Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Bitcoin Turn everyday sales into long-term value

Diversify your savings, automatically

Choose how much to convert and when to sell

No fees at time of bitcoin payments

No chargebacks and near-instant access

Invest in bitcoin with full control

Accept bitcoin payments with no fees

Expand your customer base by accepting bitcoin payments and automatically receive them as BTC or USD without lump-sum payouts. Plus, get zero processing fees until 2027, no chargebacks, and instant access.

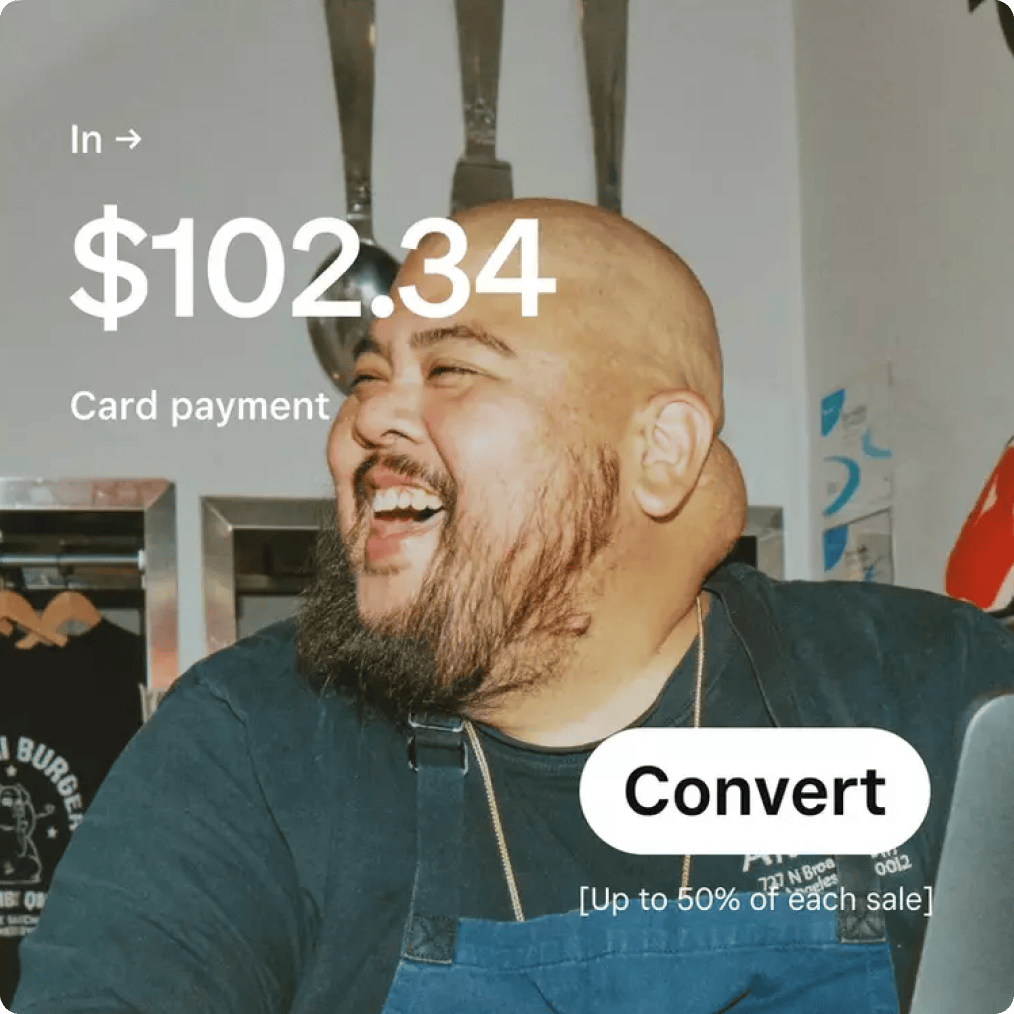

Convert sales revenue into bitcoin at your own pace

Automatically convert up to 50% of your daily sales revenue into bitcoin, as a simple way to diversify your investments. Choose how much to convert and when to sell.

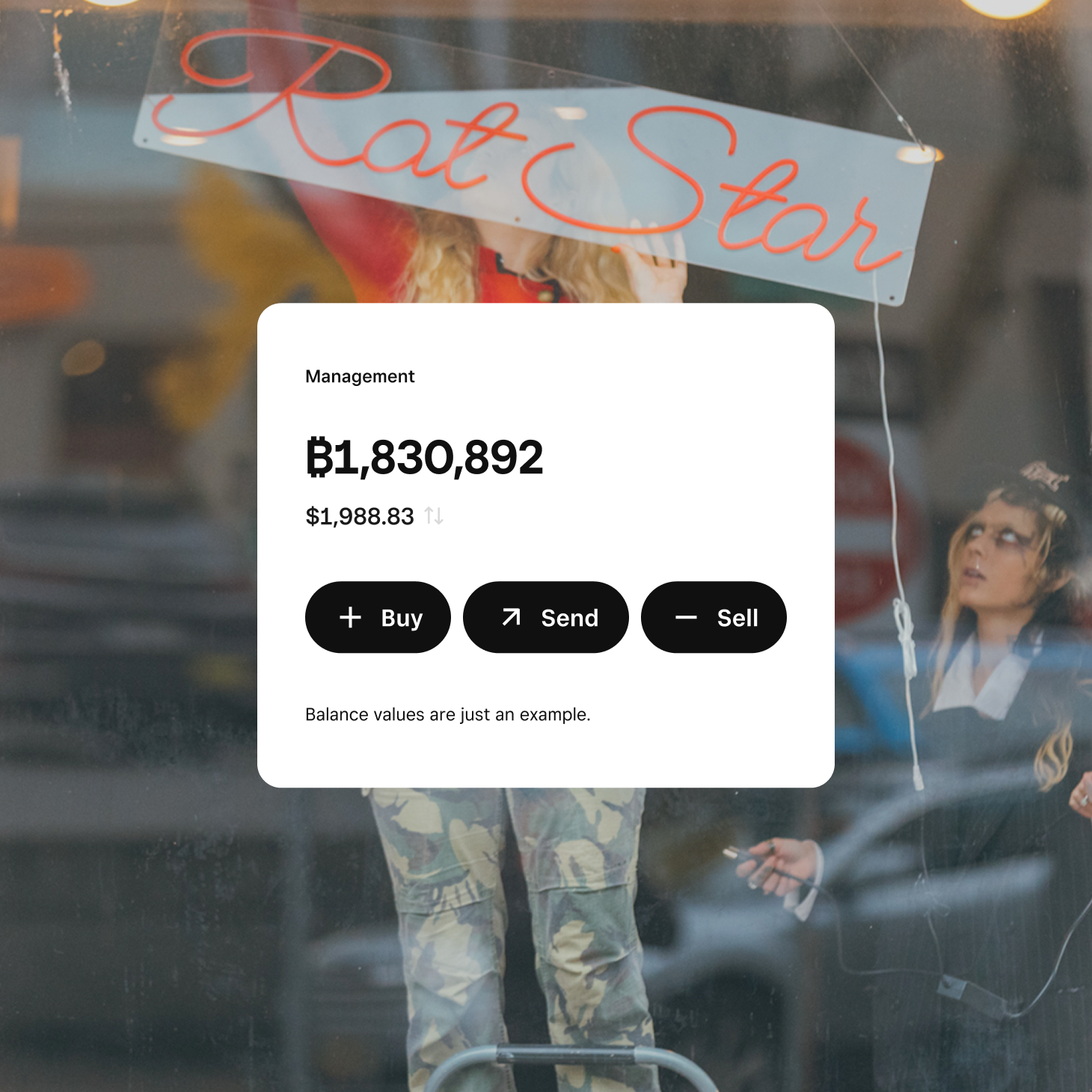

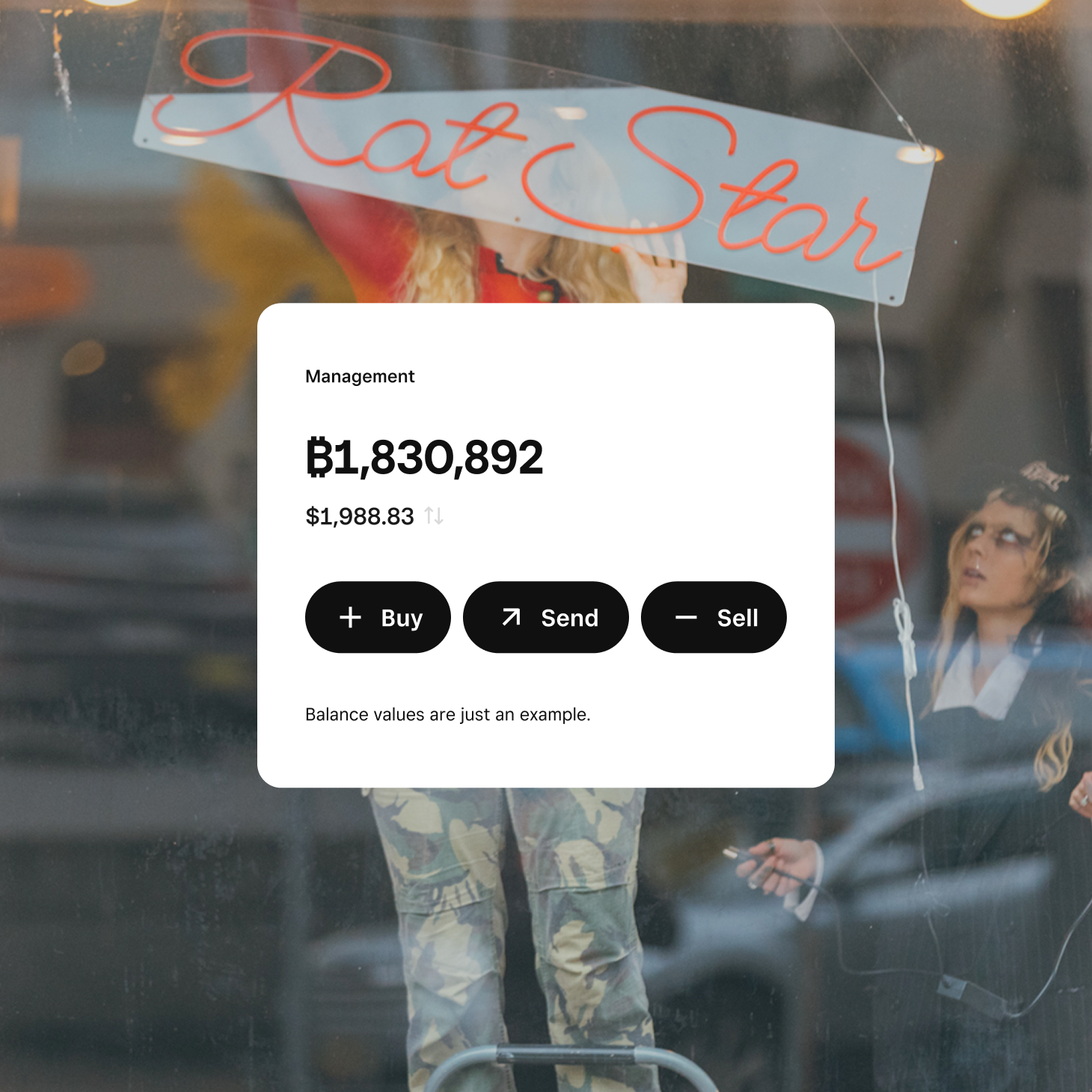

Buy, sell, hold, or withdraw bitcoin

Manage your Bitcoin Wallet seamlessly alongside Square Banking tools. Purchase up to $100K weekly, sell anytime with no limits, track market transactions, and access tax reporting directly in your Square Dashboard.

12%

of sales are set aside by participating Square sellers for automatic bitcoin conversion

29.2%

of Square sellers are exploring Bitcoin Conversions for their business savings

89%

of interested Square sellers plan to use bitcoin as a long-term savings account

Source: Bitcoin Conversions Survey for Square

Accept bitcoin and invest with any Square plan

Square Free

Game-changing access to business essentials

$0/mo.

per location

Bitcoin fees

1.00% fee Bitcoin Conversions (auto-converts sales to BTC)

0% Bitcoin Payments processing

Square Plus

Best value

Fully loaded for every aspect of business

$49/mo.

per location

Bitcoin fees

1.00% fee Bitcoin Conversions (auto-converts sales to BTC)

0% Bitcoin Payments processing

Square Premium

The best of the best with 24/7 support

$149/mo.

per location

Bitcoin fees

.50% fee Bitcoin Conversions (auto-converts sales to BTC)

0% Bitcoin Payments processing

Square Pro

Get custom pricing

If you process over $250,000 per year, talk to our team to see if you’re eligible for custom pricing and processing fees. You can also ask about hardware discounts, onboarding and implementation support, technical specialists, and account management.

Grow with flexible business finances

Diversify your investments

Expand the way you manage money and run your business with bitcoin. Take advantage of another option for managing value alongside traditional accounts.

Track taxes easily

Manage all taxable bitcoin transactions in the Square mobile app – including amount, fees, date, and time. Market purchases and sales are automatically included in tax documentation provided.

“Dollar-cost averaging into bitcoin is allowing me to hedge against inflation. The money that I'm actually saving is growing as opposed to losing value every year.”

Rafael Montoya

Precision The Barber

Lynnwood, WA

“It's seamless and I have a lot of flexibility in how I dial what percentage of our sales we want to convert into bitcoin.”

Sanjay Vohra

Thread Away

Chicago, IL

“But with bitcoin, I'm succeeding and it's working. I'm putting money in there. I'm leaving it there, like life insurance.”

Elle Abbott

Brazen and Beautiful Photography

Las Vegas, NV

“Now with bitcoin in play, my business could look much different rather than just ladder up slowly. I just look at it as long-term value.”

Patrick Robinson

Coast to Coast Coffee

Sarasota, FL

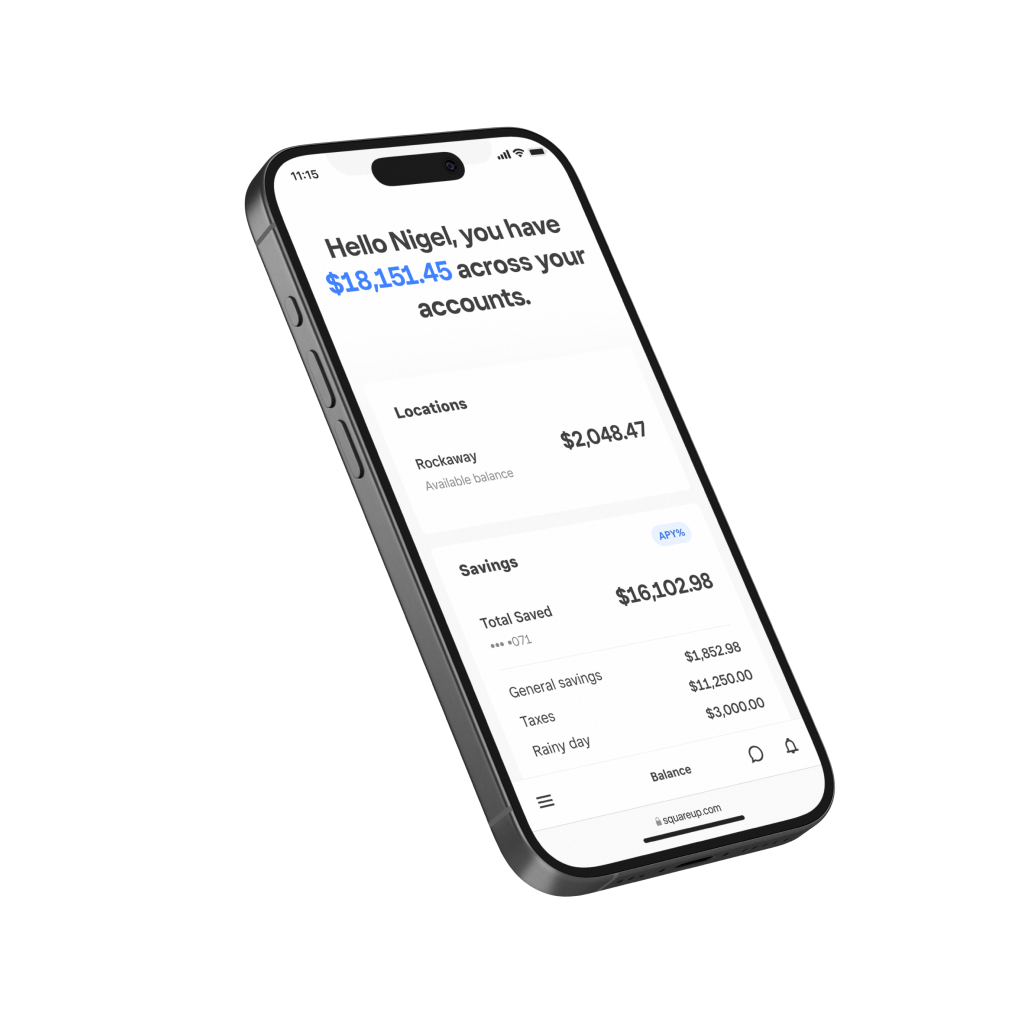

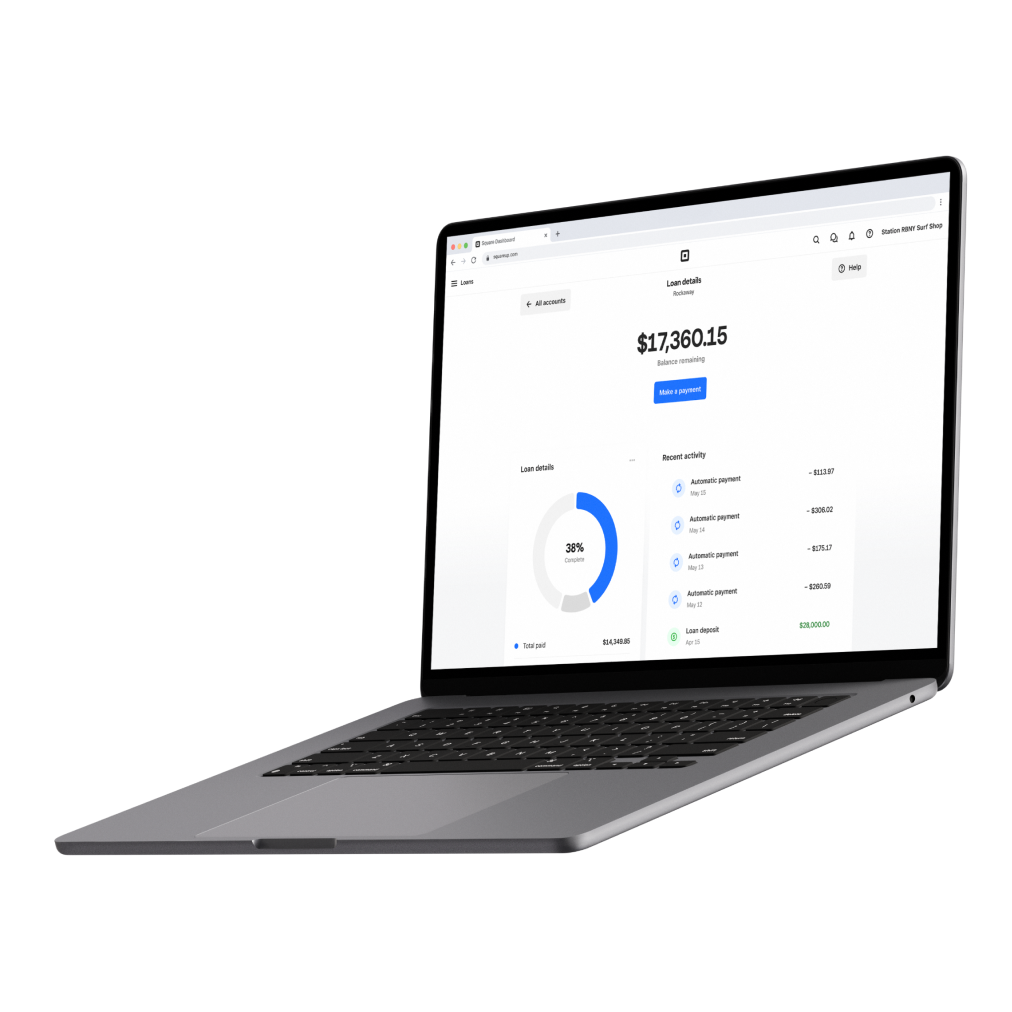

Manage your money in one place

Budget effortlessly and save

Access your revenue instantly

Get fast access to working capital

FAQ

What is bitcoin?

Bitcoin is a secure digital currency that allows you to send, spend, and save money without relying on banks or intermediaries. All you need is an internet connection. Its value can go up or down, and like any investment, it carries risk.

Where is Square Bitcoin available?

Square Bitcoin is available to all U.S. Square businesses (except those based in New York) that meet standard verification requirements. Eligibility is open to all business types, but businesses must complete Square’s KYB (Know Your Business) verification process.

What are Bitcoin Conversions?

You can automatically turn a percentage of your daily card sales into bitcoin. Your converted bitcoin will be custodied securely in your Square wallet, and appear right in your Square Dashboard.

How do I set up Bitcoin Conversions?

Setup only takes a few minutes in your Square Dashboard:

Verify your identity and complete two-step verification.

Choose how you want to use bitcoin with Square.

Enable Bitcoin Payments: start accepting bitcoin at checkout.

Turn on Bitcoin Conversions: select a percentage of your daily sales to automatically convert into bitcoin.

Review and confirm your preferences.

Once onboarding is complete, you’ll see a Bitcoin tab in your Dashboard, where you can manage payments, adjust conversion settings, and buy, sell, or withdraw bitcoin anytime.

Which sales qualify for Bitcoin Conversions?

Eligible:

Square card payments

Cash App Pay transactions

Square Invoices (paid by card or ACH)

Not eligible:

Cash payments

Checks

Afterpay transactions

Gift card payments

Deposits

How much can I convert?

Set a percentage of your daily net card sales (up to 50%) to automatically convert into bitcoin. We'll withhold that amount from your daily sales and convert it to bitcoin at the current market price.

Can I adjust or pause?

Yes, you can update your percentage or toggle off the conversion in your Dashboard at any time. Your existing bitcoin stays securely custodied in your Square wallet.

What can I do with my bitcoin?

You can buy, sell, hold, withdraw, or send bitcoin directly from your Square Dashboard. You cannot deposit bitcoin into your Square account at this time.

What are Bitcoin Payments?

You can accept bitcoin payments at checkout using the Lightning Network – it’s as simple as accepting credit or debit cards.

How do Bitcoin Payments work?

Customers select Bitcoin as their payment method and pay with any Lightning-enabled bitcoin wallet, like Cash App. Payments settle in seconds, and funds appear almost instantly in your Square Dashboard.

Setup for Square sellers

Enable Bitcoin Payments in your Square Dashboard or Square Point of Sale apps.

When a customer wants to pay with bitcoin, select Bitcoin as the payment method at checkout.

A Lightning Invoice QR code will appear on your screen.

The customer scans the QR code with their Cash App (or other Lightning-enabled) wallet.

The payment settles in seconds, and funds appear almost instantly in your Square Dashboard – either in bitcoin or in automatically converted USD, depending on your settings.

Note: Bitcoin payments are currently supported for transactions up to $600. For larger purchases, customers will need to use another payment method.

Setup for your customers using Cash App

Download Cash App and verify your identity.

Buy bitcoin in Cash App or deposit from another wallet.

Tap the ‘$’ Payments tab on the home screen.

Tap the QR scanner in the top-left corner.

Hold the camera over the QR code to scan it.

Confirm and pay; the payment should complete in seconds.

What are the fees?

Bitcoin payments are fee-free until 2027, and a flat 1% after that. Bitcoin payments can be received as either bitcoin or USD, and both benefit from the same 0% processing fee through 2026.

Bitcoin conversions have a 1% conversion fee applied to the total amount of your daily converted sales. For example, if you converted 10% of $1,000 of daily sales, you would receive $99 of bitcoin and pay a $1 fee.

Bitcoin buy/sell has a fee of 1% (plus a small spread may apply).

Bitcoin withdrawals:

Standard withdrawals (24-hour processing) are free.

For faster withdrawals, you'll pay:

Rush (2-hour processing): $2 + pro rata network fee*

Priority (20-minute processing): $3 + pro rata network fee*

What is the Lightning Network?

The Lightning Network is a secure, low-fee payment system built on top of the Bitcoin blockchain. It makes bitcoin payments fast and scalable, so transactions confirm nearly instantly.

Why accept bitcoin?

0% fees through 2026, then 1% per transaction

Near-instant settlement

More ways for customers to pay

Choose to keep earnings in bitcoin or USD

Are refunds and chargebacks possible?

Bitcoin transactions are final and cannot be disputed or reversed. Refunds are only available in the form of Square gift cards for bitcoin payments. Traditional chargeback protections do not apply to bitcoin.

What are the risks of owning bitcoin?

Just like any other investment, bitcoin’s price can’t be predicted – it’s gone up and down. Investing involves risk and you may lose money.

Will I owe taxes if I buy or sell bitcoin?

When you sell or dispose of bitcoin, Square may provide a Form 1099-DA. You’re responsible for determining any tax liability as each taxpayer's situation is unique. Consult a tax advisor, as Square cannot offer tax advice.

Can I move my bitcoin to an external wallet?

Yes, you can withdraw to any external wallet anytime.

What if there are delays?

Lightning transactions are typically instant, but occasional network or technical issues may cause delays.

Ready to grow your business with bitcoin?

*Pro Rata fees for Priority and Rush withdrawal speeds are calculated based on estimated network transaction fees at the time of your transaction and may fluctuate. A network transaction fee is a payment made to miners for adding bitcoin transfers to the blockchain. Square pays network transactions fees on your behalf with the fees charged to you at the time of the transaction. These fees can be impacted by your chosen withdrawal speed, blockchain congestion, and the specifics of each transaction. Blockchain congestion varies depending on how many people are trying to make transfers on the Bitcoin Network and can result in increased fees at certain times. The actual network fees that Square pays may differ from the estimated network fees for your transaction, and at times Square may charge you more than the estimated network fees for your transaction to account for periods of volatility and ensure transaction fees are fully paid. All transaction fees will be displayed on the transaction confirmation screen before you complete your transaction.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Square, Inc.

All loans and Savings accounts are issued by Square Financial Services, Inc., a Utah-Chartered Industrial Bank. Member FDIC. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. Accounts are FDIC-insured up to $250,000. Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

Square Bitcoin features are offered by Block, Inc. and are subject to change and may not be available in all locations. Bitcoin services are not licensable activity in all U.S. states and territories. Bitcoin is not legal tender, is not backed by the government, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation protections.

Bitcoin’s value can change rapidly, which means the amount of bitcoin needed for a purchase, or the amount made from a product sale on Square, may vary from moment to moment. Bitcoin transactions may experience technical issues and are generally irreversible – all payment details should be carefully verified before confirming any transaction.

Block, Inc. makes no representation on the accuracy, suitability, or validity of any information provided. Block, Inc. operates in New York as Block of Delaware and is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. At present, Square Bitcoin is not anticipated to be available to sellers that are located in New York State or outside the U.S. and may be subject to regulatory approval, where applicable.