Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Here

for the good

stuff

Square gives you time back to create unforgettable experiences.

Why 450,000+ restaurants use Square1

Great for your business and bottom line

All the restaurant tech you need in a value-packed plan at an industry-leading price.

The tools behind neighborhood favorites

From staff management to loyalty programs to online selling, get every tool your business needs to be the spot everyone loves.

Ranks #1 in employee satisfaction among leading POS brands²

Teams who use Square are more likely to recommend it. And happy teams make happy customers.

More clarity. More confidence.

Move faster. Run smarter. Bank better.

Handle the rush and nail every order

Let customers place orders how they prefer to — at the counter, kiosk, online, or in line.

Update menus once and sync changes across every channel and location.

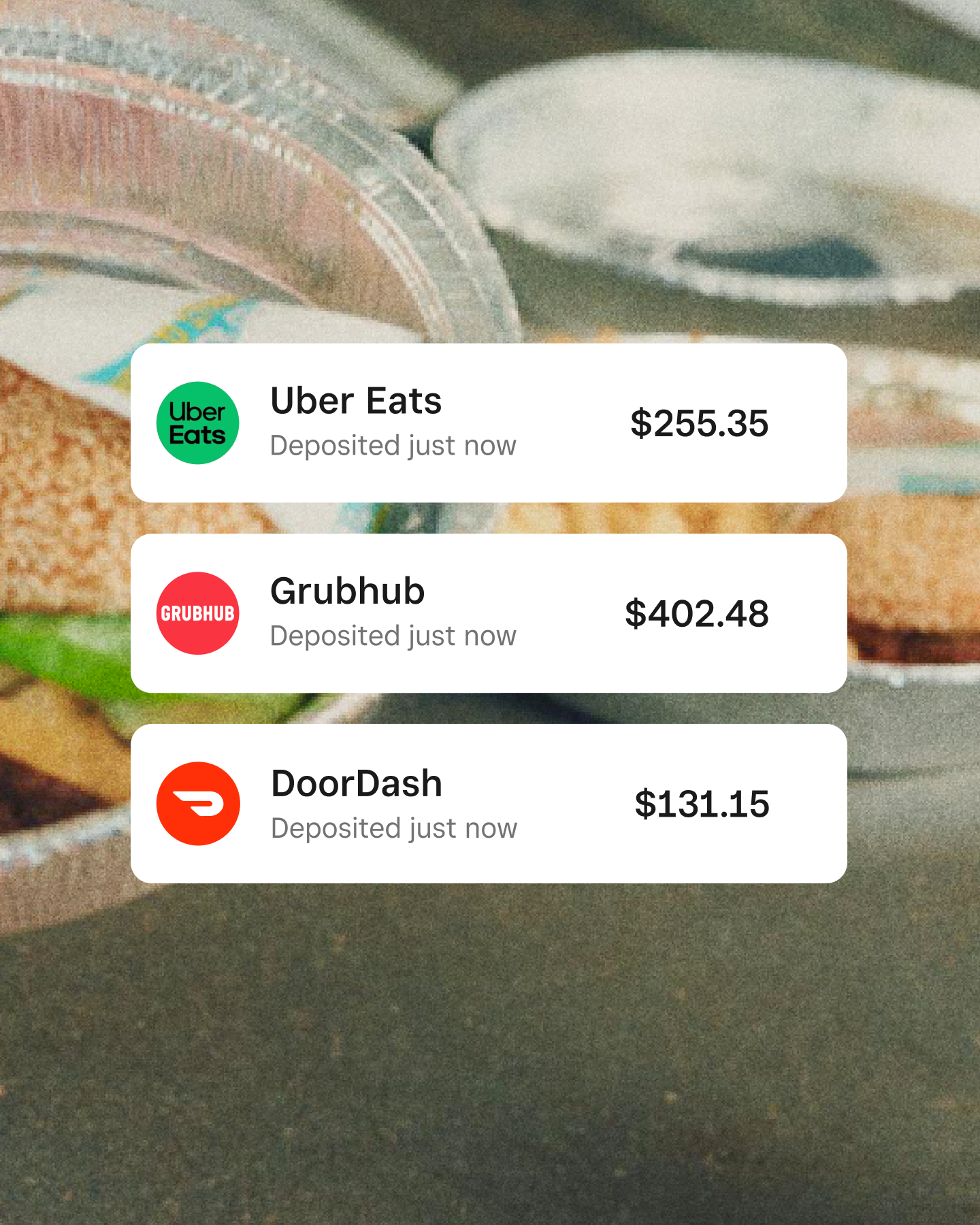

See all orders on your POS, including Uber Eats, DoorDash, and Grubhub, without managing extra tablets.

Keep selling, even if there's an outage. Payments and receipts sync when you’re back online.³

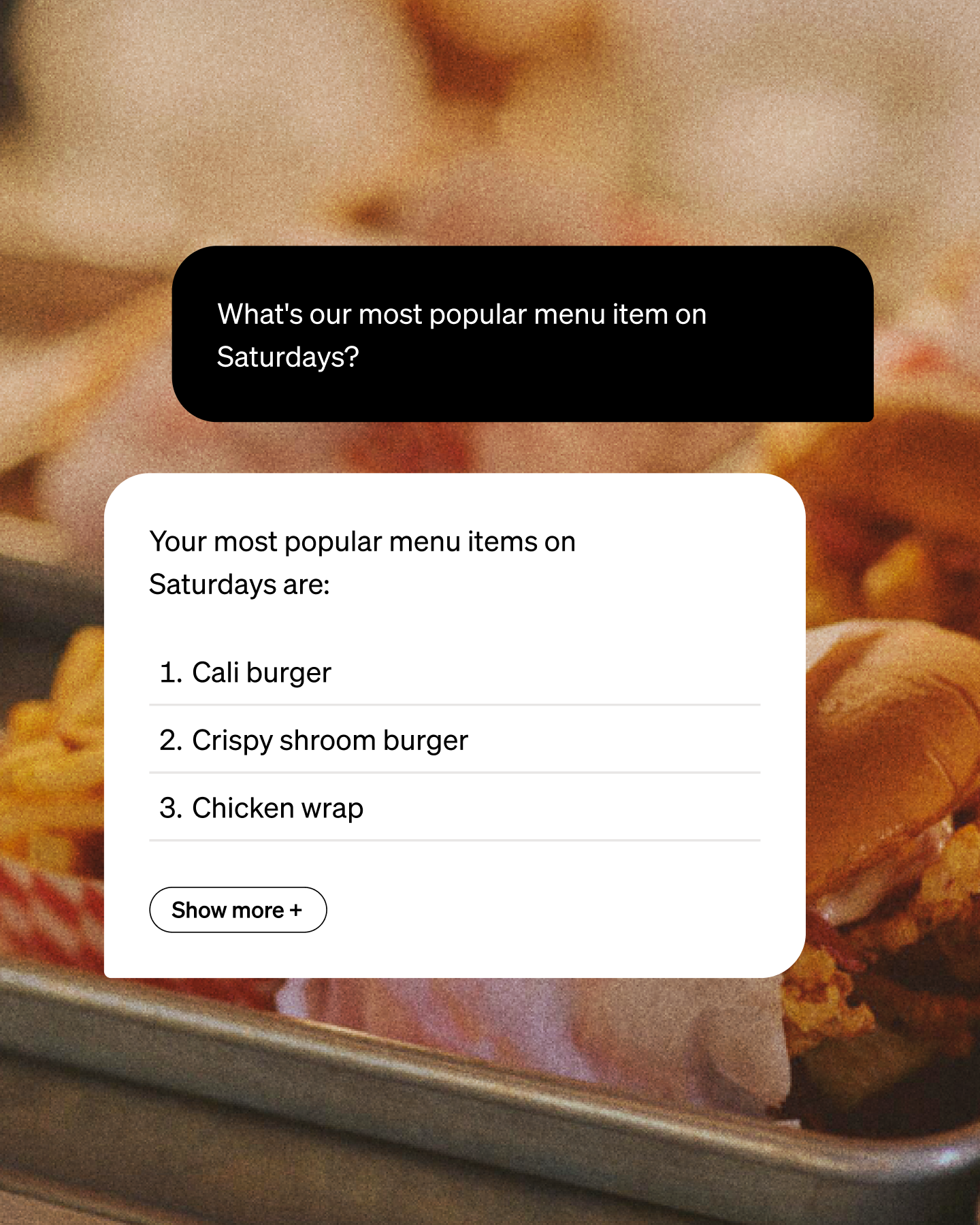

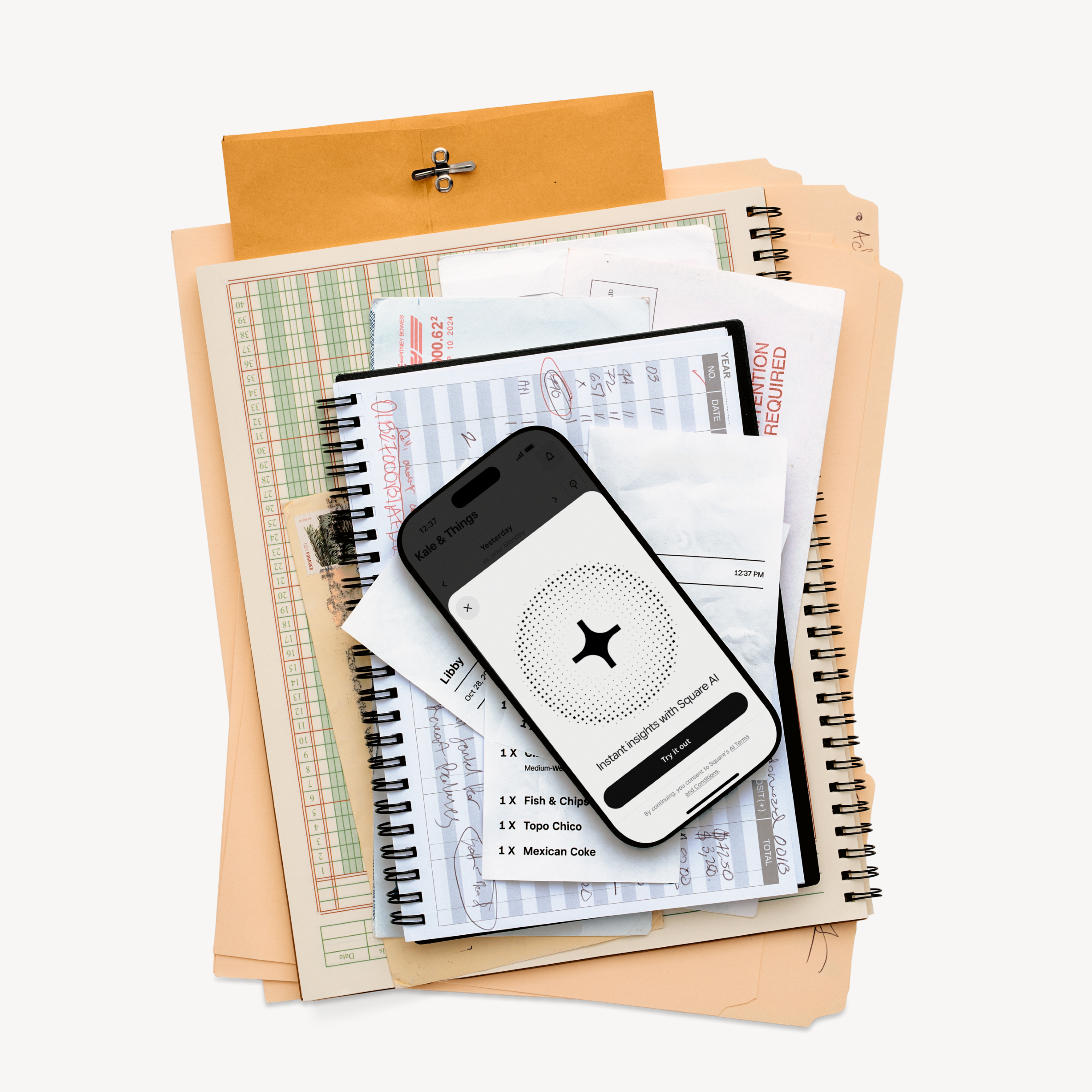

Know your business as well as you know your regulars

Use Square AI to make smarter decisions faster with data from your business and your neighborhood.

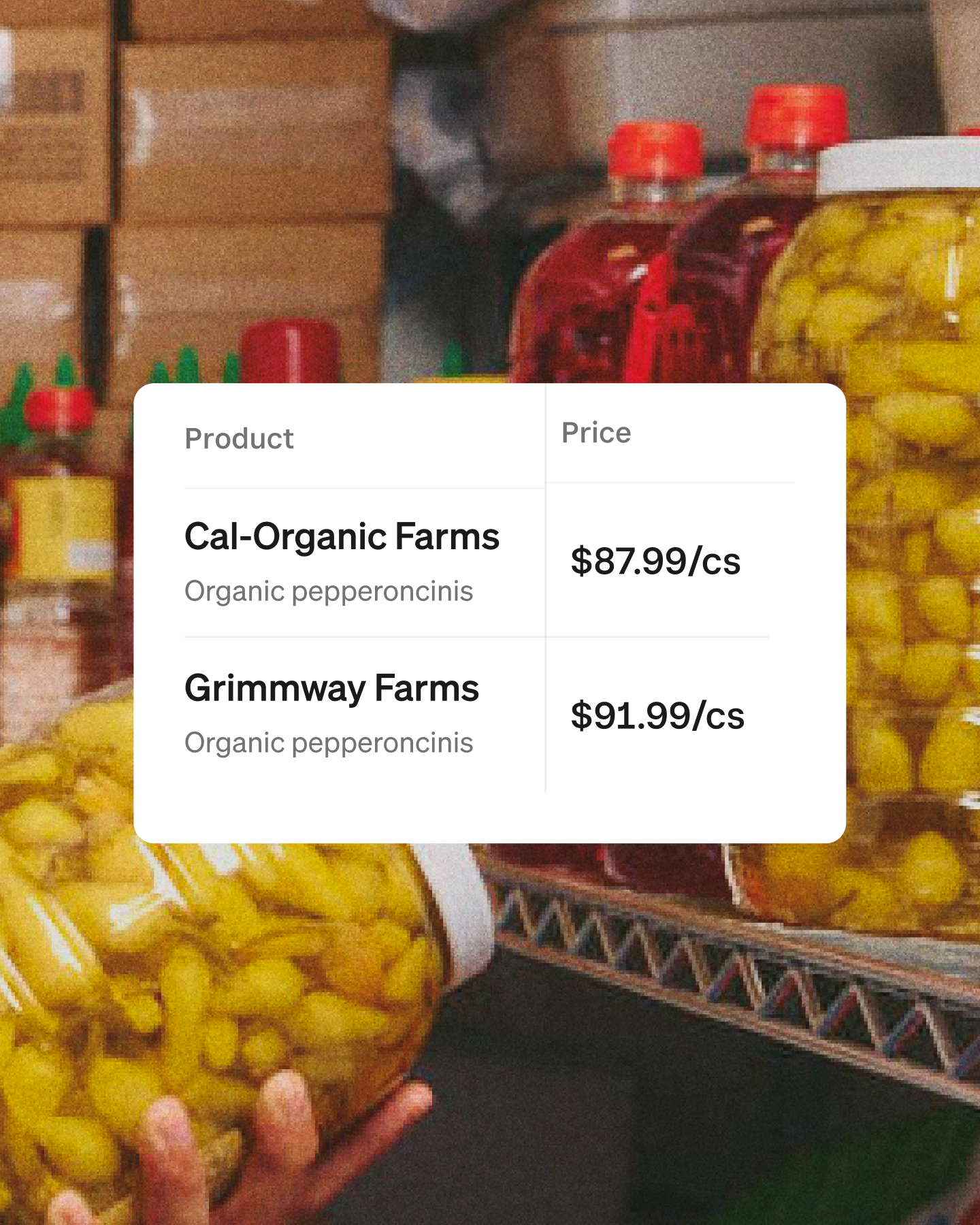

Cut food costs by comparing vendor prices side by side in order guide.

Promote new items, seasonal specials, and events with built-in marketing tools.

Drive repeat visits with a loyalty program that works — members spend 63% more and visit 51% more often.⁴

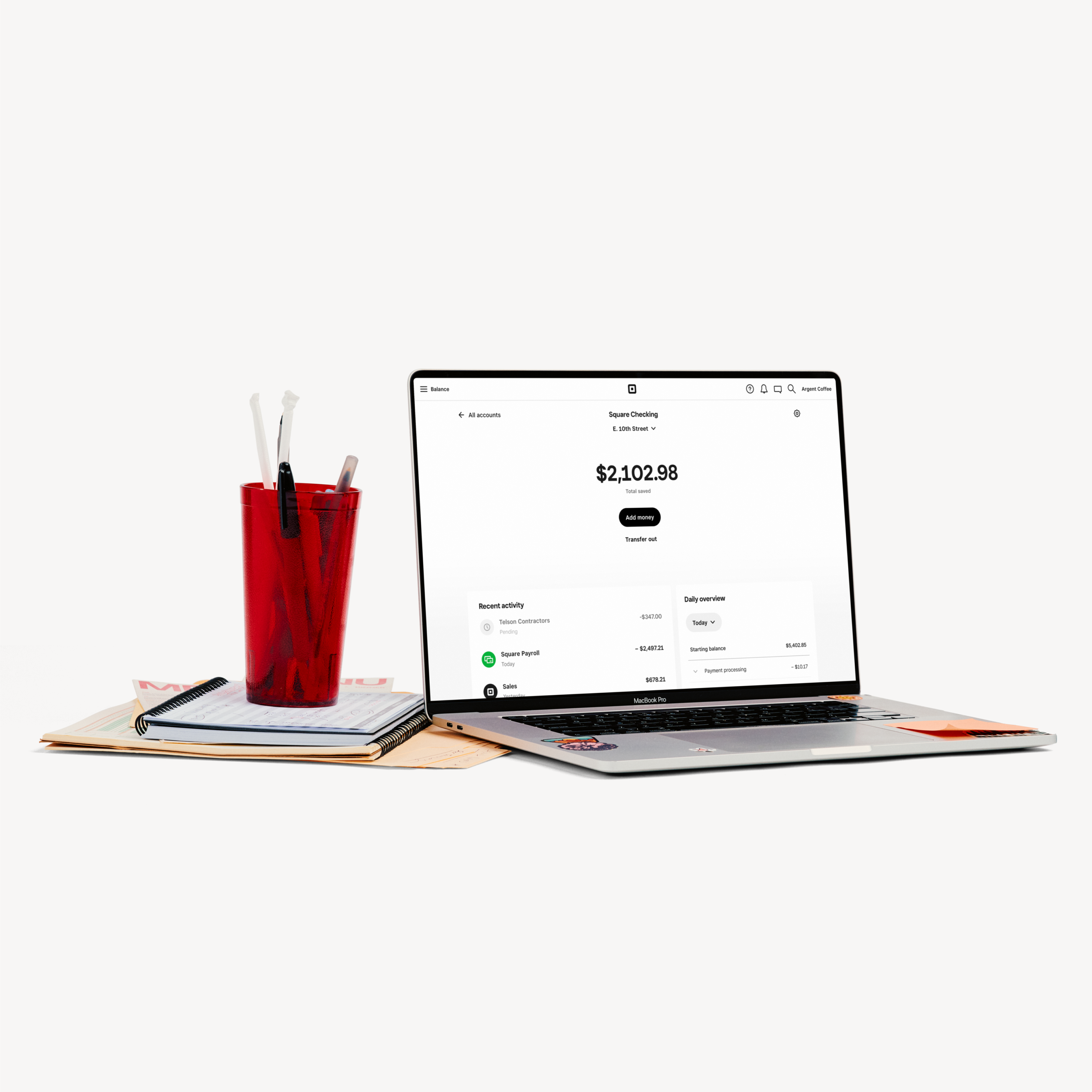

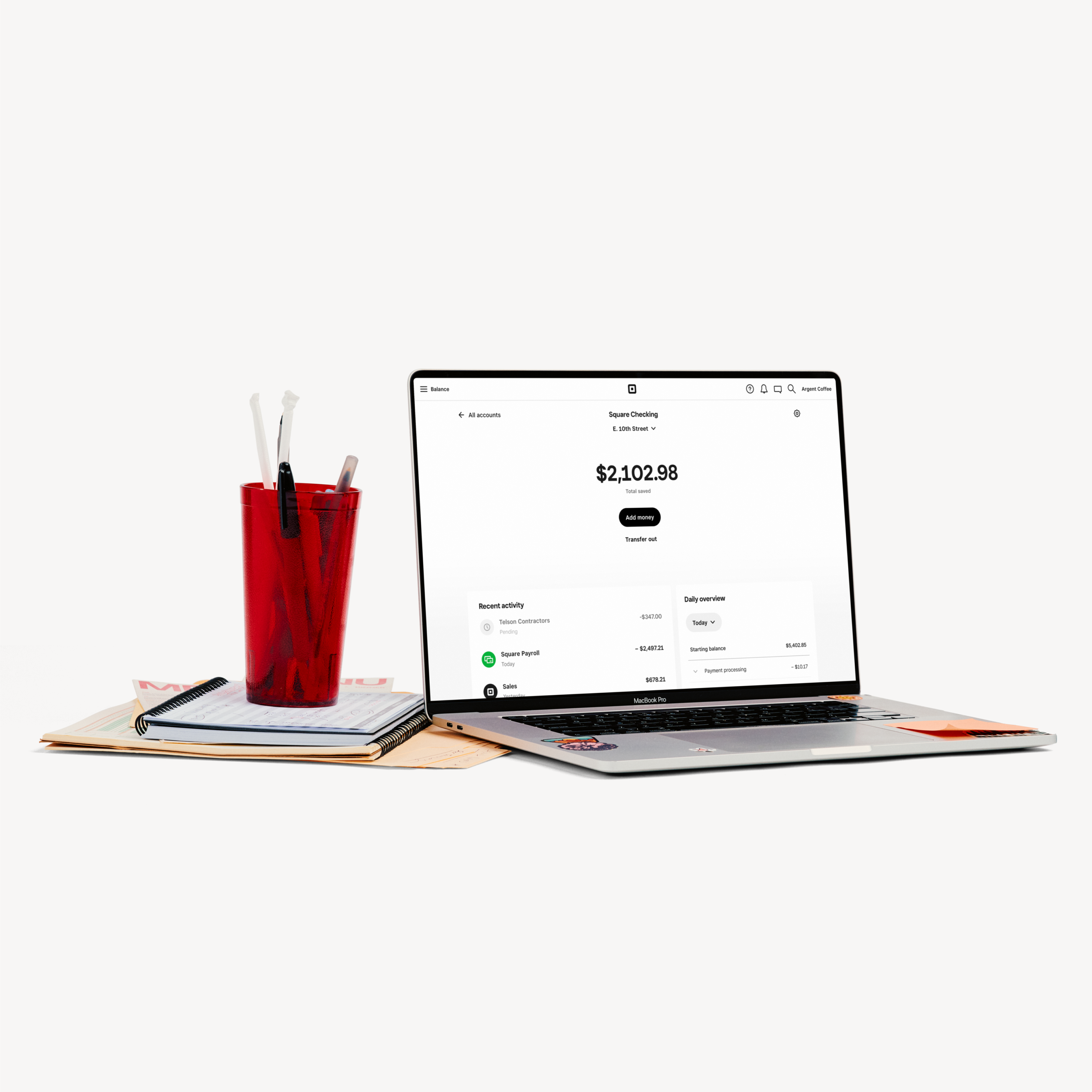

Smooth out your cash flow

Get instant access to your sales with Square Checking⁵, even with earnings from delivery partners, so you can keep things running smoothly.

Set aside a portion of every sale to budget for taxes, kitchen equipment, emergencies, and your next location with Square Savings.⁶

Secure funding when you need it with a loan and put repayment on autopilot.⁷

Hear real stories and insights from restaurateurs shaping the future in The Build

See how restaurants scale with Square

Ready to deliver more of the good stuff? Let’s connect.

Join 450,000+ restaurants who use Square to run their businesses. Fill out this form to talk with our team.

Looking for customer support? Click here.