Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Pricing Your complete business toolkit, starting at $0

Choose from value-packed plans. No hidden fees or locked-in contracts. Cancel or switch anytime.

The essentials your business needs to sell in-person, online, over the phone, or out in the field. Only pay when you take a payment.

Processing fees

What you get

POS app for any payment

Accept any payment with an all-in-one POS app.

POS app for any payment

Online site

Build an online ordering profile, a basic website or online store, or an online booking site.

Online site

Item library

Add menu items, products, and services. Keep track of inventory and sales.

Item library

Invoicing

Send estimates, contracts, and invoices.

Invoicing

Booking

Schedule appointments and manage staff calendars.

Booking

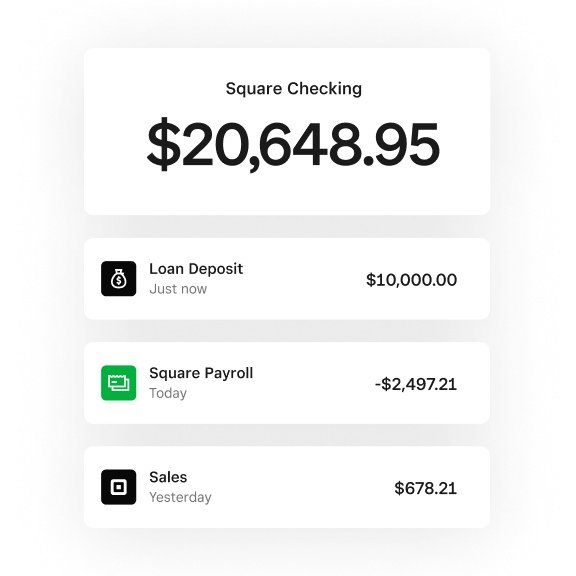

Checking and savings accounts

Access your funds instantly and plan for future expenses.

Checking and savings accounts

Details

Processing fees

What you get

POS app for any payment

Accept any payment with an all-in-one POS app.

POS app for any payment

Online site

Build an online ordering profile, a basic website or online store, or an online booking site.

Online site

Item library

Add menu items, products, and services. Keep track of inventory and sales.

Item library

Invoicing

Send estimates, contracts, and invoices.

Invoicing

Booking

Schedule appointments and manage staff calendars.

Booking

Checking and savings accounts

Access your funds instantly and plan for future expenses.

Checking and savings accounts

A full suite of features built specifically for food, retail, and appointment-based businesses. Designed to help you grow and thrive.

Processing fees

What you get

Everything in Square Free

POS features for every industry

Access advanced POS features for food and beverage, retail, appointments, and invoicing.

POS features for every industry

Lower processing fees

Save on in-person and online card processing fees.

Lower processing fees

Loyalty rewards program

Create a custom rewards program that connects to your POS.

Loyalty rewards program

Email and text message marketing

Send unlimited email marketing campaigns. The first 500 texts are free, then pay 3¢ per text.

Email and text message marketing

Staff management

Schedule shifts and track team attendance.

Staff management

Details

Processing fees

What you get

Everything in Square Free

POS features for every industry

Access advanced POS features for food and beverage, retail, appointments, and invoicing.

POS features for every industry

Lower processing fees

Save on in-person and online card processing fees.

Lower processing fees

Loyalty rewards program

Create a custom rewards program that connects to your POS.

Loyalty rewards program

Email and text message marketing

Send unlimited email marketing campaigns. The first 500 texts are free, then pay 3¢ per text.

Email and text message marketing

Staff management

Schedule shifts and track team attendance.

Staff management

Square Pro

Get custom pricing

If you process over $250,000 per year, talk to our team to see if you’re eligible for custom pricing and processing fees. You can also ask about hardware discounts, onboarding and implementation support, technical specialists, and account management.

Explore features by business type

Payments & checkout

Payment methods

Checkout

Restaurant operations

Payments, discounts, and gratuity

Simple percentage

Party-size thresholds

Party-size thresholds

Checks

Order management apps

Not available in Square Free

$30/mo. for the Square KDS app per device

$20/mo. for the Square KDS app per device

Not available in Square Free

$50/mo. for the Square Kiosk app per device

$30/mo. for the Square Kiosk app per device

Device settings

Bookings

Scheduling

Client communication

Custom emails

Custom emails & texts

Custom emails & texts

Integrations

Inventory & catalog management

Item management

Inventory management

$99/mo. per location

$99/mo. per location

Reporting & analytics

Sales reporting

Bookings reporting

Inventory reporting

Marketing reporting

Restaurant reporting

Invoices reporting

Staff reporting

Web reporting

AI-powered insights

Online selling

Commerce

Orders & fulfillment

Cart & checkout

Item & catalog

Website

Marketing

Customer engagement

Customer directory

Messaging

Loyalty

Marketing

500 messages included, then 3¢ per message

2,500 messages included, then 1.5¢ per message

2.5% load fee

2.5% load fee

0% load fee

Invoicing

Invoices

Contracts

Estimates

Staff management

Time tracking & attendance

Shift management

Communication

Tips & commissions

Admin

Square Banking¹

Checking²

Savings³

Loans⁴

Bitcoin⁵

Support

6am–6pm PT M–F for the first 90 days

6am–6pm PT M–F

24/7

Fees

Processing fees

2.6% + 15¢

2.5% + 15¢

2.4% + 15¢

3.3% + 30¢

2.9% + 30¢

2.9% + 30¢

2.9% + 30¢

2.9% + 30¢

2.9% + 30¢

1%, $1 min

1%, $1 min, $10 fee cap

1%, $1 min, $10 fee cap

1%, $1 min, $5 fee cap

1%, $1 min, $5 fee cap

1%, $1 min, $5 fee cap

3.5% + 15¢

3.5% + 15¢

3.5% + 15¢

6% + 30¢

6% + 30¢

6% + 30¢

Free

Free

Free

0% until 2027

0% until 2027

0% until 2027

Additional fees that may apply

$0/mo. per location

$49/mo. per location

$149/mo. per location

Not available in Square Free

500 texts included, then 3¢ per text

2,500 texts included, then 1.5¢ per text

2.5% load fee

2.5% load fee

0% load fee

Not available in Square Free

$30/mo. for the Square KDS app per device

$20/mo. for the Square KDS app per device

Not available in Square Free

$50/mo. for the Square Kiosk app per device

$30/mo. for the Square Kiosk app per device

1.00%

1.00%

0.5%

Included with every plan:

End-to-end encrypted payments

Active fraud prevention

Next day transfers

Offline payments6

More solutions from Square

Square Payroll

Run full-service payroll starting at $35 per month + $6 per person paid.

Square Hardware

Get the right hardware for how you sell with options starting at $59.

FAQ

Is there a free trial and can I cancel later?

Square Plus and Square Premium each offer a free 30-day trial, and you can cancel or switch plans anytime. With Square Free, there are no monthly subscription costs — you only pay processing fees when you take a payment.

How much will I pay in processing fees?

Processing fees vary based on the Square plan you choose. Square Premium offers the lowest processing fees. If you process over $250,000 per year, you can talk to our team about custom pricing and processing fees.

Can I accept any type of credit card?

You can accept every major card — Visa, Mastercard, American Express, and Discover — all for the same processing fees. You can also take cash, checks, and Square Gift Cards.

When will I get paid?

You can transfer funds to an external bank account the next business day for free or instantly for a fee.

Do I need to purchase hardware?

You do not need to purchase hardware to take payments with Square. There are several ways to take payments without any hardware, including invoicing, payment links, virtual terminal, Tap to Pay on iPhone, and Tap to Pay on Android.

How can I get in touch for support?

You can contact sales for support getting started or with your account.

How can I switch from my current solution?

With Square you can get set up quickly. Import existing customer contacts and connect third–party apps you already use.

I already use Square. Has my pricing changed?

If you're already using Square, your pricing may change depending on your current plan. We'll notify you ahead of time so you know exactly what to expect.

These changes are designed to make Square's pricing simpler and give you more flexibility.

Try Square

1Block, Inc. is a financial services platform and not an FDIC-insured bank. Banking services are provided by Square Financial Services, Inc. or Sutton Bank; Members FDIC.

2Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met. See Terms and Conditions.

Instant availability of Square payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues. Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

With early deposit access, Block, Inc. may make incoming electronic direct deposits made through ACH available for up to two days before the scheduled payment date. Not all direct deposits are eligible. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. Early deposit access is automatic and there is no fee.

Instant Payouts services require a Square Checking account. Funds provided through Instant Payouts services are generally available in the Square Checking account balance immediately after an order is processed. Fund availability times may vary due to technical issues. If an order is not paid out instantly, it will be available according to your regular deposit schedule. Payout limits, including limits on payout amounts, may apply.

3Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

The rate of our savings account is more than 2x the national average of 0.41% APY, based on the national average of savings accounts rates published in the FDIC Weekly National Rates and Rate Caps accurate as of 1/21/2025.

4Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc. All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

5Square Bitcoin is not offered to NY Sellers or non-US Sellers. Availability subject to change and regulatory approval. Bitcoin’s value is volatile and can change quickly. Bitcoin transactions are irreversible and may experience occasional delays or payment failures. Bitcoin services are provided by Block, Inc., licensed where required. Block, Inc. operates in NY as Block of Delaware and is licensed to engage in virtual currency business activity by the NYDFS.

6Offline payments are processed automatically when you reconnect your device to the internet and will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined, or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. Offline payments are not supported on Square Reader for contactless and chip (1st generation, v1 and v2). Learn more about how to enable and use offline payments here.