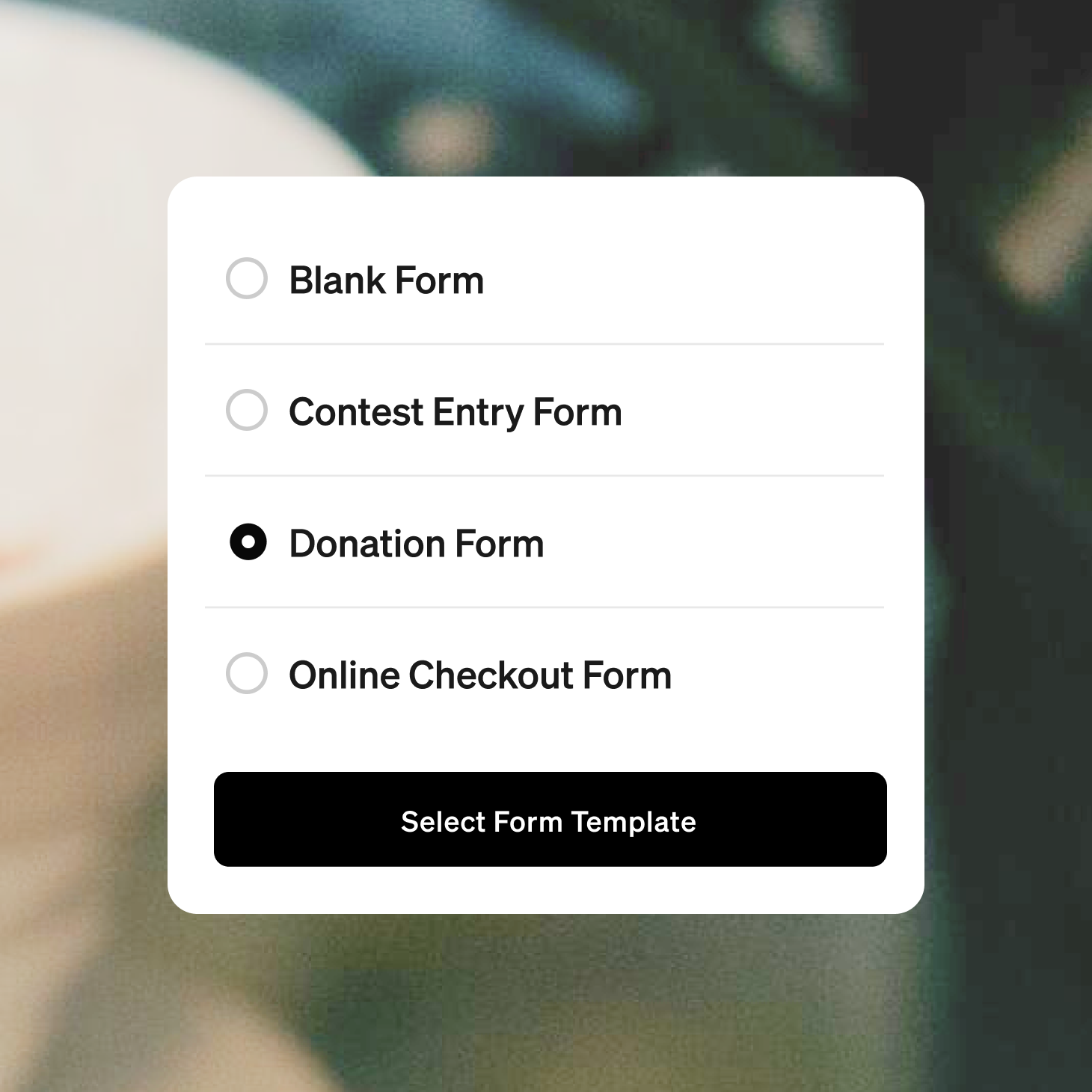

Collect payments directly through your forms

Support all major credit and debit cards

Send automated invoices and payment requests

Take contactless payments with just your phone

Grow beyond forms

Create an online store or integrate your existing website

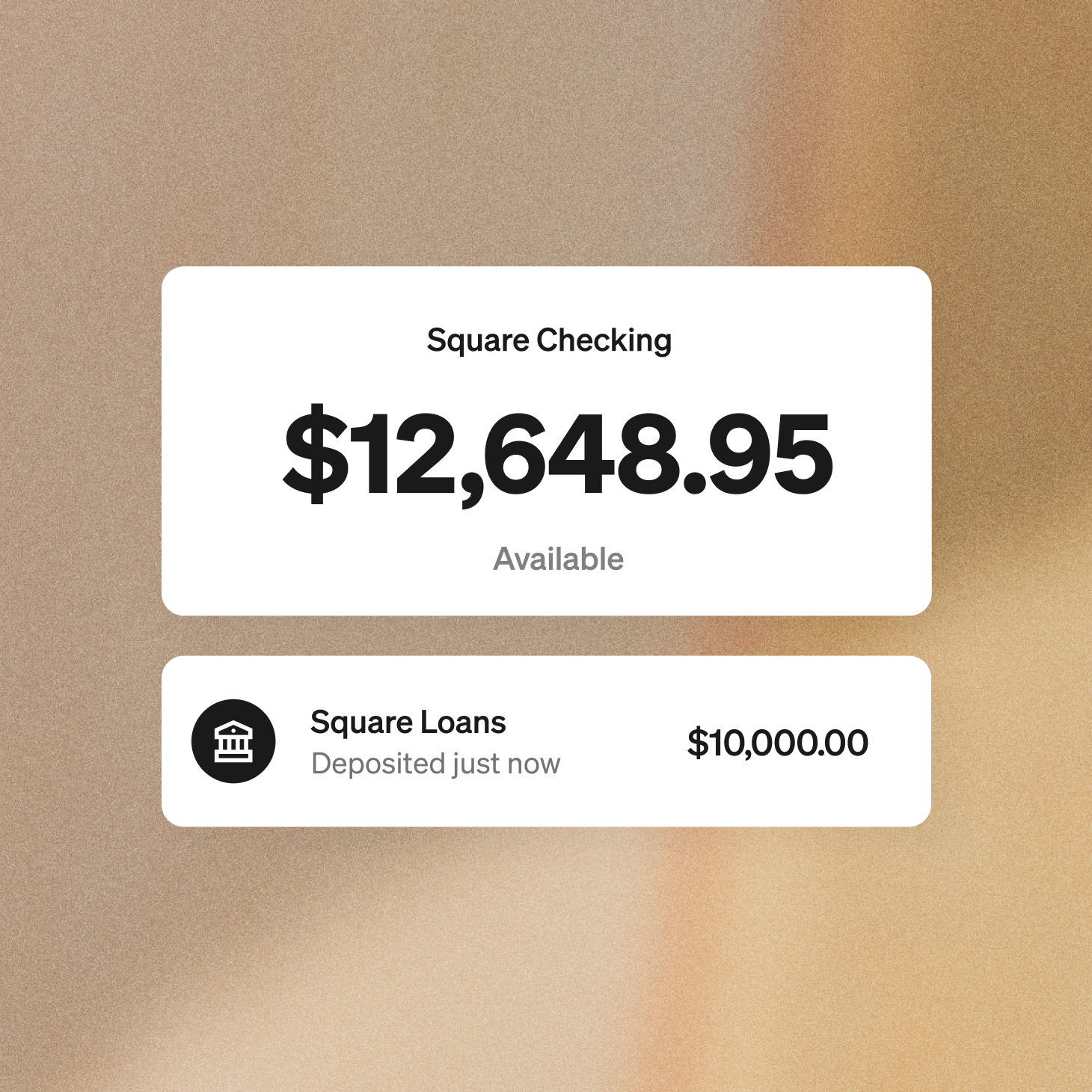

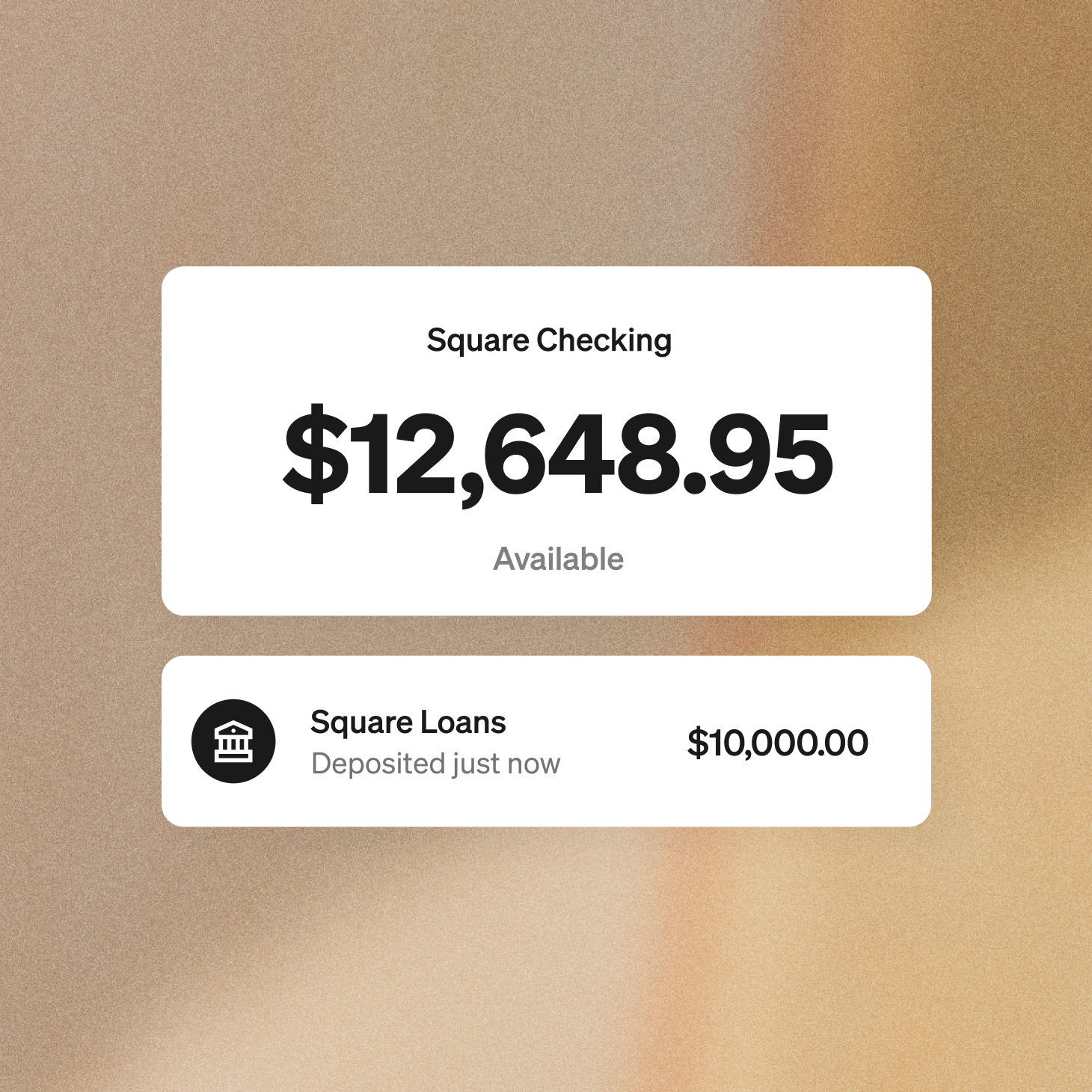

Access your money instantly with a free Square Checking account²

Automatically set aside funds from transactions with Square Savings³

Get funding offers to scale your business⁴

Modern, reliable hardware

Customize your setup with exactly what you need

Choose portable or countertop devices to serve your customers

Built-in monitoring identifies suspicious payment activity

Security you can trust

All payments encrypted end-to-end

Built-in monitoring identifies suspicious payment activity

PCI compliance handled automatically — no stressful yearly maintenance updates required

Square manages chargeback disputes for you

Hardware that works wherever you do

“Being able to say I can take any payment method is really nice and convenient for the clients.”

Tiffany Cady, owner

Angel Pets

Houston, TX

Ready to try Square?

1 Limited time offer valid only for new Square customers and is not transferable. Offer expires 180 days after account creation. Free Processing: Processing fees are waived on eligible transactions up to the total free processing amount specified in the offer or until the expiration date, whichever comes first. SaaS Discount: Discounts on subscriptions will be applied starting with your first monthly bill, even if that bill is charged at a prorated amount when signing up in the middle of a calendar month. Following the expiration of the promotional period, you will be charged at the standard monthly rate. Visit Pricing and Subscriptions in your dashboard after signing up to view your standard rates. Square reserves the right to modify, revoke or cancel the offer at any time. This offer cannot be combined with any other offer. Void where prohibited, not redeemable for cash, and non-transferable.

2 Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard.

Square Debit Card may be used wherever Mastercard is accepted.Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Accounts are FDIC-insured up to $250,000.

3 Savings accounts are provided by Square Financial Services, Inc. Member FDIC.

4 All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.