Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Credit Card Financial flexibility for every moment

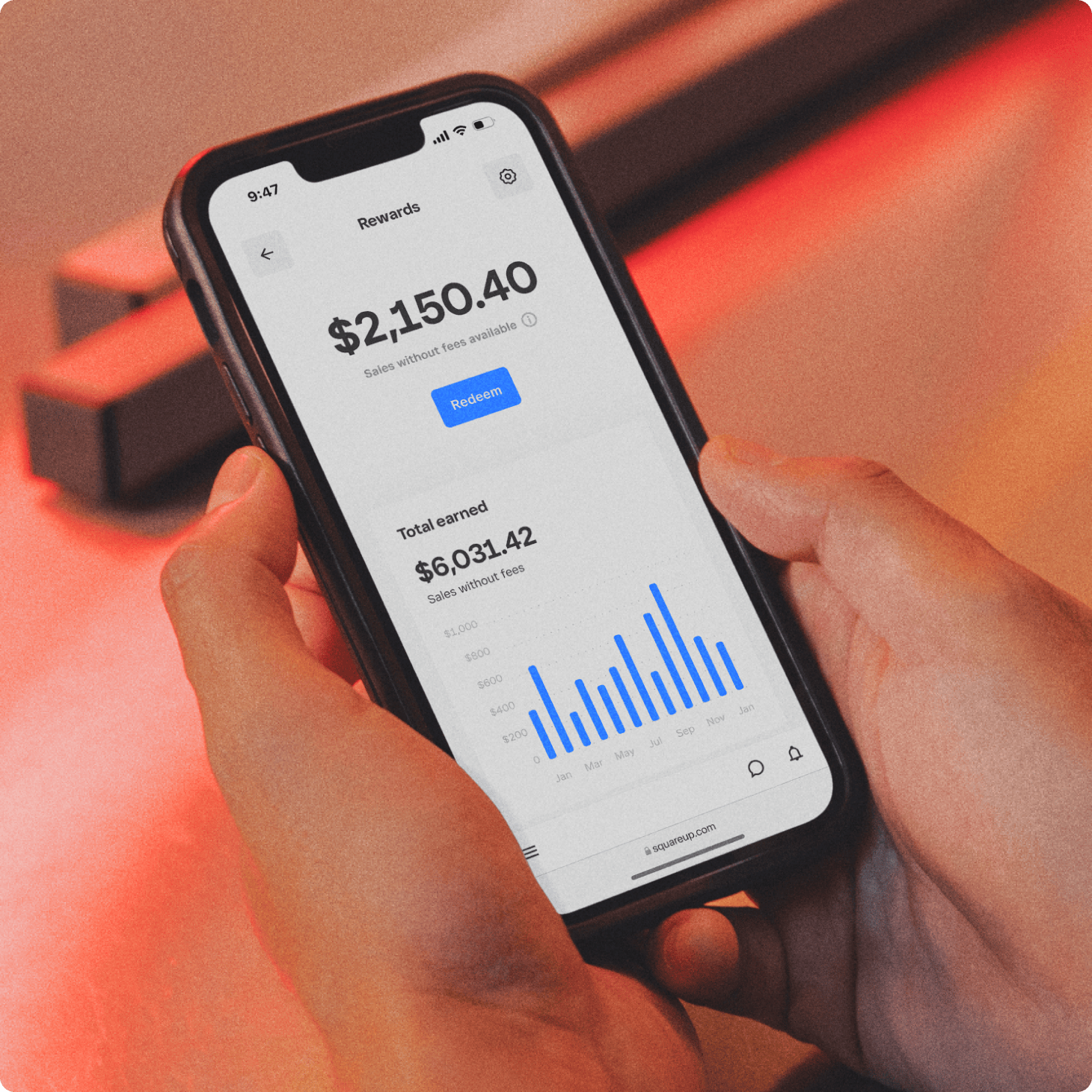

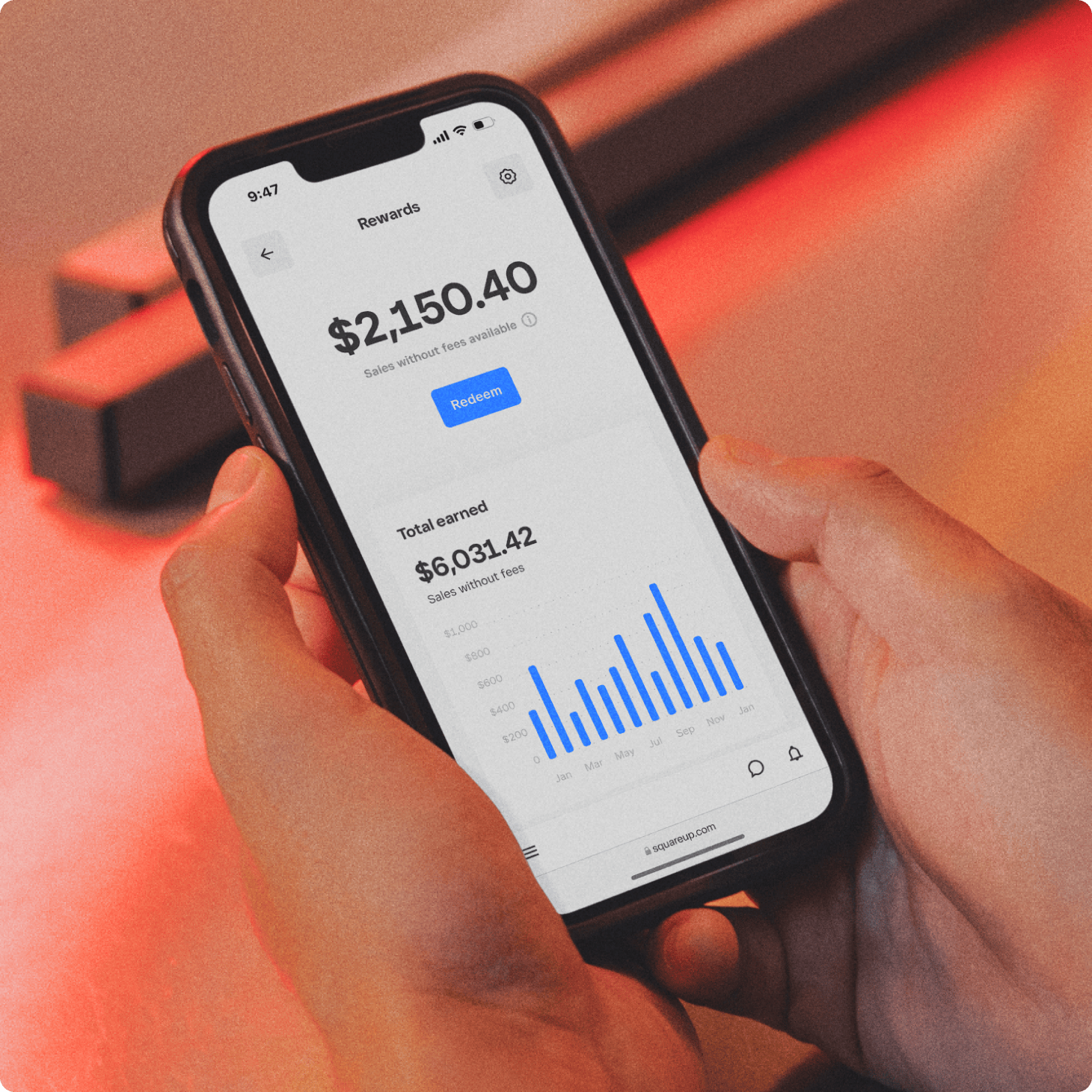

1% back in waived Square processing fees1

No fees, ever

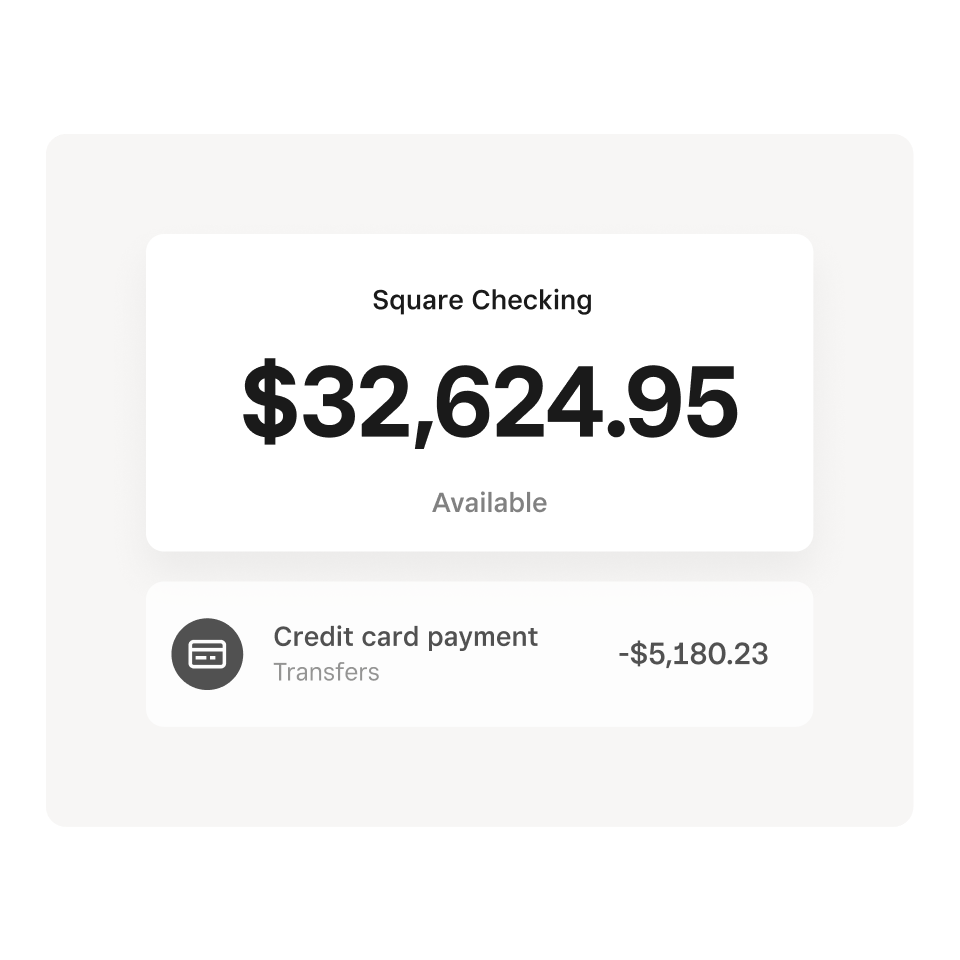

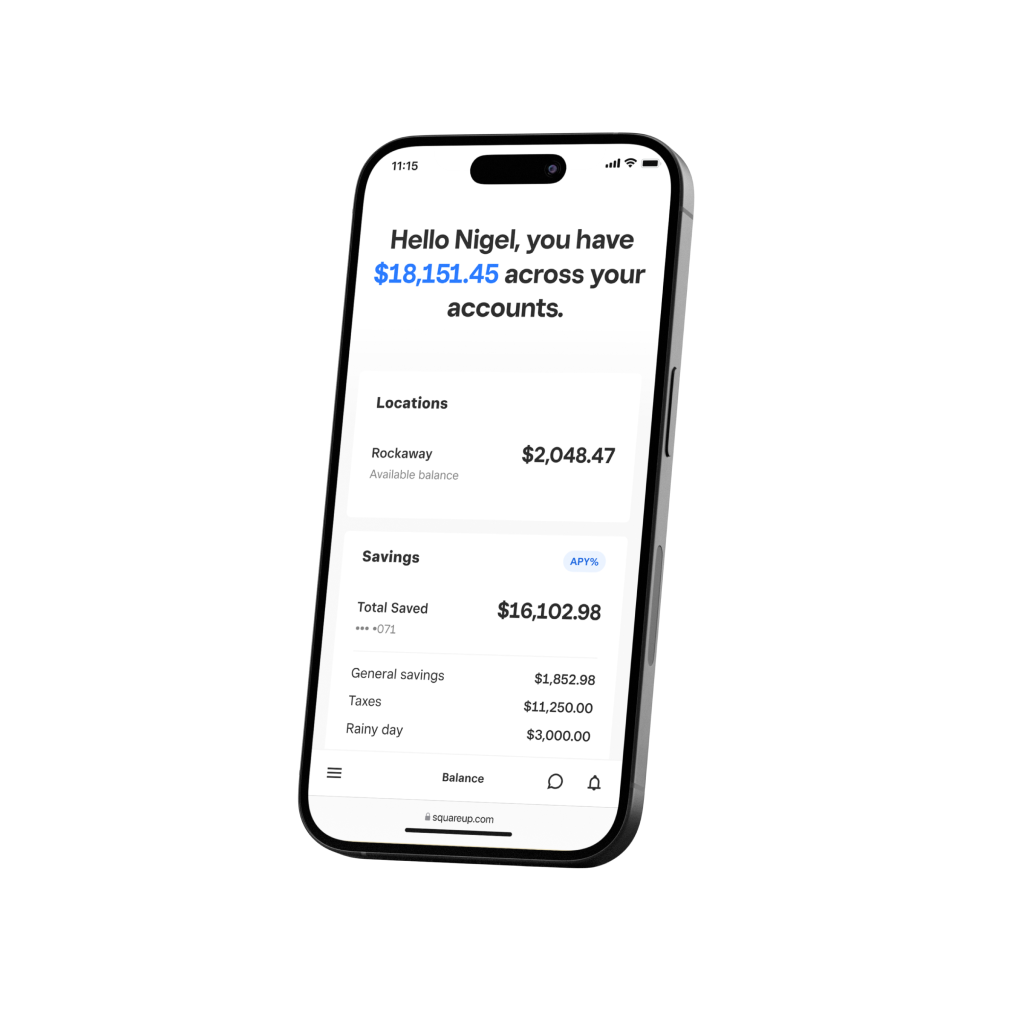

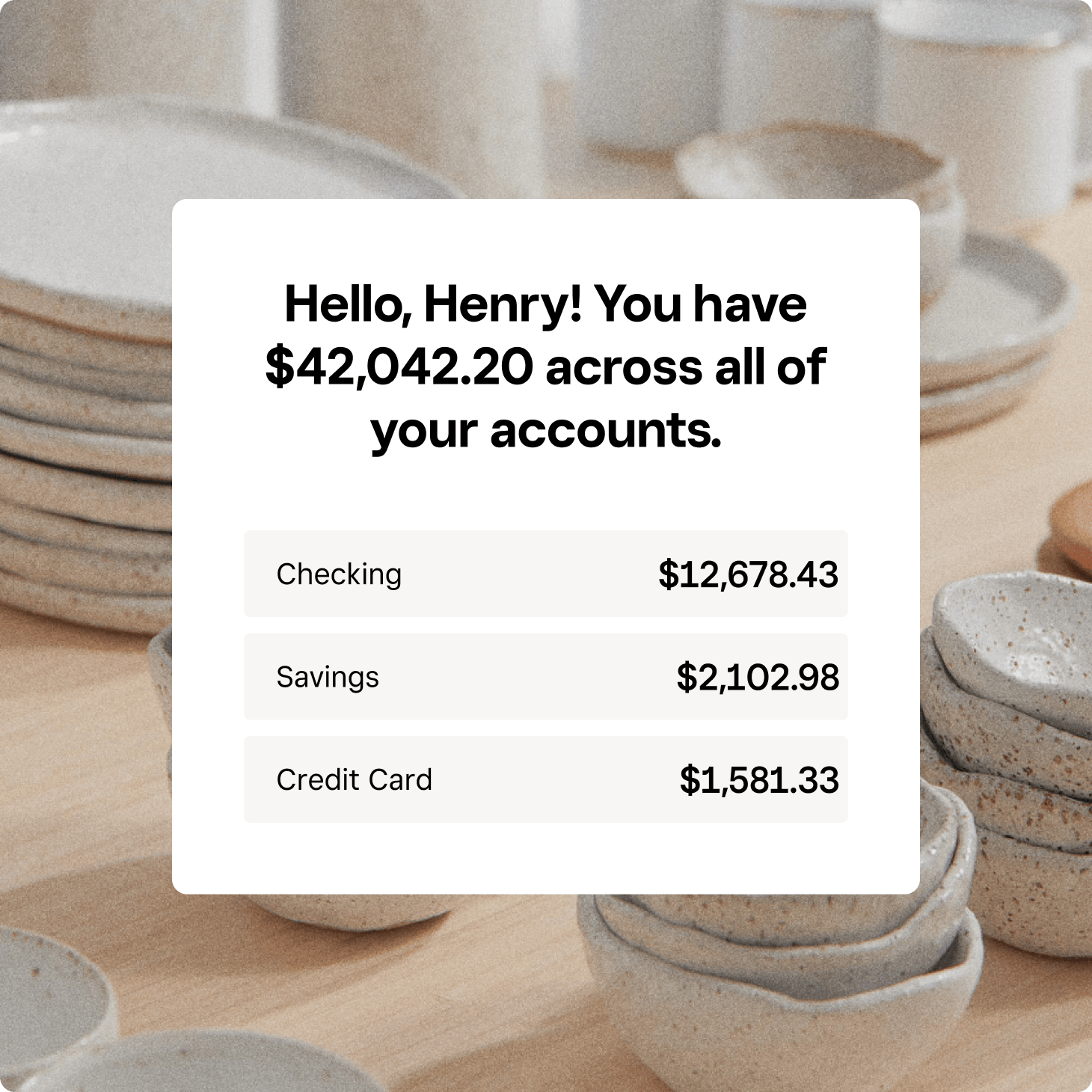

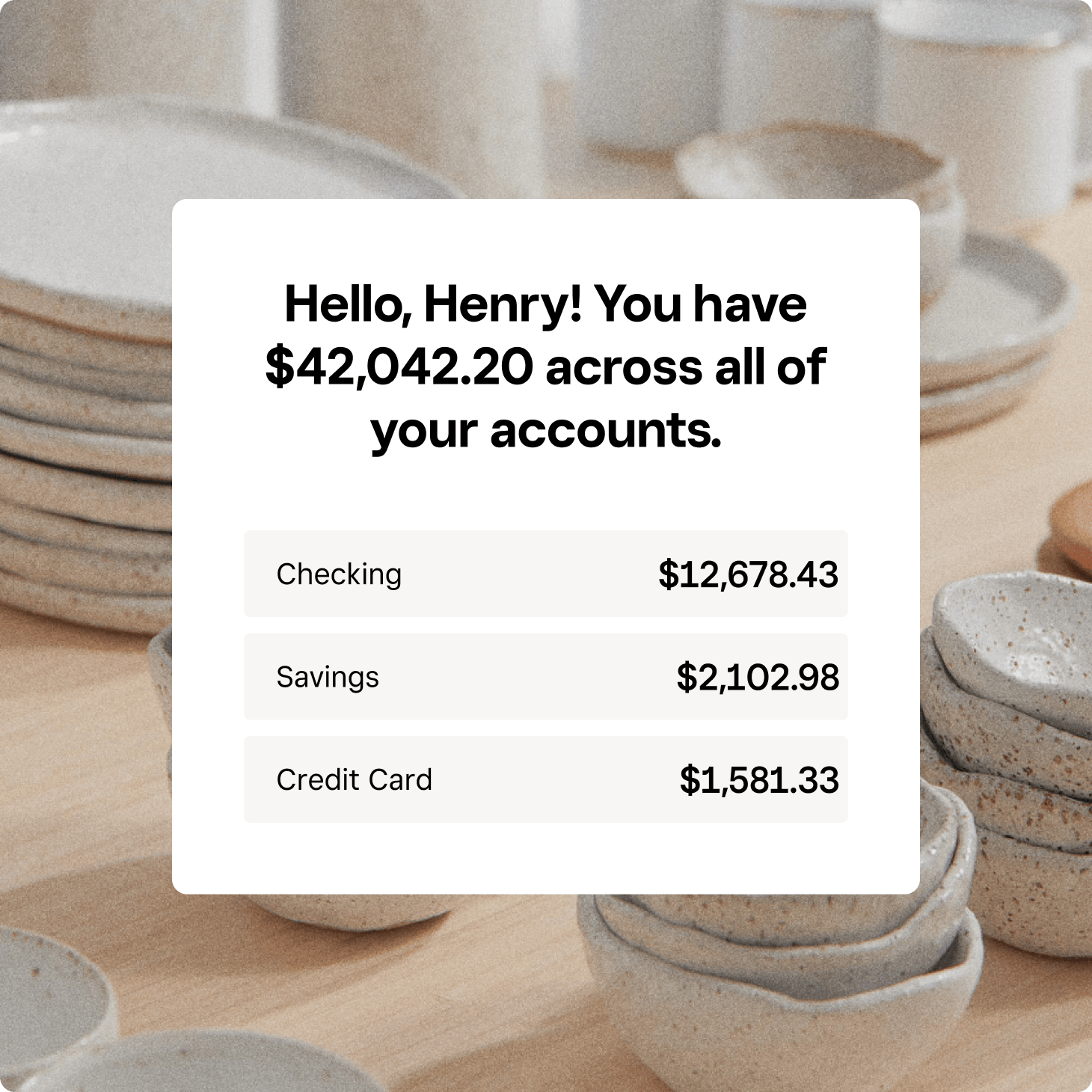

Your business finances in one place

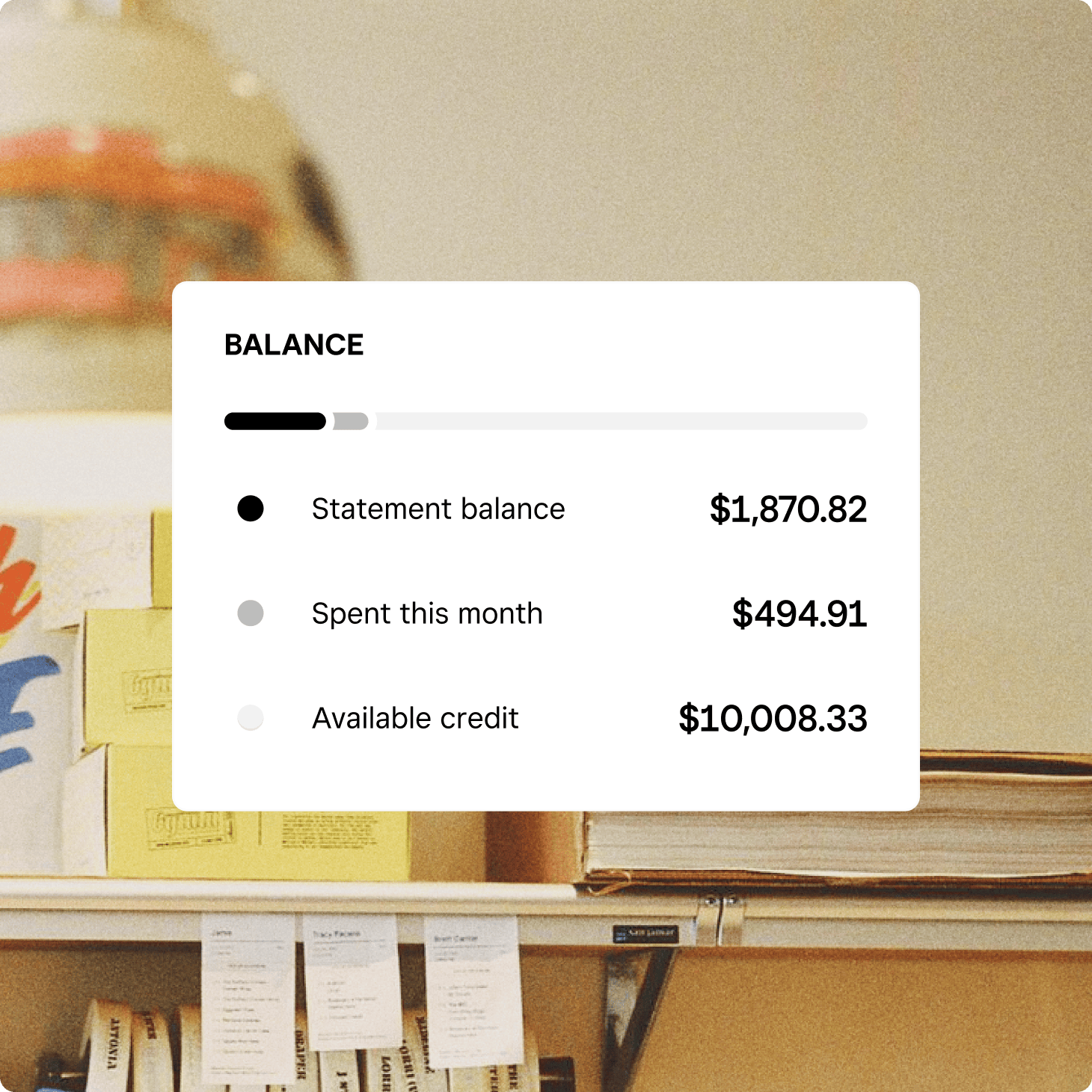

More control over your cash flow

Earn rewards with every purchase

Get 1% back in waived Square processing fees so you can put more money back into your business. No earn limits or category restrictions.

Pay zero fees

That means no annual, late, hidden, foreign transaction, or other fees.

Manage everything inside Square

Get (and stay) organized with your Square sales, credit card expenses, and more under one roof.

Access your financial cushion anytime

The Square Credit Card is a reliable resource for everything from daily expenses to strategic investments and growth opportunities.

Manage everyday expenses effortlessly

Apply in minutes

Apply in minutes

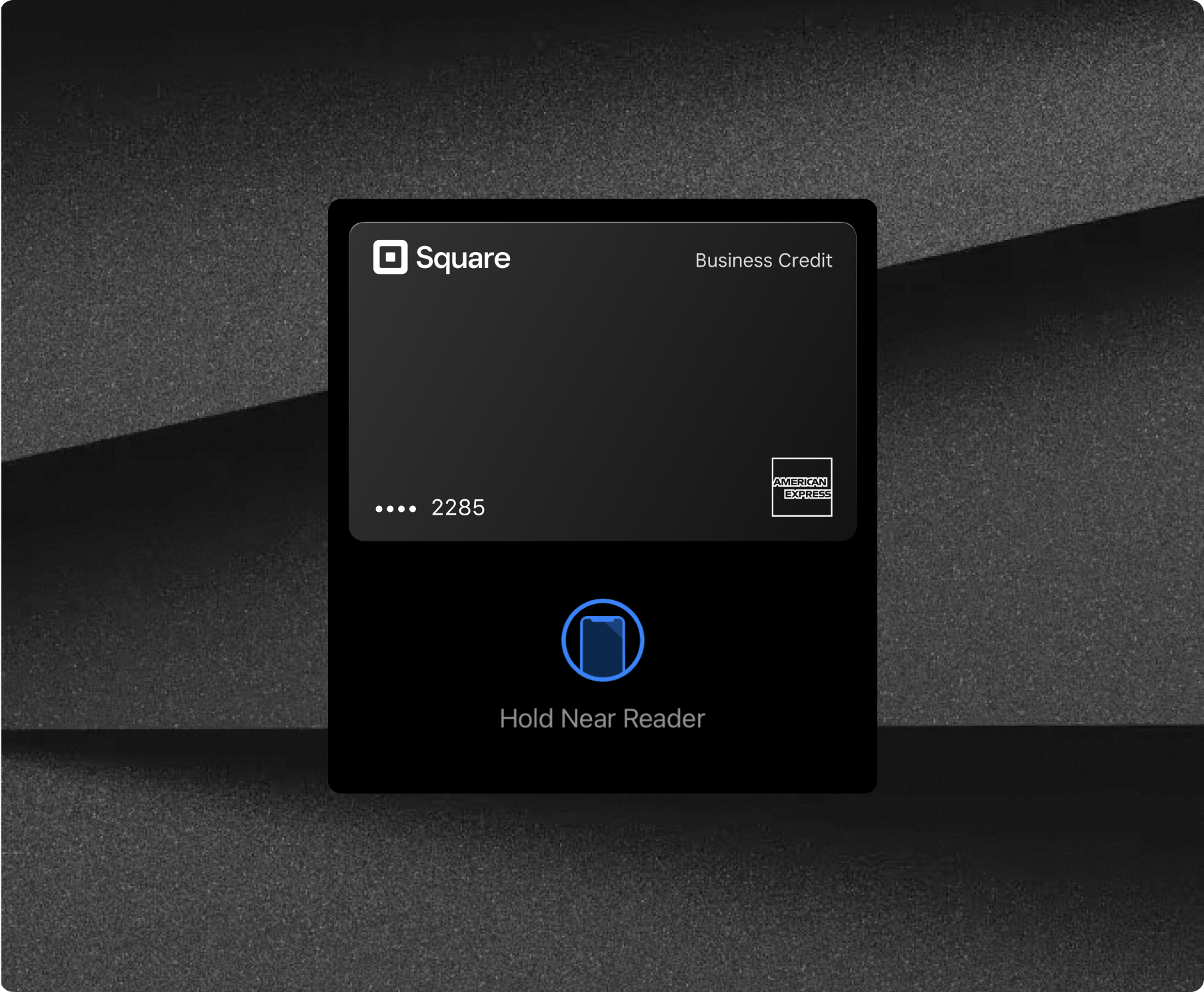

Complete your application in a few taps, and start using your digital card right away if approved.

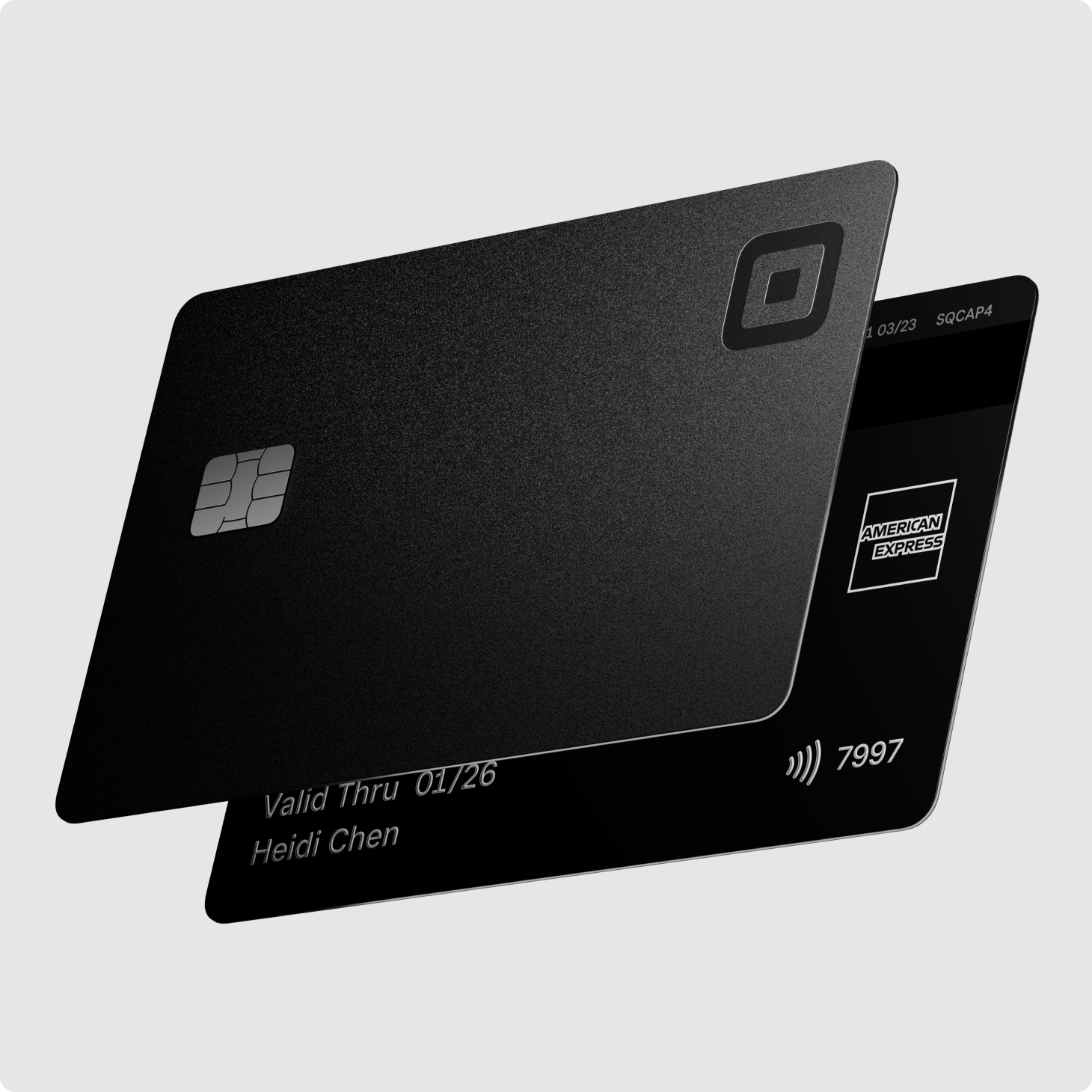

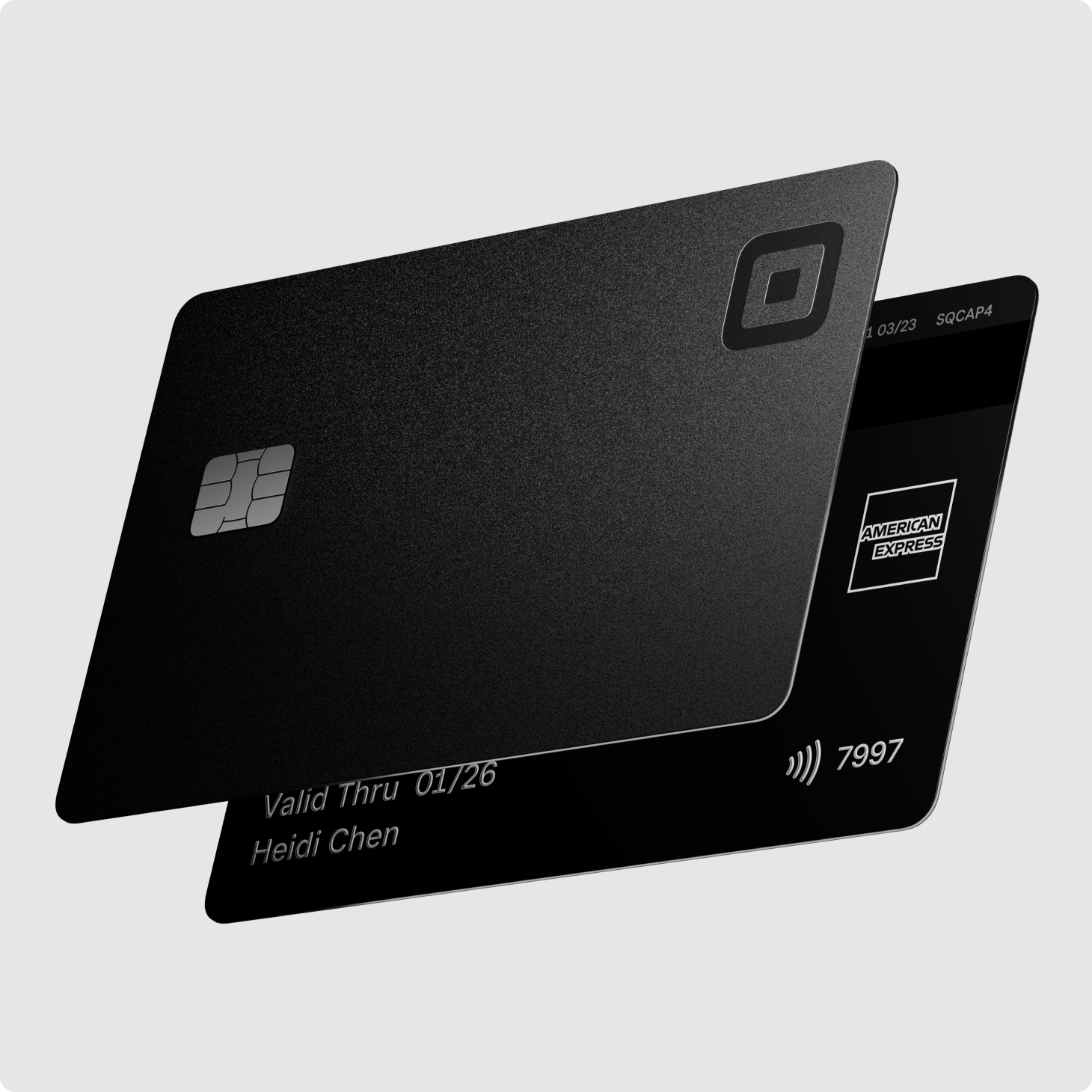

Stand out with a sleek metal card

Stand out with a sleek metal card

Your Square Credit Card is customized with your business name on it. With built-in fraud and purchase protection, your card is secure.

Spend on anything your business needs

Spend on anything your business needs

Top off the gas tank, stock up on supplies, cover unexpected repairs, and more — anywhere American Express is accepted.

Get your money moving at your speed

FAQ

How do I become eligible?

Square Credit Card offers are invite-only for Square sellers who meet a number of criteria. To become eligible, you’ll first need to start selling with Square. Then, we’ll send you an invitation when you meet the rest of the criteria.

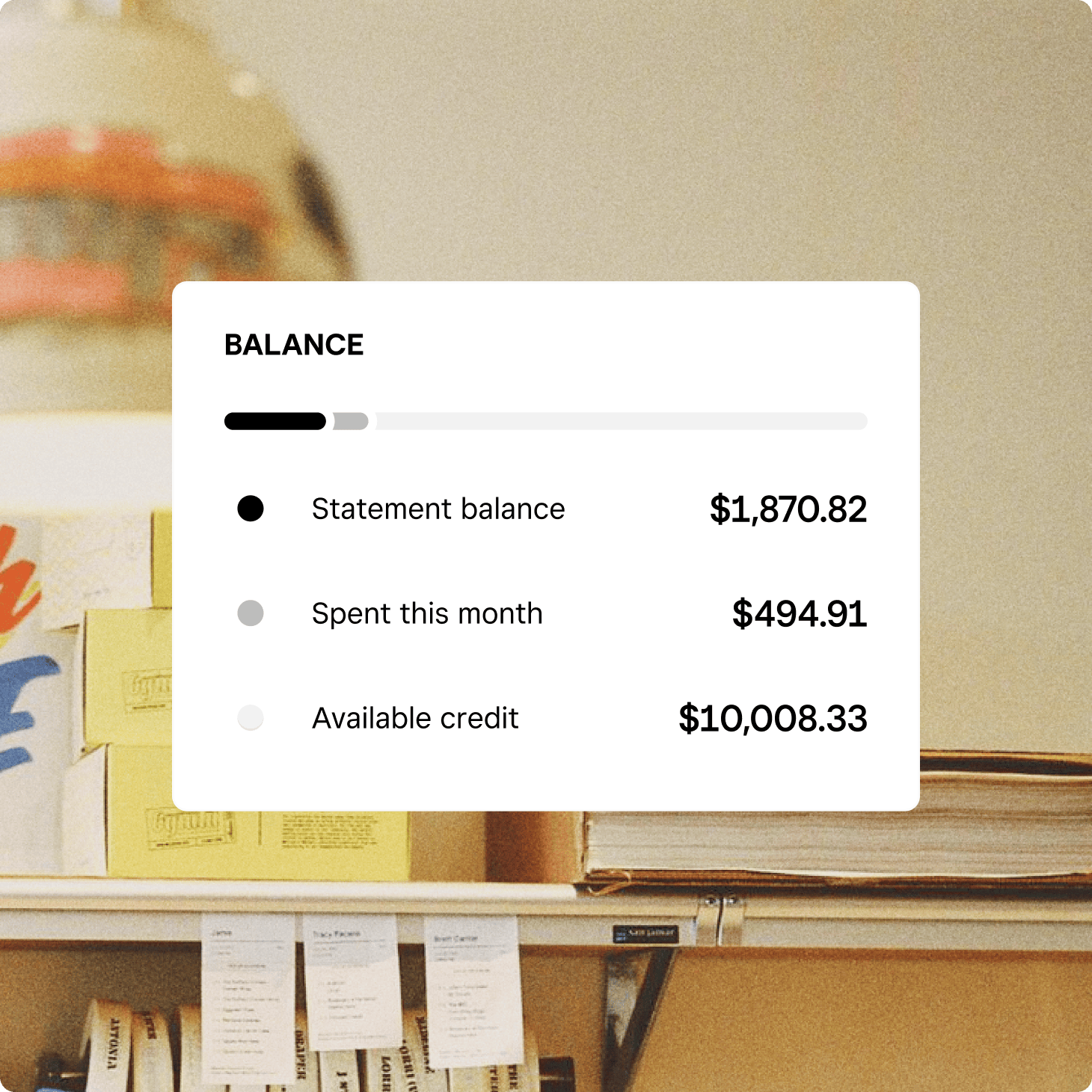

How do I make a payment?

You’re able to make a payment for your Square Credit Card anytime on your Square Dashboard.

To make a payment online:

Go to the Balances section of your Square Dashboard.

Click on Make a Payment and choose how much you want to pay by using the slider.

Review your payment and select Pay.

Then select Done.

When will my payment post?

When you make a payment toward your Square Credit Card, your payment will be posted immediately. You can reference any payments made on your Square Dashboard

Are there any fees?

There are no fees with the Square Credit Card — no late fees, no annual fees, no foreign transaction fees. No other fees.

What happens if I miss a payment?

If you miss a monthly minimum, a percent of your daily card sales will be deducted until your minimum payment amount is met.

Where can I use the Square Credit Card?

You can use your Square Credit Card anywhere that American Express (AMEX)® is accepted.

How is my credit limit determined?

Your credit limit is determined by your history with Square and is based on a number of factors, including your Square processing volume.

Keep your business moving with the Square Credit Card

Learn about new features and hear stories from other Square cardholders.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Block, Inc.

1Based on internal calculation of cash spent on credit card, your Square payment type, and Square processing volume on average. See cardmember agreement for more terms about rewards.

Square Capital, LLC is a wholly owned subsidiary of Block, Inc., d/b/a Square Capital of California, LLC in FL, GA, MT, and NY. Block, Inc. and Square Capital, LLC are not banks. Square Credit Cards are issued by Celtic Bank pursuant to a license from American Express, and may be used wherever American Express is accepted. If approved, APR may vary based on creditworthiness and other factors. Subject to credit approval.